Socially Responsible Investing Revisited

Many of us are looking for ways to make the world a better place. ESG (Environmental, Social, and Governance) investing is a way to use your investment dollars towards those ends.

Darrow covered ESG investing on the blog five years ago. A lot has changed since then. ESG investing is growing in popularity, new funds are being added regularly, and the topic is getting a lot more attention in investing and personal finance circles.

So I decided to give ESG investing another look. Can your investment dollars really help change the world for the better? Or is ESG investing mostly a feel-good marketing ploy with little real world impact?

Improvements In ESG

Darrow highlighted significant challenges to implementing an ESG investment philosophy when he covered the topic. I was pleased to find substantial improvements in two key areas in the time since.

More Offerings & Lower Costs

Five years ago, Darrow wrote “Diversification and low-cost are essential for retirement security. But it’s currently very difficult to build a well-diversified, truly low-cost portfolio of socially responsible mutual funds . . . Critical for retirees, there are no truly low-cost SRI bond funds, and no low-cost SRI balanced funds.”

This is an area that has improved substantially over the past five years and continues to do so. Just last month, Vanguard launched its ESG U.S. Corporate Bond index.

Expect ESG investment options to continue to expand to meet growing consumer demand. Kiplinger recently reported that 75% of investors applied ESG principles to at least a quarter of their portfolios in 2019, up from 49% just two years earlier.

Five years ago, Darrow wrote “only a handful of SRI funds have expense ratios below even 0.5%.” He highlighted the Vanguard FTSE Social Index Fund as an exception with an expense ratio of .27%.

The fees on that particular fund have dropped by about 50% since then. They are .14% as of this writing. Vanguard also has an ESG US Stock ETF and the newly issued ESG U.S. Corporate Bond Index which each have expense ratios of .12%

Vanguard is not alone in lowering fees on ESG investment options. ETF.com published The Cheapest ESG ETF Portfolio. It has a blended expense ratio of only .17% and provides US, international, and emerging markets equity, fixed income, REIT and commodity exposure.

If you want to pursue an ESG investment strategy, cost and lack of investment options do not present the same challenges they did even a few years ago. As long as consumer demand continues to increase for ESG investments, I would anticipate these trends will continue.

What Hasn’t Changed With ESG

But will consumer demand continue to increase? Other challenges to implementing an ESG investment strategy haven’t substantially changed.

One of the biggest problems with implementing an ESG approach is determining what characteristics make a company worthy of investment. Defining “good” vs. “bad” is difficult and imperfect at best.

When investing in an ESG mutual fund or ETF, you have to determine if your values match up with the values of the fund you are investing in. This can be even more challenging when investing in actively managed funds whose criteria may be less concrete and subject to the manager’s opinions. Those opinions and the managers themselves may change over time.

ESG vs. Total Market Portfolio Composition

To illustrate this challenge, I’ll compare Vanguard’s ESG U.S. Stock ETF to Vanguard’s Total Stock Market ETF. Different investment companies offer a wide variety of ESG investment options, so the choice of funds was arbitrary.

Comparing only two offerings from one company will highlight how difficult it can be to decide on an ESG investment strategy. Sorting through all available ESG funds and strategies or choosing individual companies to invest in would be a massive undertaking.

I started by looking at portfolio composition. The total market ETF contains 3,525 companies compared to only 1,477 for the ESG fund. Despite over half of the companies not meeting ESG criteria, opportunity for broad diversification with an ESG approach exists.

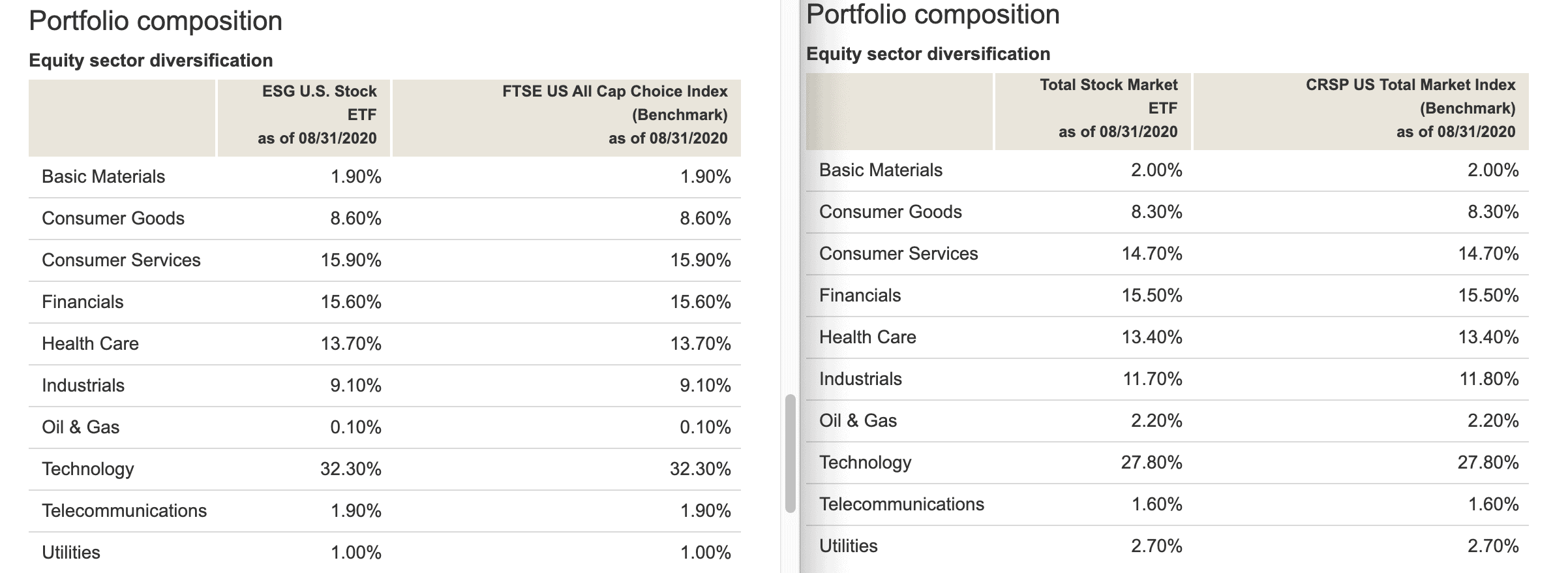

Next I looked at how the portfolio was diversified by sector. You can see from the side by side screenshot that the ESG ETF is even more tech heavy than the already tech heavy total market ETF, with 32.3% of the ESG portfolio in tech stocks vs. 27.8% of the total market portfolio.

Oil and gas, utilities, and industrials are all considerably less in the ESG portfolio than the total market portfolio. Oil and gas are essentially non-existent on the ESG side. That makes sense with regards to the environmental portion of the ESG acronym.

The funds allocation by sector was otherwise essentially the same, with less than 1% difference by category. The lone exception was consumer services which accounted for 15.9% of the ESG fund compared to 14.7% of the total market fund.

Comparing at the company level muddied the waters on the environmental side, and left me scratching my head on how social and governance issues are judged.

ESG vs Total Market Company Holdings

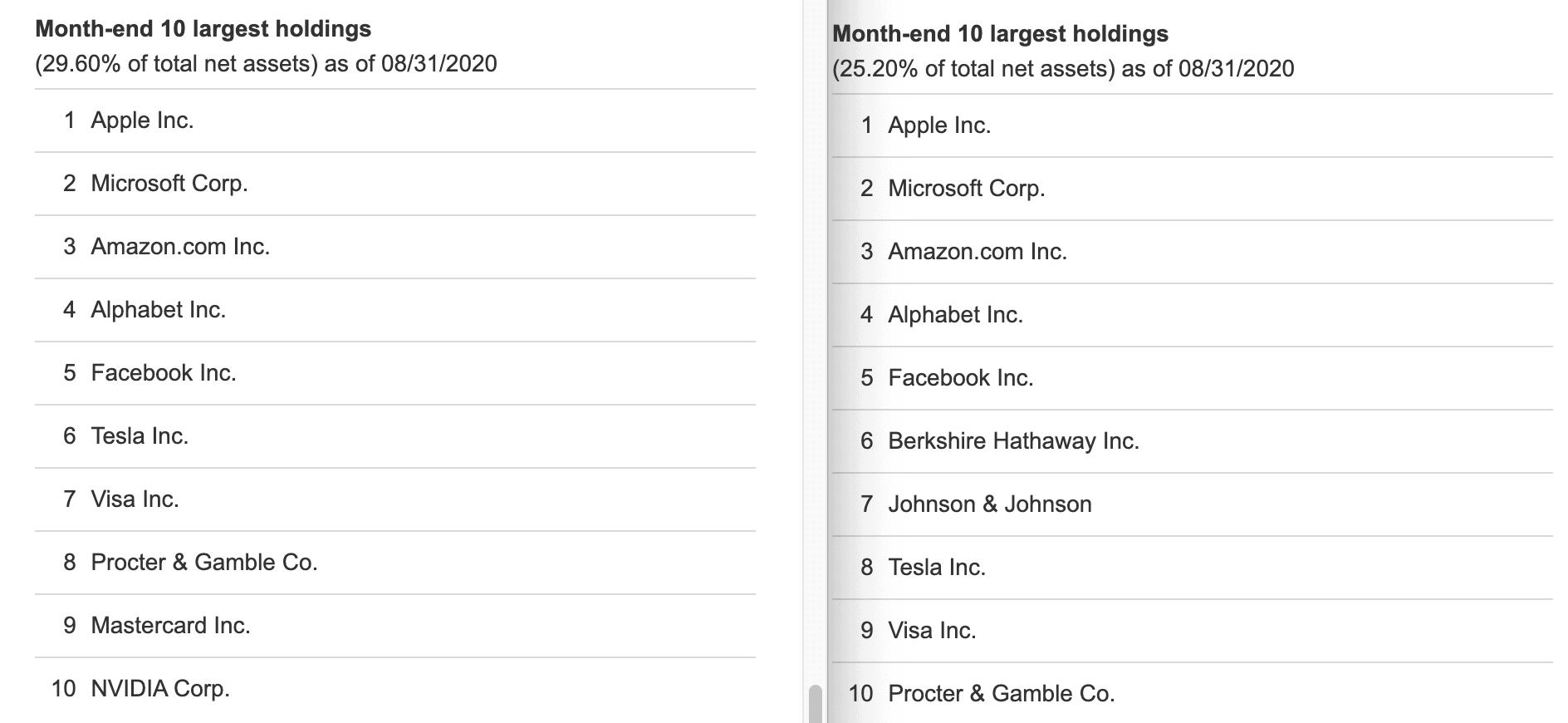

Looking at the top 10 company holdings side by side is revealing. The top 5 companies of both the ESG and total market index are identical. Eight of the top ten holdings are present in both indexes.

One of the reasons that ESG may be gaining in popularity so quickly is that ESG funds give the feeling of doing good with your investment dollars while recently producing better returns than the broad market.

A Bloomberg headline from January touted The Biggest ESG Funds Are Beating the Market. That trend continues in 2020. Through September 30th, the Vanguard ESG fund is up nearly 21% compared to the Vanguard Total Stock Market fund, which is up 15% for the year.

ESG Performance

Seeing so much overlap in the largest holdings between the ESG and total market funds raises a key question related to performance. Are ESG funds’ recent outsized returns an indicator that consumers are looking for businesses that aim to do more good? Or are the returns a result of ESG funds investing in companies that happen to be in favor (technology) and avoiding companies that are currently out of favor (energy)?

I suspect it is more of the latter. While the largest and most impactful companies are largely the same in both funds, they make up 29.6% of the ESG fund, compared to 25.2% of the total market. In other words, their performance isn’t being diluted by as many underperforming companies.

Any strategy that invests in a sector of a market will have periods of over and under performance related to the broader market. I have no idea how ESG funds will perform going forward.

Small cap and value stocks are sectors that at times have outperformed the broad U.S. market. Over the past decade, both strategies have consistently underperformed. The same could be said of international stocks.

In 1980, energy stocks accounted for seven of the top ten largest companies in the S&P 500. Today there are none.

Markets are cyclical. Performance comes and goes.

Fees do not. They are a predictor of future performance.

Even the ultra-low cost Vanguard ESG ETF has expenses that are 4 times greater than their total market ETF. A recent Morningstar study reported that the median net expense ratio of comparable ESG Large Cap stock funds, while consistently decreasing, is still .84%.

ESG Strategies

So what are we getting for the cost? To answer that, we need to take a closer look at the ESG fund’s strategies and how they impact the companies it invests in.

Vanguard differentiates among a variety of ESG investment strategies. They include more passive strategies that can be exclusionary (i.e. no companies that produce tobacco) or inclusionary (i.e. invest in sectors or companies with higher ESG ratings compared to their peers). More active and involved ESG strategies include ESG integration, advocacy, and impact investing.

To see how complicated and time consuming it can be to sort through this, let’s return to our comparison of just two relatively simple to understand ETFs that track major indexes.

The Vanguard ESG US Stock ETF uses an exclusionary strategy. You can find the fund’s investment criteria here.

Let’s look at what companies are included and excluded compared side by side with the total market index. This will illustrate some of the challenges investors face when looking to do more good with their investments.

Tech’s Environmental and Social Impact

The top five holdings in the ESG ETF are tech giants Apple, Microsoft, Amazon, Alphabet (Google), and Facebook. There are things I like and respect about each of these companies. Each also has major concerns in environmental, social, and/or governance, in my opinion.

The New York Times recently reported that Apple agreed to pay $500 million to settle a lawsuit related to their strategy of planned obsolescence of their iPhones. This doesn’t strike me as an ethical way of doing business. Nor does needing to replace millions of batteries or entire devices seem environmentally friendly.

Each of these tech companies use practices to engineer their products to be addictive. These practices can lead to negative health and social impacts. Each company also does what it can to create a monopoly.

Beyond Tech Companies

The largest company in the total market index, but absent from the ESG fund, is Berkshire Hathaway Inc. I was surprised to find that this had little or nothing to do with being large stakeholders in Coca-Cola (contributing to obesity and diabetes) or Wells Fargo (with a history of unethical practices).

According to Bloomberg, Berkshire is excluded from most ESG funds because of poor governance metrics and lack of reporting. Neither meet ESG standards. They report that Berkshire is rated so poorly by ESG governance standards that they are in less ESG funds than Exxon-Mobile.

I found it surprising that a company run by respected business icon and philanthropist Warren Buffet does not meet ESG standards due to governance issues, but Elon Musk’s Tesla does. Tesla is the sixth largest holding in the ESG fund, despite Musk’s erratic behavior that includes tweets that get him in trouble with the SEC and openly smoking pot on Joe Rogan’s podcast.

The ESG fund’s seventh and ninth largest funds are Visa and Mastercard. I don’t personally find credit card companies to be inherently evil. I’ve recently shared how I’ve used credit cards responsibly to my benefit.

However, I also don’t think a business model built upon lending money with an average APR of over 20% to people who in sum don’t use their cards responsibly is exactly “doing God’s work.” I was surprised to find that credit card companies are two of the ten largest holdings in this popular ESG fund.

Do Your Values Match ESG Values?

The biggest challenge to ESG investing is that companies, like people, are imperfect. I didn’t write negative things about Apple, Tesla, or Visa in the previous section to be disparaging.

I could do the same with any company. That’s the point. I am writing this on an Apple desktop, regularly use a Visa credit card, and anticipate a Tesla will be my next car.

It can feel good to choose sides, and label things good or bad. But making value judgments is difficult. Rather than living in a world of black and white, in reality we live in a world that is many shades of gray.

So is applying extra time and effort and paying higher fees to use an ESG investing approach worth these costs? Will this approach substantially change the world for the better?

Worth the Cost and Effort?

Ultimately, I determined the answer to both of those questions is no. Analyzing just this one ESG fund sent me down many rabbit holes and raised more questions than it answered.

I am certain that reconfiguring my portfolio would involve substantial time and effort to figure out what to sell off and what to replace it with. An ESG approach would result in paying higher investment fees. I’m not certain ESG investing will make the world a better place.

If I was starting from scratch today, I may allocate a portion of my assets to an ESG strategy. I certainly understand why this ideal is appealing to many.

If doing so, I would choose from among the low cost ESG alternatives. Cost is one of the most important things you can control as an investor.

I would not select a particular ESG investment or the strategy in general because of recent outperformance. We have no idea how ESG investments will perform in the future compared to broad market returns.

History teaches buying any investment while chasing past returns and then selling low when outperformance doesn’t persist is a losing strategy. If you are interested in an ESG investment approach, you would be wise to select a strategy and fund or collection of funds you are willing to buy and hold forever.

As for me, I’ll stick with my current index fund investment strategy. I’ll focus on using my time in early retirement to serve others, giving more generously, and continuing to live a low impact lifestyle.

I’m confident these actions will positively impact the world and are worth the time, money and effort involved. I’m not ready to say the same thing about ESG investing.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Your comment and assessment of Tesla, Visa , MasterCard and Berkshire Hathaway are spot on!

Thanks for reading and taking the time to comment Mark. Though I’ll point out that for everyone who agrees with us, there is someone else that doesn’t which is what makes this so subjective.

Thanks Chris, another thoughtful and well researched article. I appreciate the clarity in the muddy of this type of investment. I agree that sometimes and now more than ever, living in the grey is something I have to accept and get comfortable with which is never easy for someone who feels safest with the black and white….cheers Nancy in the mountains

Nancy,

I also cherish simplicity and clarity and there is little of that to be found in 2020. Glad to see know that you found the article helpful.

Best,

Chris

I’m amazed at how parallel our interests and financial explorations have been lately, Chris! The topic of ESG investing has recently come up for us, as our 20-year-old, who has not yet started college but is living at home while working through a “gap” year, has been paying us rent for his bedroom. What to do with that money? We are charging him as a mean of helping him develop independent living and budgeting skills, but we don’t really need the income. So we decided to invest it, with the plan that it will eventually be returned to him in the future when we are no longer here – and provide him insight into how small, regular investments can grow over time, so he’s keen to start long-term investing on his own. And we decided to invest it in a Vanguard ESG ETF, wanting to not support the fossil fuel energy sector (how well our investment does that, or whether we end up penalizing energy companies that diversify into clean energy alternatives, remains to be seen). Having VTSAX in our IRA’s, it was quite noticeable how much the holdings of both funds overlap. So far (since August), the ESG seems to just be treading water – but we expect that growth will ramp up over the next several years. Still, I’m thinking this idea of socially-responsible investing might be better implemented thru investment in individual companies, rather than index funds that will inherently have difficulty separating which stocks/industries are “good” vs. “bad”.

Thanks for reading and sharing your thoughts GAH.

While we tend to mostly agree, I think applying ESG principles to individual companies may be even harder. It is already hard to invest in individual companies. Few people want to do the technical analysis of enough companies to provide diversification and the potential for acceptable returns.

Add on determining ESG analysis and I think that’s a pretty tall order for most investors. IMO there are much better ways to spend your time.

I’m sticking with VTSAX, too. ESG seems to me to be a proxy for “Growth”.

I expect at some point “Value” will have it’s day in the sun also, and I would like to have some stake in it.

There are many reasonable investment approaches. The key in my mind is choosing one you believe in and will stick with for the long run.

Best,

Chris

I have long been a proponent of the type of investing, dating back to the 80’s, and it has served me well. I’ve always felt that the small additional costs were a good value. Given the shareholder activism and alignment with my values, I sincerely felt I was getting my “money’s worth”. In many cases over the years, the ideas of the SRI/ESG investors have served as a sort of early warning system, pointing to risks before others were paying attention, e.g…the 2008 credit crisis, not to mention climate change.

This much appreciate update reminds me that things really are changing. Now, with sophisticated modeling algorithms, index funds can take advantage of the wealth of ESG data, while closely tracking the ordinary funds. By definition these index tracking funds offer no advantage or disadvantage but rather the intention that the companies in your portfolio are among the best environmental and community stewards.

Bottom line, in my years of experience and “early-at-57” retirement, I believe the best performance comes when investors take advantage of all the information available. In actively managed portfolios, ignoring ESG data doesn’t make sense. Regardless of one’s particular values, the more you know, the better your chances of good results.

Thanks again, Chris for this update. I really enjoy your newsletter!

Laura,

Thanks for reading and taking the time to share your thoughts and experiences. I certainly am drawn to the idea of ESG investing, I’m just not convinced on the impact it has. As noted, in the article, if starting today with the options available, I’d probably dedicate at least some of my money to these investments as you have. Happy to hear it is working out for you.

Best,

Chris

Best article I’ve read on the topic. Thanks for doing the research.

Thanks for the kind words Bill.

Thanks for another thoughtful post. I agree with a lot of what you point out here. I do have one quibble which I think is worth mentioning because it relates to how you understand the business of one possible (and for me, at least, very successful investment). Regarding Visa and Mastercard you wrote in part:

“However, I also don’t think a business model built upon lending money with an average APR of over 20% to people who in sum don’t use their cards responsibly is exactly “doing God’s work.” I was surprised to find that credit card companies are two of the ten largest holdings in this popular ESG fund.”

When you use a credit card you don’t borrow money from Visa or Mastercard nor are they the company getting that 20% APR. These two companies are essentially payment networks. American Express and Discover, on the other hand, are both payment networks and on the other side of that borrowing in at least some cases. The distinction is important not as a matter of “doing God’s work” but because the risks these companies face in downturns are different. Visa and Mastercard suffered earlier this year because payments went down as the economy froze but they didn’t face the risk of bad debt or insolvent borrowers. I understand you are mostly (and wisely!) an index fund investor but for your readers who might also own stocks I think it’s important to understand the real nature of these businesses and their risks. Please keep up your excellent work here!

Thanks for the thoughtful comment Wart. I agree that it is wise for me (and likely the vast majority of people) to be an index fund investor because I don’t want to spend my time researching the business models, management, and fundamentals of companies as is required to be successful when investing in individual stocks. This also reinforces why adding the additional layer of assessing whether companies are not only good investments, but meet ESG requirements is not something I want to spend my time figuring out.

Best,

Chris