Are Health Care Sharing Ministries A Viable Alternative To Health Insurance For Early Retirement?

Like many Americans planning early retirement, our family’s biggest challenge is obtaining affordable health insurance. We’re searching for an affordable, long-term solution to bridge the gap from employer provided coverage to Medicare.

My recent research shows purchasing Affordable Care Act (ACA) compliant insurance on the marketplace presents several challenges. For those who have variable income, it is difficult to predict what your insurance premium will cost to within a few thousand dollars from year to year. This is before factoring in actual costs for medications and services if you need care.

My recent research shows purchasing Affordable Care Act (ACA) compliant insurance on the marketplace presents several challenges. For those who have variable income, it is difficult to predict what your insurance premium will cost to within a few thousand dollars from year to year. This is before factoring in actual costs for medications and services if you need care.

There is variability in the number of plans and providers available who accept the ACA plans based on geographic location.

You may qualify for subsidies and live in an area where the ACA is functioning well. Still, you face risk if you are relying on tax credits to keep insurance affordable. The system could can change at any time.

This led me to look outside traditional insurance options to health care sharing ministries (HCSM).

I compared the four major health care sharing ministries. My goal was to answer four fundamental questions for each.

- Who is eligible to use the HCSM?

- What services and providers are covered (and excluded) by the HCSM?

- Does this HCSM provide the financial protection of traditional insurance to protect me in a worst case scenario?

- What does it cost to participate in the HCSM?

Brief History of Health Sharing Ministries

Christian Healthcare Ministries was the first HCSM. It was formed in 1981. Use of HCSM increased dramatically after the passage of the ACA.

I wrote an overview of health care sharing ministries for the website Doughroller a few years ago. If you aren’t familiar with HCSM, you may want to start there for a more thorough introduction.

There are currently four major HCSM; Christian Healthcare Ministries, Liberty HealthShare, Medi-Share and Samaritan Ministries.

Before diving into specifics of each of the four HCSM, it is important to understand two universal truths that apply to all of them.

Healthcare Sharing Ministries Are Not Insurance

HCSM are based on the early Christian tradition of voluntarily pooling resources to meet others needs. This pooling of resources is similar to how health insurance functions.

HCSM terminology is analogous to health insurance. Below is a list of insurance terms, and the rough equivalent used by HSM.

| Health Insurance Terminology | Analogous HCSM Terminology |

|---|---|

| Premium | Monthly Share |

| Deductible | Annual Household Portion, Annual Unshared Amount, or Personal Responsibility |

| Claim | Event, Incident, or Accident |

It’s important to understand there are real differences. There is more at stake than a play on words.

Anecdotally, HCSM work well for most participants. However, there is no legally binding contract and no legal recourse for a member if financial needs are not met. This introduces a unique financial risk of HCSM that is difficult to quantify.

Because HCSM are not medical insurance, they are not bound to laws that govern ACA insurance products.

HCSM aren’t required to pay for all treatments and conditions ACA insurance is required to cover. They also aren’t required to accept people with pre-existing conditions.

Another distinction is HCSM can cap annual and lifetime benefits. Medical insurance cannot.

These distinctions allow the price of HCSM to be far cheaper than the unsubsidized price of ACA compliant insurance plans. HCSM can control financial risks that insurance companies can’t. This is a distinct benefit of using a HCSM if cost is your primary concern.

However, the ability of an HCSM to cap benefits creates a challenge for individuals trying to limit downside risk of a worst case scenario. HCSM may also not be a viable option for those with a pre-existing condition.

Members of an HCSM can’t utilize a Health Savings Account. They also are not eligible for ACA tax credits. Technically, members are uninsured.

Healthcare Sharing Ministries Are Exclusive

As noted above, ACA compliant insurance plans must cover anyone who applies during open enrollment periods or who have a qualifying life event. HCSM have the ability to deny membership or limit benefits to anyone with a pre-existing condition.

As religious organizations, each has unique requirements that members agree to a set of shared beliefs and behaviors. These requirements vary between HCSM. Some HCSM have theologically specific statements. Others require agreeing to broad statements that are more consistent with a general agreement with freedom of religion. We’ll explore differences below.

It is important to understand this exclusivity for two reasons.

Being able to cover a limited segment of the population and not pay for expenses that result from certain behaviors gives HCSM the ability to control risks and thus costs. This is a reason why HCSM are so much cheaper than unsubsidized insurance.

HCSM exclusivity means they are not an option for everyone. Some are more inclusive than others.

Comparison Shopping

Let’s compare four variables for each of the major HCSM.

First, I’ll explore eligibility. I’ll outline statements of belief and pre-existing condition policies. This will allow you to know whether a particular ministry is an option for you before exploring any further.

Next, I’ll summarize covered services and provider networks for each HCSM to give an idea of whether the HCSM could fit your needs.

Third, I’ll examine the benefit limits of each HCSM. This should allow a more accurate comparison to ACA insurance with regards to protecting downside financial risks in worst case scenarios.

It doesn’t take long to accumulate large medical bills for someone with a serious or chronic medical condition. Therefore, I will only consider options with benefit limits of at least one million dollars. If none is available, I’ll explain the maximum benefits offered.

Finally, we’ll look at cost. It’s impossible to cover every scenario. I’ll share costs for my family of three; 42, 41 and 6 years of age. I’ll also look at what each HCSM would cost for a couple in their early 60’s with no dependents.

Christian Healthcare Ministries

Eligibility

Eligibility requirements from Christian Healthcare Ministries (CHM) website read as follows: “To be CHM members, participating adults must be Christians living by biblical principles, including abstaining from the use of tobacco and the illegal use of drugs, following biblical teaching on the use of alcohol, and attending group worship regularly if health permits. There are no restrictions based on age, weight, geographic location or health history.”

A pre-existing condition is defined as “any medical condition for which you experience signs, symptoms, testing or treatment before joining Christian Healthcare Ministries, even if you have not been diagnosed.”

A pre-existing condition does not necessarily disqualify you from membership. Conditions are divided into “active” vs. “maintenance”. This classification determines whether needs are eligible for sharing. There is a progressive increase in cost sharing available for pre-existing conditions for three years after becoming a member. After year three, the condition is no longer considered pre-existing.

The full pre-existing condition policy can be referenced here.

Included/Excluded Services and Providers

Christian Healthcare Ministries has no provider network. Members are free to receive treatment from any doctor or hospital as long as the treatment is within CHM Guidelines. CMH shares bills for approved conditions if procedures are generally accepted by the medical community.

There are three levels of coverage; gold, silver and bronze. Only the gold level coverage shares costs for doctors office visits, prescription medications, physical therapy, home health and most maternity costs.

CHM instructs members to tell providers they are self-pay patients without health insurance. The member is responsible for negotiating a discount. CHM will help negotiate on their behalf. The member then receives the bill, pays it and submits it to CHM for reimbursement.

Members are responsible for the first $500 per incident (similar to a deductible). Following this, CHM pays 100% of the cost of care.

Any discount negotiated is credited towards the patient’s share. This incentivizes members to negotiate the best possible discount. The reimbursement process may take up to 120 days.

Maximum Benefits

The “sharing limit” is $125,000 per illness across all benefit levels. For gold level members, there is an option to purchase “Brother’s Keeper” catastrophic bills program. Gold members with “Brother’s Keeper” receive “unlimited cost support per illness.”

Cost

Christian Healthcare Ministries provides memberships in “units.” A unit is a participating individual within a membership. A single person is one unit, a married couple is two units and a family is three units, regardless of the number of dependent children.

Gold membership is $150/month/unit. For our family of three it would cost $450/month, or $5,400/year.

To add Brother’s Keeper to protect us against expenses that exceed $125,000/diagnosis adds an additional $420 to our annual cost. This additional cost consists of an annual fee of $40/unit/year, or $120 annually for our family. There is also a quarterly fee of $25 per membership unit. This would add $300 for our family of three.

In total, our family of three would pay $5,820 annually for gold memberships plus catastrophic Brother’s Keeper coverage.

Costs are not dependent on age. A couple in their early 60’s with no dependents would pay $3,880 for this coverage.

Liberty Healthshare

Eligibility

To qualify for Liberty Healthshare you have to agree that you; don’t use tobacco in any form, don’t abuse alcohol, illegal drugs or prescription drugs, are healthy and living a healthy lifestyle, and are in agreement with their shared beliefs.

Liberty’s statement of belief is the most inclusive of the four HCSM. A portion requires members to agree that “We believe every individual has a fundamental religious right to worship the God of the Bible in his or her own way.” You can read the full eligibility requirements here.

Pre-existing conditions are defined as “a condition for which signs, symptoms or treatment were present prior to application, or can be reasonably expected to require medical intervention in the future.”

Liberty has a policy of offering membership to those with pre-existing conditions, with limited coverage for those conditions for the first three years of membership. “After the first full year of continuous membership, up to $50,000 of total medical expenses incurred for a pre-existing condition may be shared in total during the second and third years of membership. Upon the inception of the 37th month of continuous membership and thereafter, the condition may no longer be subject to the pre-existing condition sharing limitations.”

Those seeking membership who have certain chronic conditions or who are tobacco users are also required to participate in the HealthTrac program. This requires working with a health coach.

The program costs an additional $80/month for each member who is required to participate. Liberty Healthshare membership may be revoked after one year if goals toward managing the condition are not met.

Included/Excluded Services and Providers

Liberty Healthshare has no network of providers. Members may choose a provider of their choice.

Members are responsible for their annual unshared amount (analogous to a deductible) following which they submit bills to Liberty Healthshare which handles the bills similar to traditional insurance.

Conditions eligible for cost sharing are outlined on page nine of the Liberty Healthshare Sharing Guidelines.

Medications are excluded. “Outpatient Pharmaceuticals—maintenance pharmaceuticals and over-the-counter medications (whether prescribed or not) are not shared in beyond any pharmaceutical discount programs that Liberty HealthShare may offer.”

Among the exclusions are “hazardous hobbies”. Per their guidelines: ”An activity is hazardous if it is an activity which is characterized by a constant or recurring threat of danger or risk of bodily harm.”

Rock climbing and spelunking are explicitly mentioned as examples. Other adventure sports I participate in including mountain biking, mountaineering and backcountry skiing are not explicitly excluded, but would seem to fit the same category.

It is wise to read the benefits of any plan in detail. These two specific exclusions combined with my wife’s pre-existing history of migraines and autoimmune like symptoms (never definitively diagnosed) would have disqualified every medical cost we’ve incurred in the past five years, aside from one or two sick visits for our daughter. These would also be our most likely future expenses as a young, relatively healthy and active family.

Maximum Benefits

Liberty offers three programs; Liberty Complete, Liberty Plus and Liberty Share. The Plus and Share options each cap benefits at only $125,000 per incident. The Liberty Complete program caps benefits at one million dollars per incident.

Cost

The cost of the Liberty Complete varies based on age and number of participants. The age classifications are divided into under 30, 30-64 and 65 & over.

The price is based on a single participant, a couple or a family (regardless of number of dependents).

The Annual Unshared Amount (analogous to a deductible) is the same across age groups. It is $1,000 for an individual, $1,750 for a couple and $2,250 for a family.

The cost for our family of three would be $529/month or $6,348/year. The price for a couple in their early 60’s would be $399/month or $4,788/year.

Medi-Share

Eligibility

Medi-Share has a theologically specific statement of faith that is more exclusive than either Christian Healthshare Ministries or Liberty Healthcare. You can read the full statement of faith here to determine if you would qualify.

Medi-Share defines pre-existing conditions as “a sign, symptom, diagnosis, testing, medication or treatment of a condition that a Member has before the start of membership.”

This does not disqualify someone from membership. However, there is no sharing of costs for any treatment related to a pre-existing condition for the first three years of membership. After three years, members are eligible for sharing up to $100,000 annually for treatment of the pre-existing condition. After 5 years of membership, the limit increases to $500,000 annually.

Included/Excluded Services and Providers

Medi-Share utilizes a preferred-provider organization (PPO). They encourage members to use providers in the PPO to help control costs.

If care is sought by an out of PPO provider, members are responsible for an increased share of costs as outlined in the Medi-Share guidelines.

The list of services eligible for cost sharing is robust with Medi-Share, including limited sharing for prescription medications. A full list of medical conditions eligible for limited sharing and those not eligible for sharing can be found in the guidelines.

Maximum Benefits

The maximum sharable amount is $50,000 for the first month of membership with Medi-Share. Following this, cost sharing is unlimited for new eligible conditions. There is limited sharing for pre-existing conditions as outlined above.

Cost

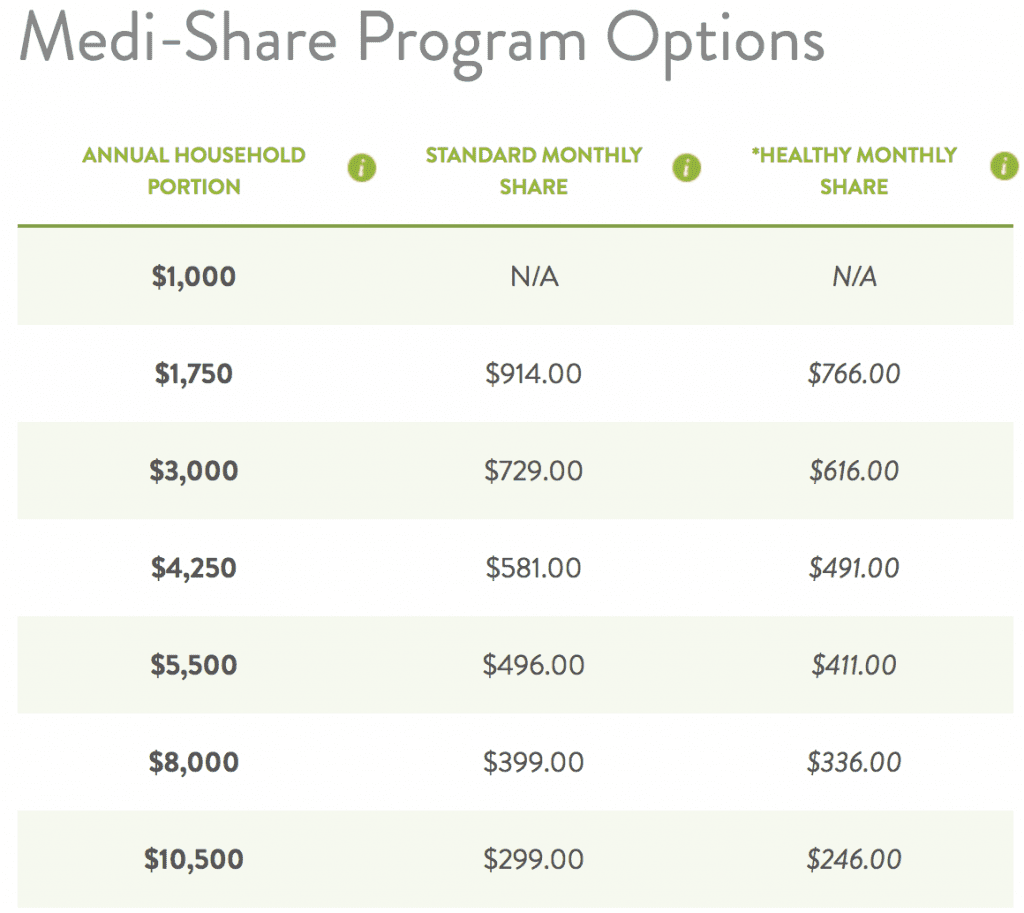

Medi-Share has a more complex pricing system, which is analogous to traditional insurance. You can choose higher Annual Household Portion (analogous to a deductible) to get a lower Monthly Share (analogous to a premium), or vice versa.

Medi-Share also offers a “Health Incentive” which enables members who meet certain criteria, including satisfactorily completing their Online Health Form and meeting requirements for blood pressure, body-mass index and waist circumference to pay a lower “healthy monthly share.”

Due to the many price options and possibilities, it is easier to report Medi-Share prices in graphic form. The first screen shot are prices for our family of three.

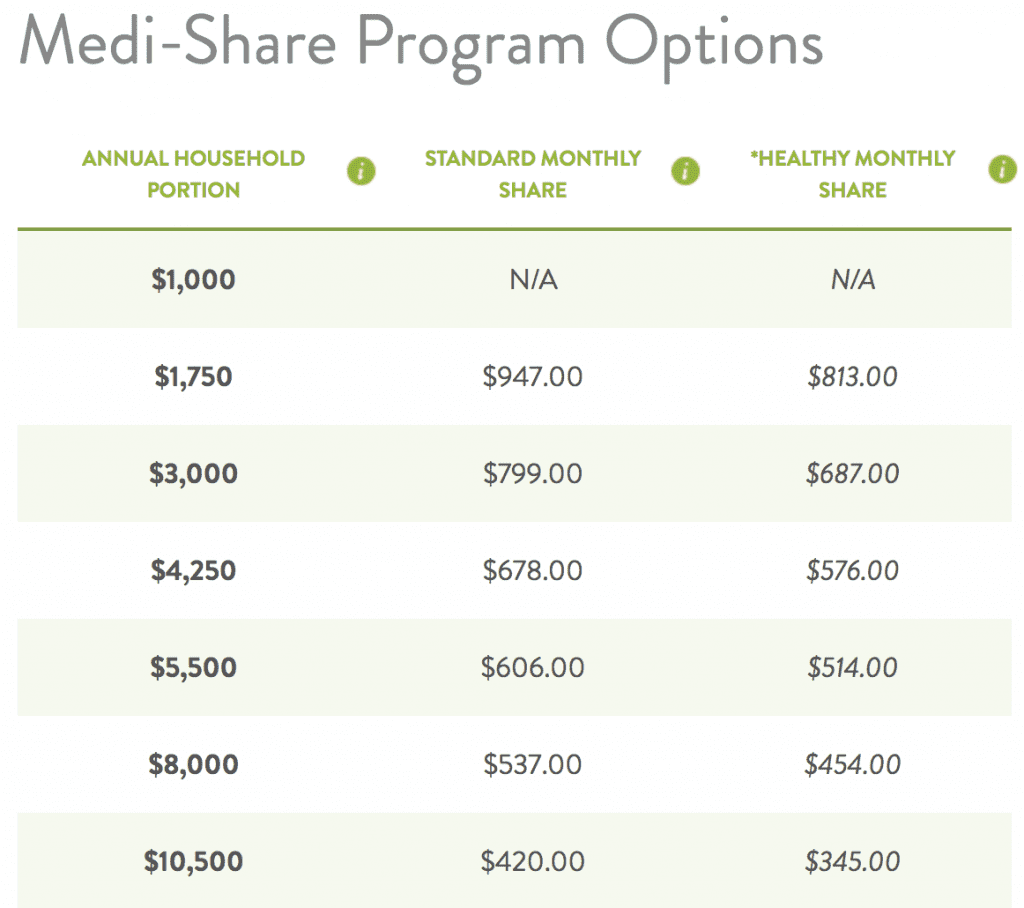

The second screen shot shows pricing for a married couple, with the oldest partner being 62 years of age.

Samaritan Ministries

Eligibility

Similar to Medi-Share, Samaritan Ministries has a lengthy and theologically specific statement of beliefs (found here) that must be agreed to prior to applying for membership.

Notable requirements include requiring members:

- “Attend a Christian church regularly (at least three out of four weeks per month that weather or your health permits).”

- “Agree that when you have a dispute with a fellow Christian, and your fellow Christian is willing to submit that dispute to fellow believers for resolution, you are not to sue each other in the civil courts or other government agencies, (Section XII). A person initiating a legal proceeding against SMI to become a member would disqualify himself from membership.”

- “Have your pastor or Christian church leader sign a statement confirming that you meet the above requirements.”

Samaritan Ministries has a lengthy and variable policy on pre-existing conditions. Limitations in sharing are based on the nature and type of condition. Their full pre-existing condition policy can be found here.

Included/Excluded Services and Providers

Samaritan Ministries has one of the more robust lists of sharable expenses. This includes some prescription medications, alternative treatments such as chiropractic, some dental expenses and even medical tourism “when there are substantial savings.” Members are not restricted by a provider network.

However, their policy is also the least straightforward of the four HSM, with many specific conditions for sharing based on diagnoses and treatments. If Samaritan Ministries seems like a good fit, you can review their Guidelines for specifics as they relate to your needs.

Samaritan Ministries has two benefit levels, Samaritan Classic and Samaritan Basic.

Samaritan Classic has an initial unsharable amount (analogous to a deductible) of $300 per need (injury or illness). Following this, Samaritan Ministries pay 100% of medical bills related to the need.

Samaritan Basic has an initial unsharable amount of $1,500 per need. Following this Samaritan Ministries pays 90% of expenses and the member is responsible for 10%.

Samaritan applies any discount obtained on care to reduce the member’s initial unsharable amount.

Maximum Benefits

Maximum benefits are limited per need (injury or illness). For the Classic plan, the maximal benefit is $250,000 per need. For the Basic plan, the maximal benefit is $236,500 per need.

Members of either plan can participate in the Samaritan Ministries Save to Share Program. This program covers expenses that exceed a members $250,000 maximal benefit. This benefit costs $133/individual, $266/couple or $399/family annually.

Details of the program are outlined in Samaritan Ministries Guidelines and should be read carefully. There is no benefit limit for Save to Share participants. However, it is made clear that there is no guarantee of fund availability.

Cost

The cost of Samaritan Ministries is based on membership level and the number and age of participants.

Membership for our family of three is $495/month, or $5,940/year for Classic. Adding Save to Share coverage would add $399 annually, bringing total cost to $6,339.

It would cost $300/month, or $3,600/year for Basic. Adding Save to Share would bring total cost to $3,999.

For a couple in their 60’s, the cost for membership at the Classic level is $440/month or $5,280/year. Adding Save to Share would give a total cost of $5,546.

It would cost this same couple $320/month for Basic, or $3,840/year. Adding Save to Share would give a total cost of $4,106.

Conclusion

I’ve read a number of bloggers’ positive reviews of different health sharing ministries. I also have several entrepreneur friends who chose health sharing ministries because traditional health insurance was unaffordable. They share overwhelmingly positive experiences with HCSM.

Prior to digging into the details, I assumed an HCSM would be a viable long-term solution for our health insurance needs. After doing research, we’ve concluded none of the HCSM will work for our family.

Unacceptable Risks

About five years ago, my wife began having an assortment of odd symptoms. She has never been diagnosed with any specific disease, but is suspected to be in the early stages of an autoimmune disorder.

She has refused medication, electing to manage her symptoms with a combination of improving diet, decreasing exercise and improving stress management and sleep. To this point, her efforts have been successful. To a casual observer, she is extremely healthy.

Despite this, her symptoms would qualify her as having a pre-existing condition per each HCSM’s definition. She also does have a diagnosed pre-existing condition of migraine headaches.

She went to the ER when one particularly scary flare up of symptoms, possibly a severe migraine or a presentation of her autoimmune symptoms, mimicked symptoms of a stroke.

Using a HSM would mean having to decide between the unacceptable risk of waiting too long in a true emergency vs. the unacceptable risk of receiving an excessive emergency room bill for another “false alarm” with symptoms that could be attributed to a pre-existing condition.

Incentivizing Behavior

One of the many flaws in our healthcare system is the tremendous cost to treat chronic medical conditions. Many of these conditions are partially or completely preventable.

Smoking has become so stigmatized in our society that smokers are discriminated against with higher insurance rates. By comparison, there is no such penalty for any other high risk behavior.

HCSM have a definite price advantage compared to traditional insurance. They have the ability to incentivize healthy behavior to control their costs.

This was one of the appeals of our family using a HCSM. We’re health conscious. We assumed we would benefit with lower costs compared to health insurance.

Matching Incentives to Lifestyle

I learned that some of what we consider healthy activities are deemed “hazardous” by HCSM. Thus, they put us at increased financial risk if using certain HCSM.

I highlighted this above with Liberty Healthshare. This was not to single them out as particularly bad or different. It was just the most specific application to our situation.

Liberty’s guidelines explicitly define rock climbing as a “hazardous hobby.” As such, injuries that occur as a result are not eligible for cost sharing.

We try to be extremely cautious when climbing. Still my wife suffered a finger tendon injury when climbing last year doing a “sit start”. Her butt was literally on the cushioned floor of an indoor climbing gym when the injury occurred. She was performing an activity safer than crossing a street or riding in a car when her injury occurred.

The injury was first treated with cortisone injections. This was unsuccessful. Next, she needed an MRI. Surgery and physical therapy were eventually required to regain function in her hand. This would have cost us tens of thousands of dollars in unshared costs due to the injury occurring as a result of a “hazardous hobby.”

I realize most readers of a retirement blog are not rock climbers. However, other more common activities including riding motorcycles and ATVs are excluded or limited by some ministries due to their risk. Each HCSM has a different policy regarding the use of alcohol and alcohol related injuries.

Other specific conditions that vary greatly in coverage between plans are pregnancy and issues with childbirth, coverage of prescription medications and alternative medicine treatments.

If someone is going to use a HCSM in lieu of traditional medical insurance, it’s vital to understand the specific guidelines of the particular HCSM to assure it does not expose you to unacceptable financial risks.

Weigh In

What are your thoughts about health care sharing ministries? Have you had positive or negative experiences with a particular HCSM? Who is a good candidate to use an HCSM? Who should avoid them?

Last week, I was overwhelmed by the quantity and quality of comments related to purchasing insurance on the open marketplace. I look forward to reading your feedback on HCSM as well.

Any discussion of health insurance in America has a political component to it. When we discuss health care sharing ministries, it also adds a religious component to the discussion.

Remember the mission of this blog is to assist others planning to retire sooner. Please continue to refrain from political or religious rants or name calling. Comments should add value to others’ planning efforts. Thank you.

* * *

Valuable Resources

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers.

Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.