The One Thing That Determines Financial Success or Failure

I spent the first decade of my adult life wandering through the wilderness when it came to personal finance. Then I got a wake up call.

We were going to be parents. This sent me down a rabbit hole where I found the FIRE movement and the Bogleheads. I devoured everything I could get my hands on.

I took control of my investments and financial plan. At 41 years of age, I gained the confidence to leave my career as a physical therapist and plot a different course in life. Still I felt a sense of insecurity. I didn’t know what I didn’t know.

So I kept educating myself. Last year, I completed the CFP education curriculum and passed the certification exam. This year I began working with planning clients.

The more I learn about the technical aspects of financial planning and see these concepts applied in my life and the lives of others, the more convinced I become. One single factor trumps everything else you can possibly do with your money. It is the lead domino that dictates all other options and decisions from the start of your financial journey through retirement. And it’s not even close!

Living Below Your Means

The single thing that matters more than anything else is living below your means. In your accumulation years this means developing a high savings rate. In retirement, it means having a low burn rate.

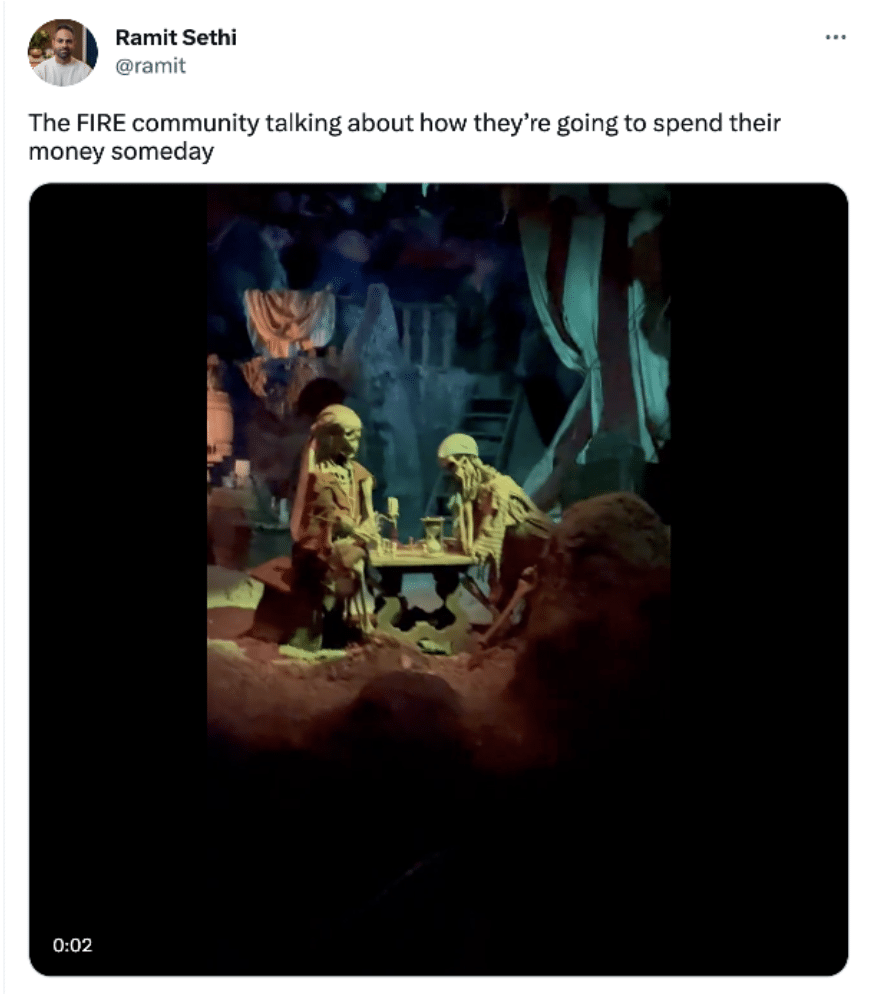

It is popular in personal finance circles to look down on those who live frugally. Though I enjoy much of his content, there may be no more prominent example of this than Ramit Sethi.

I think this disdain for frugality comes from the confusion between being frugal and being cheap. Yes, you can go too far with frugality. Yes, it can be hard for people who are natural savers to spend and enjoy their money.

I’ve explored those topics in depth and will continue to write about them. But not today.

This post is a reminder of the importance of learning to live happily, comfortably, and sustainably below your means. There is nothing more important you can do to be financially successful.

Let’s look at a few core personal finance concepts from the perspective of three different households, one:

- Following standard financial advice saving 10% of income,

- Living paycheck to paycheck,

- Applying FIRE principles saving approximately 50% of income.

Emergency Funds

A ubiquitous first step of personal finance advice taught by everyone from self-proclaimed experts like Dave Ramsey to the CFP Board is to create an emergency fund. This fund should hold 3-6 months of expenses. These funds should be liquid, i.e. easily accessible and not subject to price volatility.

Standard Path

This is sound advice and a great goal for the middle of the road case, saving 10% of their income. It provides a foundation from which to build towards bigger financial goals. It is also hard!

I’ve outlined the math of what it takes to build an emergency fund while saving 10% of your income in a separate blog post. Here’s the CliffsNotes version. Saving 10% of income, it would take:

- 27 months (2 years, 3 months) to save 3 months of expenses.

- 54 months (4 years, 6 months) to save 6 months of expenses.

This assumes that you save 10% every month. The purpose of having these savings is to be able to cover an unanticipated expense without needing to use a credit card, loan, or take money from volatile investments at inopportune times.

The longer it takes to build the emergency fund, the more likely it is you will incur such an expense and disrupt the process. You would be better served to build your emergency fund more quickly to be able to progress to other financial goals. But this would require…. a higher savings rate.

Paycheck to Paycheck

An emergency fund is even more important for someone struggling to save anything month to month. This could prevent them from the vicious cycle that traps so many Americans.

They often use high interest credit to meet their monthly obligations. However, this creates future obligations making it challenging to ever break the cycle.

Simply telling people they should have an emergency fund is pretty worthless advice without breaking down how to do it. How can someone barely making ends meet possibly save a quarter to a half a year’s worth of expenses?

You can hustle to increase earnings or sell off some assets. However, you still have to commit to saving the extra income, i.e. developing a savings rate.

This may seem obvious if you are a natural saver, but only this intentionality makes earning more matter. You must change the underlying mindset, patterns, and behaviors.

High Savings Rate

The household that is best positioned to follow this foundational advice is the one with a high savings rate. If you are saving 50% of your income, it would take only 3-6 months of saving to fully fund an emergency fund of 3-6 months expenses.

Conversely, these are the households that least need an emergency fund. If you build a lifestyle in which you consistently live on only half your income, there is little need to have cash savings sitting around. This allows you to invest more aggressively and grow your wealth even faster while incurring minimal risk.

Insurance

Another foundational personal finance concept is being properly insured. What would happen to your household if you were unable to work for a month, a year, or a decade? What if you or your spouse dies? How would you pay for a medical emergency? Or a car accident? Or cover damage to your home, or car, or major appliances?

The answer to each of those questions will vary considerably from person to person.

Related: Beyond Insurance — Strategies to Manage Risk

Standard Path

For people following standard advice, choosing when and how much insurance to purchase is hard. They will have to balance the risk of not being insured vs. the cost of paying insurance premiums. Every policy you buy means less money available to direct to other financial goals.

Building cash savings provides returns beyond the actual interest rates you see on conservative investments. Having cash on hand can simultaneously self-insure against multiple smaller risks. You can raise deductibles on home, auto, and health insurance. Eliminate buying warranties. Bypass short-term disability insurance.

These savings can be redirected to savings and investments. But significant time and mental energy as well as the actual cost of premiums will need to be spent to be sure you are properly insured.

And financial independence will take decades to achieve. Purchasing long-term disability and life insurance is important to mitigate risks until you build investments that can maintain your lifestyle and provide for your family if you weren’t able to work. The alternative is to assume substantial financial risk.

Paycheck to Paycheck

Those living a paycheck to paycheck lifestyle have even a greater need for insurance. Virtually any adverse event would be harmful, exposing them to financial risk.

Simultaneously, we know that every time we purchase insurance, we’re making a decision with negative expectancy. In other words, the more insurance we buy, the more we stack the odds that these decisions, cumulatively, will work against us financially.

So people that most need to buy insurance policies are the ones least able to afford them. This keeps people trapped on a cycle where they’re damned if they do, and damned if they don’t.

High Savings Rate

Those with a high savings rate can quickly self-insure against many negative events. Because they are on a rapid path to financial independence, the amount of time they need life and disability insurance is years, even decades, less than those on the other paths.

It may be reasonable to bypass insurance policies that many people would consider necessary. This is a decision Kim and I made, that I’ve written about in the past.

So those that can most afford insurance least need it. On the flip side, those with a high savings rate may choose to buy insurance policies to provide comfort.

And that’s OK, as long as it is a conscious decision you are making. Those with high savings rates simultaneously are the people who can most afford them.

Investing

Albert Einstein has a famous quote. “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t pays it.”

When calculating how your money will compound, three variables determine your ultimate outcome.

- How much you contribute (your principle),

- Your rate of return, and

- The time your money compounds.

The compounding formula is the same for all of us.

There is overwhelming evidence that it is exceedingly hard to pick stocks that will consistently outperform a portfolio of index funds that match the market’s performance. The vast majority of investors should not try.

Instead, focus should also be placed on controlling the things you can control:

- How much you invest,

- Maximizing the time you are invested,

- Your behavior,

- The amount of risk you assume,

- Fees and taxes.

These principles are true for all investors. But how you apply this knowledge and the outcomes you achieve will be drastically different based upon your savings rate.

Standard Path

If you are saving 10% of your income, you will be primarily reliant on the third variable, the time your investments have to compound, to achieve financial independence. This is a valid path to build wealth over a long period of time.

However, most of us aren’t patient. If you can’t increase your savings rate, the only variable left to work with is your rate of return. This may lead to getting more aggressive with asset allocation, taking on more risk in the hopes of higher returns.

A reasonable strategy would be to choose an asset allocation of 100% stocks. This is likely to work in your favor over time, IF you have the stomach for great volatility and the patience to stick with this lack of diversification in periods when stocks perform poorly. Unfortunately, an individual can’t know if they can tolerate this approach until they’re tested.

Many people seek speculative investments with higher promised returns as a short cut to saving more. Unfortunately, this approach is more likely to leave you broke than to help you achieve your financial goals.

Another challenge of having a low savings rate is having to choose between competing goals. Do you buy insurance and forgo investing as much? Or take on more risk by skimping on insurance to invest more?

There is no shortage of people who will try to sell you products (annuities, whole, universal, indexed, etc. life insurance) that purport to do both simultaneously. In reality, they are unlikely to serve either purpose well. They will cost you a lot of money and set you up for headaches down the road when you eventually have to figure out how to get out of these products.

Paycheck to Paycheck

Everything I wrote above for someone with a 10% savings rate is true for someone living paycheck to paycheck. Just on steroids.

You can’t squeeze blood from a stone. There is no magic formula to create wealth without first saving. Yet people in this situation are often desperate to try.

Occasionally people without good financial habits get their hands on a little extra money. It may come in the form of an inheritance, gift, bonus, prize, etc.

They are immediately vulnerable to the next hot investment fad, a can’t miss business opportunity, or “financial professionals” with a product to solve all that ails them. They’re almost certain to fail. Worse yet is applying leverage, borrowing the money you couldn’t save, to fund these strategies.

High Savings Rate

Those who have a high savings rate benefit by quickly having a substantial amount to invest. If you develop a high savings rate early in life, you also benefit by having a longer period of time for compounding to work its magic on this larger principal.

This is one area where traditional financial advice is actually more important to those with a high net worth. Cutting investment fees and taxes creates substantial savings for those with larger account balances and annual savings. These tax and fee savings in turn compound in your favor over decades. Likewise, behavioral errors are far more costly when you have more to lose.

Fortunately, if you have a healthy savings rate, there is less need to take unnecessary risks. A reasonable asset allocation will get you to your financial goals. This can allow you to dial down the risk taken in a portfolio if it will help you control behavior without sacrificing the opportunity to meet your financial goals.

Conversely, those with the least need to take excessive risk can most afford to. As long as you stay the course and continue investing through market downturns, making sizable additions to your portfolio at depressed prices can lead to accumulating substantial wealth.

Tax Planning

There are endless schemes that people will try to avoid paying taxes. The IRS annually publishes a Dirty Dozen List of prevalent schemes for people to be aware of. Simultaneously, many people ignore simple, foolproof, and totally legal ways to decrease their tax burdens.

Of course, the simplest and most effective strategies start with… having a positive savings rate. Let’s explore.

Standard Path

Once someone is able to consistently save and invest money, they have an opportunity to accelerate their wealth building process by utilizing tax advantaged accounts. Contrary to what you may have heard on TikTok 🙄, your 401(k) is not a scam!

Tax advantaged investing allows you to defer taxes you would pay in the current year. Consider someone who pays a 30% marginal (state + local) income tax rate on their last dollar. Every dollar they invest in their 401(k) results in a decrease of only seventy cents in their take home pay due to the tax savings.

Most employer sponsored retirement plans offer to match a percent of your contributions. This is free money that should never be passed up. Then you get tax-free growth until you take the money from the accounts.

Related: Early Retirement Tax Planning 101

Alternatively, it may be advantageous to use a Roth option rather than a tax-deferred account. This does not provide the tax break in the year of the contribution. However, you then have tax-free growth for life with no taxes owed when you take qualified withdrawals from these accounts.

Related: When are Roth Accounts Better Than Traditional?

Paycheck to Paycheck

Unfortunately, if you don’t have the ability to save, there is no way to access these tax advantages. This makes it challenging for those trapped in a cycle of debt to get their heads above water.

The process of living below your means in order to be able to pay off debt quickly is identical to what is required to build a positive savings rate to invest consistently. However, it is a slower process. Paying off debt doesn’t offer the tax advantages that investing does.

Related: The Stages of Financial Independence

High Savings Rate

Everything written above about those following standard financial advice applies to those with a high savings rate. However, those with a high savings rate are better positioned to fully take advantage of these tax planning opportunities.

A married couple could potentially save $46,000 in two 401(k) plans, $14,000 in two Roth or Traditional IRAs, and another $8,300 in a Health Savings Account in 2024. Those numbers would be halved for an individual and increased for those over 50 years of age who can also make catch-up contributions.

Related: Using an HSA as a Triple Tax Advantaged Retirement Account

Beyond tax advantaged accounts, someone with a high savings rate could also invest in taxable accounts. Investment income is taxed favorably compared to earned income.

A high savings rate leads to the ability to take advantage of these tax breaks. The tax breaks accelerate the time to financial independence. Financial independence enables early retirement or semi-retirement which can be far more tax friendly than your working years. But it all starts with a high savings rate.

Retirement

When we get to the end of our working years and enter retirement, we shift from accumulation to decumulation. As we do, the most important factor to our success or failure continues to be living below our means.

Your burn rate replaces your savings rate as the variable to consider. But the importance of this one single factor continues to trump all others.

Standard Path

When trying to answer the question “Can I retire yet?” there are many things to consider. They include:

- How should you structure your retirement portfolio?

- What is the best retirement withdrawal strategy?

- When should you take Social Security?

- What are my health care options?

- What will my tax rate be in retirement?

- Should I continue doing some work in retirement?

These are among the factors to determine the type of life you can lead in retirement. They are given a lot of attention and rightfully so. You want to be as informed and prepared as possible.

After a lifetime of following standard financial advice there will be uncertainty and angst. Most of us can never know with certainty if we have enough.

There are too many key factors that determine your outcome that are impossible to know and out of your control. They include investment returns and the sequence in which they occur, inflation, future tax rates, your health, and how long you live.

This is where solid financial planning can have the most impact. You have options and agency. It will be important to make the most of them.

Retirement on a Shoestring

After a lifetime of not saving and investing, there will be little optionality. Without savings, working into later years will be a necessity rather than an option.

Fortunately, we have a number of social programs and safety nets in our society. Social Security will hopefully meet basic needs. But this is not the way we want to live out our “golden years.”

Low Burn Rate

A desire to save is often driven by a feeling of comfort or security that saving brings. Therefore, these “super savers” during their working years often enter retirement with more money than they are likely to ever need in their lifetimes.

Just as a high savings rate during working years makes all other aspects of financial planning easier, a low burn rate has the same effect in retirement. You’ll still want to pay attention to your portfolio, tax situation, Social Security decision, etc.

But you don’t need to worry about getting everything perfect. Analogous to a high savings rate during accumulation, a low burn rate gives you many financial options in retirement. Simultaneously it makes it less important to optimize any of these decisions.

Take Home Message

If you are struggling to save because you associate saving with sacrifice, recognize the importance of living below your means. Establishing good habits can eliminate the stress and anxiety most people experience around money. It also enables countless options that snowball in your favor over time. The vast majority of the general public don’t understand this and need to have it hammered home repeatedly.

That said, a high savings rate or low burn rate are not a magic elixir that fixes all your problems. A higher savings rate or lower burn rate are not always better. You can go too far.

Intentional frugality can be powerful. However, frugality can be an unintentional side effect of being anxious about money.

Focusing too much on frugality can lead to deprivation. This can lead to missing out on things that matter in life while being too future focused. It can also lead to burning out on frugality and then going too in the other direction if you fall off the wagon.

The comfort that comes with saving makes it hard for many of us who are natural savers to enjoy retirement. It requires a different mindset and skill set to spend from the portfolio we’ve worked so hard to build.

We each have to find a level of frugality that is sustainable and leads to a life that is enjoyable. I suspect that many people drawn to this blog, and the ideas of FIRE and frugality more generally, need the occasional reminder that spending more can improve your quality of life.

Just don’t lose sight of the superpower that frugality is. Living below your means makes every aspect of financial planning easier. It provides options.

Remember that those of you with the most options to optimize your financial lives are also the ones that least need to. Go take advantage of that fact. Reap the rewards your frugality have provided and enjoy life!

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Live well within your means is my favorite double entendre. It is also the key to saving.

Agree!

It is never too late.

Throughout my 20s’, 30’s’ 40’s and up to my early 50’s I lived like there was no tomorrow. I never saved, spent way beyond my means and was deeply in cc debt.

One day, around age 52 i realized that if I did not want to deal with pushy people any more, I’d have to retire. So, I met my basic expenses and everything else went to pay off debt (Not including mortgage – “Good debt”). I finally paid it all off.

Next step, was savings. Once out of debt, around age 56, I saved half my paycheck. Mind you, I was still having fun, going on trips, etc. I was just being more conservative, spending only what I had after savings. Disclaimer. No wife, no kids, made it a lot easier.

By age 58, I had pensions (Minimal payments) from two employers, so I retired right about when covid started.

Between that, savings and yes, the blessing of the ACA (Health Insurance will bankrupt you!) I lived comfortably (If using some of my savings) until I was 62 and started collecting Social Security and had no need to touch my savings anymore.

I am not wealthy by any means. I do not live in a mansion in Palm Beach, a sprawling ranch, or drive a Ferrari (Heck, I got rid of my car – Was only driving 2000 miles a year). But I can do pretty much whatever I want. I travel internationally and stay in great hotels. If I want something, I buy it.

Early retirement for me was a blessing. Four years later, I have absolutely no regrets.

Everyone has different goals and ambitions in life. Mine, was to be free. I am.

Thanks for sharing Jesse James.

I’ve written about this from a theoretical approach, but love that you can share a real world application. If you would ever have an interest in sharing your story in more detail on the blog, I’d love to learn more and share it more widely.

Best,

Chris

Chris, another great article. Love how you’ve summarized everything together. The one area I’ve noticed pain with younger investors in light of the more recent increase in prices and the housing/rental market is the feeling that they “can’t” save because even the most basic necessities have become so expensive. When I get into discussions with people in this position, I point out that in addition to all the financial best practices, they should also be very proactive with their career and looking to increase earnings. If they stagnate in a career that isn’t working for them, they will still struggle to some degree their whole life. I saw this personally with my siblings who did not go to college and ended up in careers where they struggled with money their whole lives. Not saying all careers need to be focused on getting rich, but they should at a minimum be able to support a base lifestyle plus savings.

Wade,

Agree. I think people think of frugality only as cutting spending. I do think this is the faster and easier place to start when looking to establish a positive savings rate, I like to think about relative frugality which simply means spending less than you earn. Ignoring earning means you are ignoring one of the two big levers available for you to pull.

Best,

Chris

Great point! “Living below your means.” I’ve always lived with one point related to that:

“Pay yourself first.” Given that no one receives exactly the perfect income amount (especially when allowing for variables such as damages and repairs that may or may not ever come), I realized that by setting up to automatically remove a fix percentage from each paycheck, before doing anything else, I could afford to live “paycheck to paycheck” with the remainder, no matter what. If I had extra left over, that was well and good—and I could blow any extra, or save it, as my choice.

We always used 10% as our figure.

This always, always, always meant that we never had to budget. We’d already sent 10% off to some bank/investment-house we couldn’t easily touch. Each year, we’d put away 120% of a paycheck, and it could grow how it did (CDs, at first; Discount Brokerage account, later; rental real estate, later on).

For me, the benefit was that it took no budget to do this. And any excess at the end of pay period at least gave us the option, of whether to self-indulge or to stash away.

__________

This worked equally well with salary-paychecks and with any other, self-employed contractor type income. A check would come in: 10% was sent away to savings.

We treated gifts a bit differently: we stashed half. Our kids started this way, too. What’s the difference between someone giving you $25 or giving you $50, back then? If it was $50, and you stashed half, you still have the equivalent of an entire $25 gift to blow.

If you have a job where you get a regular paycheck, and you’re living by that paycheck, and you get a regular raise, if you sequester the amount of the increase, you’re still living by what you’re used to, but you put more away, each time. If you then get a subsequent raise, you can adjust the amount of money you keep to live on, by increasing your monthly live-on funds to match what they were when you got the previous raise. That way, after you forego the extra benefits of that first raise, from then on, whenever your boss gives you a raise, you actually get an increase—while your amounts of savings grow, too.

I’m not enough of a writer to have managed to write this up an good form. But I’d like the concept to spread: especially with one’s kids, and their first job, the concept of “Pay Yourself First” is a tremendous place to start. (In my own case, going back to my late teens, by my early twenties, I was able to use my savings to fund a book-publishing venture. Where else I could have gotten such money, I can’t imagine. AND: the fact that I was self-investing with carefully-nurtured savings meant that I was extremely careful about the venture.) (A year and a half into the venture, my visibly concrete portfolio got me an outstanding job as the Director of Marketing with a key, state-level trade book-publisher. But those are other stories, for other places and times.)

I hope you can use your megaphone to help more of our fellow money-straitened citizens get bigger “bootstraps” to “pull themselves up by,” in these challenging economic times.

Regards,

(($; -)}™

Gozo

Totally agree! I started my current job (24 years ago) as a 30 yr old single mom of a 4 year old. I had NO extra money. I started contributing probably 6 or 8 percent to my 401K. Each time I got a raise, half went to increasing my contributions and half went to us. After 5 years, this increased by contributions by at least 10% without feeling like I have any less money. Now I have almost $600K in that account with another 7-10 years left to work. I never would have been able to save that much any other way.

Slow and Steady,

Thanks for sharing your experience and congrats on finding a way to make gradual but consistent changes which clearly have added up over time. Kudos!

Chris

Thanks for the feedback and for sharing your experience Gozo!

Cheers!

Chris

Chris-

Great post! After years of learning about and focusing on this subject, we sometimes need to be banged upside the head with what’s patently obvious and, you did that in a very gentle and informative way…well done.

I’d add a couple things, which I’m guessing you omitted due to length of post. Anyway, they are:

1. There is a lot of room between the “10% Standard Savings Path” & the “50% High Savings Path”, and the math of it is fascinating. I’ve listed some intermediate examples below to illustrate but, a more comprehensive chart is contained in this post. https://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/

Savings Rate. Years to Retirement

10 51

20 37

30 28

40 22

50 17

2. To add to the discussion of ‘how to spend in retirement’, I’d suggest you add some links to variable spending methodologies that your readers can use to find what works best for them. I like “VPW” [see Bogleheads] but, there are many decumulation methodologies. I’ve found that a variable withdrawal strategy has helped me transition from my frugality-minded ‘accumulation’ years to my balance spending/risk ‘decumulation’ years.

Keep up the good work.

Best,

Mark

Mark,

Yes! I felt the post was already a bit long, but I think the idea you present in point one is crucial to understand and we cover it in detail in my book. And as for point 2, I cover that in next week’s resources post.

Cheers!

Chris

Congratulations on earning your CFP. This article is very informative and words to live by I only wish I would of read it in my twenties. It is great advice for the younger work force or actually anyone. The sooner you start the better off you are financially when you are able to reach retirement and hopefully that is sooner rather than later for your readers. Again, great article!

Hi Chris,

I hope you and your family had a great holiday.

In regards to spending in retirement, I wonder if you could educate your readers, including myself, about differences between a 60/40 AA and a bucket system. When I read about them separately they seem to make sense, but when I try to compare them, I sort of feel stomped by them. I think I can grasp

the bucket system easier at the moment.

How does the 60/40 AA portfolio support retirees?

Do people live on the interest only that the 40% bonds of the portfolio provide or do people sell some bond fund shares in addition to the interest?