Maximize ACA Subsidies and Minimize Health Insurance Costs

There are three main challenges to buying health insurance as an individual:

- The high cost of our medical system

- The complexity of understanding and navigating the system

- Political instability that makes long term planning virtually impossible.

Each of those dynamics changed significantly, if only temporarily, in 2021 with passage of the American Rescue Plan Act of 2021. These changes impacted health insurance costs and decisions for those purchasing their own health insurance through 2022.

Those changes have been extended, at least through 2025, as one provision of the recently passed Inflation Reduction Act. While still not ideal for those of us planning for a decade or more until Medicare eligibility, this new legislation at least extends the planning window a few years.

It is vital to understand how to purchase the optimal medical insurance coverage for your household while controlling your costs. So, I’ve updated this post originally published in 2021 to reflect this most recent change in law.

Table of Contents

- What’s changed since the original Affordable Care Act (ACA)?

- Buying a Health Insurance Plan on Healthcare.gov

- Using a Health Insurance Calculator to Assist Planning

- What Factors Influence Your Marketplace Health Insurance Subsidies and Costs?

- How Income Impacts Your ACA Subsidies

- What Constitutes Income For ACA Subsidies?

- Calculating MAGI for ACA subsidies

- Estimating Your Premium Tax Credit

- How Premium Tax Credits Work

- Choosing a Plan

- Conclusion

What’s Changed Since the Original Affordable Care Act (ACA)?

I originally wrote about the large impact that the American Rescue Plan Act of 2021 had on health insurance costs for early retirees and others buying health insurance on the Health Insurance Marketplace and utilizing ACA subsidies to make it affordable. The passage of the Inflation Reduction Act in August 2022 extends those changes through 2025.

These changes to the ACA decrease cost and complexity for those buying health insurance on their own.

On the negative side, these bills highlight how unstable the system is and how challenging it is to plan for health care costs for the long term. On a more positive note, both of these recent bills lower health insurance premiums for many voters. The longer they are in place, the less politically popular it will be to change them back.

Let’s start by reviewing what has changed and for how long.

Decreased Health Insurance Premiums for Many

Under the Affordable Care Act, the price you pay for health insurance premiums has always been a function of your household income, among other factors.

Those with the lowest incomes are eligible for Medicaid. The minimum income threshold is 100%-138% of the Federal Poverty Level (FPL) depending on your state of residence.

Once your income exceeds this threshold, you qualify for subsidies to make insurance premiums more affordable under the Affordable Care Act (ACA). The official term for the subsidies are Premium Tax Credits (PTC). Throughout this article, I’ll use these terms interchangeably.

Eventually, those with higher incomes, exceeding 400% of FPL, did not qualify for subsidies. They had to pay the full cost of health insurance under the original ACA.

The American Rescue Plan made two significant changes, which were extended through 2025 by the Inflation Reduction Act. First, those who already received subsidies will now receive larger subsidies, lowering their out of pocket expenses.

Second, the new law eliminated the cap of 400% of FPL which is a feature of the original ACA.

The changes in the maximum percentage of household income paid towards insurance premiums through 2025 are summarized in the table below.

| Income as % FPL | Original ACA | Changes to ACA Through 2025 |

|---|---|---|

| Up to 150% | 2.07 - 4.14% | 0% |

| 150-200% | 4.14% – 6.52% | 0% - 2% |

| 200-250% | 6.52% – 8.33% | 2.0% – 4.0% |

| 250-300% | 8.33% – 9.83% | 4.0% - 6.0% |

| 300-400% | 9.83% | 6.0% - 8.5% |

| >400% | No Cap, Subsidies Eliminated | 8.5% |

Eliminating the Subsidy Cliff Decreases Planning Complexity

Under the original ACA, subsidies were completely eliminated when household income exceeded 400% of FPL. This was frequently referred to as the subsidy cliff.

If you had an income of $X that put you right at the cliff, you qualified for generous subsidies of thousands of dollars per year. If your income increased to $X + 1 and that pushed you over the cliff, you completely lost the subsidy.

This was in effect a several thousand dollar tax on that one dollar of extra income. It made planning challenging for entrepreneurs, freelancers, people who have a substantial portion of income in the form of tips and commissions, and others with irregular and unpredictable income.

The subsidy cliff also presented challenges for early retirees who have to generate income from a mix of sources and may also be incorporating tax-gain harvesting or Roth IRA conversions to lower their future tax burden.

The elimination of the cliff makes planning simpler. If you earn an extra dollar, or even a few thousand extra dollars, over the 400% FPL threshold, your subsidy decreases and out of pocket costs increase gradually until they eventually phase out. Small planning errors are not nearly as punishing.

Subsidy Cliff Complexity Still Exists

The subsidy cliff on the lower end of the income spectrum is still in place with this new legislation. You need to have a MAGI of at least 100 to 138% of the FPL (depending on your state of residence) to receive subsidies and avoid being pushed into Medicaid.

The level depends on whether you live in a state that expanded Medicaid. Avoiding Medicaid is desirable for many people, because Medicaid is not accepted by many health care providers and institutions.

It is also important to not make the mistake of signing up for a Marketplace plan rather than Medicaid if you don’t have enough income to reach this lower threshold, because you will not qualify for ACA subsidies.

Most early retirees could generate income by doing Roth IRA conversions. Just be aware of this and do it before the end of the calendar year.

Highlighting Political Instability

These recent pieces of legislation highlight the instability and unpredictability of the health insurance marketplace. Marrying health insurance premiums to tax subsidies is problematic.

Our health and thus health care needs are unpredictable. Anyone who has had any need to utilize the system knows that health care costs are extremely high and rarely transparent in the United States. Adding to the challenge, health care costs consistently increase faster than the general inflation rate.

These issues make planning for health care expenses challenging, even without incorporating tax planning into the equation. Adding in the tax planning component can make for a nightmare!

Tax laws can and do change frequently. The American Rescue Plan is a perfect example of why planning for health care costs for the long term is impossible.

This law was in effect for 2021 and 2022. The law didn’t go into effect until March 11 of 2021. That’s about 3-4 months after most Americans made their health insurance decisions for 2021. The inflation reduction act at least extends our planning windows three additional years through 2025.

What will happen after 2025? Your guess is as good as mine. If nothing changes, we’ll revert back to the original ACA rules. However, as noted above, the longer the current rules are in place, the less politically popular it will be to revert back.

Certain aspects, particularly eliminating the subsidy cliff, make sense and simplify the process of buying insurance. But as we’ll see below, common sense and simplicity are in low supply with the ACA. So we can’t assume these changes are permanent.

Buying a Health Insurance Plan on Healthcare.gov

Buying insurance through healthcare.gov (or your state’s marketplace) guarantees access to health insurance similar to what we traditionally have had through our employers. There is a lot I don’t like about our current healthcare system. That said, I find comfort in familiarity.

One of the most read articles on this site explores the many imperfect health insurance options that American early retirees have available. I’ve also done a deep dive into the best alternative for our family, Health Care Sharing Ministries.

I’ve concluded that buying traditional health insurance through the Marketplace utilizing available premium tax credits is the best solution for our family if we can’t get insurance through an employer. An ACA compliant plan allows us to have contractually binding health insurance that should protect us in a worst case scenario.

Our challenge is determining how to obtain the best coverage in the most affordable way.

Using a Health Insurance Calculator to Assist Planning

I’m a big fan of the Kaiser Family Foundation’s Health Insurance Marketplace Calculator. It is helpful in a number of ways when planning for short and long-term health insurance costs.

It shows what your estimated health insurance premiums will cost for a Silver Level plan with and without subsidies. Both are useful pieces of information.

The size of your Premium Tax Credit determines your actual costs for health insurance. Calculating this is helpful in planning for the upcoming year.

Knowing the full unsubsidized cost of health insurance is useful when considering what your insurance would cost if the law changes and/or your income exceeds the limits which allow you to qualify for subsidies. This prepares you for worst case scenarios.

Using the calculator is also helpful for planning purposes. It shows what factors influence your health insurance costs, some of which you may be able to control.

What Factors Influence Your Marketplace Health Insurance Subsidies and Costs?

Factors that influence costs for marketplace health insurance plans include:

- Income,

- Geographic location,

- Whether health insurance coverage is available at your or your spouse’s job,

- Number of people in your household (adults and children),

- Ages of people who will be covered,

- Whether those covered use tobacco.

We’ll explore each in more detail below.

The Impact of Income on Health Insurance Costs

Your Modified Adjusted Gross Income (MAGI) determines your Premium Tax Credit and thus out of pocket costs for health insurance. This variable is particularly important for planning purposes for early retirees.

That’s because we early retirees often have considerable control over how we generate the income needed to meet our spending needs.

This is in contrast to entrepreneurs, freelancers, and others without employer sponsored health insurance. Controlling income may be more difficult and less predictable in those circumstances.

Income also stands in contrast to other factors that determine premium costs, because we have little to no control over many of those variables. Because it is so important to understand how income affects health insurance premium costs, we’ll go into more detail below.

First, it is important to understand what other factors impact your insurance premiums.

Geographic Location

There is variability in the cost of health insurance plans based on your geographic location.

One factor to consider is whether you live in a state that expanded Medicaid. If you’re not sure, find the status of your state here. Alternatively, enter your current location and any other locations you may be considering into the calculator to see if it impacts your health insurance costs.

In states that did not expand Medicaid, your income needs to be at least 100% of FPL to qualify for insurance subsidies. You must have income greater than 138% of FPL in states that expanded Medicaid.

Another consideration is differences for residents of one of the non-contiguous states. Note that Alaska and Hawaii FPL numbers have been adjusted upward due to higher cost of living.

Also note, the number and quality of insurance options available differs greatly by geographic area. This will not be evident until you begin shopping for health insurance plans in your particular area.

Health Insurance Available Through an Employer

An important variable in the cost of your health insurance is whether you or your spouse have health insurance offered through an employer. If so, you generally won’t qualify for any subsidy and will pay the full cost of a health insurance plan purchased through the Marketplace.

There are rare exceptions if coverage provided by an employer does not meet minimum standards for coverage or affordability. You can read full details of these exceptions here.

Number of People in Your Household

The number of people in your household is defined as a tax filer, their spouse, and dependents. The more people in a household, given a fixed household income, the higher your Premium Tax Credit and lower your out of pocket cost will be.

This can be counterintuitive. You may assume that the more people you insure, the higher your health insurance expenses will be. That is true when looking at the full, unsubsidized costs.

However, subsidies are based on your income as a multiple of FPL. Because it is generally more expensive to house, clothe, and feed more people, a larger household would have higher expenses. A given household income wouldn’t go as far in a household with more people.

Consider two households with the same income. The larger household will get a greater Premium Tax Credit and thus pay a lower share of the health insurance costs. A smaller household would qualify for less subsidies, and thus pay a greater share of health insurance costs.

This is important to consider if you will be adding (birth, adoption, marriage, etc.) or subtracting (death, divorce, children aging out, etc.) people from your household. The number of people in your household will substantially impact health care costs, assuming household income remains constant.

Ages of people who will be covered

Age is a factor that makes it especially important to optimize your ACA subsidies as we get older. We tend to use more healthcare services as we age. Thus, health insurance premiums increase considerably as we get older.

As an example, premiums for our family of 3 would have a full unsubsidized premium cost of $15,877 based on Kim’s and my ages, in our mid-40’s.

I experimented with increasing the adult ages to 60 in the health insurance calculator and leaving all else equal. The full cost of an unsubsidized plan jumped to $25,546.

However, our out of pocket costs for health insurance premiums for Marketplace plans are based on a percentage of our income. So our out of pocket costs for premiums are exactly the same in either scenario, regardless of our age.

Our subsidy in this example increases by nearly $10,000/year by entering a higher age! This demonstrates why it is more important to be able to optimize your Premium Tax Credit as you age.

Use of Tobacco

Using tobacco is another factor that impacts your health insurance costs. The calculator doesn’t indicate how much more tobacco users will pay. It simply states: “You may pay more if your insurer charges a higher rate for tobacco use. In most states, insurers can charge a tobacco surcharge of up to 50% of your total premium before the tax credit. The tax credit cannot be applied to the tobacco surcharge.”

I can think of many reasons that are better than saving money on health insurance to stop using tobacco. Increased risk of cancers, lung disease, heart disease, and stroke jump front of mind. The direct financial benefits of not buying tobacco products and paying the high taxes on them are others. But if paying a lower health insurance premium pushes you over the edge to quit, all the better!

Eliminating discrimination based on pre-existing conditions is one of the most politically popular provisions of the ACA. I find it odd that tobacco use is the one behavioral factor that is, for whatever reason, so stigmatized that it can cause you to pay a higher health insurance premium. For current planning purposes, this is all you need to know.

When planning for the long term, it will be important to see whether this remains the case. Or will other behaviors and lifestyle related conditions that may impact your costs be incentivized or punished via health insurance subsidies and premiums? Stay tuned!

How Income Impacts Your ACA Subsidies

The factor which you have the most control over to maximize your ACA subsidies and limit your out of pocket expenses is income. It’s important to first understand what counts as income as it relates to obtaining Premium Tax Credits.

What Constitutes Income For ACA Subsidies?

Your subsidies, and thus your personal health care expenses for a given year, will be based on your household income in that year. So next year’s subsidies and your share of expenses will be based on your income in that year.

You will have to estimate this. If your estimate is off, you’ll have to pay the difference or receive a refund after the fact.

Your current year’s income will probably be a good enough approximation to start planning if your expectation is that your situation isn’t going to change much.

If you are retiring, cutting back work, transitioning to self-employment, or making other changes that will substantially increase or decrease your income, you’ll make your best guess at what income in the following year will be.

It is also important to understand that subsidies are based on total household income, even if not everyone in the household needs to buy insurance through the Marketplace.

Consider a household of three where only one spouse works. The working spouse has insurance through their employer, but coverage is not extended to their family. The worker’s income counts against the subsidy the remaining spouse and child can qualify for.

Finally, you need to understand what counts as income which impacts premium subsidies and out of pocket premium costs. For the purposes of this discussion, income is your Modified Adjusted Gross Income (MAGI).

Calculating MAGI for ACA subsidies

I’ve written about how to calculate your Adjusted Gross Income (AGI) and Modified Adjusted Gross Income (MAGI). If you are not familiar with these terms and how to calculate these numbers, start there.

Once you generally understand these calculations, you’ll have to factor in how a few specific factors related to health insurance decisions will alter these calculations.

Finally, after getting your AGI, learn how to adjust it to arrive at your MAGI. This number determines your Premium Tax Credit and out of pocket insurance premium costs.

Determining Eligibility for a Health Savings Account (HSA)

Contributing to a HSA provides an “above the line” deduction that lowers your AGI, and thus MAGI. Lowering your MAGI will increase the subsidy you qualify for. This in turn lowers your out of pocket expense for health insurance premiums.

Since 2017, we’ve obtained our health insurance through my wife’s employer. Each year, we have chosen a high-deductible health plan. Part of our reasoning for doing so was having the ability to contribute to an HSA.

Related: Using a HSA to Save for Retirement

We assumed we would choose similar coverage and continue contributing to an HSA annually when purchasing a Marketplace plan. We assumed the determining factor of whether a plan was a high-deductible health plan was… the size of the deductible. Don’t assume!

I created an account to explore specific insurance plan options offered through the Marketplace at Healthcare.gov. I began by exploring plans with similar features to those we currently have. The closest equivalent to our current coverage is a Silver Level plan.

To my surprise, Utah has no silver level plans that are HSA compatible. We need to choose a Bronze Level plan that has considerably higher deductibles and coinsurance amounts than we’re accustomed to. Otherwise, we lose the ability to contribute to an HSA.

You can find the qualifications for a high-deductible health plan in IRS publication 969. Alternatively, when shopping plans on the Marketplace you can sort them by whether they are HSA compatible.

Take home: Don’t assume you will be able to contribute to an HSA and claim that deduction when projecting income until you explore the plans available in your area. You may not find an HSA compatible plan to your liking.

Circular Logic for Self-Employed Deductions

Buying your own health insurance provides another valuable above the line deduction that reduces AGI for the self-employed. However, it quickly becomes apparent that this also adds complexity to your calculation.

Self-employed health insurance costs are deductible. The deduction lowers AGI. A lower AGI leads to receiving a larger tax credit. A larger tax credit means lower health insurance costs for you.

These lower costs reduce your deduction. The lower deductible amount increases AGI. A higher AGI results in reduced tax credit. The smaller subsidy results in higher insurance premium costs.

After going in circles with this, I was certain I didn’t understand something. I reached out to CPA Mike Piper to clarify.

He assured me my understanding of the law was correct and pointed me to an excellent resource from the Harry Sit’s Finance Buff blog. It provides IRS Guidance On Circular Reference in ACA Premium Subsidy and Deduction and explains how to resolve it.

If you are self-employed, take time to understand how to calculate this deduction correctly to legally minimize premium costs.

Modifying AGI to Determine Premium Tax Credits

Once you have an acceptable estimate of your AGI, you need to modify it to get to your final income number that will determine your Premium Tax Credit. Find the calculations to determine MAGI for the purposes of health insurance subsidies on the IRS Instructions for Form 8962.

This is an estimate. We’re trying to determine our costs for health insurance next year, based on projections of income we will make this year. We won’t ultimately know our final costs until spring of the following year when we file our tax returns and have our actual MAGI.

This is the best we can do for now. So we use the estimated MAGI that we calculated to estimate our Premium Tax Credit.

Estimating Your Premium Tax Credit

You can determine your estimated Premium Tax Credit by filling out an application at HealthCare.gov. However, be careful before jumping to this step.

Before you start shopping on the Marketplace, play with an AGI calculator to experiment with manipulating your income. Then plug different income numbers into the KFF Health Insurance Marketplace Calculator to fine tune your planning, until you are confident in your estimate.

I started on the Marketplace website and completed an application. I wanted to change one income number to see the impact of contributing to a 401(k). Doing so required going through the entire application again, which took nearly ten minutes.

After going back and working with the other calculators, I found the estimated subsidy from the KFF calculator was within $4 of my results on HealthCare.gov. In addition to being precise and accurate, the KFF calculator provided a more user-friendly experience when experimenting with different income scenarios.

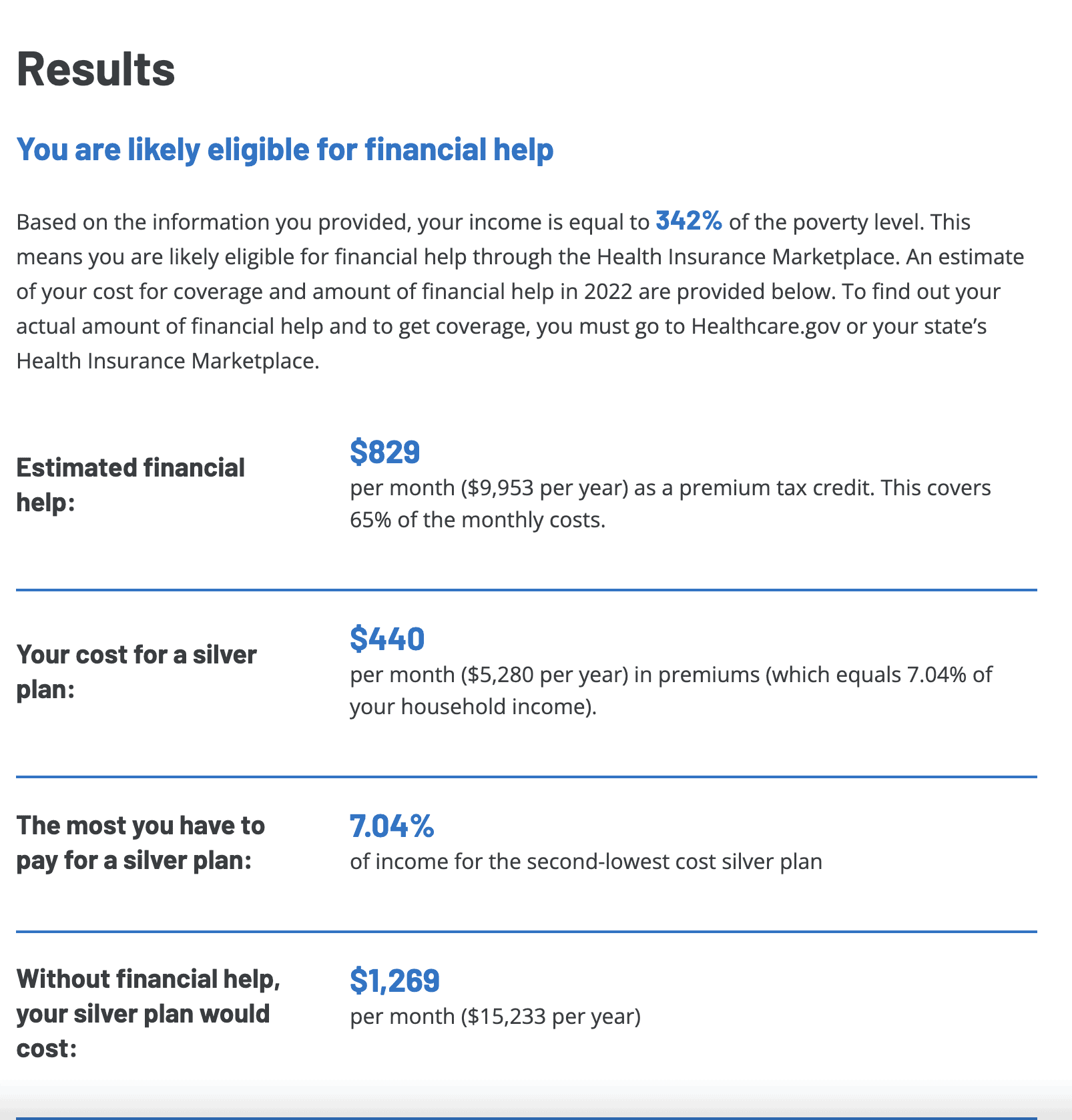

The screenshot below shows our outcomes from the KFF calculator.

How Do Premium Tax Credits Work?

Based on our best assumptions for next year’s income, combined with our household size, geographic location, and our ages, we qualify for a monthly subsidy of about $830/month. The KFF calculator shows that with this premium tax credit, we would pay about a $440 premium for the second lowest cost Silver Level health insurance premium.

You do not have to choose that particular plan. Your premium tax credit is the same regardless of the plan you choose.

If we were to choose a higher cost Silver level or Gold level plan, our subsidy would remain the same, but our out of pocket costs for premiums would be higher than shown on the calculator.

Conversely, if we choose a lower cost Bronze level plan, our premium cost would be lower. Our out of pocket cost could potentially be $0 if we choose a plan with a price tag equal to or less than our $830 monthly subsidy.

The PTC is a non-refundable tax credit. In other words, if you choose a plan with premium costs less than your PTC, you do not get any additional tax refund.

Choosing a Plan

When looking to minimize health care costs, health insurance premiums are only part of the equation. You need to consider your total cost of insurance premiums plus your share of any costs for care.

I’ve focused a lot on the challenges of predicting income and thus costs of health insurance premiums. Predicting health care needs and costs can be even harder.

You need to determine both your best and worst case scenario to help manage risk.

What Is Your Minimum Health Care Cost?

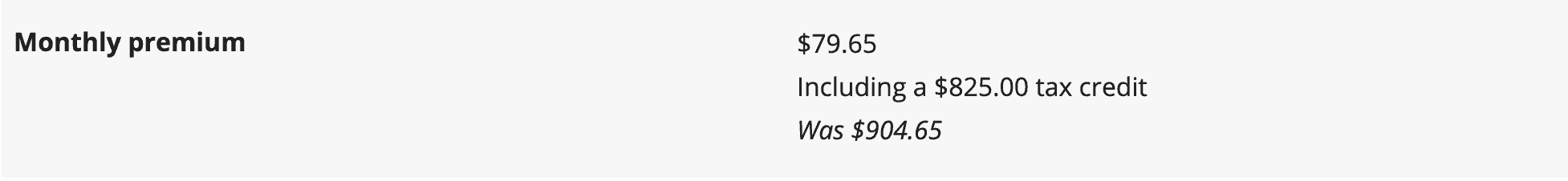

The best plan for our family based on a combination of having our current health care providers in network, cost, and HSA compatibility has an unsubsidized premium cost of about $905/month. With our premium tax credit applied, we would pay only about $80/month with the Marketplace plan.

In a best case scenario where we don’t need any health care evaluation or treatments, we would pay about $960 in annual premiums. Preventative care is covered with all Marketplace plans.

This compares favorably to the $300/month or $3,600 we would pay as our share of premiums for a high deductible plan through Kim’s employer. We would need to incur about $2,600 in health care expenses, which is rare for our household, just to get back to even.

What Is Your Maximal Health Care Cost?

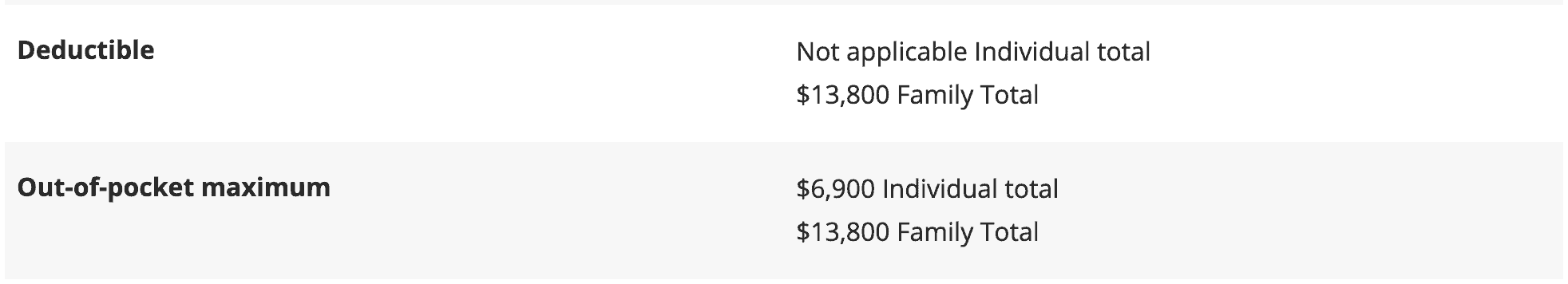

Paying a lower insurance premium is nice. But the whole purpose of having insurance is to protect your downside in a worst case scenario. How does this Marketplace plan compare to the insurance we currently have?

The out of pocket maximum for our family is $13,800 with the Marketplace plan. The plan we currently are covered under has an out of pocket maximum of $8,000 for our family.

However, when factoring the worst case scenario you have to factor in the total cost of insurance premiums and out-of-pocket costs.

The total premium plus maximum out-of-pocket expenses are $14,760 for our family with the Marketplace plan. The worst case scenario under our current coverage from Kim’s employer is $11,600 for our family.

The Challenge of Buying Individual Health Insurance

Our situation demonstrates the challenge of buying affordable individual health insurance. It requires a combination of tax planning, risk management, making healthy lifestyle decisions, staying up to date on ever changing rules and regulations, and at the end of the day… luck.

The difference between the cost of subsidized insurance and the full cost of insurance demonstrates the variability that any early retiree needs to plan for in case subsidies are discontinued or the system substantially changes. This only becomes more important as we age and health care costs and the likelihood of needing care increases.

I frequently share articles or write about non-conventional approaches to retirement such as semi-retirement, mini-retirements, one spouse retiring first, or investing in alternative asset classes like real estate or retirement businesses that may produce more retirement income than traditional paper assets.

These approaches allow starting down the road toward early retirement sooner, with more income and life options and less financial risk. However, having a higher income produces unique challenges to obtaining affordable medical insurance.

Unfortunately, no one has a crystal ball. So we have to make our best decision year to year. Hopefully this framework will help you minimize your health insurance costs, at least through 2025.

Beyond that? Stay tuned…

Chime In

How are you dealing with the challenges and risks of obtaining health insurance? Is health insurance keeping you trapped in a job when you would otherwise retire, work less, start a business, or choose another career?

I am always impressed by the level of knowledge, experience, and creativity shared by readers of this blog and look forward to reading your ideas, insights, and solutions in the comments.

I understand political instability and risk is part of the challenge when planning for health insurance. Name calling and ideological rants are not helpful to anyone trying to develop a plan to transition to retirement sooner.

Please refrain from making this a political conversation. There are thousands of other places on the internet for those seeking that. I reserve the right to delete or edit comments that don’t comply with this request. Thank you.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

We’ve been retired since late 2019 and easily qualify for a very large subsidy essentially making our premium costs (less than $100/mo) negligible for a silver plan. Yet, I still can’t figure out how/why such a plan would be a good thing for us. The only plans available to us in our state (Texas) are very restrictive HMO plans.

Thankfully everyone in my family is reasonably healthy and have no long term health care needs. As such, I think of health insurance as a “back-stop” against the large catastrophic events (i.e. emergencies, cancers, major diagnosis, etc.). Even though we live in a major metropolitan area (Houston) there is literally only one hospital within 20 miles that’s considered “in-network.” Additionally, in the event of a rare cancer diagnosis, we would be unable to avail ourselves the leading cancer center in the world (MD Anderson) and the various doctors there.

In the end, we decided to use a health sharing ministry (Samaritan Ministries Given) in 2020 and 2021 and will likely continue for 2022. Our cost is about $400/mo and we’ve had about another $2500 each year in other health care costs not “reimbursed” by the ministry for approximately $7,500 in total out of pocket health care costs each year. Not too bad plus it gives us the freedom to choose any doctor or facility that we want.

The one thing we don’t have is that contractual right to reimbursement. Trust me, as a retired lawyer, this gave me fits and took awhile to get my head around. My wife, not so much, but for me it was tough. I’m in no way hardcore on the faith side of things. So far though it seems to have worked out well.

To me it seems like such a simple analysis that I can’t help but think there is something I am missing that I may come to regret later on. I certainly hope not.

MikeFI,

For us, the “affordable” with subsidies plans we would have available through the exchange would be similar to what we currently have through my wife’s employer. They at least cover our current physicians and local hospitals. Essentially it is a catastrophic plan that covers nothing aside from preventative care until we spend thousands of dollars out of pocket.

Like you, I prefer the simplicity of health sharing ministries, but they’re just not a good fit for us, or at least for my wife, due to a pre-existing condition. I’ve covered it here.

Ultimately, it comes down to figuring out an acceptable solution given the circumstances we have to deal with in this country. And ultimately, as you allude to, we can’t know what coverage, if any, we will need. So we can never really know if we made a good decision until after the fact.

Best,

Chris

I totally agree with Chris’s conclusion: Unless you know the future a lot of people have to gamble each year when picking their health plan for a year ahead. After that year is almost over you know if you ‘won’ or ‘lost’ for that year. It can be mentally exhausting for families to do this every year. That’s one of the reasons why we are still working. I’m hoping to bow out soon and luckily my spouse considers to continue working for a few years and have the same health plan for the four of us.

I agree with this wholeheartedly. Up to this point, that’s what we’ve done as well. You may have noticed that I compared the ACA plan vs. Kim’s current insurance, but didn’t reveal what we’ll do. That’s not to be coy, but b/c we still haven’t decided. With the law set to revert back next year, it’s hard to know what things will look like more than a year out.

Please be careful about choosing a healthcare ministry. They may not reimburse you. They can be very fickle and unreliable. John Oliver did a segment on them that makes some of them seem pretty sketchy. Here’s the show.

“Health Care Sharing Ministries, or HCSMs, advertise themselves as a more affordable, faith-based alternative to health insurance. But John Oliver explains some of the massive limitations these plans can have”:

https://www.youtube.com/watch?v=oFetFqrVBNc

I watched this, and he MOST DEFINITELY isn’t an unbiased reporter. Mostly, it was a rant against something he didn’t like before he even did the report, and given his obvious extreme left political stance, he’s never going to like it if it’s not by the government. In reading a few of the thousands of responses below the report, it was also obvious that his audience is very much of the same leftist viewpoint as he is.

I didn’t watch it, but I would agree with Dean’s take. Oliver is a talented comic/entertainer. I wouldn’t make life altering decisions based on his “reporting”.

HCSM are far from perfect. I’ve covered them in depth. https://www.caniretireyet.com/health-care-sharing-ministries-early-retirement/

But neither are ACA insurance plans. For example, see Robert Chase’s comment below about certain coverages being capped (i.e. 20 PT visits/year) and also understand that many ACA plans do not cover any non-emergency care across state lines.

You really need to consider your personal needs and make a fully informed decision.

Best,

Chris

At least the decisions aren’t capricious with caps and limits. If you think the people in the segment shouldn’t have been reimbursed for medical reasons, then that’s a different story. Otherwise, it seemed rather obvious that they were promised reimbursement but the healthcare ministries opted for the profit. It”s unfortunate that only a comedian would investigate such a serious subject but that the way it is. I know it can turn some people off. It’s sad that people would let politics influence their healthcare but it’s happening all across the country with fatal consequences now and there isn’t much we can do about it. Stay well and thanks for all of your financial insights.

Hi Chris,

Great job on this analysis and encouraging everyone to run their own numbers and make their best-informed choices. In addition to premiums, deductibles, shared costs, and maximum-out-of-pocket limits, folks should be aware of the fact that these plans plan have limits on covered services, like Physical Therapy. The per-person limit for PT is 20 visits/year. This will be blown through pretty quickly with knee surgery, for example. It doesn’t matter if your doctor deems the treatments medically necessary. “No soup for you” says BC/BS. So, you’re paying out-of-pocket again and these costs don’t count towards max out-of-pocket limits. “Gotchas” like this, plus the completely horrible customer experience of dealing with health insurers has led us to look again at alternatives. In 2022, we’ll opt out of the exchange health insurance and try CrowdHealth (www.joincrowdhealth.com), which operates similarly to the ministry health care options that you have explored in the past. It’s a new company and not without risk, but I like the idea of supporting an alternate approach to health care. I’ll let you know how it goes.

Thanks for chiming in and sharing your experience. I always appreciate reading about your perspectives.

Hi Chris! I cannot even begin to express my gratitude for this article. Not only is the timing, for me, precisely what I needed to see today but it is VERY helpful. I have been struggling with deciding IF I can retire slightly early, at 63 instead of waiting until 65 for Medicare insurance to kick in. My concern is moving from work-sponsored insurance, to self-selected insurance, and then to Medicare. I would like to do it as seamlessly as possible, and to not be disqualified because of existing conditions. I was recently diagnosed with cancer that will need follow-up visits for the next five years. I believe my stress levels will subside to make early retirement well worth my while, if I can ultimately not worry about insurance. I believe your article has set my mind at ease. Now it’s just a matter of looking to see what I qualify for in my area and then to select a plan that meets my current or expected needs. Thank you so much! Happy Thanksgiving to you and your family. I enjoy your posts and read them fully, while lurking and seldom commenting.

Thanks for the kinds words Rosanne. That makes my day!

Congrats on your retirement and good luck with all that lies ahead.

Cheers!

Chris

Really appreciate this post, thank you! I’m seriously considering pulling the corporate plug after 30 yrs at age 52 on 1/1 and spent the weekend considering health care options. Perfect timing! I wonder if you or your readers have experience with real estate investments and can confirm/deny that the MAGI includes rental income? Sadly I think it does, and was hoping the MAGI would include only the income after mortgage interest was deducted. Silly me (and nice problem to have, so I can’t complain). Thanks for a great and helpful post!

Short answer, yes rental income counts towards MAGI.

Longer answer, real estate investors like all business owners do have some increased control over how they structure income and time when it is taxed that regular W2 employees don’t.

This may help clarify that: https://www.caniretireyet.com/how-to-calculate-agi-and-magi/

Best,

Chris

Another important considerations that have saved my family thousands of dollars. My wife’s deductible for her ACA plan is $350 and Max out of pocket is $750. “Cost Sharing Reduction (CSR)

A discount that lowers the amount you have to pay for deductibles, copayments, and coinsurance. In the Health Insurance Marketplace®, cost-sharing reductions are often called “extra savings.” If you qualify, you must enroll in a plan in the Silver category to get the extra savings.

When you fill out a Marketplace application, you’ll find out if you qualify for premium tax credits and extra savings. You can use a premium tax credit for a plan in any metal category. But if you qualify for extra savings too, you’ll get those savings only if you pick a Silver plan.

If you qualify for cost-sharing reductions, you also have a lower out-of-pocket maximum — the total amount you’d have to pay for covered medical services per year. When you reach your out-of-pocket maximum, your insurance plan covers 100% of all covered services.”

For 2021 YTD her new hip another other bills were $164,565.89, amount the plan approved was $33,690.25 and our share was $743.02.

Excellent point about the CSR that are also available to those that can get MAGI low enough. As noted in the article, layering tax planning over the already complicated health care decisions is very complex.

Many early retirees will have to prioritize and find the right balance between: tax planning to optimizing subsidies (premium and cost sharing) with an eye on potential future RMD and IRMAA issues, HSA compatibility, and finding appropriate coverage, preferred medical providers, etc.

It’s important to be aware of all of the issues, but not get too fixated on any of them.

Best,

Chris

Thanks for a great summary, Chris. Like Utah our area of Wisconsin doesn’t have Silver plans with High Deductible plans so that we can take advantage of using a health savings account. After running the numbers when retiring 2 years ago we decided to go with a high deductible Bronze plan to continue having an HSA. Where we live there is a wide variety of Bronze plans, and the higher cost ones with HSA have similar costs and coverage to a basic Silver plan. As you have said before it is critical to know your states specific situation as costs and coverages vary so widely depending on where you live.

Another useful set of facts on the blog. Thank you as the research you put in is not easy. As you indicate, there are competing goals in many of the considerations. For many, the low MAGI years of early retirement are an opportunity to tax harvest IRAs / 401k investments via a set of periodic ROTH conversions. My analysis indicates that upon executing this strategy, it puts one well above the meaningful subsidy criteria. Roth conversion + necessary life income is typically too great above the poverty level. Don’t execute the Roth conversions and RMD withdrawals will come home to roost shortly after medicare eligibility.

Excellent Article Chris. After reading, I checked out my H&R Block Tax return from last year. The software automatically computes your Form8962 based on the inputs from the regular 1040 filing. I never knew this was available and it will be useful next year when I switch from employer insurance to ACA. I wanted to share with your readers that do their own taxes via Turbo Tax or H&R Block that it appears the software already computes your MAGI and you can experiment with your income sources to see your tax credits. Thanks Chris for all of the research, this is great.

Thanks for that insight, DAP! I wasn’t aware that the Block tax software automatically computes the Form 8962. I will have to check that out from last year! Happy Holidays to you and your family.

Thank you for that helpful info DAP. We’ve paid an accountant the past couple of years due to the increased complexity of our situation, but I’d like to start doing our own taxes again.

Chris, your article is well-written, thorough and timely, and it’s followed by a good and helpful discussion in the comment section. I’d like to underscore one of your points and offer a few comments. Your advice to consider ALL of a plan’s potential costs is spot on. Too often people focus on premiums and subsidies, but the Maximum Out of Pocket expense is a critical number. Whether we’re young or old, we could be one step away from an auto accident or major medical illness that could easily and unexpectedly catapult medical expenses into the realm of five or six figures. As healthcare consumers, we could be liable for the Max Out of Pocket in any given year despite current good health. It’s smart to include that possibility when creating each year’s budget or financial plans.

As early retirees, 2022 will be our 7th year paying out of pocket for health insurance, and I’d like to offer a few comments. (1) You used Healthcare.gov to run your family’s scenario; I use our state specific marketplace. I can confirm that we, too, have to go through the entire application again whenever wishing to make changes. While I’ve never used the Kaiser calculator to play with various possibilities, it sounds like that’s an excellent, time-saving suggestion. (2) Our state’s marketplace allows consumers to apply all, none or part of the subsidies for which they’re eligible to the cost of the monthly premium. This option allows someone with variable income to determine the level of risk they’re willing to assume in reference to the possibility of having to “pay back” a subsidy at tax time if they find themselves no longer eligible for a subsidy (or eligible for a lesser amount) due to an unexpected increase in income. I like that option and have used it each year we’ve purchased through the marketplace. (3) Our state provides “navigators” in communities throughout the state to assist individuals in understanding the marketplace and applying for coverage. The navigator who was originally assigned to us was so inexperienced that I’m pretty sure we knew more than she did based on the research I had already done. However, when I contacted the marketplace through the state’s toll-free help line, I found that those staff members seemed to be better educated on the system and more experienced in fielding questions. My point is that if you have any question about the validity of the information being provided to you, verify it through a different and reputable resource.

This is such a complex topic that every year I still feel like I’m jumping in the lake not knowing how deep it is despite all the research and calculations I’ve done. As you said, we go year by year and make the best decisions we can with the info we have available. Nicely done!

Mary,

Thanks for taking the time to leave such detailed feedback.

To your point #2–That feature is the same on the Marketplace site. You can elect to take only a portion or none of your subsidy, pay the entire premium and then receive a large refund. I personally wouldn’t want to do that, b/c then I’d have to generate more taxable income during the year.

To your point #3 — This is also offered through the central site, but again I’ve read varying reports on the quality of assistance you will get, so I would say buyer beware.]

Best,

Chris

I’ve found that HCSMs do work, though I use it in conjunction with a high deductible HSA eligible marketplace plan. A key disadvantage of some of the HCSMs is that they’re not part of a preferred provider network, so they don’t have negotiated rates. This means that you have to try to negotiate your own discounts, and many providers want IMMEDIATE payment if you don’t have what they consider as health insurance.

With the ACA subsidies, the high deductible plans ~($12k) are quite affordable. The key reason to have it is the pre-negotiated provider discounts, so even if you have to pay the deductible yourself out of pocket, you get the up to 80% discounts that you couldn’t ever negotiate on your own. I then submit the paperwork to the HCSM for all expenses that were over their $500 base amount PRIOR to any negotiated discounts, which is most medical visits. For example, a wellness visit with blood tests will likely be over $600 prior to discounts, though after negotiated provider discounts the actual costs will likely be around $200. I can submit this to the HCSM and get full reimbursement for the out of pocket costs because the pre-discounted cost is > than the minimum and because it was discounted substantially from this number.

This gives me the best of both worlds, in that I’m very unlikely to ever be on the hook for the full $12k high deductible amount in any given year, plus I can fully fund an HSA which lowers MAGI. My HSA allows me to invest in mutual funds, so I’m just letting it grow for future expenses rather than paying for current medical costs. HSAs are one of the greatest, triple tax advantaged accounts available, so I want to use it rather than trying to lower my deductible by buying a silver or gold plan. (in my state, only bronze plans are HSA eligible).

And the HCSM likes the fact that I also have insurance as they know that their potential costs are limited.

In addition, as mentioned previously, as a real estate investor, expenses can be controlled as needed to hit key MAGI targets for each year. though this takes in-depth planning before year end. Most of the rental income is offset with depreciation and expenses, while most of my income is interest from personal loans to the business. This interest is a business expense on one side and income on the other (personally) so it’s a wash and isn’t included as part of my income, even though the amount that I pay myself is well into 4 figures monthly.

I am in a different situation than most of your readers. I retired at 58, just as the pandemic hit. I was simply tired from the rat race.

Being single with no children, it was a simpler decision.

When I retired, I took my ex-employer’s group insurance benefit for a year. I was paying $750 a month (HMO). This year I decided to enroll in ACA.

I am income poor ($14000 a year pension for the very few years I worked at my last employer) but have plenty of cash for day-to-day living.

I never considered ACA before, so I might have made the mistake of cashing in my retirement savings, so I took the tax hit on year one.

Now of course, I can’t show that as income and find myself in need of scraping a minimum $4000 a year so that I don’t get thrown into medicare.

I am now on BCBS PPO through ACA and paying $450 a month (Going up to $525 in 2022). I rarely if ever visit a doctor other than an annual checkup, but I am afraid of something happening and getting wiped out with major medical expenses.

ACA has been a lifesaver. I could have stuck with my ex-employer’s insurance for the next five years (Until Medicare) but the exact same coverage (BCBS HMO) was $400 less a month under ACA.

I won’t make the full $18000 required this year. Someone told me I may have to pay a $350 penalty (Since it was an honest understatement of income) but be able to continue under the health insurance market for next year.

Moral of the story, yes, it takes planning ahead and careful examination of the rules, but there is no viable alternative out there.

I see the amount of money my mother pays for Medicare, and it is just under what I pay through the ACA, so there will be no relief on medical related expenses until I below ground. I can afford it, but I do feel for the tens of millions of people that have to work until they drop dead.

G.gATTO,

I appreciate you sharing your experience. Run your numbers and your pension should put you over 100% of the FPL for a household of one ($12,880 in 2021) and close to the 138% threshold depending what state you live in. https://www.healthcare.gov/glossary/federal-poverty-level-fpl/

If not, investment income counts if you have any. You could also convert any money from traditional to Roth accounts if you have any. Finally, you could always work a few hours here and there to earn a couple thousand dollars over the course of a year to push you over the lower threshold.

One last thought, Medicaid isn’t always a horrible option. Many providers don’t accept it, but many do. You need to check in your area and with your regular doctors/providers. There was a great discussion of that when I covered this topic under the old law a few years ago. https://www.caniretireyet.com/aca-subsidies-affordable-health-insurance/

Hope that helps!

Chris

Two recommendations:

1. Use healthsherpa to browse plans in your zip code. You can easily adjust MAGI to see price differences. There is also a filter feature so you can sort by things like HSA plans, by metal level, etc. They also have links to full details of each plan.

2. Once you determine the plan you want, use a broker to purchase your plan. They will do the whole healthcare.gov application for you. SUPER time and aggravation saver!

Thanks for the tips Lorraine!

This is an absolutely fantastic article.

Thanks Lynn. I value your opinion, especially on this topic!

We had to get our own insurance starting in May with only one week at the end of April to decide and we were swayed to just purchase on our own. Our MAGI seemed like it would be too high and the application process seemed like it wouldn’t even be a guarantee we’d be accepted. We felt pressured to make a quick decision before May 1. In retrospect, we should have purchased through the marketplace even if it would have been the high end/no subsidy cost. We could have adjusted our income as circumstances changed. Lesson learned. I spoke with a couple insurance brokers and this wasn’t clearly explained to me. We felt rushed to make a decision. I tell myself that it’s cheaper than the cobra option we also had! Employer sponsored insurance spoiled us and we didn’t realize how complicated it was.

Thanks for the feedback Sandra. Hopefully this info will help you navigate as you move forward.

A future related topic is the portability of the insurance. I have heard that ACA plans only cover you within your home state. I have also heard that there can be coverage outside of the state but it could be out of network. In general I have heard that ACA plans vary significantly by state. In my ideal retirement plan I want to retire at 55 in a L/MCOL location, get the ACA, and then spend 2-3 months a travelling for the first few years of retirement. Figuring out where to plant the home base flag has stood as quite the challenge.

Great article. That KFF calculator is a gem. Just wish I could figure out what I might be buying when the time comes.

Thanks very much Chris for both the great original article and for the invaluable updates!

As you say, health insurance is a moving target in this country and apparently will always remain so! In my wife’s and my case, as long-time early retirees, these issues have driven a whole lot of major life decisions, including choosing to live in Mexico for 5 years pre-ACA where we could pay out-of-pocket for routine care (at pennies on the dollar vs. U.S. costs, for much better care) and buy catastrophic insurance cheaply.

Fast-forward to today and I’m 65 soon to be 66 while my wife is about to turn 59 so we’ve had the added “thrill” of dealing with figuring out the Medicare and Medicare supplement rat’s nest for me while still needing to carefully control our MAGI in order to get decent subsidy levels for my wife’s ACA plan. Given that we were able to keep our MAGI in the 28-35K a year range for years our monthly premium costs, while still low by most people’s standards, roughly tripled when I went on Medicare (Parts A & B plus a high-deductible Part G and the lowest-cost Part D prescription drug option).

Anyone thinking that the waters become calmer or less perilous at 65 is unfortunately in for a rude awakening. Instead the sea is full of sharks (AKA Medicare Advantage plan salespeople) and premium as well as out-of-pocket costs continue to grow at rates that exceed both inflation and annual Social Security premium increases. Much as we didn’t enjoy many aspects of expat life we’re glad that we feel comfortable enough with it to be okay with a possible late-life move back to Mexico or other lower-cost locales should ever of us ever need long-term assisted living or other such care. It’s a booming business down there, as you’d expect.

Meanwhile any readers who are near age 65 would be well-advised to read this post (and a follow-up one on Part D plans) by John P. Greaney, the brilliant iconoclast who started what I’m pretty sure is the very first early retirement site and is still at it 26 years later. It could save you a fortune.

https://retireearlyhomepage.com/medicare2020.html

When I retired, we purchased our health care insurance through our state’s exchange. It was easy to do and the premium was actually less expensive than the portion I had been paying with my employer. In addition to the monthly premium being less, a recent surprise is we received a rebate for a portion of our premiums we paid in 2021. Here is an excerpt from the letter we received: “The Affordable Care Act requires Premera Blue Cross to issue a rebate to you if Premera Blue Cross does not spend at least 80 percent of the premiums it receives on healthcare services, such as doctors and hospital bills, and activities to improve health care quality, such as efforts to improve patient safety. No more than 20 percent of premiums may be spent on administrative costs such as salaries, sales, and advertising. The requirement is referred to as the Medical Loss Ratio standard or 80/20 rule. The 80/20 rule in the Affordable Care Act is intended to ensure that consumers get value for their health care dollars.” Here is the link they provided: https://www.healthcare.gov/health-care-law-protections/rate-review/. I know there is no way to budget for a rebate that you have no control over but never the less it was good to get this.

Chris,

Thank you for the update; the original article got me pointed towards an ACA plan, and once I ran the numbers I decided it was time to retire which I did last December at 62. We were able to get a Silver plan in Alabama with similar out-of-pocket costs as yours; very similar coverage to what I was getting with my employer with the difference being out-of-pocket and the deductible. I projected income for the two of us at 308% over FPL, which resulted in a monthly cost of $133. The income we have didn’t really result in any necessary cutbacks as we live a very modest lifestyle.

We were preparing for the subsidies to revert and pay about 1.7x the above amount, and would have been able to do that.

The extension of the ACA subsidies gets both my spouse and me to Medicare.

Keep the great articles coming!