Is It Time to Rebalance Your Portfolio?

Over the past month, the stock indexes have been extremely volatile. There have been multiple instances when the major indexes have gone up or down more than 10% in a day. Stocks are down considerably overall.

Many investors argue that because stock prices have fallen dramatically, this is a great buying opportunity. They’ll back up this assertion with “_________________” (Insert your favorite Warren Buffett quote here).

Many investors argue that because stock prices have fallen dramatically, this is a great buying opportunity. They’ll back up this assertion with “_________________” (Insert your favorite Warren Buffett quote here).

This position eliminates all nuance and fails to ask a fundamental question. Is buying more stocks a good value?

I’m not using the word value in terms of traditional metrics. Stock valuations are most commonly discussed as a relationship between a stock’s price and the company’s earnings. With the abrupt and extreme disruption of the economy that we’ve recently experienced and continued uncertainty about how and if we can contain the virus that caused it, any earnings projections are pure speculation.

Instead, I’m talking about value at a personal level. In my book, I discussed the concept of being a valuist, writing “you have to determine what you value and then start spending your time and money accordingly.”

People in this audience tend to understand this with consumer purchases. Most of our readers will not buy a new sports car because 0% financing is offered, or purchase five pairs of shoes in different colors because they’re 50% off.

Yet many become dogmatic about how others should invest, as though there is one right way. I recently considered whether I should rebalance my portfolio by selling off bonds to buy more stocks as we transition into early retirement. I also talked to my parent’s about what to do with their portfolio in traditional retirement.

Despite being guided by the same investment principles, the conclusions for each were dramatically different.

Principles of Rebalancing

Darrow has written in depth about rebalancing on this blog. He covered several expert opinions on when and how to rebalance and also his own personal strategies for and experiences with rebalancing. Both are excellent reads if you are unfamiliar with the concept or need a good refresher.

For the Cliff’s Notes version, rebalancing is a way of periodically selling off investments that represent a relatively high percentage of your portfolio to buy more of those that are relatively low to keep your asset allocation within parameters consistent with your investment goals, risk tolerance and overall financial plan.

Doing so systematically either at a predetermined time or when your portfolio is off by a predefined percentage of your target allocation prevents emotion from driving your actions.

When I was using a financial advisor, he made rebalancing seem like a big production. In reality, in the eight years I’ve been managing my own investments I’ve never moved more than a few thousand dollars around or spent more than an hour on rebalancing my portfolio in a given year. Some years, I did nothing.

When working and investing regularly, I was able to periodically direct new money to investments that were low and maintain balance in that way. Even with the large run up in stocks last year, I was able to use our HSA contribution and my wife’s 401(k) contributions to purchase bonds, keeping us close to our target allocation.

Bottom line, there is no magical time, frequency or method for rebalancing. Michael Batnick reinforced this in this recent article. The key is to have an investment policy statement and have a plan for rebalancing be a part of it.

Straying From the Plan?

With the recent rapid drop in stock prices, many people believe this is a great time to buy stocks. Our personal investment policy statement calls for us to rebalance once a year around tax time. So rebalancing was front of mind for us. (Note: We tend to file early. If you haven’t filed yet, the deadline has been moved back to July 15 and you may want to wait to file.)

I generally put minimal thought or effort into rebalancing. But with our portfolio down by hundreds of thousands of dollars and regular daily volatility of +/- 5-10%, choosing the wrong day to rebalance could result in substantial losses. This caused me to revisit our plan and give it more thought than usual.

Why even have an investment policy statement if you stray from it? The best analogy I can give is that of a football coach. The average NFL or college head coach works over one hundred (out of 168 available) hours per week during the season to plan for a single sixty minute game. Then they assess and adjust at half-time, or more frequently, as needed.

These are fine lines to walk. Follow the plan verbatim vs. adjust to conditions. Emotion vs. reason. It’s why being an investor is difficult, even if you follow a simple passive index fund strategy and have a plan.

Why to Buy/Rebalance

Following our plan has been a no brainer in past years under normal circumstances. But with the market in free fall, fear everywhere, and insane volatility (i.e. the exact reasons you write out a plan in calm and rational times) I began to second guess our plan.

That’s not a bad thing. It caused me to go back and double check my initial reasoning. This left me with some questions to ponder before deciding how to proceed.

Why Do We Hold Stocks and Bonds?

Before shifting more money into stocks, it was important to reiterate why we hold them and why we hold the bonds we would have to sell off in order to buy more stocks.

We hold 80% or our portfolio in stocks. We rely on the dividends they produce and growth in stock prices as companies become more productive and valuable. This growth is necessary to support spending needs for a potentially fifty plus year retirement time frame without it being eroded by inflation.

With interest rates at all time lows, bonds don’t produce much income and they have little potential for substantial price appreciation. They do have substantial inflation risk over long periods of time. They also face considerable interest rate risk if rates rise. This risk is particularly high with interest rates at all-time lows.

High quality bonds historically hold their value well, or even go up in value when people flee stocks in fear or when interest rates are lowered, often in times of financial distress. They’ve done this over the past month, giving us the capital to buy more stocks.

Will We Need To Sell Stocks At Depressed Prices in the Next 5-10 Years?

The second question I had to ask before feeling confident following through on buying more stocks is how likely it might be that I’d need to sell them at a loss.

Even after rebalancing our portfolio, we would still have over three years of our normal living expenses in bonds. We also have over a year’s worth of normal living expenses in cash. We also have the ability and willingness to continue to earn money and/or cut spending.

My wife continues to work part-time and her income covers most if not all of our normal spending. In this time when many companies and individuals are being thrust into working remotely and figuring it out on the fly, her company is spending time and effort to create free webinars to share how they built their company to work virtually in an effort to help others. Her job and income appear to be solid.

I’ve spent the past two years writing a book and working on this blog to develop a modest retirement income stream. Given the loss of traffic to the blog, anticipated loss of advertising dollars, and decreased discretionary spending over the past month, I anticipate little to no income this year beyond what I’ve already earned. Still, I’m positioned well for when we get through the medical part of this crisis, the economy restarts, and people again focus on their financial well being.

Should We Change Our Plans?

Answering the first two questions gave me confidence to follow through with our plans to rebalance our portfolio.

On March 30th I sat down and looked at our balances as I do at the end of every month. By using mutual funds, we get the price of the NAV at the end of the same day we make trades. Given the extreme volatility of recent weeks, I kept an eye on the markets on April 1st. When I saw they were down considerably that day, I made our transactions to rebalance later that afternoon.

After thinking through these questions I’ve realized that our lives have changed considerably since we wrote our investment policy statement, but our plan has not. We wrote our plan when we had two full-time incomes and a high savings rate to invest. We now have little to no new money to invest.

It may be time to change our policy on rebalancing by considering it more frequently to take advantage of buying opportunities. Another option would be to rebalance if our allocation is off by a particular percent from our target. This is something we’ll discuss over the coming weeks or months as life regains some normalcy.

Why Not to Buy/Rebalance

I help my parents with their investments in their traditional retirement. We typically rebalance around the end of the year when I can sit down with them and get a handle on their annual financial information.

At the end of 2019 we took a sizable distribution to replenish their cash position by selling appreciated stocks. We then sold off more stocks to rebalance their portfolio back to their target 50% stock, 50% bond allocation.

They called me in mid-March as the health and financial news were getting really scary. Should they be doing anything with their investments? I went through the same three questions with them.

Why Do We Hold Stocks and Bonds?

My parents hold 50% of their portfolio in bonds for several reasons. They are at a stage in life when going back to work to generate income is not realistic or desirable. Thus, they can’t tolerate great portfolio volatility. Bonds are there to provide for their current living needs.

Stocks are not held for current consumption. They are only to be sold from a position of strength if they outperform. This was the case last year, when the gains were used to replenish cash and bonds.

Will We Need To Sell Stocks At Depressed Prices in the Next 5-10 Years?

The little bit of income bonds produce, combined with Social Security, goes a long way towards covering my parent’s current modest spending needs. Even in their “go-go years” of retirement when (pre-Covid-19 and hopefully one day again soon) they were traveling extensively, my dad was playing a lot of golf, they were enjoying spoiling their young granddaughter, etc. they were drawing about 3% from their investment portfolio annually.

In a worst case scenario, my parents would need to start considering selling stocks in about 15-20 years. In the most likely scenario, my parents are in the fortunate position that they will never have to sell stocks unless they choose to.

We’re most likely managing their stocks for future generations. This is something that we’ve discussed and that excites them. Given my fortunate financial position, this quickly starts turning into a conversation like JL Collins wrote about in the blog post Investing for Seven Generations.

Should We Change Our Plans?

So my parents are in a position where they could buy more stocks. But should they do it just because they can?

Now that Jack Bogle has passed away, my go to voice of reason for investment decisions is William Bernstein. I read and listen to anything he writes or says and consider it carefully.

Bernstein has a famous quote: “If you’ve won the game, stop playing.” At the time that we developed my parent’s defensive portfolio, I felt that’s what we were already doing.

But I recently listened to this outstanding interview Bernstein gave to Ben Carlson. One statement, actually one particular word, caught my attention. Bernstein stated that if you’re in retirement and in the fortunate position to do so, you should only invest in stocks if you can do so with “equanimity.”

Equanimity is defined as mental calmness, composure, and evenness of temper, especially in a difficult situation. That was not the emotion I heard on the other end of the phone in March.

At a time when there are real stresses and pressures, particularly for older individuals who are at medical risk during this pandemic, is there any reason to be adding risk and decreasing security just because you can?

For me, the answer was a resounding no. We will not rebalance now out of fear of missing out on a buying opportunity. We will have a longer discussion when their fears are less about whether their portfolio already has too much risk and we may adjust their target allocation simply by not rebalancing when their plan calls for it in December.

Enough?

One of the hardest and most important financial decisions we have to make is determining when we have enough. For many people the answer to the question “How much is enough?” is always “Just a little bit more.”

As always, I am not your financial advisor and I can not tell you what to do or whether you have enough. I can only share what I’m thinking and doing, and hope it provides value and insight.

I have a great deal of financial independence, enough that I felt comfortable retiring from my career in 2017 at the age of 41. But I don’t feel like we’ve won the game yet. So, as I wrote a few months ago in better times, we’re continuing to play offense with our financial decisions. One way we continue to do so is by rebalancing our portfolio to buy more stocks.

Others may have determined your consistent saving and careful planning mean you already have enough to secure the comfortable retirement lifestyle that you desire. If so, I encourage you, as I have my parents, to embrace the equanimity that provides, and cherish the fact that you don’t always have to chase more.

* * *

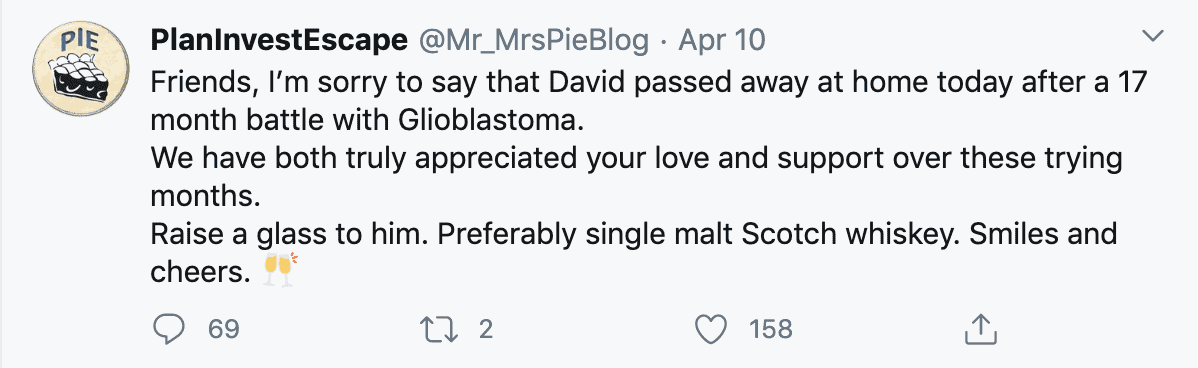

Last fall, my friends from the blog Plan, Invest, Escape publicly shared the news that David was diagnosed with Glioblastoma, an extremely aggressive brain tumor. His wife, Emily, did so with an incredibly touching and insightful string of Tweets. I felt it was something all of our readers should see. With her permission, I shared her words on the blog.

I was apparently not the only one moved by Emily’s words. That ended up being one of the most read and widely shared posts on the blog last year.

So it is with a heavy heart that I’m sharing one more Tweet from Emily:

Please join me in offering thoughts and prayers to Emily and her two boys and raising a glass to David. Cheers!

* * *

Valuable Resources

* * * [Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning.

After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence.

Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible.

Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences.

Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers.

Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Re-balancing should occur more frequently than most people do it (once per year). But it doesn’t have to be a full re-balance in times like these. If you only re-balance once per year you’ll miss V markets, but if you re-balance every month or each time there is a dip, you’ll take more risk than necessary. It’s good to “scale in” the re-balance during draw-downs. Move a little bit in, and wait a week. See where the market goes. Scale a little more in the following week. Take your time.

I would generally disagree that you need to rebalance more than once per year as there is little good evidence for that. Also, when contributing regularly you can just allocate new money to asset classes that are below your target allocation and when drawing money from the portfolio, take from areas that are relatively high. It is only the combination of extreme volatility that we’re currently experiencing combined with the fact that we’re not putting a lot into or taking from our portfolio that has me thinking we should consider rebalancing more frequently for the reason you site. And at a time like this, I don’t think it would be wrong to either wait for volatility to stabilize or dollar cost average into the market.

Best,

Chris

Hi Chris, maybe you can help me: I can Reply to replies, but I somehow don’t see a button to reply to the main articles. I am subscribed to the newsletter. ¿what am I missing?

Javier,

Just scroll to the bottom and hit the Post Comment button.

Best,

Chris

Great article as always, Chris. It seems like you’re doing a bucket system – one year expenses in cash, three plus in bonds, the rest in equities. That’s what I plan for our very soon retirement, but I’ve heard others like JL Collins don’t support it. Seems to make a lot of sense to me, to avoid selling equities in a downturn. Could you do an article on it as a strategy for retirement?

Bill,

I’m familiar with the bucket terminology. I’m not sure how it is particularly different from setting an asset allocation and rebalancing to it other than semantics. Yes we hold about a year in the “cash bucket.” To be clear, as a household we’re more semi-retired as we still have my wife’s part-time income. When we had two full-time incomes and a high savings rate we kept only a few thousand dollars in this bucket. If we were fully retired, we’d probably keep 1-3 years. I actually plan to write about how we are approaching bonds (aka the intermediate bucket) in the very near future. Stay tuned!

Chris

I was rebalancing (or checking to see if I needed to) each quarter before retirement. Then I read something on the Bogleheads forum that contradicted frequent rebalancing as non productive. I didn’t fully grasp the math, but trusted the sources. So once I retired, I switched to rebalancing once a year, and checking twice a year.

Then a few weeks ago, Mark Hebner of Index Fund Advisors posted a video with a compelling argument to rebalance. Equities were down, my Long Term Govt Bonds were sky high, and his idea of missing a high (and low) in the market was compelling, so I rebalanced, and was rewarded the following 2 weeks as things rebounded/settled.

Humph. What will I do going forward? My measure is my own calmness. If I’m feeling good about rebalancing and it is needed, I will do it. But if I’m feeling queasy, I’ll wait, because sleeping well is more important than missing a market bottom/top.

This is a great question. Rebalancing is just a systematic way of forcing the discipline to buy low (relatively) and sell high (relatively) without trying to time the market. The key is the word systematic. If you stop following a system and start following hunches and “expert” opinions, you’re quickly entering the world of market timing. That can work out well (as it has for you and I so far) or poorly (as is very possible if the market drops back down).

As you note, it can also make you crazy trying to guess the perfect time which can lead to regret or get you stuck in fear of taking action. This is the challenge, particularly in times of extreme volatility as we are experiencing, and especially were experiencing a few weeks ago.

I hope that helped clarify more than muddy the waters!?!

Best,

Chris

Hi Chris,

Thanks for the excellent post. We are in our late 50s and in early retirement. We subscribe to the safety first approach consisting of a Floor Portfolio of low-risk investments to fund current and future essential expenses and an Upside Portfolio of riskier investments to fund current and future discretionary expenses. A recent post in the blog, “How Much Can I Afford to Spend in Retirement” had what I believe to be excellent advice for those in a similar situation. Here it is:

“Some retirement experts may tell you that since the markets are currently down (and the reason is largely due to the novel coronavirus), now is a good time to increase your investment in them (buy low, sell high). This may make sense if you have non-risky assets in your Upside Portfolio, but it will generally be a risky strategy to liquidate your floor assets for this purpose (unless you truly believe that your future essential expenses will be lower than you originally estimated).”

Paul,

I agree 100% with this idea and is why I recommended my parents sit tight for now and started the conversation as to whether it makes sense to continue to rebalance money away from that safe floor into more risky assets when they don’t need the risk.

As noted in response to an earlier comment, my wife are in more of a transition period or semi-retirement where we still have the ability to earn money to meet our needs and so we can afford to take on the risk of rebalancing which may well be a bad decision in one or even 5 years, but is almost certain to pay off over the long haul.

Thanks for chiming in and sharing your perspective.

Best,

Chris

Rebalancing frequency depends on your circumstances. If you have a Vanguard, or similar, balanced portfolio, with almost zero trading costs, rebalancing frequently in years of high volatility can be quite profitable. I use a guideline of 5 % change in the S&P. It can add a percent or more to your annual return, but only works well if volatility is high. If your portfolio has different characteristics, it may well be better to do it only once a year.

I completely agree with Bernstein on “If you have won the game, quit playing” We had “won” by last year and I greatly reduced my stock percentage before recent black swan. Contributed a whole lot to the feeling that we had still “won”.

Thanks for taking the time to share your perspective. My only area of slight pushback is that many (most?) people will end up doing more harm than good if they start fiddling with their portfolio too much. Particularly in low volatility times as we’ve had for the past several years, the juice will not be worth the squeeze.

Cheers!

Chris

Hi Chris,

Excellent article! I was wondering if anyone has compared the returns of a Target Date or Balanced Fund, which rebalance daily, vs yearly or parameter based reallocations ? Curious if there are any major advantages or disadvantages.

Peter,

I’ve never used a Target Date or Balanced Fund so I haven’t taken the time to research the details of how they are administered. Mike Piper at Oblivious Investor is a big fan and writes about them frequently. You may want to scroll around his website to see if he has addressed this topic.

Best,

Chris

Our floor in fixed income is 3 times what we need now, so most of the time we use the extra to buy our bond fund because it doesn’t grow as our stock fund. We use a 16/84 balance stocks/bonds so that, because of their vastly different standard deviations, this allows both funds to affect their sum somewhat equally and protect us from Black Swans like this one and like the 2008-2009 one. So far, they have done so wonderfully. Not exactly always, but very often, one goes up and the other goes down, or they both go up, but less frequently, they both go down. We smile as we watch their dance that gives us a pretty smooth ride through Black Swans.

With this plan the bond fund gives us nice, monthly, tax-free income and a sd of 3-4% with the stock fund paying only 2% in income but a sd of 14-18% and growth that long-term exceeds inflation. So we almost always buy the bond fund to keep our 16/84 balance. At this moment we have 14/86 because of the stock fund has been heading down. Do we rebalance? Nope, that is not enough of a change and we know it won’t last and the bond fund will need feeding to keep up the the stock fund. It might be tough to keep the balance if the stock fund heads up quickly as it often does after crashing.

Vanguard reports such a balance over long times rarely finishes a year with a loss, and not a very big one at that, and long-term has generated 6.5%, a nice safe growth for we who retired 28 years ago at age 50. We expect our portfolio to pay for inflation and potential long term care, future costs that might surprise us. We think we have a version of Bernstein’s, if you have won, quit playing the game.

You could argue that today we should buy more stock fund, but that feels a bit like timing the market and we think with just a little patience, bond fund buying will still be the move, as currently they are on sale too, just not quite as much as the stock fund we know can have big leaps or falls.

Nice post to cause thoughtful rethinking, but for us, we will use the standard routine of buying the bond fund, as our plan says we should almost always do. Thank you!

A follow-up question for Dick Shumway: Please clarify why your income from the bond portfolio is tax-free: “With this plan the bond fund gives us nice, monthly, tax-free income…” Are the bonds held in a Roth IRA? If not, is the bond portfolio composed exclusively of munis? Please explain. Thanks!

Terry, We are so old we are all in taxable for a portfolio. We use VWALX for bonds and VTSAX for stocks, just two funds. We have no RMDs and our floor is a taxable pension, a charitable gift annuity (80% tax free until 2038) and very minimal social security based on teenage income. We have plenty of room for tax free capital gains, if we need it, and most of of our stock fund income is tax free as well as we stay in the 12% bracket. The bond fund and the charitable gift annuity reduce our taxable income dramatically.

Most municipal bond investors seem to be rich guys but not us. We work hard to control what we can, expense ratios, taxes, and actual cost of living. Our first home now is an RV and our second home is in latin america. For many years we were go/go, now we are go/slow, and we have a plan for no/go that the coronavirus is letting us test, a little early, right now. KISS is our plan, Keep it Simple Stupid, but of course God laughs.

Dick

Dick,

It sounds like you have found a plan that makes sense for you and is working.

Best,

Chris

Chris, I have read 348 financial books, including yours, and God is still laughing. I suspect God is not alone. As many say, however, there are no perfect plans, but there are many that are good enough (we hope we are in this group), and many, many more that are foolish.

Dick

Thanks for reading and taking the time to comment Dick. I appreciate your candor and humor. We can use more of both.

Cheers!

Chris

One thing I have found out (the hard way) is “balanced” funds in the category 50-70% range are not always what appears. I think the fund managers are trying to goose the numbers in good times and hit the 70% number. Those more conservative trend towards 50%. During the latest sell-off my 2 funds hand similar amounts. Now… the conservative is WAY ahead of the Vanguard fund. You really have to dig down and look at the holdings in the prospectus. Rebalancing these funds is tricky.

John,

Always important to read a prospectus before investing. That is a lesson learned the hard way and why I so like index funds that are so simple to understand.

I do understand the appeal of having a single balanced or target date fund if holding only one, but if holding several and trying to rebalance them I can imagine that could get very complicated.

Best,

Chris

We had been considering a move away from buy-and-hold to tactical asset allocation which has more frequent rebalancing and made the move this year, even though that meant selling some of our holdings at a loss. I think it’ll still pay off in smoothing out the volatility, and this is for a portfolio that is growing in the background — our real estate and business income is the primary source right now. I can’t imagine the markets will be any less volatile as we’re only at the beginning and the secondary effects of the pandemic are still to come (e.g., reduced spending, higher prices due to supply chain disruption).

Caroline,

I agree that there is still a ton of uncertainty and so anticipate a lot more volatility in the months (I hope) to years ahead.

If you don’t mind sharing:

Did you start to de-risk prior to the market drop or decide to change after it became apparent how serious this was?

What made you decide to change your approach?

I always like to see how other people are thinking.

Best,

Chris