Because You Never Know

I spent the last week in Washington D.C. at FinCon, a conference for those who create digital content in the personal finance space. After long days, late nights, too much noise, and traveling cross country, I planned to take a week off from posting on the blog.

Then I saw something that I felt every reader of this blog, no matter where you are on your journey, needs to read and consider.

At my first FinCon in 2017, I hit it off over a few many pints with a bloke named David, who with his wife Emily was writing the blog Plan, Invest, Escape (PIE). They were preparing to retire early to the mountains of New Hampshire to have more time to get outdoors, travel, and generally enjoy life with their two young boys.

I was part of a small mastermind group of couples with similar plans of early retirement with young children. We met monthly to discuss common dreams, goals and challenges. We invited David and Emily to join us.

One of the most valuable exercises the group did was “red teaming” one another’s early retirement plans. These two were detailed planners who had thought through everything we threw at them.

But less than six months into their retirement the unthinkable happened. Emily recently shared publicly what I’ve known for some time.

Her words are powerful, touching, and insightful. So with her permission, I am going to repost them here for you all to consider. . .

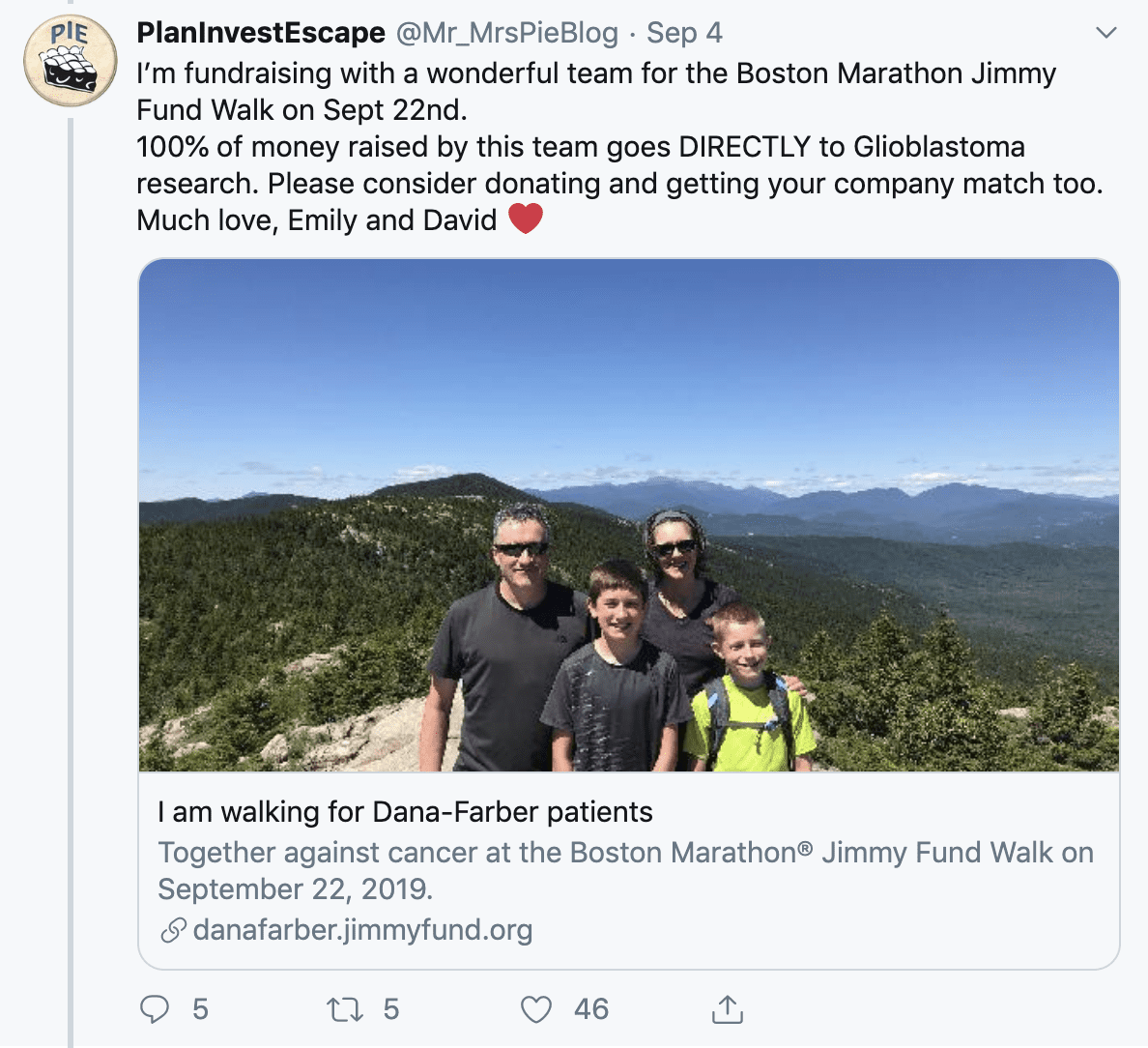

If you would like to send words of love and support to these amazing people during this challenging time, you can find them on Twitter or leave a comment below.

If you want to make a donation to support their fundraising efforts for the Dana Farber Cancer Institute, you can do so by clicking here.

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.