Travel More & Spend Less With Credit Card Travel Rewards

Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Some or all of the card offers that appear on the website are from advertisers. Can I Retire Yet? and CardRatings may receive a commission from card issuers. That compensation may impact on how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A common theme on this blog is an emphasis on financial simplicity. Get the biggest things right. Automate these decisions and actions. Then go live your life.

Every rule has exceptions. One big exception in my personal life is the use of credit card travel rewards. There are several reasons for this.

Personally, I find learning about and implementing strategies to accumulate credit card travel rewards to be lucrative and fun. It enables me to do more of what I love, travel. Simultaneously, I spend less of my hard earned dollars doing it.

A number of personal finance strategies that get a lot of attention sound too good to be true. That’s because they generally are. Most of these strategies involve considerable risk, cost, uncertainty, and complexity.

Conversely, using travel credit card rewards wisely is predictable, repeatable, and saves you money. If you focus on achieving the biggest wins with the least effort, it is also relatively simple.

Simplest Credit Card Strategy – Cash Back

The most simple way you can start to get some benefits from credit cards is to use a cash back card. Spend as you normally would using a credit card rather than cash or a debit card. You then get a portion of your spending refunded to you in the form of cash back or reward points.

This is what Kim and I did for years before learning about travel credit card rewards. We generally earned about $500 per year with this simple strategy while developing good habits of always paying the card on time to avoid any fees. This simultaneously helped improve our credit score.

As a general rule, the best cards will provide approximately 1.5% cash back on every purchase. Most of these cards have no annual fee.

You can optimize this strategy, choosing multiple cash back cards that offer more rewards in select categories like grocery stores, gas, restaurants, etc. Then use the optimal card for each purpose.

This strategy seems like a lot of effort to track and implement for a relatively small reward to me, but I have heard from a number of readers for whom this approach is popular.

One version of this strategy that could be lucrative is for renters to pay their rent on a credit card. card_name is designed for this. It offers up to one point per dollar spent on rent payments up to 100,000 points each calendar year without a transaction fee. There is no annual fee for users. This could help renters to accumulate rewards quickly.

You can find a list of the current best offers for cash back credit cards here.

The 80/20 Analysis of Travel Rewards

Once we established the habit of spending on a card and paying it off on time, we were ready to see how much we could earn in travel rewards with the least amount of effort.

Targeting Sign-Up Bonuses

The single biggest thing you can do to optimize credit card rewards is to target the generous sign up bonuses that come with new cards. Sign up for a card. Put all spending on that one card. Earn bonus. Repeat if desired.

We keep a spreadsheet tracking when the annual fee is due and what perks the credit card provides. If the ongoing value of the card exceeds the annual fee, we keep it. If the value doesn’t justify the fee, we close it before the fee is due.

In general, to receive the bonus you will have to meet a defined minimum spend (generally $2,000-$6,000 for personal cards) in a set amount of time (generally 3-6 months). To make it worth the effort of doing so, I target cards where I will get at least $750-$1,000 of value from the sign up bonus alone.

You can earn upwards of 20% on dollars spent towards the bonus, as compared to the 1.5% average for cash back cards. You can then repeat this process with multiple cards per year.

Sustainable Strategy?

Chase, Capital One, American Express and Citi each have multiple cards with generous bonuses. As a couple, we are each able to individually apply for each card, providing an essentially never ending source of travel rewards.

We generally assume we will sign up for one card per quarter and earn the bonus with our normal spending. We may target additional bonuses through the year if we anticipate additional spending that would enable us to hit minimum spends.

An example is looking at current sign up bonuses in anticipation of buying our annual ski passes. Another recent example was signing up for a business card at the beginning of the year to pay health insurance premiums as a lump sum on the card in order to get a bonus vs. paying premiums monthly.

Don’t Get Overzealous

As you watch your travel rewards accumulate after collecting your first few bonuses, it is easy to go overboard signing up for new cards. Don’t get overzealous when getting started.

In our household, either Kim or I will sign up for a card. We do not add the other person as an authorized user. This enables both of us to earn the bonus separately. It also keeps our finances simple as we put everything on this one card as we spend toward the bonus.

Applying for too many cards too quickly can result in missing out on valuable welcome bonuses, may prevent you from getting cards you want in the future, and excessive credit inquiries can hurt your credit score.

Chase has the most valuable cards for my travel needs. They also have a policy that limits the number of cards you can obtain from any issuer to 5 in a 24 month period. This is one reason that I recommend starting with Chase cards and being intentional with signing up for new cards.

Best Cards to Start With Travel Credit Card Rewards

When someone who has never utilized travel credit card rewards asks me where to start, I have two go to recommendations: The Chase Sapphire Preferred® and the Capital One Venture card. Each of these cards have a $95 annual fee.

Each offers a lucrative sign up bonus and is simple to use. I slightly prefer the Chase Sapphire Preferred® because with a bit of effort, you can get more value out of these rewards.

If you think you’ll sign up for multiple cards, this also prevents missing out on this valuable card. Remember, Chase restricts the number of cards you can apply for in a 24 month period as noted above. You can always come back and get the Capital One Venture card later.

Chase Sapphire Preferred® Card

The standard bonus on the card_name is 60,000 Ultimate Rewards points earned by spending at least $4,000 in the first three months after opening the card. That’s $750 when you redeem through Chase Travel(SM).

To earn the points, you would have to spend at least $4,000 on the card which would give you a minimum of 4,000 additional points. This brings the value of your rewards to a minimum of $800 towards travel for spending $4,000 in the first 3 months after opening the card.

While those benefits are nice, the reason I love the card_name is that it is one of several cards that offer Chase Ultimate Rewards points. These points can be transferred in 1,000 point increments 1:1 to travel partner’s reward programs, where they may provide outsized value.

You can get well over $1,000 in travel rewards by strategically transferring the Ultimate Rewards points to a travel partner. This happens instantly with the click of a button. You can find a full list of travel partners here. Two of my favorites are Southwest Airlines and Hyatt Hotels due to their ease of use and incredible value.

The Chase Sapphire Preferred® Card, like many travel cards, also offers significant travel insurance protections at no additional charge.

Capital One Venture

The card_name provides a similarly generous sign up bonus and is simple to use.

After you spend at least $4,000 on the card_name within three months of opening it, you will earn 75,000 miles. Again, you will also earn miles for each dollar you spend on your way to the bonus, so you will have at least 79,000 miles, worth $790 when you achieve your bonus.

They also have their own set of travel partners, which I personally find less attractive. I like this card because it is extremely easy to redeem these miles for a wide variety of travel expenses.

Like Chase, Capital One has a travel portal through which you can book travel. You may find better rates than you could on your own and pay directly with miles.

For ultimate simplicity, you can book travel and pay for it with the card. Then simply apply the miles at a rate of 100 miles to $1 to offset the cost for any expense coded by the vendor in the travel category. In addition to hotels and flights, these miles can be used to offset rental car, Airbnb, and rideshare expenses.

The card_name has some additional perks. It provides travel insurance benefits. In addition, it provides a $100 annual credit for Global Entry or TSA PreCheck®.

Business Credit Cards

I’ve traditionally focused my attention on personal credit cards. Small business owners can apply the same strategies of targeting credit card sign up bonuses when making business purchases.

This allows you to accumulate even more travel rewards. Most personal cards have a similar business version. The downside of business cards is they tend to have higher spending limits to achieve the bonus (though the bonuses also tend to be higher).

As an example, card_name offers new cardmembers a 100,000 Ultimate Rewards point bonus after spending at least $8,000 in purchases in the first 3 months of opening the card. This card would be the first business card I would personally sign up for if I could meet the minimum spend to achieve the sign up bonus, for the same reasons I like the Chase Sapphire Preferred® for personal use.

However, I don’t have enough business expenses to achieve the bonus. When I do have anticipated upcoming business expenses I scan the available small business cards to see if there are any with low enough spending limits that I could achieve. I have signed up for two business cards in the past couple of years that had achievable spending requirements to achieve valuable bonuses. I’ll highlight them below.

American Express Membership Rewards

To this point, I’ve highlighted Chase Cards that offer Chase’s Ultimate Rewards Points and Capital One Cards offering Capital One Miles.

The card_name is a similar offering from American Express. It has an offer of 60,000 Membership Rewards® points which you can earn by spending $6,000 on the card in the first 6 months after opening the account.

The American Express® Gold Card has a $250 annual fee. See Rates and Fees; terms apply

I personally wouldn’t start with this card due to providing less points and having a higher annual fee. However, many people are attracted to the Membership Rewards® Travel Partners. Airline partners include Delta domestically and a wide array of international airlines. Hotel partners include Hilton and Marriott.

There is also an card_name. You can earn 70,000 Membership Rewards® points after spending $10,000 on eligible purchases with Business Gold Card within the first 3 month. This card has a $375 annual fee. See Rates and Fees.

Another lucrative source of travel rewards are co-branded credit cards with specific airlines and hotel chains. Virtually every airline and hotel chain has its own loyalty program and associated credit cards with the opportunity to earn points or miles. I’ll highlight a few of my favorites.

Airline Specific Cards

Most airline reward programs are fairly similar. You can transfer rewards from travel partners (Am Ex, Capital One, or Chase) to accumulate points or miles. Alternatively you can search for cards affiliated specifically with your favorite airline. For example, we first started targeting cards that offer Delta SkyMiles® since our closest airport, SLC, is a Delta Hub.

My first airline specific card was a card_name. It currently offers 40,000 points after spending at least $2,000 on the card in the first 6 months after account opening. Cardholders also can check one bag for free on every Delta flight booked on the card. The card has a $0 introductory annual fee for the first year, then $150 thereafter. See Rates and Fees; terms apply.

All airline rewards generally work well for those who travel alone or with a partner and have some flexibility on timing and style of travel (i.e., many early retirees!). You can also get outsize value for business class flights.

Those who have more rigid schedules, travel last minute, or with family may find it harder to redeem reward points with many airlines. For our family of three that tends to travel around our daughter’s school schedule, one airline’s program stands head and shoulders above the rest.

Southwest Rapid Rewards

I love Southwest Rapid Rewards points for a number of reasons, including:

- Ability to accumulate a lot of points,

- Ease of use,

- Value, and

- The Companion Pass

Easy to Obtain

There are three ways to accumulate Southwest Rapid Rewards points:

- Flying Southwest (paying cash),

- Earning Chase Ultimate Rewards points and transferring them to Southwest,

- Earning rewards directly with a Chase/Southwest co-branded credit card.

The first is a long, slow way to accumulate these valuable reward points. You can accumulate points much more quickly by using credit card rewards.

Southwest/Chase offer three different personal credit cards. They also have two different business credit cards.

Having this variety of cards combined with the ability to transfer Chase Ultimate Rewards to Southwest makes it easy to rack up a nearly never ending supply of Southwest Rapid Rewards points.

Easy to Use

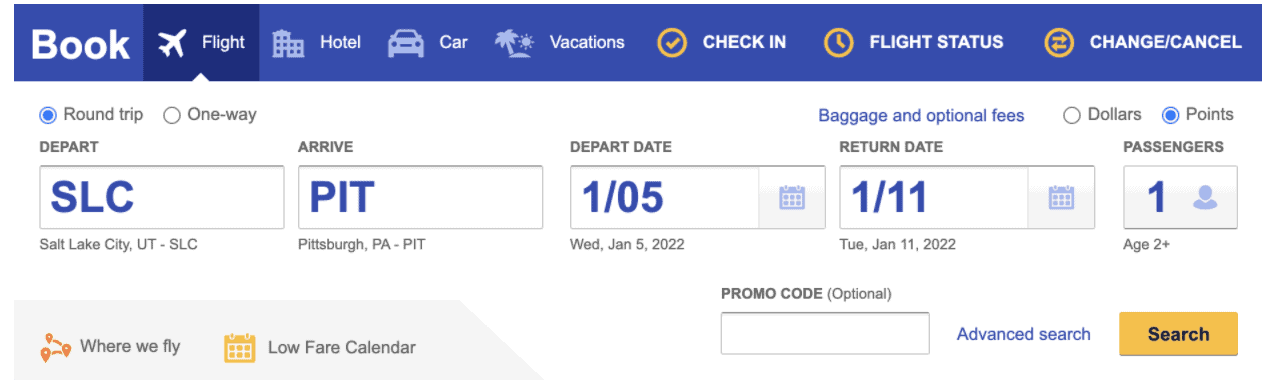

Once you accumulate the Southwest reward points, they are easy to use. Simply go to the Southwest website and select where and when you want to go.

You can display airfare in dollars or points. Click points and search for flights.

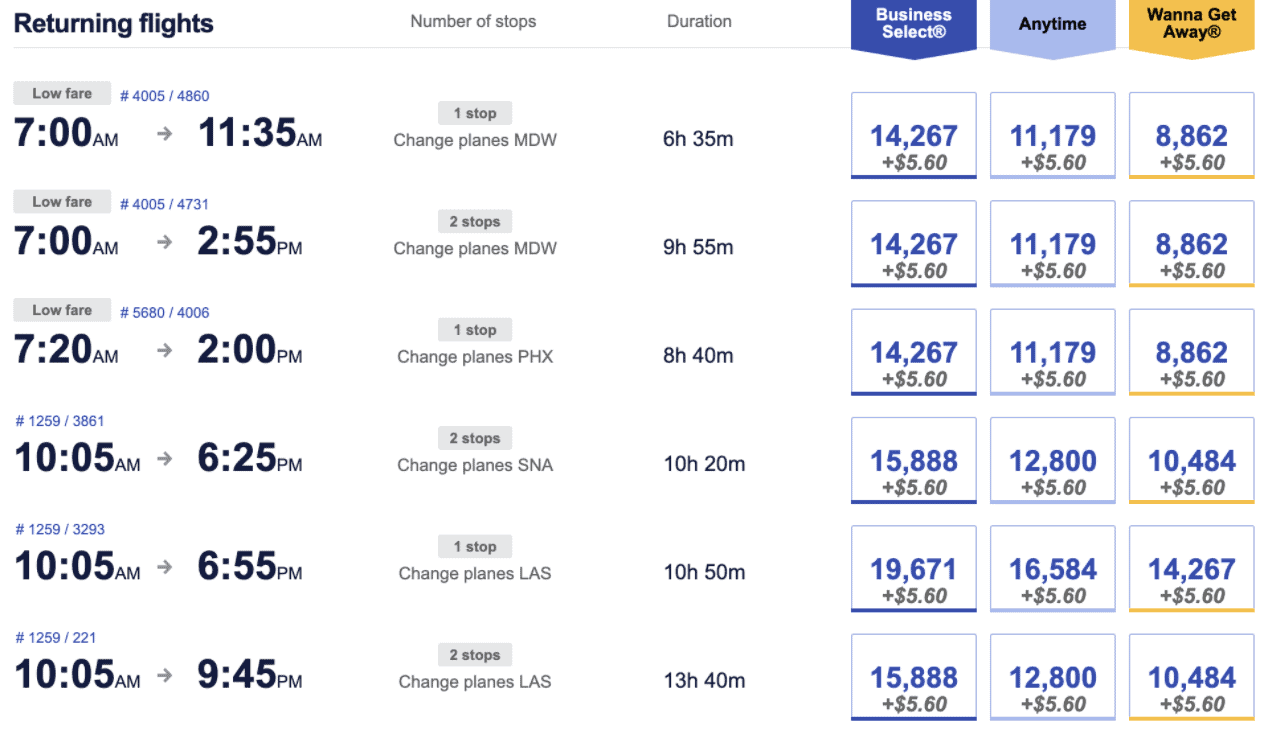

Flights then display with airfare represented in points (plus $5.60, the U.S. 9/11 security fee, which you have to pay for every one-way domestic flight). Click the flight you want, book your flight, and points are deducted from your account.

Southwest does not black out dates for rewards points. They also don’t limit the number of seats that can be booked on points, which is great for families. For example, our family of three regularly flies back to Pennsylvania over the Christmas holidays and we recently flew to Hawaii on points over Thanksgiving break.

If you cancel or change travel plans, your points are fully credited back to your account with no change fees as long as you do so ten minutes prior to your scheduled departure time.

Value

Southwest points offer considerable value. They correspond to the price of the flight. So if you have a flexible schedule, you can get great deals.

Unlike many airlines, Southwest doesn’t nickel and dime you with hidden fees. You can check two bags for free. This includes oversized items including golf clubs and skis.

Beyond saving on airfare and baggage fees, booking with rewards points eliminates all taxes. The lone exception is the $5.60 U.S. 9/11 Security Fee which is explained above.

We pay a total of $33.60 to fly our family of three cross-country and back using points. That’s far less than the price to Uber thirty minutes from our home to the airport!

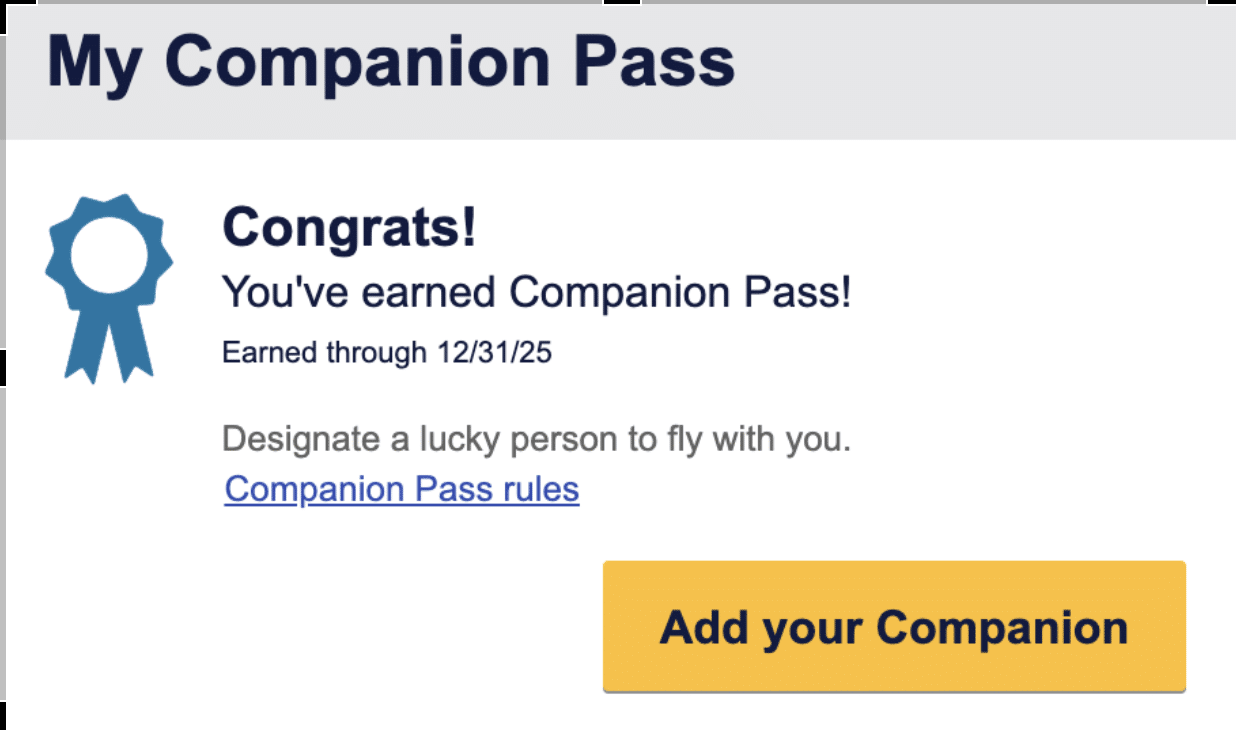

The Companion Pass

Best of all, Southwest offers one of the best deals in the world of travel rewards: The Companion Pass. You have to accumulate 135,000 qualifying points in a calendar year to earn the pass. Once you earn the pass, every time you fly your designated companion can fly with you for free for the remainder of that year and the entire following year.

The points needed to qualify for the Companion Pass can be earned through sign up bonuses with Southwest co-branded credit cards. (Note: Chase Ultimate Rewards points can be transferred to Southwest. Thus they can be twice as valuable once you have the Companion Pass, but they DO NOT help you earn the Companion Pass.)

Early in 2022, Kim took advantage of a credit card sign-up promotion that enabled her to earn a Companion Pass. We took advantage of it to redeem ten free round-trip flights in 2022 and 2023.

Her companion pass expired last December 31. Knowing this, in mid-December I signed up for a Southwest® Rapid Rewards personal card and a Southwest® Rapid Rewards® Premier Business Credit Card. The points earned in January between spending on the cards and the two bonuses allowed me to earn nearly 150,000 points and another Companion Pass which will be good through the end of 2025!

Current Southwest Offers

Southwest bonuses change frequently. The offers on the personal cards I took advantage of in December are no longer available.

However, you can currently earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.

This offer is available with any of three Southwest Personal Cards:

The two Southwest business cards are offering their standard sign-up offer.

card_name offers a 60,000 point bonus after spending at least $3,000 in the first three months your account is open. It has an annual fee of $99.

card_name offers a 80,000 point bonus after spending at least $5,000 in the first three months your account is open. It has an annual fee of $199.

Hotel Specific Cards

The major hotel chains also all offer co-branded credit cards. At one point, we’ve had cards with Hilton, Hyatt, IHG and Marriott. All can be valuable. I like to have a bank of rewards with different chains so I always have options when booking travel.

I will briefly highlight two hotel rewards programs that we’ve gotten tremendous value from by utilizing different strategies.

Hyatt

World of Hyatt points generally provide the best redemption value for the least amount of points. We try to accumulate as many of these points as possible.

Examples of places we’ve stayed in Hyatt properties on points include Times Square in NYC and Park City, UT. Comparable hotels with other chains with similar cash prices would have required 2-3 times more points.

The challenge is obtaining Hyatt points. For example, the world of Hyatt Credit Card, which has a $95 annual fee, currently has a sign up bonus of 65,000 points. However, achieving the full bonus requires spending $18,000 on the card over the first six months of account opening.

This is where having a little understanding of travel partners is helpful. Chase Ultimate Rewards points can be transferred 1:1 to travel partners, including Hyatt. This makes it much easier to accumulate these valuable points.

IHG

IHG hotels reward program is another Chase Ultimate Rewards partner the other end of the spectrum. Their points don’t go nearly as far.

For example, we spent a few nights at the Holiday Inn Express Kailua-Kona in Hawaii recently. The cost was 40,000 points/night for a room that would have been about $350/night if we paid cash. Transferring Chase Ultimate Rewards to IHG to pay for the room would have been a suboptimal use of these valuable points.

However, we have an abundance of IHG points because they are so easy to obtain on IHG co-branded credit cards.

Over the past few years, both Kim and I have each separately signed up for an card_name. This card enables you to earn 140,000 points after spending $3,000 on it in the three months after account opening. It also provides a free night each year on the anniversary of card opening as well as a free reward night every time you redeem points for a four consecutive night stay at an IHG hotel. The card has an annual fee of $99.

The card_name currently has a limited time offer. You can earn up to 175,000 Bonus Points:

- Earn 140,000 Bonus Points after spending $4,000 on purchases in the first 3 months from account opening.

- Plus, earn 35,000 Bonus Points after spending a total of $7,000 in the first 6 monthsfrom account opening

This has been my business card for the past few years, enabling me to accumulate additional points while easily tracking my business expenses. This card also provides a free bonus night each year on the card anniversary as well as a free night every time you redeem points for a four consecutive night stay at an IHG hotel. This card also has a $99 annual fee.

Using these three cards, we’ve obtained hundreds of thousands of IHG points as well as free anniversary nights for the business card that I keep open. We’ve redeemed these rewards for hotel stays all over the country, while still having a health balance of points in our account.

Premium Credit Cards

For years I’ve read personal finance and travel bloggers write about the card_name ($695 annual fee) and the card_name ($550 annual fee). I never saw the value, so I simply avoided this category of credit cards.

Last year, we decided to try Capital One’s premium card when they launched the card_name. We flew a lot last year and the thing that drew us to this card was access to airport lounges.

The card_name provides unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and Priority Pass lounge partners which added a lot of comfort while saving us considerable money when flying. Of particular interest to us was the brand new Capital One Lounge in Denver where we frequently lay over since there are no direct flights between our current home in SLC, UT and our family near Pittsburgh, PA.

Aside from the airport lounge benefit, this card functions very similar to the card_name card which as noted above has long been one of my favorites. You earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

The Capital One Venture X has a $395 annual fee. However, that is easily recouped because you receive a $300 annual credit for travel booked through Capital One Travel. This can be used to book anything from flights, to hotels, to rental cars.

In addition the card provides a $100 credit for Global Entry or TSA PreCheck® . You also get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary.

So if you are willing to apply a little bit of effort to book travel through the Capital One Travel portal and you would take advantage of the airport lounges, this is a great card that justifies the fee.

Interested In Credit Card Travel Rewards?

For readers who share my interest in travel credit card rewards, I’ve established an affiliate relationship with CardRatings. This creates an outlet to make money to support the blog while writing about this strategy that I personally love and use.

It also motivates me to stay abreast of the newest developments and best offers for my own benefit and to share them with you. This will help us all to travel more while spending less.

If you want to support the blog when you sign up for new credit cards, we will earn a commission if you click on the links in this post to do so. I’ll be keeping this page up to date as a reference, with updates to any new offers as they become available.

It won’t cost you anything more and you’ll be getting the best current offer on the internet through CardRatings. Thanks for your support and happy traveling.

Share your experience with using credit card travel rewards in the comments below.

*Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Chase blue sapphire do not allow 5 cards within 24 months. They told us one card every 24 months

John,

I believe what you’re referring to is the restricion on earning the sign up bonus on both the Chase Sapphire Preferred (my personal favorite card) and the Sapphire Reserve (the “Premium” card I referenced, but haven’t used) in a set period of time. You can sign up for other Chase cards in the 24 month period (IHG, Hyatt, SW, United, British Air, etc.) I hope that clarifies.

Best,

Chris

Glad you talked about hotel cards and that you can transfer points to them. I will have to look into that more as so far I’ve never seen the value. But you have obviously worked this to your advantage very well! Thanks for the write up.

Mark P,

I tried to give some examples, but obviously can’t go into detail of each with one blog post. Feel free to ask any specific questions here.

Best,

Chris

No mention in your article of foreign transaction fees or how difficult it is to use American Express outside of the United States.

I’ve never encountered these issues. Would you care to elaborate?

Chris, I think one think that is really attractive to people who travel a lot is that a high end card like Chase Sapphire Reserve carries travel insurance on par with what you can purchase. Last year, we spend $1000 for a 1 year plan with https://www.allianztravelinsurance.com that include $10K trip cancellation. I get a very similar plan with CSR and I “only” spend $550 on the card. And, Allianz is who currently underwrites CSR’s travel insurance I believe.

Another commenter mentioned foreign transaction fees. Some cards like CapitalOne don’t charge these so I take it international. My 2% cash back card from First National Bank does charge them so that stays at home.

Another post talks about limits on the # of cards. This is a big concern with people known as “churners”. The reddit sub https://new.reddit.com/r/churning is dedicated to this hobby and contains a lot of information on how to get a lot of cards (and sign up bonuses) without running afoul of the hidden rules of the credit card companies.

John,

Thank you for reading and taking the time to share your experience and knowledge!

Cheers!

Chris

Outstanding content! Thank you for the travel rewards ideas!!!

Thanks for the feedback Tracey. I’d be curious to hear how much value you are able to get traveling out of Pittsburgh (assuming from your handle that you still are living there) and what you find to be the biggest wins. It always bums me out traveling through that airport and seeing how underutilized it is. I’m hoping to see more flight options (and thus more options to use CC rewards!) there once the new airport is finished.

Cheers!

Chris