PRALANA GOLD RETIREMENT CALCULATOR

The Mercedes-Benz of Retirement Calculators

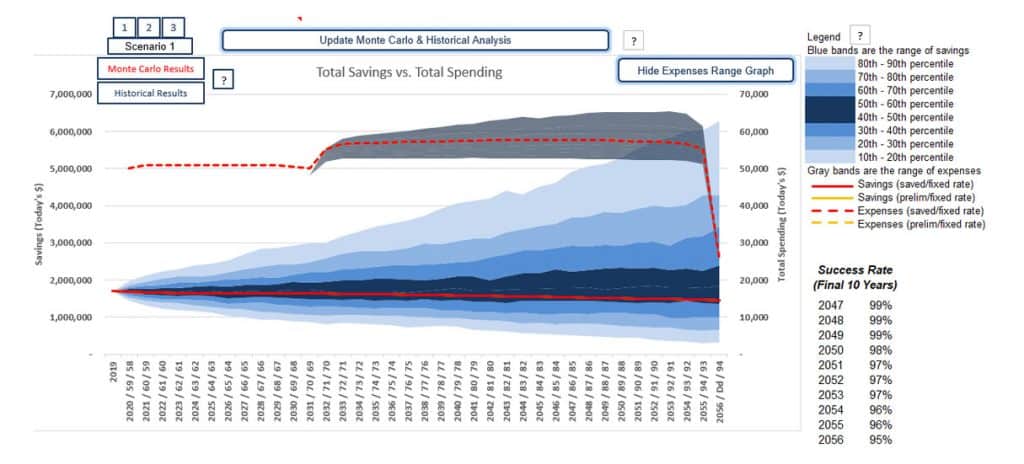

See into your financial future with arguably the most advanced personal financial model available at any price. Comprehensive help and simplified input get you started fast. Detailed assets/real estate, income, and expense input. Optimize retirement withdrawals with the most accurate tax calculations available in a personal retirement calculator.

Handles Social Security, ACA, Medicare, HSAs, RMDs, QCDs, Roth conversions and much more. Graphical and tabular projections for the highest-fidelity analysis of your financial independence plan.

What Users Are Saying…

“I’m hooked! This is by far the most comprehensive of the 18 retirement calculators I tried and the easiest to use among the detailed ones. I started with the free Bronze version and loved it, so I bought Pralana/Gold – and they’re in Excel so I don’t need to be online. It allows for impressive detail of inputs and variables, lets you easily test different scenarios, creates great reports, and gives this control freak everything I need. Customer service was prompt and thorough when I had questions. The User Guide is substantial and very useful, including examples. I have full confidence in its results!”

CATHERINE R., SPARTA, NJ

“…superior in every respect to every other medium and high fidelity retirement calculator that I have used. The tool’s ability to effortlessly model various financial “what-if” scenarios with a holistic view of the results is truly invaluable (Roth conversion vs. no Roth conversion, moving from a high tax state to a lower-cost home in a low tax state, should I work part time or not?, should I pay off a rental property or not?, should I keep on working or retire now?, should I delay taking social security?, etc.). Additionally, Pralana Gold’s ability to do “stress testing” is exceptional (testing lower rates of return, higher inflation, longer life spans, higher expenses, etc.). And best of all the cost of Pralana Gold is miniscule – a heck of a bargain- and the support from the developer is truly excellent. I highly recommend this tool for young people all the way up to people in retirement, and for everyone in between. Fantastically useful, at a ridiculously low price.”

SHAYNE B., SANTA ROSA, CA

“This is an amazing product that I’ve spent hours and hours utilizing to model my situation. I’m on the cusp of 60 and I read everything I see about personal finance .I’m a banker, MBA, so I know finance, and 99.99% of the time there is not much new. Your model is the best tool I’ve ever found!”

MARK H., SEATTLE, WA

WHAT YOU’LL GET…

ABOUT THE DEVELOPER

Stuart Matthews

Stuart Matthews, the designer and developer of the Pralana Retirement Calculator, is a retired electrical engineer, systems integrator and program manager. He received a bachelor’s degree in electrical engineering from the University of Texas at Austin and had a rewarding career in the defense industry with Bendix, Rockwell International and Raytheon, retiring in early 2009.

From Darrow Kirkpatrick: “PRC/Gold is an incredible value, given the amount of savvy domain knowledge and software skill embedded in this impressive tool. Considering the potential hundreds of thousands of dollars at stake in managing your retirement nest egg, the price seems trivial. Add to that an extensive User Manual (a rarity with any software these days) that can teach you a great deal about retirement planning in itself, and same-day support via e-mail from the extremely knowledgeable developer (also a rarity), PRC/Gold is simply a superb analytical tool – arguably the highest fidelity retirement calculator available – and a great value.”