The Psychology of Saving Money

To begin the new year, I began coursework towards my CFP designation. My goal is to increase my knowledge of technical aspects of financial planning where I lack formal education or expertise in order to better serve this audience.

At the same time, I started reading Morgan Housel’s book The Psychology of Money. In it, Housel focuses exclusively on why we do what we do with our money. Sometimes, those actions may appear insane to others.

This all has me thinking about how to help you do better with your money. What is the relative importance of the technical aspects (what to do and how to do it) in personal finance? What role do psychological aspects (understanding why we do things and using that knowledge to promote better behaviors) play? Where should we focus our attention?

As I explore new topics with increased technical depth, it’s important that I don’t drift too far from my roots in the FIRE community. Despite lacking technical expertise, we’ve managed to achieve financial outcomes that are rare in our society.

Nowhere in this FIRE community do we get things more right, both tactically and psychologically, than with saving money. So it’s worth exploring exactly what we do differently than most. Why do we do those things? What we can learn from it?

Is Saving Money Hard?

I frequently share my story on general personal finance platforms as an example of what is possible. We achieved financial independence (defined as having accumulated greater than 25 times our annual spending in invested assets) decades earlier than most people. We accomplished this primarily by saving roughly half of our household income for about 15 years.

When I share that fact, I nearly always get some version of the same question as a response. Isn’t that hard?

The question is understandable. But it misses a key point.

It assumes that the standard path must be easy, since it is what most people do. That assumption is dead wrong!

We’re often told we should try to save about 10% of our income. Standard advice is to have an emergency fund of three to six months worth of expenses. So understandably, saving at five times that rate and accumulating decades of living expenses sounds difficult to achieve.

But the fact is that the standard path is hard. Many people listen to standard advice and struggle with their finances. A recent survey found that only 44% of Americans could pay for a $1,000 emergency from their savings.

Vanguard’s How America Saves 2021 report showed that the median retirement account balance for those ages 55-65 is only $84,714. Assuming a 4% safe withdrawal rate, that means they can spend only about $3,400/year to supplement any Social Security benefits at the start of retirement.

So let’s take a closer look at the psychology and tactics of saving 50% of our income vs. saving 10% of our income and reconsider our assumptions.

The Scenario

To show the impact of a 10% vs. a 50% savings rate, we will use this example. Let’s assume a household has a monthly income of $10,000*. They are starting with no savings or debt on January 1, 2022. They will put all they save into a savings account and not invest until their emergency fund is fully funded with 3-6 months of expenses.

(*Note: I chose these assumptions because they make the math easy. I’m aware that for some of you reading this that seems like an unachievable high income number. Others may make multiples of this and still don’t think you could possibly save 50%. This is all part of the psychology of saving. I’m going to ask you to suspend your preconceived notions and follow the example through.)

To start, we’re going to ignore taxes, inflation, investment returns, pay raises, etc. I realize this is not how the real world works, but factoring in all of these variables unnecessarily complicates the scenario while detracting from the main take home points.

The Math of Savings Rates

Consider what happens when we follow standard advice and save 10% of our income. We start with $10,000, spend $9,000, and save $1,000. At the end of January, we have 1/9 ($1,000/$9,000) of one month’s expenses saved.

This continues each month we continue to save 10%. So at the end of February we would have 2/9 of a single month’s expenses. We would have 3/9 of one month’s expenses at the end of March and so on.

If we save 50% of our income each month, we will save $5,000. That is five times as much as the household saving 10%. So at the end of January, we will have saved $5,000. This is simple and intuitive.

What is less obvious is that we have lowered the bar on how much we need to save to support our spending. Instead of spending $9,000/month, to save 50% we’re now only spending $5,000/month. The $5,000 we saved in January represents one full month’s expenses.

This continues each month we save 50%. So at the end of February we have saved two months of expenses, at the end of March three months of expenses, and so on.

The Psychology of a High Savings Rate

What many people miss when they ask if saving 50% is hard is the impact of momentum. Success begets more success.

Saving for an Emergency Fund

Let’s follow this example until we amass a fully funded emergency fund of 3-6 months expenses.

Saving 10% of income, it would take 27 months (2 years, 3 months) to save 3 months of expenses. Saving 6 months expenses would take 54 months (four and a half years). If you start building your emergency fund in January 2022, you would reach your goal of saving three to six months’ expenses sometime between March 2024 and June 2026.

In contrast, if you are saving 50% of your income, you would have saved an emergency fund of 3-6 months expenses in 3-6 months. You would reach your goal between March and June of the year you started.

Yes, you have to save five times as much. But you achieve your savings goal in 1/9th the time.

Once you achieve your goal, you immediately experience the benefits of a fully funded emergency fund. They include the ability to:

- Pay for a large unforeseen expense without going into debt

- Cover living expenses for several months if you lose a job

- Direct future savings to investments that will start compounding.

Feelings of achievement, momentum, and security can and will propel you forward.

If saving only 10%, progress will be painfully slow. When it takes several years to build the emergency fund, there is also an increased likelihood that you’ll actually have an emergency in that longer period of time.

It is easy to get off track or quit trying altogether. It’s not surprising that statistics show the average American has so little saved.

Saving for Retirement

Play this scenario out to retirement. The exact same principles apply. The amount you will need to support you in retirement is dependent on how much it costs to support the lifestyle you want to live.

Let’s assume you can withdraw between 3-5% of your invested assets to support retirement spending. The inverse of this means you would need between twenty to thirty-three times your annual expenses at the start of retirement.

If you spend $9,000/month, or $108,000/year, then you would need to accumulate between $2.16 million and $3.56 million. Saving only 10% or $1,000/month, that would require either unexpectedly high investment returns or more years of compounding than you likely have available.

If you spend $5,000/month, or $60,000/year, you would need to accumulate between $1.2 million and $1.98 million. Saving 50% of your income and investing at conservative return assumptions, it is reasonable to assume you will achieve financial independence in less than twenty years.

Is it easy? No. But in my humble opinion, it’s a whole lot easier than never achieving financial independence.

The alternative is relying on a paycheck into your 70’s and government programs in retirement. That’s not easy either. Yet few people try to achieve financial independence because progress is so slow and the goal so far in the future when following standard advice.

That psychological reframe is powerful for many people. The upside of understanding the psychology of saving is that it can inspire action.

Regardless of how much motivation you have to save, we need to understand what actions to take that will actually move the needle.

The Math of Increasing Your Savings Rate

First, you have to understand what savings rate is:

Savings Rate = Savings/Income

Stated another way:

Savings Rate = (Income-Spending)/Income

Returning to our example household saving 10% of income:

Savings Rate = ($10,000-$9,000)/$10,000 = $1,000/$10,000 = 10%

There are two clear actions you can take to increase your savings rate. You can increase your income, keeping spending constant. You can decrease spending, keeping income constant. (A third option is to work on both components simultaneously.)

If you had to choose only one, it is faster and easier to increase your savings rate by decreasing spending. There are mathematical and tax reasons that make this true.

Using our example, decreasing spending by $4,000/month looks like this:

Savings Rate = ($10,000-$5,000)/$10,000 = $5,000/$10,000 = 50%

Using our example, increasing income by $4,000 looks like this:

Savings Rate = ($14,000-$9,000)/$14,000 = $5,000/$14,000 = 36%

In either case, we increased our net savings by $4,000 and improved our savings rate. But when we decrease what our lifestyle costs, we simultaneously lower the bar for how much we need to save.

The math clearly shows that if your goal is to increase your savings rate, spending less is more impactful than earning more, all things equal. But all things are not equal.

Tax Advantages of Spending Less

To this point, we’ve ignored taxes so as to keep the example simple. But in the real world taxes exist and they provide extra incentive to be more frugal.

Assume our example household is in the 22% marginal tax bracket. If they want to increase their income by $4,000/month, they would have to actually earn an extra $5,685 after accounting for federal income and payroll taxes. This doesn’t account for any state or local taxes they may also owe.

If they wanted to cut spending by $4,000, they would have to spend exactly $4,000 less.

This tax advantage alone is powerful if you’re looking to direct savings to debt payoff or building an emergency fund quickly. As you can start directing savings into tax advantaged investments, you can further decrease your tax burden and accelerate reaching financial goals.

Related: Early Retirement Tax Planning 101

The Tactics of Increasing Your High Savings Rate

We now understand the psychology and math of savings, but we still need to understand the tactics. Once again, standard personal finance advice is failing most people.

There are endless articles about the “latte factor” and cutting the cord. An entire reality series was dedicated to extreme couponing. News stories frequently shame the poor for buying lottery tickets or owning fancy cell phones.

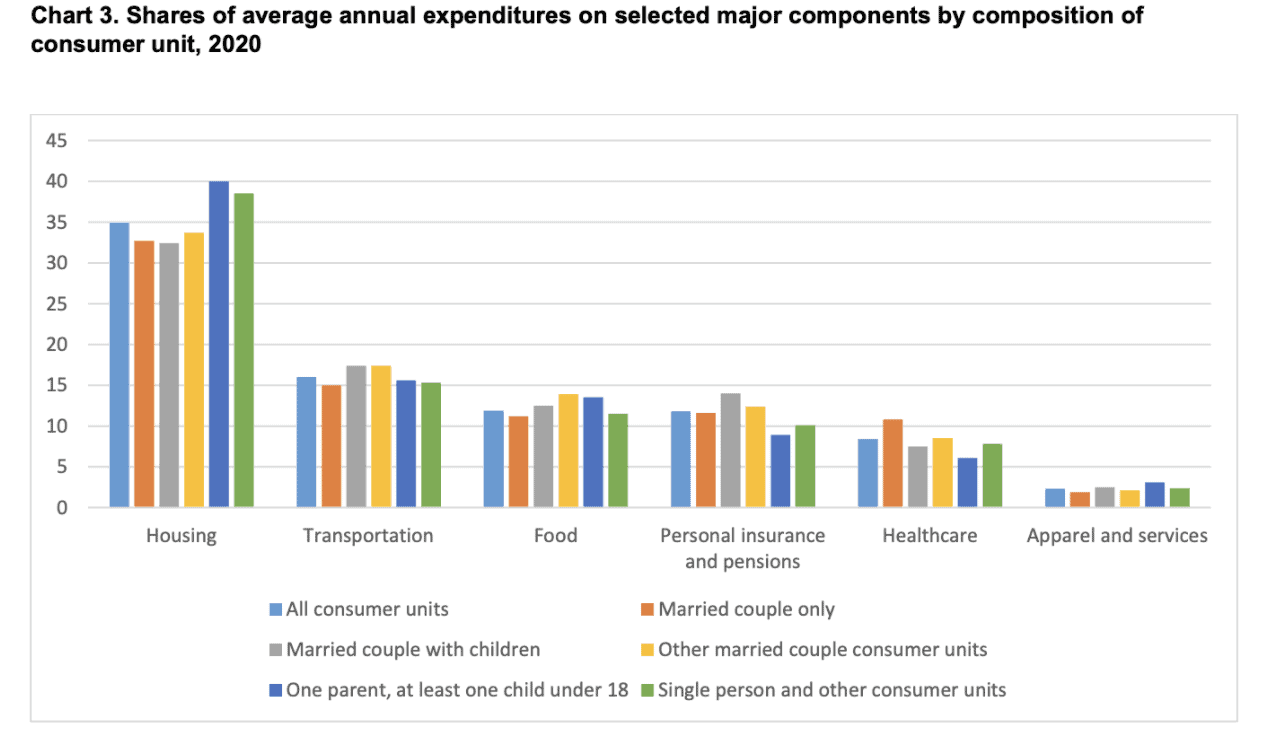

Check out this chart from the Department of Labor’s 2020 Consumer Expenditures Report.

Combined spending on housing and transportation represents at least 50% of average household spending across all demographic groups. Food accounts for at least another 10%. That’s over sixty percent of most household’s spending.

Focus on optimizing spending on housing, transportation, and food first. Systematize and automate your finances so your money is going where you want it to go every month without applying effort or even thinking about it and you are on the path to a high savings rate.

Taxes are not accounted for in the consumer expenditure report, but they are a large expense that can be lessened with good planning. Once you have adequate savings and liquidity, you can start considering self-insuring.

Reassess taxes and insurance needs once a year, automate actions, and forget about them for another year. These actions accelerate an already high savings rate with zero sacrifice (unless you enjoy paying taxes or insurance premiums).

The alternative is to buy into the narrative that saving requires sacrifice. Ignore the big ticket items and instead focus on lattes, lottery tickets, and your cable bill.

That advice is great for getting clicks to a website or starting arguments on social media. But it really doesn’t move the needle if we actually want to develop a high savings rate that can change your future.

The Psychology of Financial Independence

In The Psychology of Money, Housel has some great quotes about the importance of financial independence.

“Being able to wake up one morning and change what you’re doing, on your own terms, whenever you’re ready, seems like the grandmother of all financial goals.”

“The ability to do what you want, when you want, with who you want, for as long as you want to, pays the highest dividend that exists in finance.”

Housel is a fabulous writer. He wrote an excellent book packed with valuable lessons and timeless knowledge.

In one of the last lines in the book, he writes of his family’s approach to money, “We think it’s the ultimate goal; the mastery of the psychology of money.”

I ultimately disagree with his final conclusion. Mastering your money is a mix of mastering psychology and knowing what actions to take to actually move the needle. We need both.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Hi,

I read Housel’s book on our vacation last June or July. It was a wonderful book and I thought to myself that if this man is writing almost exactly what we’ve been doing with our money for the last two decades then we are doing something right and hopefully, everything will be fine in the future.

What I was surprised about is that he doesn’t condemn people who choose to buy dividend paying stocks in addition to the usual index/mutual funds. He used to buy them himself but I think later chose to focus on funds only. But regardless I found that note interesting. I guess it means there are many different roads leading to Rome :-).

I hope more starting out young people will find this blog as this article would be a nice primer for them.

I really think the psychology of how you handle life is the biggest determinant of happiness in retirement and every thing else. No doubt extreme poverty sucks but to say that the ability to to do what you want, with whom you want whenever you want for as long as you want is paramount, only works if you’ve cleared out a lifetime’s worth of biases and blockages that everyone accumulates. When you’ve worked on that you find out that most things you would chase are distractions from being uncomfortable inside. Chris, I’d love it if you always mention that up front because it’s that significant. You could say that it’s understood, but it’s not.

Interesting insight Stephen.

Chris-

Thx for posting about this “always timely” subject. I first read this advice a few decades ago in “Your Money or Your Life”, which I recommend everyone read at least once and would be a great next step after reading this post. I hope you follow up with posts on the specifics of “how” to reach a 50% savings rate. That’s where the rubber meets the road.

Thanks for the feedback Mark. As far as specifics, I think that would be challenging because it will be different for everyone.

I’ve added that to my list of ideas for a future blog post.

Best,

Chris

Chris, Well written article, thank you! From talking with folks starting out this message is not as broadly understood as it should be, I have heard from young team mates and family members that FIRE doesn’t interest them as “why would I leave a job I love early, to live on less?”. In recent times I ignore the RE and just concentrate on encouraging FI as a goal,

which is better received.

I love the idea of looking at the two choices with an open mind and to at least consider that the standard way is actually harder. I will be recommending your article, thanks again!

Thanks for the feedback Rick. The thing I’ve been thinking a lot about recently is the idea of how much we change and evolve over time. I think this is a great reason not to lock yourself into anything when you’re young, and is probably the best reason to save.

I also think it is a problem with the way many people think about retirement planning. Things like the research behind the 4% rule assuming constant spending adjusted only for inflation are great for simplifying a model. But no one I know actually lives like that. People who plan based on that assumption, particularly those who live extremely frugally to reach retirement as quickly as possible may be boxing themselves in.

Food for thought for those that resist the idea of saving towards FI and for those who pursue it too aggressively.

Best,

Chris

Chris, a few times, you basically stated that “standard financial planning advice” doesn’t encourage enough of a savings rate, and I agree. I fired our financial planner after 10 years in part because he never encouraged me to save at the much higher savings rate I was capable of doing to achieve financial independence. I figured out that I could do this myself, after reading JL Collins’ “The Simple Path to Wealth” a few times. I also agree that you should not stray from your FI saving roots if you move into professional planning; saving more by reducing unnecessary spending can turbocharge a person’s journey to FI, and more people need encouragement to do this.

Thanks for the feedback Betty.

We had a similar experience with an advisor. I never heard the term savings rate. We only discussed investments, insurance, etc.

Best,

Chris

Rick,

If your met people truly say “why would I leave a job I love early, to live on less?” then it’s actually awesome for them. Still it would be great if they could save 15-20% of their income in order to fund their retirement when they retire at their FRA. So, if people love their jobs, then no, they definitely don’t need to aspire to FIRE if they know for sure that they’ll have that passion for the next 40-50 years.

But like Stephen above said social aspect matter very much, especially for extroverts. I wonder how introverts handle FIRE because I’m betting it should be easier for them than for extroverts.

I say health, money, and social network are all important. Vicki’s and Joe’s book stressed that point much better than Housel, IMO, but boy, this guy is seriously good too. I need to google to find his blog because I read a few of his articles in the past shared with me by somebody else and I always found them thoughtful.

Well said S&M. Here is a link to Housel’s blog:https://www.collaborativefund.com/blog/

Interesting observation on introverts vs extroverts and how they handle FIRE (and getting to FIRE). I speculate that introverts are more likely to achieve FIRE as they don’t care as much about keeping up with the Jones, try to impress others with fancy houses and cars (by far, the biggest household expenses), wear designer clothes, brag about fancy vacations, etc. IMO, not giving as much a crap about what others think of them enables them to save and invest more. Just a theory.

Very interesting theory! I don’t really consider myself either an introvert or extrovert but I do march to the beat of my own drum by not caring at all what others buy.

Couldn’t agree more on the savings, S&M. Spreading the word that there are alternatives to living the standard way (save 10% or less, spend the rest) is a key benefit of this blog and others.

While I don’t disagree with your basic contention that saving more is better than earning more, and I realize you “arbitrarily” picked a number to make the math easy ($120K/year), how about showing how to do this when you make what many of the people I know make, which is 30K per year?

Roger,

It would obviously be harder to have a high savings rate with a low income, but not impossible.

If you are talking about a couple making only $30k total, then they are averaging $15k/each. That is essentially two minimum wage earners. So the first and obvious step is to work on increasing income. There is a floor on how low spending can go.

If you are talking about a single person living off $30k/year or a couple each making $30k each, so $60k total, then you start to have options. I would focus on housing costs. This may involve relocating to a lower cost area, house hacking to lower or eliminate housing expenses, etc. They would also want to focus on aggressively lowering transportation costs. This goes beyond buying a used car, but is a comprehensive planning decision to limit transport costs by living close to activities you do most often, having access to public transport, biking, etc.

For full disclosure, we started living off my wife’s salary and using mine to pay off debt, save for down payment on a house, and then invest when we each were making about $35k/year so I know that is possible.

We maintained that system as our incomes grew in parallel, and I will also say that life got more comfortable when we were able to increase spending. For us, most of our increased spending went towards travel, outdoor gear, and increased giving.

As income grew, our specific tactics changed but the principles behind them did not. We continued to live in housing and drive cars way below what we could “afford.” Our savings rate also increased.

Hope that helps,

Chris

Chris, an excellent post, as usual. I’d like to address saving money from an introvert’s perspective, since a couple of comments referred to it. I believe introverts get their energy from within and extroverts tend to get more of their energy from interactions with others. I admit I don’t know that for sure because the concept of extroversion seems so foreign to me. Alan and I are both introverts and, from the time we became a couple prior to our marriage, we have always depended on only ourselves. It was easy to focus on our shared goals (building a house, traveling, retiring early) because distractions from the outside world were limited and easily ignored. During the first two years after our marriage, Alan built our house with cash from his salary while we lived on my earnings. We didn’t miss socializing with colleagues on a Friday night because we had never done that anyway. While our friends were going out to dinner and to the movies, running bar tabs and flying to Florida for the weekend, we were working on the house. Living mortgage-free was more important to us than transient pleasures and social interactions. Having no interest in the Joneses (never mind keeping up with them) and an aversion to social media also limits distractions, making it easier for us to focus on what’s important in our lives – our kids, siblings and friends (who we enjoy immensely – often and in small doses), travel and (of course) financial independence.

When we started out, the FIRE movement didn’t exist as it does today, but we wouldn’t have joined up anyway. We wanted to retire early and did (in our 50’s), but always knew that travel would be a huge part (and big expense) during our marriage as we had made a conscious decision not to wait until we retired to enjoy it. Added to our travel expenses over the years have been the costs of our daughter’s international adoption (ka-ching) and dependable four wheel drive vehicles (needed in the area in which we live). Over the years, we’ve both contributed to 401Ks, IRAs and regular savings without a second thought or influence from anyone or anything outside our marriage. Saving is easier when you’re not concerned about the newest smartphone, trendy clothes and five star hotels. I won’t say we live simply because we don’t. We maintain several good vehicles, have both a power boat and an RV, and enjoy extended travel. But we do live quietly which allows us to hear and follow our hearts.

I don’t believe that extroversion precludes anyone from financial success. In fact, I’m sure there are situations where it enhances it. But, as introverts, I think Alan and I found it easier to tune out the outside world, focus on our goals and stay true to ourselves. Sending best regards along with my apologies for hijacking your comment section!

Mary,

I always appreciate your insights. Hijack away! 🙂

Cheers!

Chris

Ok, I will play. First, I am a big believer in the Millionaire Next Store philosophy of living below your means and saving first. Ten percent was the initial wisdom passed on to me which I practiced in my early years. I set a goal of being FI at age 55 and moved the goal posts many times due to arguably lifestyle creep and general desire to live at a certain level people in this community would describe as FAT FIRE. My strategy was to manage expenses within reason keeping some balance (not giving up everything to be FI at 40), but more importantly, increase my income which would increase my savings rate over time. Now that I can look back, I can see this approach was effective for me and I have no regrets on really missing out on things I wish I would have done earlier. While to each their own, I do think many in the FIRE community are so obsessed with winning the ER part that they make sacrifices they may regret later in life. I think we all should try to find the balance that works for us and at least in my experience, I believe putting more energy in increasing your income will move the savings % needle more than trying to live life at extreme low level. Again, to each their own.

I agree with the idea that it’s easy to become too future focused and not enjoy the journey. We started saving 50% when we made relatively little money and bascially locked in our housing and transport expenses at those levels. Over the years both our discretionary spending (mostly to travel, outdoor gear that enabled better experiences, and attending events) and our savings rate increased with our incomes. The key to me is to be able to be happy in less house and car than you can “affford” (i.e.what someone is willing to lend you). I’m sure for some people that does feel like sacrifice, but for us it didn’t and so we lived a life of relative luxury (international travel, hobbies like skiing and scuba diving, and even attending Super Bowls twice) along the way. And to be clear, part of that was increasing our income, but a huge piece was relative frugality.

Cheers!

Chris

I should do my CFP I think. However, the difference between savings and spending has to be optimized for a particular person. Most people don’t know how to do that.