Developing Systems To Conquer Your Early Retirement Fears

I’ve observed a common pattern among readers I’ve met. Many of you are natural savers. You’ve amassed enough money, often more than enough, to likely last the rest of your life. You’re ready for change in your life. But you’re afraid to leave your career and start spending assets you’ve worked so hard to accumulate.

My story may seem different at first glance. I left my career as a physical therapist at the age of 41. We had a then five year-old child and less than twenty-five times our annual expenses saved in our investment accounts. We moved across the country to seek more outdoor adventures in the mountains.

Am I fearless? Absolutely not.

Reckless? I like to think I’m thoughtful and prudent.

Risk management is the key to safely navigating outdoor adventures. A quote of American mountaineer Ed Viesturs has become a mantra that keeps the importance of risk management front of mind for me. “Getting to the top is optional, getting down is mandatory.”

Risk management skills we’ve developed over years of outdoor adventures have helped us manage this life transition. Focus too much on risk, and you’ll never take action. Focus too little on it, and you expose yourself to unnecessary and potentially catastrophic risks.

So I would like to share a simple climbing concept that we’ve applied to our finances to allow us to take the requisite actions to change our life sooner while minimizing the real risks that trap so many people in fear.

Redundancy

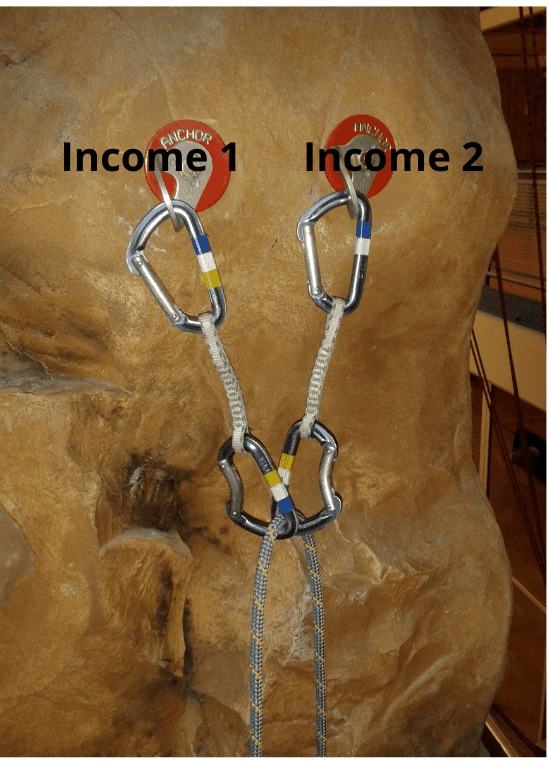

A common theme in climbing is having redundant systems. This means that whenever possible, every component of a system that could catastrophically fail should be backed up. Both systems should independently be capable of handling a load. If one system fails, the other will work.

Here is a simple demonstration. The first system should be good enough. Every component of the system (point of attachment to the rock, bolt, carabiners and nylon) is strong enough to support the full weight of a climber. But imagine what would happen to the person on the end of the rope if any one failed.

The second system is redundant. Again, imagine any component failing. You would be left with the system in the first picture above.

Is Redundancy Necessary?

The term redundancy can have a negative connotation. It can mean being unnecessary, inefficient, and thus wasteful. Redundancy is vital when the consequences of failure can be catastrophic.

This concept is not unique to climbing. Former Navy seal Jocko Willink frequently uses the saying “Two is one, and one is none” as a reminder to incorporate the concept of redundancy where failure is not acceptable.

When the consequences are serious, whether leading soldiers into battle in a war zone or hanging your weight on a rope hundreds of feet off the ground, redundancy can literally mean the difference between life and death.

The stakes aren’t quite as high when leaving your career and entering early retirement. But having too little money could make early retired life less desirable than the known lifestyle you’re leaving behind.

Related: Not Going Back to Work

That is an unacceptable risk in my book. I’ve witnessed that fear trap others. We need to develop systems that enable us to safely step off the cliff. Redundancy can provide the safety to take that crucial next step towards a different way of life.

Redundancy to get to Financial Independence

I frequently write and talk about Kim and I choosing to live off only one salary from the time we merged our finances. We didn’t have a grand plan of achieving financial independence quickly and retiring early. FIRE blogs didn’t exist then. The ideas I now share would have sounded absurd to my younger self even if they did.

Like many of you, we saved because saving felt good.

Kim grew up in a house where money was a source of constant stress and anxiety. She wanted a different way of life, one of stability and safety.

I grew up in a home with a healthier relationship to money, but money still limited options. I also wanted a different way of life; one of freedom, travel, and adventure.

While most of our peers inflated their lifestyle to match their salaries, we made a different choice. Major decisions like purchasing a home and cars were made so that we could afford our lifestyle on either of our incomes.

We considered all our worst case scenarios. What if one of us lost a job, suffered a serious injury or illness, died, or we were divorced? In any case, we as a couple or either one of us individually could live on one income. The other provided redundancy.

Some people may consider this too conservative. It wasn’t for us.

Redundancy gave each of us what we desired. Because we lived so far below our means we had security, and it was easy to splurge when opportunities arose or circumstances dictated. Consequently, we lived a life free of financial stress and full of adventure and amazing experiences on the way to financial independence.

Making the transition to early retirement

As we approached financial independence and early retirement, we began to feel fear and anxiety around our finances, just as so many readers have shared with me. Rather than continuing on with the feeling of abundance, we pictured a life of worry.

Worry that we didn’t save enough money. Worry that we wouldn’t be able to return to our high paying careers if needed. Instead of abundance, we developed a mindset of scarcity around spending.

Even before starting our transition to early retirement, we began fighting about money. This was remarkable to me at first.

We managed to fall in love in college when neither of us had two nickels to rub together. Early in our careers, we lived on Kim’s small starting salary while my salary went to paying off debt, saving for a down payment on a house, and then starting to invest. Yet we were always happy, adventurous, and able to have fun.

We saved diligently for fifteen years. We educated ourselves and took control of our investments, had enough money to last decades, and were approaching the point of having enough to likely last the rest of our lives.

And this is when we started fighting about money!

So we stepped back and asked important questions:

- Is retirement, never working or earning money again for the rest of our lives, our ultimate goal?

- Are we willing to give up the feeling of abundance and flexibility we’ve had with our finances our entire adult lives?

- Do we really want to lock ourselves into a lifestyle constrained by the performance of our portfolio?

- Should we just maintain the status quo? Is that ultimately preferable to making hard changes?

The answer to each question was a resounding no.

Redundancy in Early Retirement

So we kept asking questions. What did we really want?

- More time for our daughter, each other, and deeper relationships with friends and family.

- The time to seek more outdoor adventure while we are young and healthy.

- The flexibility and freedom to continue spending money when a need or want arises without stress or worry about whether we have saved enough.

We knew we didn’t have enough time to do all the things we wanted while working. Retirement would solve our time problem, with the tradeoff of creating new financial stress and worry.

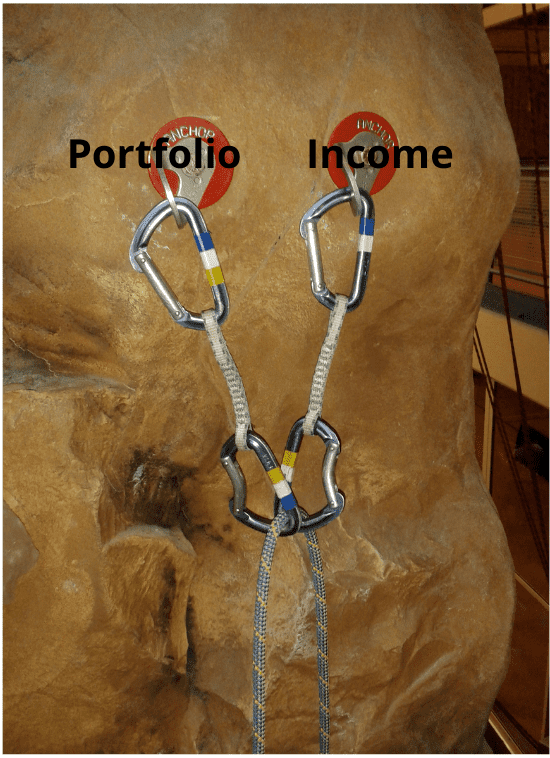

We developed an alternative plan to overcome our fear and still be able to have the things we really want. That meant having to earn enough income to cover our expenses each year and having a portfolio that should cover our expenses indefinitely. Redundancy.

We did this by Kim continuing to work remotely about 30 hours per week while I worked on writing my book and this blog. In our first year, our earning “anchor” didn’t quite support our spending due to me contributing very little financially and our expenses being high while moving across the country.

Since then, our expenses have come down as we’ve settled into our new lifestyle. Simultaneously, my writing projects started producing income.

Our combined income “anchor” has been strong enough to not only support our spending needs, but to allow us to be net savers each of the past two years. We anticipate saving even more this year. We have reached a point where Kim can further reduce her hours or switch completely to a new lower paying line of work whenever she chooses, without losing this redundancy.

Simultaneously our portfolio “anchor” has grown substantially stronger due to a combination of favorable market conditions and us not having to stress it by taking regular draws.

Expenses in Early Retirement

Doing something similar may seem unreasonable to you at first glance. But before you write this off, consider what most people’s biggest expenses are and how you can lower them in early or semi-retirement and how much income it would take to support your expenses.

Retirement Saving

In the Choose FI book, I wrote about three valid investment approaches to achieve financial independence quickly. The paths are:

- A high savings rate combined with investing in low-cost index funds

- Real estate

- A personal business

The people who I talk to who tend to have a hard time transitioning from saver to spender primarily utilized the first path. This makes sense because to achieve financial independence with this approach means you lived well below your means on the way to financial independence. You’re a natural saver. So naturally, these people would have a harder time shifting from saver to spender.

The other two paths are more compatible with incorporating leverage, so they don’t require such a high savings rate. They also tend to produce more income in retirement, rather than requiring spending down principle. Thus, they don’t elicit the same feeling of scarcity.

We can assume someone on this first path to FI is saving at least 20-30% of their income in order to be in position to consider early retirement. Someone catching up on savings later in life or a FIRE type like myself may have a savings rate of 50% or more to achieve FI more quickly.

Related: 7 Advantages When You Start Saving For Retirement Late

If you no longer have to save, you can live on much less than you made while on the path towards financial independence. This lowers the bar for how much is needed to create a redundant income stream to complement your portfolio in early or semi-retirement.

Housing

Our early retirement plan included living in a fully paid off home. With no mortgage or rent payment, we eliminated the biggest expense most households face.

Related: How Does Home Ownership Fit Into an Investment Portfolio and Financial Plan?

We also lowered many secondary expenses by relocating to a smaller home in a different area. This move lowered our utility bills and property taxes. We also drastically lowered travel and adventure costs by moving closer to the activities we want to do on a daily basis rather than having to fly across the country or drive substantial distances to get to them.

Related: Where Should You Retire?

Taxes

Once we paid off our mortgage, our biggest expense when working was our income tax bill. Cutting our pre-tax income by about 60% from a two full-time income household to our current semi-retired lifestyle drastically reduced our income tax bill. We now keep about $.07 more of every pre-tax dollar we earn.

Earning less money cut income that had been taxed at our highest marginal tax rates. Our earned income now falls under the standard deduction and into the lowest marginal tax brackets. This lower income means we also pay a 0% tax rate on our long-term capital gains.

Related: The Amazing Tax Benefits of Semi-Retirement

Transportation

Since I’ve left my job, Kim and I both have the freedom to work from home (or anywhere else in the world with a stable internet connection). I’ve eliminated my hourlong daily round-trip commute and the gasoline, maintenance, and accelerated depreciation costs that came with it.

We found that after living a year in our new location, we didn’t need a second vehicle at all. Selling it and becoming a one vehicle household lowered our insurance and maintenance costs. We also added the proceeds of the sale to our savings.

Related: Downsizing — Any Regrets?

In my final years of working, I invested some of my time to learn about how to get more value out of credit card travel rewards. We’ve continued this practice to offset most of our airline and hotel costs by using these points for travel credits.

Related: Travel More & Spend Less With Credit Card Travel Rewards

The combined effect of cutting our biggest expenses lowers the bar for how much income we need to create a redundant income stream in early retirement or semi-retirement.

Earning in Early/Semi-Retirement

Understanding what your expenses will be in early retirement will help determine how much money you need to earn in order to create a redundant income stream. Many people who are able to achieve the high savings rates necessary to be in position to contemplate early retirement have considerable earning power.

When high earning power is combined with relatively low expenses in early or semi-retirement, creating a redundant income stream may be easier than it seems at first glance.

For a household with one primary income earner and relatively high expenses, the easiest way to create a redundant income stream would likely be to simply cut back to part-time work if that is possible and desirable. Those with lower expenses and two potential income earners are limited only by your imagination.

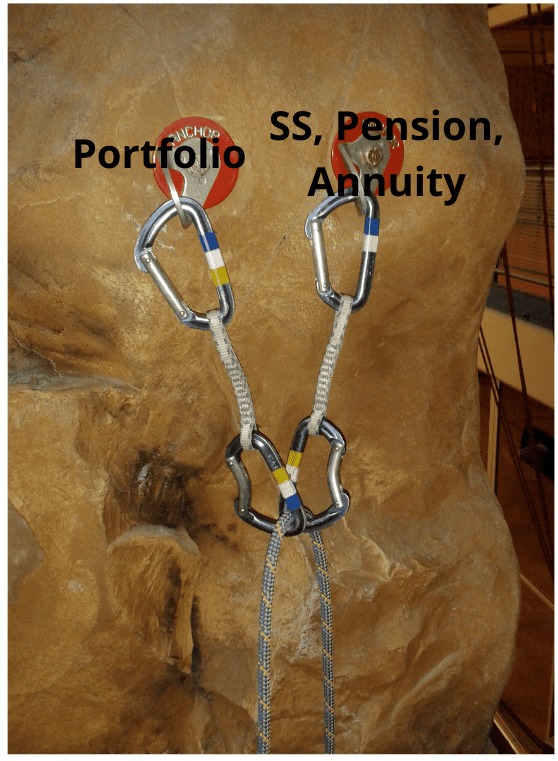

Redundancy in Traditional Retirement

In our society, conventional wisdom says it is hard to retire securely. Some people will argue that what we’re doing is not retiring at all. When we “really” retire, it will be nearly impossible to maintain redundant income streams that could each cover our full expenses.

For someone on the path to early retirement, I respectfully disagree. This is exactly what we aspire to do.

I would argue that not only is it possible to have a redundant income stream in retirement, but I anticipate this is our most likely outcome unless something drastically changes with our spending or our conservative return assumptions.

We saved aggressively for financial independence. We likely accumulated enough to retire early, but elected not to start drawing our portfolio down to any significant degree most years. This choice should mean our portfolio will grow substantially by the time we reach traditional retirement age.

Continuing to do some work during early/semi-retirement means we are also padding our Social Security retirement benefits. These benefits are calculated based on your 35 highest earning years. Completely retiring very early would result in years of $0 earnings factored into our average. Having even relatively low earnings compared to our peak earning years will help increase our retirement benefit.

Related: How Does Retiring Early Impact Social Security Benefits?

An Income Floor With Upside Potential

Social Security benefits will likely cover a substantial portion of our spending needs in traditional retirement. We should be in a strong financial position to convert a portion of our portfolio into an annuity to cover at least our remaining core spending needs. This builds upon the idea Darrow has written about on the blog of creating an income floor while maintaining upside potential with the remainder of our portfolio.

Alternatively, if our portfolio grows enough, we may well skip annuitizing a portion of our portfolio. Our withdrawal rate will likely be very low by the time we stop earning income, making this measure to decrease longevity risk unnecessary.

Does Redundancy Make Sense for You?

Would doing something similar give you the freedom you desire in early retirement? What would give you the confidence to start making major life transitions sooner?

Do you need a fully redundant income stream? Would earning half or even a quarter of your expenses with early/semi-retirement work do enough to decrease stress to your portfolio to give you the courage to start making changes to improve your quality of life sooner?

We were hungry for a change, but we’ve always had a low tolerance for financial risk. Utilizing the concept of redundancy enabled us to overcome our fears and start making major life changes.

In retirement planning, there are no hard and fast rules. This can make planning challenging. But if you embrace that fact, it can also be incredibly freeing.

How much risk are you willing to take? What would enable you to overcome your fears and change your lifestyle sooner?

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Great topic to bring up Chris. I wouldnt say i’m officially retired just yet, but this is something I have been doing since my layoff a few years ago. I ramped up my long time side job and it almost covers my expenses. It gives me an added sense of security even though my portfolio has really performed well over that time. It also gives me a lot of extra time to myself. Plus at 52, I feel I have plenty of gas left in the tank. Even though I probably could, I’m not sure I want to start withdrawing money from my accounts at this point. I’m considering going back to work full time for a few years just for added safety. But I wont put up with a bad work situation anymore just for the paycheck either. I think I’ll always try to work part time doing something I enjoy. I’ve managed to keep my expenses pretty low and making at least some money helps pay some bills and is less to withdraw from your portfolio. It also makes me feel a little less anxious about the markets even though its not a significant amount of income. I think its a great to have a system like this as you pointed out.

Arrgo,

Thanks for sharing your experience and insights.

Cheers!

Chris

I agree that I am a super saver and now that I’m retired that is comforting. I have always beed a DYI investor, dollar cost averaging every pay period into a diverse Index fund. A couple years ago I discover the great tools at NewRetirment.com Inputting your income and expenditures into their very intuitive system and updating it often always you to see where your wealth will be in 10, 20, 30, 40 years. It answers the question “Can I retire yet? Can I afford that? Can I help that family member without hurting our income generation. Great tool…reasonable price, gets better every year as they add to the tool.

DePere WI

Curt,

I agree than the NewRetirement tool is great which is why we have partnered with them. That said, there is a disconnect between seeing numbers on a screen that show that you should have enough given a set of assumptions and actually being able to take action knowing that assumptions by definition are just that, things that are unknowable. It’s important to understand that there is more to retirement planning than just math. Our emotions can stand in the way of taking action or can make the retirement we’ve worked and planned so hard for less pleasurable than the life we left behind.

Best,

Chris

I would like to speak to having a base salary in retirement. After a 40 yr career as a PT, I retired. This was earlier than I had planned, because we received an unexpected inheritance that basically covered 2 yrs of living expenses. I had a small pension from an earlier job and we did have to make some withdrawals from our retirement accounts, but, like many I am sure, I have probably 25% more money than when I first retired. Six months ago, at 70, I started my SS and my wife had started hers about a year before. Between our combined SS and the pension, we have enough money to take care of all of our expenses, including rent and medical costs.

Subjectively, I now feel much more at ease at spending from our savings. Objectively, I am gradually increasing the stock allocation to 60%. During the last few years before retirement and the 4 post years up to now, I had kept a fairly conservative 40% stocks/60% bonds and cash, still in place when the March 2020 drop occurred. It was difficult at times to wait to 70 to take SS, but now that I am there I do think it was the best solution for us.

Thanks for the blog. This is one of the first financial blogs I subscribed to and I still think it is one of the best

Mark,

Thanks for the kind words and thanks for sharing your experience and perspective. I think hearing what you are doing and feeling is really helpful to others in a similar situation.

Best,

Chris

We did the same thing with 2 incomes. Mostly, this has led to a comfortable life. In your last example you have S.S., pension and annuity. I disagree with the annuity part. After dealing with an insurance company, i have found out that once you give any money to them – it is theirs!- and they will do any and everything possible to put up all manners of road blocks to not giving you back what is justly yours. Do you really want to spend any retirement at all being lied to on the phone and writing letters to solve problem after problem (of their creation)? I have spent many hours every week for the past 4 years -of my retirement- trying to keep the money coming it that is owed to my mother. I would definitely be far ahead (mentally and physically) if i would have just given her money out of my own pocket and lived off of medicaid when it all ran out!! Conclusion, insurance companies are thieves, liars, cheats and can’t be trusted at all!!!

Ed,

I actually started writing about personal finance in part b/c I had such a negative experience with a financial advisor/insurance salesman who sold us an annuity that was inappropriate for our situation and insanely expensive, so I feel your pain.

That said, there are many types of annuities and they’re not all the same. I’d also point out that an annuity is simply a tool. Like any tool, it can be appropriate when used in the right situation, and harmful when used at the wrong time or by someone that doesn’t know what they’re doing with it. I’ve written about this topic in more detail for those that may be interested: https://www.caniretireyet.com/annuity/

Best,

Chris

I love this post. My wife and I struggle as well to figure out how to move from earning to spending and having to live on a slightly stricter budget.

We came to a similar conclusion. It’s not that we don’t want to be productive or fully retire, we want to be able to spend more time with our kids and be able to travel and live a life of abundance.

But not having a normal income has been a transition and we realize we need this second pillar of income or as you call it redundancy income. Work in progress, but thanks for being so open and honest about your situation.

AR,

Thanks for sharing your experience and for sharing the kind words. I totally agree that the whole pursuit of FI is about spending time on the things we most value and living a life of abundance, versus retiring to meet society’s expectations.

Best,

Chris

Brilliant article! I love your “redundancy” take.

I retired at age 53, 17 years ago, with enough savings that both my wife and I could retire, yet if the market or health issues occurred, one of us might have to go back to work, part-time.

Our solution was for my wife to work for “five more years” to make sure we’d have a big margin of safety.

Well, she worked 17 more years! I think it was because she had so many dependent on her skills that she felt guilty about leaving.

We have way more than we’ll ever need now, with both of us age 70.

BUT, she has developed a medical condition which may have been due to the heavy stress of those last 17 years.

So being extra cautious with super-redundancy, may have hurt our lifestyle or actual years in retirement.

It’s always a balance of what is really a safe level of savings and how many years we we have of “quality time” left.

In our case those “lost” 17 years were a lot for her…

Doug C.

Doug C.

I really appreciate this perspective. Where you likely were after those first 5 years sounds similar to where we are now, due to growth of our portfolio and the development of my writing income over the past couple of years.

My wife also continues to work more than necessary. This is in part out of a sense of obligation to her employers who have bent over backwards to provide her with fabulous working conditions and also out of a sense of pride and belonging in having helped build the company as one of the first couple of employees.

There is never a clear “right” time to cut back more or retire completely, and for now continuing as we are seems to provide more positives than negatives. But it is an ongoing consideration and conversation. I value your input.

Thanks!

Chris

Best,

Chris

As I think about redundancy in early retirement, my husband and I both have the opportunity to work towards a pension, which we could start drawing at the age of 60…even if we leave work before then. My redundancy goal is to have the projected pension amount be enough to cover the majority of our expenses, but also strive for 25x our annual expenses in investments. That way, even if the markets don’t work in our favor and we have to draw down a bit over time, we’ll still have the pension as a safety net later.

Alexis,

I was anticipating some pushback against our ultraconservative stance, but this seems to be more the norm than the exception among this crowd.

Cheers!

Chris

Love this post! This describes me very well: “You’re ready for change in your life. But you’re afraid to leave your career and start spending assets you’ve worked so hard to accumulate.”

This gives me a lot to think about, thank you!

Remy,

Our conversation was not unique. I would say among readers that I’ve spoken to, this is more the norm than the exception. What does surprise me a bit is that you don’t exactly fit the pattern of being a super saver and pouring it into index funds. Even with the regular income of real estate, we may not be immune to these emotions. I suppose the take home message is that change is just generally hard.

Cheers!

Chris

Chris:

This one was near and dear to my heart as I am “retiring” at the end of June at the age of 58. I fear, fear , fear this milestone. And when I say “retiring” the plan is to not have any more jobs (wife retired several years ago). To alleviate my fear maybe we need to take a different approach and look for potential side hustles, but that seems to be the “semi-retirement” situation. As of this morning, we have 26.125 times our yearly expenses in our retirement accounts. I think we’d be fine financially assuming no catastrophic change in the financial markets. I need to spend more time on this site getting to know all teh wise insight you have.

This is the most commented on post I’ve ever written among people named Doug C. 😉

As I mentioned in the conclusion to the post, there are no hard and fast rules as to when to retire, how to know when you have enough money, etc. And as the other Doug C. pointed out, there are no free lunches. Every decision you make has tradeoffs, risks, and consequences.

Two great questions to spend some time with are:

1.) What do you really want out of life and retirement? and

2.) For any path you may choose (full retirement, semi-retirement/part-time work, hobby work, etc) what are you getting and what are you giving up if you choose that option?

I hope that helps and best wishes as you make your decision.

Chris

Hi Chris, this is a great article and as others have mentioned so timely. My husband and I are 55 and 50, both have good jobs but are stressed out. We are about 80% to FI. We are taking this year to track our spending very carefully (we have a good estimate of our budget) and then start part-time next year. At the same time we may withdraw a small portion of our investments as a test run for this process and adjusting our allocations. As much as we both want to quit and work at—as we call—‘Lowe’s part time jobs’ our strategy is going to be to first ‘try it’. Try working at our careers part time to see how it works out before we completely give them up. So we’ll see how it goes. It is scary. Love your blog.

Mary,

Thanks for the kind words.

It is natural that these major life decisions that are difficult to reverse are stressful. I think that it’s very smart to take baby steps and try things out when possible to help overcome your fears, which you may find were irrational or maybe were warranted. One thing we know for sure is that you never know for sure until you try something.

Best wishes,

Chris

Another great article, and I’ve read many dozens mainly here and at MrMoneyMustache since discovering FIRE 6 months ago.. At 56 (and my wife 53), it seems we have the required 25 times annual spending saved, very little debt, but still have 2 kids in early 20’s preparing to flee the nest. The big question I’ve had for myself is trying to figure out which side hustle I want to do in 2 – 3 years if I retire “early” at 58 or 59, and then getting it started. My wife, a nurse, desires to leave the stressful hospital setting for a smaller office or general practice – and would cover our insurance needs until Medicare/Medicare.

I’d rather retire and spend 4 to 6 hours a day on my mountain bike, but I think I’d get board, and the side hustle / redundant income would ease my mind about the decision to quit working full time, so it’s an important one to me. Thanks for the article!

Tim S.

A couple of things to think about. You’re about a decade ahead of us with regards to having kids out of the house and collecting SS benefits, so you have a lot less uncertainty. Maybe a fully redundant income is too conservative for your needs. If you’re thinking about a side hustle what if you could earn enough to support 25-50% of your spending. This turns a 4% draw into a 2-3% draw. That will likely feel a lot less intimidating and also should open the door to many fun and interesting ways to potentially make money without setting the bar so high as far as to what you need to earn.

Best wishes!

Chris

Those are some wise words – you never know until you try – thank you.

I was supposed to write this post, I do climbing-money comparisons dammit!

Haha, nice job Chris, love it. Near and dear to my heart, and you managed to include an anchor system which I had yet to use in one of my numerous climbing-money posts. I already have a 3 piece anchor for retirement in that I have a pension. But my graphic design business will make it a 4 point system, it’s like turning the redundancy up to “11”!

Ha Ha! You are actually a couple of years late to the party on this one then. I originally wrote about this idea speculatively on the old blog. https://eatthefinancialelephant.com/our-ultra-safe-early-retirement-plan/

It is nice to be able to update it based on our actual real life experience now that we’re 3+ years into this experiment.

I hope you’re getting some decent weather and able to get out and after it.

Cheers!

Chris

As an engineer I immediately spotted the fallacy in your redundancy image… still only one rope :-)!

Anyway, good article. I will likely retire by the end of the year @57. I say likely since I’m still working on convincing my wife that I should retire. The numbers clearly show we can retire and replace my salary with assets and other income sources. One challenge will be to switch gears from saving to spending. I’m already starting to work on that by not pinching unnecessarily. No need to chase another dollar. Live is short and we need to enjoy it.

Our biggest challenge is where to retire as we must move when I retire. Our current location/home as an Expat in Japan is tied to my job. Covid travel restrictions have made it difficult to scope out locations and make firm plans. We will be “snow birds” to Thailand where we’ll build a house on land my wife owns in her home town. We will also want a home in the US but that presents a bigger challenge. We have family to include kids in college on both coasts. We’ll probably be US nomads for a while till we make up our mind.

You are correct! In climbing and rappelling the rope is the one element of the system that doesn’t have a backup. I’ve often thought about why, and my best answer is that climbing accidents almost always occur due to human error and not the equipment failing. It is not unheard of for a rope to be cut though.

If you haven’t seen, I’ve shared my thoughts on finding the right retirement location. I hope you find it helpful. https://www.caniretireyet.com/where-should-you-retire/

Best,

Chris

Like others I also fear to quit my job. Numbers say we’re good to go, but that’s on the computer and not the real life.

Once I quit, the door will be shut or/and in other words, I don’t think I’ll even want to work for a half price. I will get a miniscule pension, but it’s not COLA’d. And since we don’t have entrepreneurial spirit, I don’t think we’ll be capable of developing additional income streams. I’d be willing to volunteer more than sell stuff. And now with inflation rearing its ugly end it makes me even more fearful on some days.

You mention that you retired with less than 25x expenses. What’s the multiple today if you don’t mind this question?

Today I even don’t know how the multiple can even be accurate anymore in case the inflation takes off. The Feds might be very reluctant to raise interest rates due to all the debts the gov’t is sitting on and keeps spending even more, but they seem to downplay this threat saying all will be good in a few years. Well, if inflation hits double digits, today’s expense will be almost double in those few years. Of course, if investments also continue upwards, it wouldn’t be too bad.

S&M,

You make a great point that what computer models tell you should happen and what we see in the real world don’t always equate. As a financially conservative group, this fear of taking the leap can become paralyzing for many of us.

Our current multiple of our portfolio to current expenses is 29 (+ separate college savings fund, blog and book income, future SS benefits, and paid off home). You mention the valuation of assets side of the equation, but as a very early retiree there is also a lot of uncertainty on the spending side of the equation. Our multiple is based on our current medical insurance (subsidized by wife’s employer), relatively healthy status (x3), having an 8 y/o, etc. I anticipate our expenses will go up and down as we go through different stages of life. Just as with our sequence of returns, we’re not sure what that sequence of spending will look like, but we don’t want to be handcuffed by a budget.

Best,

Chris

I’ve noticed some people take redundancy too far. Many don’t spend 4%, just 2%. Many won’t FIRE until very calculator on earth shows 100% success, etc. The problem is, this fear-based overkill keeps people on the hamster wheel for years longer than is necessary. That said, I take redundancy seriously and appreciate your article. From what I’ve read, the fear of losing everything never goes away but it can be managed. As you note, redundancy is a powerful tool and you mentioned flexibility, which is another super-power. Cheers.

Markola,

You are absolutely correct if looking at things only from a math/rational perspective. But we’re humans, not robots. At least not yet! 🙂

If we can step away from the idea that work has to mean 40+ hours/week at a soul sucking job vs. retirement has to mean no work, no earned income, and playing a game of chicken to see if you run out of money before you run out of life, then I think people will find a lot of better alternatives in the middle ground between the extremes.

I’m only sharing this strategy as an idea that works for us to manage our fears as a couple looking for change in our early 40’s with a young kid and a lot of unknowns about the future. I will emphasize again, no one should follow our exact path. Instead, they should apply these ideas to their own situation to find the right balance of not being trapped in either extreme by fear and anxiety.

Cheers!

Chris

Chris,

Inflation last month was over 4%. How does this affect retirees where many are locked into a certain monthly amount that is worth less every year?

I am 51, but remember when movies cost $5 that are now $20 per ticket 30 years later.

Rob,

I’m not saying that I don’t share your concerns about inflation. See my post from just last week about all the government spending and Modern Monetary Theory.

That said, the inflation numbers are currently wonky. First off, there is a lot of money floating around and a lot of pent up demand from the pandemic and everything being shut down. Second, the way that inflation is measured compares current asset prices to what they were when severely depressed a year ago due to the shutdowns. (Remember negative oil prices?)

So, again I share your concern, but we’ve been an extended period of low inflation, and now we’re in a period where a lot of things just don’t make sense. So we have to wait and see how things play out.

Best,

Chris

A big thumbs up for redundancy! For years I’ve driven people crazy with my plan A, plan B, and plan C strategies. Although I feel annuities have many cons, I still have one as part of my back up plans. A small pension, savings, dividend income, and social security are all part of the picture. A small allocation to gold and bitcoin too. One or 2 of these plans can fail, the back up plans will allow me to carry on.

One pet peeve: You and a few posters have mentioned index funds. I have a mixture of index funds and individual stocks. My Apple, Microsoft, and T Rowe Price are up 440%, 300%, and 150% respectively. my 2 best performing index funds are up 150% during the same time frame. At first glance they tied the performance of the last mentioned stock. But the index funds were charging a small fee while the no fee TROW stock was paying me dividends. So many in the investment community think that Index funds are the ONLY way to wisely invest. I disagree. My Apple holdings have made me wealthy, not my index funds.

Fred,

Thanks Fred. We all have to decide how much risk we are willing to accept and then live with the consequences.

To clarify, I never tell anyone there is an only way to invest, or do much of anything for that matter. But I do know that statistics show that index funds give every day investors the best chance to succeed while going about their lives and not spending a lot of time worrying about what stocks to buy and sell and when to do it.

You mention Apple and Microsoft, but both have gone through tough times. How many people didn’t hold on to them? And could there be a selection bias here. There were a lot of tech stocks that went to 0. People who went in on only a few stocks that weren’t Apple and Microsoft aren’t talking about them. Selection bias? It’s easy to know what to own looking backward, but not quite so easy to predict the future.

And nothing is forever. What were the best stocks to have held 30, 20, or even 10 years ago. How are they doing now? Do you know when Apple and Microsoft’s days in the sun will end? Do you have an exit strategy? With index funds you don’t have to. They hold these stocks as well and they’ll hold whatever “next big thing” will replace them. While it works itself out, I’ll be spending my time as a dad, husband, climbing, skiing, etc.

So it’s index funds for me. But again, I do not recommend any specific investment for anyone else.

Best,

Chris

I’m 60, but at this exact stage where I’m nervous about spending the money I’ve saved, while at the same time, anxious about maximizing the time I have left. An advisor suggested I make a small amount of money for a few more years, and when he said that, I felt like a failure. But then I picked up some freelance, and realized how easy it would be to make my living expenses in a couple months, which made me feel much more positive about keeping some work going. So thanks for this post, it helps me further reframe this decision in a positive light.

Thanks for the feedback KR. I’m glad you found it helpful and that you’re finding ways to overcome your fears as well.

Best,

Chris

I worked as a chemical engineer designing processes that handled lethal gases and explosive chemicals. There was no acceptable level of mistakes because lives were at risk. My boss preached that you should have three ways of checking each design parameter. One might be a complex computer simulation. The other two might be comparing with a previous successful design and comparing to a published chart or graph. And all three of needed to be unrelated and independent. That way a simple data entry error could be easily caught before an unsafe design went into construction. Your redundancy example reminded me very much of that.

Good point Steveark.

An additional benefit of this system that I didn’t mention is low diversification. Last year, during the pandemic it was scary seeing every asset class (including bonds for a short time and my book sales and this blog’s advertising revenue for several months) crashing. Having Kim’s steady income was reassuring. Having our two uncorrelated income streams in addition to a portfolio of stocks (domestic and international, small and large, value and growth), bonds, cash, and gold) means that we almost always will have something working for us.

Best,

Chris