Are We Spending Too Much?

Perception is reality. When two people have a different perspective, their versions of the same reality can look quite different.

Kim is the detail person with our household finances. She’s the one paying the bills and tracking our expenses. Recently, she expressed concern that we are spending too much. Our annual expenses increased by 21% in 2022 compared to 2021.

I am the big picture person in our house. I manage our tax planning and investments, including tracking portfolio inflows and outflows. Despite our portfolio value dropping by 14.2% in 2022, I had no concern about our finances, including our spending. We were net savers, adding more new dollars to our savings and investments than we took from them over the course of last year.

I shared my perspective with Kim that we are continuing to spend too little, or conversely earning more than we need. We need to reassess if we are spending our time and money in the ways we truly want. If not, we should be working less and/or spending more.

So who is right? How do you determine if you’re spending too much, or too little, after achieving financial independence? Is there a correct amount we “should” be spending?

Historical Perspective — Where is the Money Going?

When we discovered FIRE and started considering major life changes, we started closely monitoring our expenses and investment values. We wanted to better understand how much we spent and whether we had enough to cover those expenses if we were not working and earning.

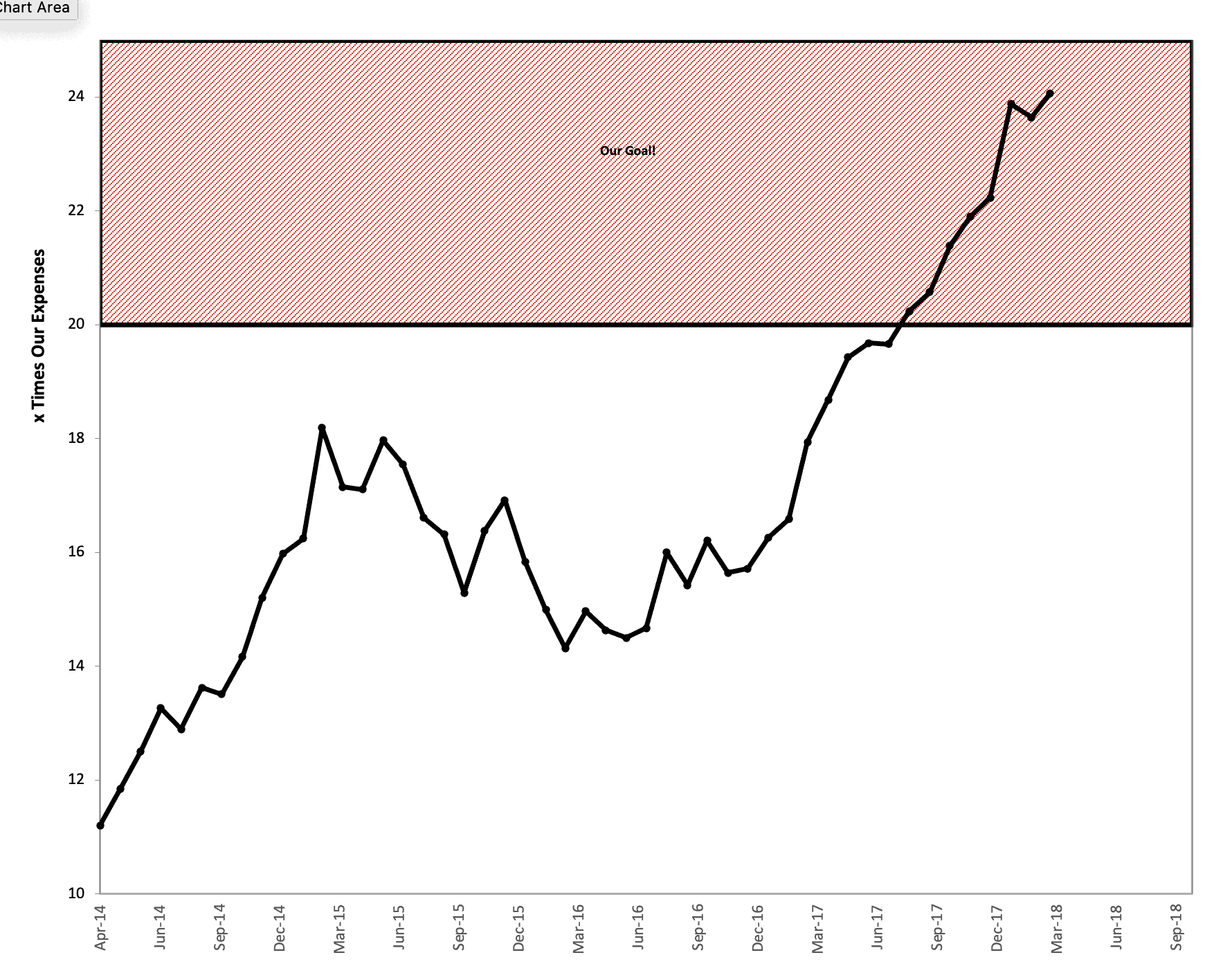

Kim created a graph plotting our monthly progress towards financial independence. She tracked our portfolio value as a multiple of our rolling average of annual spending. I shared this information monthly on my original blog as we tracked our progress.

Over the past few years, we’ve stopped monitoring our numbers so closely. Frankly, we spend very little time thinking or talking about money. I consider that a luxury. We’ve mastered the big things with our finances, so we no longer need to sweat the little things.

Out of habit, we each have continued to maintain the data every month, Kim on the spending side and me on the investing side. This data was helpful to reconcile the discrepancy in our points of view regarding how we are doing financially.

I first looked to see where our money went by comparing it to our spending from previous years. Are there any major trends that should concern us? Are there actions we should be taking?

I found that most of our increased spending could be broken down into three categories: inflation, fun, and health care expenses.

General Inflation

Inflation was all over the news in 2022. I assumed that a good portion of our increased spending was a result.

The Consumer Price Index (CPI) is the U.S. Bureau of Labor Statistics (BLS) official measure of inflation. The reported CPI for 2022 was 6.5%.

Surely we are better than average I naively assumed. I’m a “personal finance expert.”

Yet, the numbers told a different story. Our personal rate of inflation for the year was 21% and I wasn’t even aware! How was that even possible?

Groceries

One area where our personal rate of inflation was much higher than the CPI was groceries. Inflation in food prices, reported by the BLS at 10.4%, exceeded the general CPI. Our personal inflation in grocery spending was 19% year over year. Ouch!

This is somewhat concerning because groceries make up nearly 20% of our total household spending. We enjoy cooking and eat the vast majority of our meals at home.

We don’t have any desire to change the way we eat. So there’s not much for us to do here other than take note of what we are spending and figure out how to pay these expenses moving forward.

Property taxes

Another area where our personal rate of inflation far exceeded the CPI was property taxes. Our property taxes increased by another 28% in 2022 compared to 2021. They have now more than doubled since we purchased our house in summer 2017.

Fortunately, we bought far less house than we could “afford” and we live in an area with relatively low property taxes. Even with the increase, our property taxes represent only 4% of our total annual spending, so luckily it is not a major concern as we love where we live.

This rapid increase in property taxes is notable. We moved here from an area with little property value appreciation, and subsequently stable property taxes. In our new area, real estate prices are increasing rapidly.

Appreciating real estate prices are generally looked upon favorably by people who see their net worth rising. However, this is a phenomenon realized only on paper or a computer screen.

There is little benefit of your home value going up, other than being able to borrow against it, until it comes time to sell. Even then, it is no benefit if you need to buy another home and all the other properties are increasing at the same rate. You only benefit if your property value has gone up and you can buy something that has not increased as much.

Related: Using Domestic Geoarbitrage to Retire Sooner

In contrast, the cost of increasing property taxes is real. We feel those costs every year when that bill comes due.

Utilities, Gas, and Insurance

Most conversations about inflation assume that your personal costs are reflective of the general CPI. This was mostly the case for our insurance, utilities, car, and home maintenance with three notable exceptions.

Our gasoline expenses increased by 48% year over year. At first glance that number is eye popping. However, we’ve built a lifestyle that involves very little driving.

Our 2022 number represents just 2% of our annual spending. I anticipate with gas prices coming back down, it will be closer to 1% of our spending again this year.

Virtually all of our driving is for recreational activities. In spring and late fall when we aren’t driving to ski, paddleboard, or mountain bike, we may not fill the tank of our one car for an entire month. We drive so little, gas prices just don’t matter much for us.

The lifestyle we’ve built makes us essentially immune to even drastic changes in gas prices. This is another demonstration of how your personal rate of inflation can differ greatly from the CPI.

Our bundled home/car/umbrella insurance premiums increased 13% last year on the heels of an 8% increase the year before, despite having no claims or traffic violations in either year. These costs are under 3% of our total spending, so I have been lazy in shopping for better rates.

Similarly our bundled cable and internet increased by 12% this year despite no corresponding increase in service. Seeing the seemingly egregious increases makes me realize I could probably do a better job managing both of these expenses moving forward.

Fun

The second category where we spent substantially more last year was on personal enjoyment.

In 2022, our spending on outdoor adventure gear and activities increased by 120%. This spending represented 13% of our annual household spending for the year.

Our travel expenses went up by 14% in 2022. These expenses made up another 13% of our annual spending.

Outdoor Gear/ Activities

We made substantial gear additions and upgrades last year. Our major purchases included a new set of powder skis and bindings for me, an uphill ski set-up for Kim (skis, bindings, boots, skins, and avalanche safety gear), and a full-suspension mountain bike for Kim. These are all likely one off purchases that should last us at least 5 years and have little additional ongoing maintenance costs.

Our ski passes increased more than usual last year. This was in part to make up for a price freeze the year before due to uncertainty around the pandemic. Our daughter also aged into a more expensive season pass price bracket.

Still season passes are an incredible value for our ski crazy family. Our average daily cost per person is under $15 compared to the daily pass rate of $135 for a single weekday and $175 for a weekend day pass at our local resort.

Kim and I also joined our local climbing gym in November. This therefore wasn’t a big expense in 2022, but it will further increase our spending in this category by about $170/month or $2,000/year going forward if we stay with it.

Travel

I was frankly shocked by how much we spent on travel in both 2021 and 2022. We paid for no non-business flights (other than a mandatory nominal security fee of $5.60 on every flight booked with travel rewards) or hotel rooms in either year due to my efforts earning credit card travel bonuses and using up travel credits accumulated during the pandemic. Our travel spending also didn’t include my trips to speak at a CampFI event last July or the Bogleheads Conference in October, as I wrote those off as business expenses.

Still our travel expenses represented 13% of our 2022 annual spending, and increased by 14% compared to the year before.

Upon further review, the vast majority of the travel expenses from 2021 were incurred in our month-long cross country trip in a rented camper van. Likewise, a large portion of our 2022 spending was prepaid expenses for another upcoming campervan trip in 2023.

Seeing exactly where our travel expenses went made me more comfortable that our spending is under control, and we are getting a ton of value for the travel dollars we did spend considering in 2022 we took:

- Three family cross-country flights and another solo trip for me to visit family.

- A family flight to Phoenix and rental car to hike the Grand Canyon and spend time in Sedona and Phoenix.

- A family flight to Las Vegas and rental car for a trip that included a few outdoor adventures in surrounding areas and several days and nights on the Vegas strip.

- A train trip from Pennsylvania to NYC with several hotel nights in Times Square during the holiday season.

Health Care

The other area where our spending increased at a rate greater than the general inflation rate is health care expenses. When planning for retirement spending there are two components to be concerned with, health insurance premiums and out-of-pocket costs for care. Both increased substantially for us in 2022.

Our health insurance premiums increased by 11.4% in 2022. They made up 6% of our annual spending. This was disappointing to see because the primary reason Kim continues to work the amount she does is to qualify for this benefit.

A bigger concern is that this high-deductible plan leaves us with substantial out-of-pocket expenses when we actually have medical expenses as we did in 2022. Our out of pocket expenses increased by 77% from 2021.

The combination of our health insurance premiums and out-of-pocket expenses accounted for 15.7% of our annual spending in 2022.

We take a little peace of mind knowing that most of our 2022 expenses were attributable to some issues Kim is addressing. We anticipate these particular expenses will come back down as she improves. My daughter and I have so far been blessed with good health.

However, Kim and I are both aging. We have at least another decade with a child. Our lifestyle involves regular outdoor adventure activities for all three of us and our daughter’s youth sports.

Odds are 2022 will not be the only year in which at least one of us requires care for injury or illness. Unfortunately, with out of control health care costs, it takes very little care to hit our high out-of-pocket maximum payment. This will be an area in which we continue to pay close attention in our financial planning.

Spending Too Much?

After reviewing our spending, I take comfort knowing that a large chunk of our increased spending was attributable to the fun category. If necessary, we could reel that in substantially while still maintaining an amazing quality of living.

However, I enjoy being able to spend with little concern and I really don’t want to have to reel that spending in. Lifestyle inflation is real for all of us. Kim is right that I need to be more aware of our spending.

Also, seeing how little control we have over general inflation and health care spending is concerning. Reviewing our spending was helpful for me to see things from her perspective. What could she learn from looking at our spending from my perspective?

Safe Withdrawal Rate Perspective

My perspective on our spending originated from the same place as Kim’s. As we tracked our net worth as a multiple of our spending, I felt we had reached a point where we are, more or less, financially independent.

In the FIRE community, we talk a lot about “the 4% rule” as a starting point to determine how much you can safely spend in retirement annually. I prefer to think in terms of Darrow’s more qualitative “Retirement Flexibility Scale for Choosing Your Safe Withdrawal Rate” which he described on the blog years ago.

In reality, we can never know exactly what our safe withdrawal rate is until after the fact. We do know if we only spend income produced by a broadly diversified portfolio, let’s call that 2% in the low yield world of 2022, you can not run out of money because you are not touching principal.

In 2022, we spent far less than that. We actually were net savers over the course of the year! Stated another way we had a negative withdrawal rate. The new money added to our savings and investments was greater than the amount we took out over the course of the year.

Spending Too Little?

Based on that, I felt we could easily spend more or earn less. This was my basis for initially having little concern over our spending.

Kim expressed concern that if we did need to rely on our portfolio, we were not really financially independent. Our 2022 spending would have represented 4.06% of our 2022 beginning balance and 4.73% of our diminished year end balance.

From that perspective, she is correct. Our 2022 spending is a bit higher than either of us would be comfortable with if we had to live exclusively off of our portfolio.

However, we have substantial flexibility on both the spending and earning sides of the equation. A traditional retirement where neither of us have any earned income is not impending.

Seeing how much we are spending and where it is going brought me closer to Kim’s point of view. For her, seeing that the amount we took from our taxable savings and investments to meet spending needs was less than what we added (401(k), HSA, and Roth contributions) over the course of the year helped to alleviate some of her concerns.

All of this clarified that we need to do a better job of communicating about money, but it didn’t definitively answer our initial questions.

Are we spending too much (or too little)? Is there an amount we “should” be spending?

So we kept talking and looked at things from a third perspective.

Values Perspective

In my book, I discussed the concept of being a “valuist.” I defined the term as a person who aligns his or her spending with their personal values.

This is something Kim and I have traditionally done a good job with. We maybe got so good at it that we started to take it for granted, leading to our lack of communication about money. So I suggested we get more intentional.

I asked her to reflect on the past year. I did the same. We each asked ourselves three questions which we then discussed.

What spending did we particularly derive value from in the past year?

What did we regret spending money on in the past year?

What did we regret not spending money on in the past year?

It was comforting as we discussed this topic that all three of our lists mirrored one another almost identically. Neither of us have any major regrets about how or how much money we spent. Even more comforting was that the list of things we are happy we spent on far outweigh any regrets.

Spending That Added Value

In particular we both agree that our travels, spending on outdoor gear and adventures, and investment in health added substantial value to our lives.

Our vacations gave us time to bond as a family, away from the distractions of everyday life. We continue to expose our daughter to cultural, educational and physically challenging experiences in nature that shape her physically, mentally, and emotionally.

We also traveled more than usual the past two years to spend time with family. In particular, I made it a focus to spend as much time as possible with my parents. My mom has been struggling with a series of health issues that make traveling to see us impossible, and makes even normal daily activities a struggle. My dad has been faithfully serving as her primary caretaker. This is an opportunity to give back to them.

I spent a few weeks in Pennsylvania with them in February. All three of us spent a few weeks there in the summer as well as Thanksgiving week. Kim noticed on the latter trip how much they were both struggling, my mom physically and my dad emotionally. She came up with an idea to return just a month later to surprise them with a Christmas visit.

The expression on their faces when we showed up unannounced from 2,000 miles away on Christmas day made it worth every penny and ounce of energy spent.

Kim is very generous with spending on others. She has a hard time spending on herself. So it was rewarding for me to hear her acknowledge how much she valued spending on healthcare needs to take better care of herself and for outdoor gear that allowed her to treat herself. She initially resisted these spending decisions until I pushed her to make them.

Where We Regret Spending

While most of our spending added value to our lives, two areas stuck out for us where we regret our spending: our bundled home/auto/umbrella insurance and cable/internet bills. Fortunately, neither of these make up a substantial portion of our expenditures.

There in may lie the problem we struggle with. On one hand, we crave financial simplicity and value our time. Neither of us want to put in the effort of making phone calls, sitting on hold, etc. for decisions that don’t really move the needle financially for us.

On the other hand, something rubs us the wrong way with both of these expenses. We don’t believe you should treat people unfairly simply because you can get away with it.

We also know that we have obtained our financial position by not being lazy or frivolous with our money. Knowingly spending more money than we should on these services just doesn’t feel good to either of us.

The fact that both of us brought up these expenses as regrets tells me it is time to do something about them. I am currently shopping both of these services. I’ll share if our intuition is correct and we can find the same or better service for less.

Where We Regret Not Spending

Similarly, neither of us had any serious regrets. However, our one regret was the same.

After spending a few days with our families over the holidays, we took a train to New York City. We went with little agenda. After spending a few nights in Times Square, we were going to move to a hotel near Laguardia for our last night for an early flight the following morning.

One thing we considered doing before leaving Manhattan was taking our Christmas crazed ten year old to Radio City Music Hall to see the Christmas Spectacular with the Rockettes. It was sold out, but we were told to go to the ticket window an hour before the show as tickets occasionally become available. We agreed that if we could get three balcony tickets for the matinee ($65 each) we would see the show before leaving town.

When we got to the window, only two tickets were available in the whole theatre. While talking to the attendant, three floor tickets ($180 each) together opened up, and we needed to decide fast. We turned them down.

We justified our decision by the fact that we needed to get back to our first hotel to get our luggage, get a subway out of the city, and desire to do so before it got dark and Times Square was even crazier.

All these things were true…. regardless of ticket price.

Also true, is that we aren’t city people. We live in Utah. We may never go back to New York City. That was absolutely the only time we could ever have that specific experience with our daughter. Money was the deciding factor.

Take Home Messages

At the end of the day, there is no absolute right answer as to how much you should spend. Like all things with personal finance, this is personal.

There are spending rates that are not sustainable. We are clearly not there.

It is also possible to cross over from being frugal to being cheap and regularly depriving yourself of things you want and can afford. We’re clearly not there either.

A theme of this blog is financial simplicity. I’ve expressed my desire to live on financial autopilot. My goal is to spend the minimal amount of time worrying about money so I can maximize the things in life that truly matter.

Our disagreement about our spending and this analysis that grew out of it showed me the importance of maintaining some vigilance. It is great to be in a place where money is not a day-to-day concern. However, getting too lax with financial habits and systems can set you up for trouble.

Those financial habits and systems are especially important if you have a partner in this journey. It is remarkable to me that after a quick look at the numbers and a few conversations, we went from two drastically different perspectives to being back on the same page and with a plan to move forward. If you have a partner, these need to be ongoing discussions.

Finally, it is important to understand that we are constantly changing over time. Periodically, we need to reflect on the role money plays in our lives. Financial habits and attitudes that served you in one phase of life may hinder you in other phases.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Please come back to NYC! We can collaborate on some YouTube videos and then you can expense it as a business expense!

TBD. I doubt we’d ever do it again that close to New Years. I’m a little claustrophobic for that many people. 🙂

Cheers!

Chris

Great article! It’s funny that you used the same wording I did with my wife, “We’re spending too much” before I realized it should be “It’s costing us too much to keep the same.” It appears we are all being nickled and mostly dimed with a lot of costs that are going up 2-3 times the inflation rate and these are not things that add value to our lives. Our expenses are up almost identical, around 20%, and these costs are mostly taxes, utilities, insurance, and some food. Our car insurance was up 20%, homeowners up 30%, property taxes up 20%, and food around 20%. Since most of these things add no quality of life or real value it feels badly especially since we aren’t going to see these costs come down just because inflation stabilizes. Maybe food will come back down, but those other things appear to be locked in and that really hits our bottom line projections going forward.

Ed,

It’s interesting that we’re not alone in our personal inflation being substantially higher than the reported CPI. I’m sure there is political pressure in how CPI is reported, substantial variability by region, and good old error as with any statistical measure.

Over the long-term, CPI is probably as good as we can do when running projections in a retirement calculator or financial planning tool, but this highlights why your personal inflation rate is more important than CPI. It also drives home the point that some of those things, though personal to you, you can’t personally control.

Best,

Chris

Great read. Thx for the reminder to make sure we are both on the same page. She is less involved in the money issues, but I always share with her how we are doing. Here’s a picture of our portfolio progress, spending, and withdrawal rate over the last 15+ years…

https://www.dropbox.com/s/mgyorx38hnk302b/PortfolioProgress%202023-02-20.jpg?dl=0

…btw, if your travel plans for this summer take you back to the Black Hills, please hook up with us again so we can show you more of our beautiful area. There is so much to do in the Black Hills. Here’s just a sample:

Things to do in the Black Hills of South Dakota:

Towns to visit:

Rapid City

Keystone

Hill City

Hot Springs

Custer

Deadwood

Leads

Spearfish

Sturgis

Attractions:

Reptile Gardens

Bear Country

Black Hills Playhouse

Mount Rushmore

Crazy Horse Memorial

1880 Train

Hot Springs Mammoth Digs

Flying T Chuckwagon Supper Show

Fort Hays Chuckwagon Supper Show

Circle B Ranch Chuckwagon Supper Show

Museum of Geology

Journey Museum

South Dakota Air and Space Museum

Thunderhead Falls

Lakes:

Sylvan Lake

Stockade Lake

Sheridan Lake

Pactola Reservoir

Caves:

Wind Cave

Jewel Cave

Crystal Caverns

Black Hills Caverns

Rushmore Caves

Miscellaneous:

Michelson Trail (rails to trails)

Bad Lands National Park

Custer State Park

Custer State Park Wildlife Loop

Spearfish Canyon Road

Needles Highway

Iron Mountain Road

Mustang ranch

Roughlock Falls

Devil’s bathtub

Thanks for sharing JC. And thanks for the recommendations and invite. Unlike NYC above, I can promise the Black Hills are on the short list for a more extended visit. However, when that happens is still TBD.

Cheers!

Chris

I liked this. Good read.

Thanks for the feedback Andrea!

Best,

Chris

I have tracked our expenses for the last 8 years. I was surprised that the auto part of our auto/home insurance was set to go up 32% when renewed in a month. I initially put off to the idea of making insurance quote phone calls. But I finally made a few calls and the first call matched what we are paying now (so I undo a 32% increase) for the next 6 months. I was immediately satisfied, but decided to call a second insurance company. I was surprised to find their price was even less. So even though I dreaded calling around there was a reward in doing so.

As you express, Chris, some (personal) or even local items have gone up more than the averages. Same here. The one that really gets me is eggs. I have read several headline stories of egg prices going up 60% last year. Prior to Covid I could get a dozen eggs at the nearby Aldi store for $1.00. Last I checked, it was $4.19. So it is more like 60%, three years in a row! I now shop around for eggs. I could not have imagined that 3 years ago.

Thanks for the good article. Guess I value shopping around for car insurance and eggs. But only when I have to.

John G,

Thanks for sharing your experience. I hope I have similar results. I would think there would be more emphasis on loyalty to customers who regularly pay premiums and never make claims. I suppose the companies track customer retention closely and, as long as they don’t lose too many people, prefer to collect the same or more premiums to cover less people and thus expose themselves to less risk.

And yes, as a family that eats a lot of eggs those prices have gone up so much that even I noticed. 😉

Best,

Chris

One thing that I started reading is “Die with Zero,” whose premise is that money that’s left over after you die is, to some degree, wasted effort on your part. Obviously, it’s a legacy for your heirs, but it means that you’ve earned and saved money that you didn’t get to use.

On a related point is the concept of go-go, slow-go, and no-go as the 3 phases of retirement, i.e., there will be an initial period when you are physically able and anxious to travel, followed by a period where you are less able or less willing to travel, followed by the final period when you no longer able or willing to travel.

Based on all that, it seems to me that there’s an optimum spend profile that might be quite different than a fixed spend rate. The issue, obviously, is that extra uncertainty makes it even less clear what spend rate is practical or manageable.

arbiter007,

It’s interesting that you cite Die With Zero. We recently listened to an interview with the author and I think that really stuck with us as we thought about that one spending decision we regretted. My thoughts and ideas continue to grow and evolve on spending and I look forward to my wife and I both reading the whole book and having more conversations about this topic in the future.

Also, I agree that planning for a linear rate of spending through life, while easier for financial modeling purposes, is impractical and suboptimal in real life.

Thanks for the thoughtful comment.

Best,

Chris

Thank you for this post. You and your wife reflected calmly on your past year’s spending in a way that I’m not sure my husband and I could ever do (though I hope we can). It’s a good example for how to talk to one’s partner.

Sharon,

I had to laugh reading your comment. Remember you’re reading my edited analytical version. You don’t get to see the dismay when I hear my wife tell me we’re spending too much when I come to the conversation thinking the opposite. You don’t get to witness all of the emotion and turmoil before we eventually sat down, looked at the actual numbers, and tried to see things from one another’s perspectives and eventually come to a consensus.

That said, I am proud that we eventually managed to get there and I’m sure you can too. If there is something stopping those conversations, it may be time to call in a third party to help facilitate them. That may be a financial advisor or coach if this is strictly a money issue, or a marriage counselor if it extends to more areas of life. IMHO, this is one of the best investments you can make.

Best wishes to you both,

Chris

Love that pic of your mom and daughter – good decision on that extra visit at Christmas!

Thank you Tom. That is one point that the two of us were 100% in agreement.

Cheers!

Chris

I especially like the outline you gave of your approach to discussing this difference. A gift for others to try out in their own relationships!

Thank you Laura.

I always try to be as honest as possible when sharing first hand accounts. It’s not always easy to show your warts, but comments like this make it worthwhile.

Best,

Chris

My husband and I did a similar exercise at the beginning of this year. Like you, one of our biggest categories was groceries. This stumped us because our grocery list is usually pretty empty (we buy and cook in bulk), and at first we assumed it was just inflation. I tallied up all our grocery receipts for January and was surprised to see that almost half of our spending was on snacks, soda, and alcohol. Mystery solved, and a little embarrassing to see it in hard numbers. It might be an informative exercise for you if you haven’t gone to that level of detail with your grocery bills.

We also had the conversation about whether we were saving “enough” and if our spending reflected our values. We saved 30% of our income, maxed out our daughter’s and niece’s college accounts, and took two vacations. We spent more than we would prefer on groceries, restaurants, and random consumption, but at the end of the day we felt okay about that because of the 30% savings rate. I have been working to shift from a mindset of optimizing every dollar to focusing on financial and emotional impact. Yes, we could save $15 a month by canceling one of our three streaming services, but that is literally a rounding error in our annual spending and it would decrease our quality of life because we watch all three regularly.

Thank you for the thoughtful and informative posts. I really look forward to them.

I appreciate that feedback Liz. I think our philosophies are in pretty close alignment. I totally agree with spending on anything, big or small, that clearly adds value.

I think as our analysis shows, where we still struggle is handling things that won’t break us, but that are a hassle so we let them go. The other area we struggle with is wanting to share experiences with our daughter, while also teaching her the value of things and not wanting to spoil her.

For all of us, it is a work in progress.

Best,

Chris

Chris, your careful explanation of your thought process and the inclusion of key financial details always produce an interesting, relevant and thought-provoking read. This post was no exception. Our annual review of expenses generated an in-depth discussion of our travel expenses – a major line item for us. Fortunately, Alan and I were on the same page, and it didn’t take long to agree on a dollar amount for this year’s travel budget. As with so many issues (and as you’ve highlighted here), honest communication between partners is a critical component of managing finances.

Mary,

I always appreciate your thoughtful comments. One thing we’ve never really done was make a budget. Fortunately, one or both of us invariably just senses when things get out of balance one way or the other and that has been “good enough” for us.

I think a budget would help avoid these discrepancies, but like all things it would involve a tradeoff. In this case that tradeoff would be feeling restricted by a set budget so we’ve avoided it to this point, but it may be something we consider more when we transition to a more traditional retirement and fixed income.

Best,

Chris

Truthfully, our budget is mostly a suggestion because are blessed with financial flexibility. If you and Kim stay mentally on top of your spending, more power to you. Wait until you hit our age – you’re probably going to appreciate the visible reminder. 😉

Hi Chris,

This is a very educationally practical blog post. Thanks for sharing it. I have a few questions.

You wrote

I find it hard to reconcile an increase of 48% YOY vs. the very little driving. I’m not capable of cracking this subliminal message :-). Are you saying that say your gas expenses went from $1k in 2021 to $1.5k in 2022 and represents 2% of spending is only because of the gas inflation and gas inefficient vehicles? It’s also interesting that you/Kim don’t lump up gas expences with overall transportation expenses that include maintenance of vehicles, annual inspections, new tires, etc. Like they say there are different ways to skin a cat. I categorize a bit differently and in more broader categories.

I never thought of tracking our NW (w/o house value) as an expense multiple while in an accumulation stage. Since you’re financially FIRE’d, what’s the use of tracking it now? BTW, can you share what you’ve learned during your studies to become a FA in regards to the expense multiple tracking for retirement preparation? Is there some kind of benchmark to adhere to when people are in a decumulation stage? Do 25x, 20x, or even 30x expenses remain important once a couple or a single person reach FRA?

One more thing to add… I think your wife can relax even further because if I understand it correctly your shared perspective with her didn’t include future SS benefits. Am I right?

Thanks again for a good article.

S&M,

Re: gasoline spending. I like to share in percentages & multiples because I know we all have different perceptions of frugal, excessive, etc. But you nailed it. We drive very little. Our “big” drives are 20 minutes up to the mountains & most normal activities (daughter’s school, groceries, gym, library, etc.) are all less than 2 miles. So if gas increased from $4 to $12 we may drive a little less, but basically it wouldn’t matter. I’d contrast that against my early career when we each had to drive over an hour round trip to work every day, gas prices had a massive impact on our spending.

Re: investments as a multiple of spending, this was something we intuitively started doing b/c you can’t (at least not without adding interest expense & risk) spend your home value. In CFP classes, this essentially wasn’t discussed. The retirement planning was the section I started with most interest in and where I got the least value. Long story and it may be worth a blog of its own.

Re: SS you are correct that we don’t factor that in. We do with our detailed planning & projections, but we’ve found tracking investment value as a multiple of spending a good back of the envelope quick check of where we are, or at least were in our accumulation phase. As noted in the post, we don’t track keep track of this metric anymore until I checked for this blog post.

Hope that clarifies.

Chris

I really enjoyed this post. I am also wrestling with the internet/cable decision. We had a 6% increase this month for no new services and it has been creeping up considerably over the last several years. Quite frankly it has hit the ridiculous point. So perhaps we will look at Hulu Live or YouTube TV for a month while we keep the cable and if it works out, keep the internet only (which I’m sure will increase steadily as they lose cable customers to streaming services). We also had to file a claim for the only time in 40 years on our automobile insurance, so how will that affect the rate at the next renewal? Ugh

We are now officially both retired and I’m working on the “when to take SS numbers” as we are now both eligible. I carry the financial burden and with the spouse still in the “when I want something I buy it and don’t even think about the price” mindset, it is sometimes quite heavy. Thank goodness they aren’t a big-time spender, but they don’t look at the little things either. “I want it and I want it now”– while I am just beginning to navigate the waters with our new monthly numbers. They have no interest in taking over the finances or sitting down and analyzing. “You’ve made it work for all these years so just keep doing what you are doing.” And they also are quick to insist that so and so did this or that so we should too–I try to explain that everyone has different circumstances. Different portfolios, different monthly expenses, perhaps received a large inheritance–you know what I mean! But we march onward and continue to read and learn, and I thank you for your insight!