Coronavirus, Market Volatility, and “Buying the Dip”

I’m sitting down to write this post at 8:30 in the morning on Monday March 2, 2020. The previous week that ended February 28th was the worst week for the stock markets since the 2008 financial crisis, spurred in large part by fears over the Coronavirus.

I normally don’t pay much attention to what the stock market is doing on any given day, week, or month. But it’s hard not to pay attention when news of market volatility and an accompanying pandemic is everywhere you turn.

I normally don’t pay much attention to what the stock market is doing on any given day, week, or month. But it’s hard not to pay attention when news of market volatility and an accompanying pandemic is everywhere you turn.

I do look at my investments at the end of each month. So it was convenient that February 29th came at the end of one of the craziest weeks investors have experienced in quite a while.

Taking a look at my investments had me thinking about volatility, uncertainty, and market timing. It gives me an opportunity to share how I’m feeling and what I’m doing with our family’s investments.

Here are five questions I ask while investing through these times of volatility…

Do You Have A Plan?

Mike Tyson famously said, “Everyone has a plan until they get punched in the mouth.” If you’re approaching or are already in retirement, you likely saw your portfolio value drop by six-figures in one week. That qualifies as a proverbial punch in the mouth for those of us not born with nerves of steel.

John Bogle consistently advised investors, “While the interests of the business are served by the aphorism ‘Don’t just stand there. Do something!’ the interests of investors are served by an approach that is its diametrical opposite: ‘Don’t do something. Just stand there!’”

But does anyone actually do this? News sites and social media become a circus at a time like this. Even reasoned investment educators who I follow and respect seem to feel the need to be doing something.

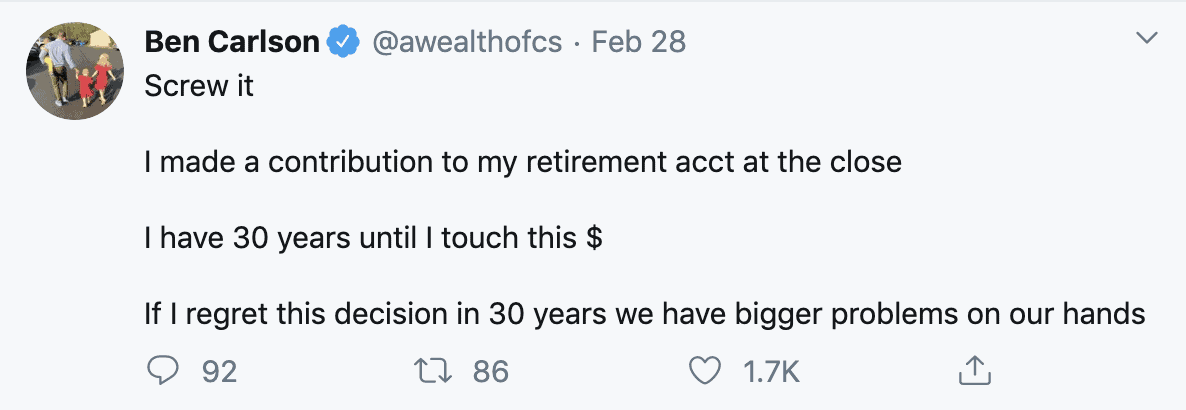

On Friday February 28th, Ben Carlson tweeted:

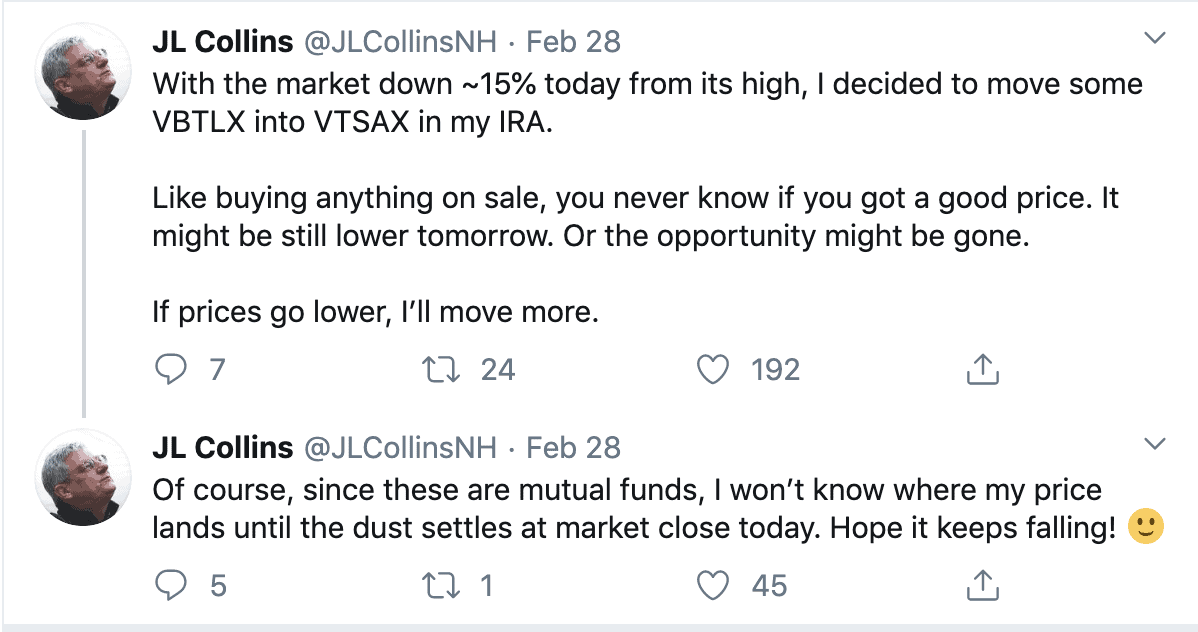

And JL Collins tweeted:

I’ve found it vital to not only think about what to do in advance of times like this, but to write out an investment policy statement and refer to it when necessary. Here is the written statement we started with and how my wife and I have changed our priorities and plans since transitioning to a lower earning early/semi-retired stage of life.

Your plan should be specific to your needs, strengths, weaknesses and personality. If you don’t have a written plan, take time now to develop one. If you do have a plan, how does it hold up when stress tested?

We often think of risk tolerance in abstract terms. How you’re feeling right now is a much better indicator of your emotional ability to handle volatility.

Can You Time the Market?

I must have seen a hundred tweets over the past week about “buying the dip” or that this market downturn presents a “great buying opportunity.” There may be something to that.

Buying on Friday afternoon the week the market fell 15% is better than buying the Friday before when it was near all time highs. For those in retirement, the opposite is true. It would have been much better to have sold a week ago when your assets were worth more.

But no one ever knows when it’s a great opportunity to buy or sell until after the fact. Maybe the market will drop another 15% or more over the next week, month, quarter, or year before bottoming out. Clearly that would be a better buying, and worse selling, opportunity.

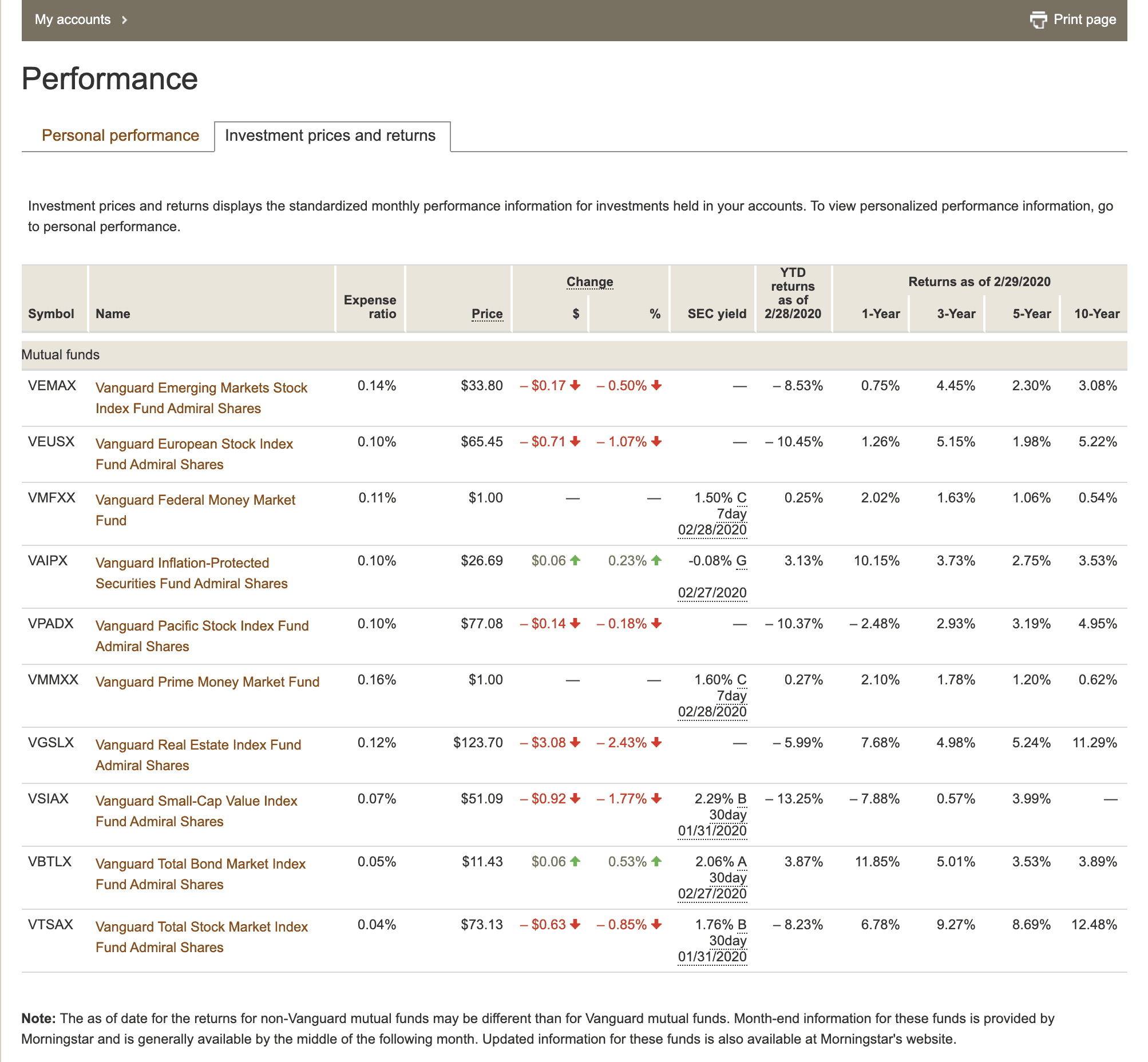

Looking at the returns of our investments shows that everything but our money market and bond holdings are down year to date as of February 28th. But going back one year, both of the bond funds and four of six of the equity funds we own are still up.

The Vanguard Total Stock Market Index is the closest approximation in our portfolio to what most Americans are talking about when they reference “the market.” At the end of a horrible week, that fund is still 7% higher than it was one year ago. It is currently selling at the price it was last fall.

If you have money sitting around that you could invest in the market right now, what excites you to buy at these prices that didn’t excite you just a few months ago? And if you’re scared to be holding stocks now, why are you fearful now if you weren’t afraid last year when every few days markets were hitting new highs?

Should You Consider Valuations?

A popular idea in investing circles is that you consider market valuations when making investment decisions. There is some logic in that.

Markets are cyclical. When stocks are cheap and interest rates higher, you expect future returns to be higher. When stocks are expensive and interest rates lower, you expect future returns to be lower.

Here’s the thing. Every day, people smarter than you and I are making arguments on both sides of this debate. The consensus of these opinions over how much stocks are worth is the market. No one can accurately predict the future of interest rates either.

This isn’t to say we should ignore market valuations. When projecting future returns for planning purposes, it is wise to be more conservative in our current environment of still lofty stock market valuations and rock bottom interest rates.

For short-term investment decisions, it is probably a waste of time at best and an expensive mistake at worst to make investment decisions based on market timing. It is far better to control what you can control.

Developing and following a plan that includes rebalancing periodically may slightly improve performance over time. It will help control risk by preventing any particular segment of your portfolio from becoming too large relative to the total portfolio.

What Is Your Worst Case Scenario?

In a recent interview I did with David Stein, he recommended assessing risk tolerance by asking, “How would your lifestyle be changed if stocks fell 60%?”.

We often consider our risk tolerance when developing a portfolio. But a 60% drawdown when you have $100,000 and are regularly contributing to your investments is a lot different than a 60% drawdown when you have $1-2 million, are close to or in retirement, and rely on your portfolio to support your spending.

I admit, when I looked how much our portfolio dropped in one month between January and February, it made me uncomfortable knowing we continue to hold 80% stocks and it could get much worse. So I asked myself the “60%” question.

At this time, we plan everything year to year based on uncertainty with getting medical insurance. We decided last December that my wife will continue to work enough to qualify for insurance through her employer through at least this December. Consequently, her earned income should cover most if not all of our expenses this year.

I’m starting to see income from my book and my efforts on this blog. My income won’t cover our expenses, but combined with dividends from our taxable investments, they’d cover enough to have minimal impact on our lifestyle.

In the unforeseeable event that both of our incomes went to zero, we hold a full year plus of expenses in cash which would buy us some time before needing to sell any stocks or bonds. We have another 4-5 years of expenses in bonds that we could sell while stocks recovered.

Seeing our portfolio go down further on paper wouldn’t feel good, but it wouldn’t substantially impact our lives. That’s reassuring for us.

Would it be for you as well? That leads to the big question.

What Should You Do?

Quite simply, we can’t tell you what to do. The value I get from reading blogs that I can’t get from academic research is learning from what other people are actually doing. In the name of full disclosure, here is what we did.

One of our goals this year is to fully fund both my wife’s and my Roth IRA. We’re using the dividends from our taxable investments to do this. Those dividends are swept to our money market account.

Our plan is that once we have $6,000 in our money market account, we’ll fully fund one. When we accumulate another $6,000 we’ll fund the other.

We had a little over $4,600 sitting in our money market account, waiting for our next dividend payout later this month. With such a dramatic drop in the market, I decided to invest that money now.

We bought shares of Vanguard’s Small Cap Value Index Fund in my wife’s Roth IRA account because that was the fund furthest from its target allocation in our portfolio. Small moves like this allow me to feel like I’m doing something that may help performance without risk of doing any real harm.

We didn’t sell anything. We also didn’t go out of our way to move cash from our savings to accelerate our buying plan. I have no clue what the market will do next. So I don’t feel an urgency to deviate any further from our plan.

Following a plan and periodically stress testing it with these types of questions removes emotions while managing our investments. Our process is not perfect. But I’m confident it will help keep us on track for long-term success as we manage our portfolio for decades to come.

* * *

Valuable Resources

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning.

After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence.

Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible.

Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences.

Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers.

Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

As I write this comment on Monday, March 9th the stock market was closed for awhile after a 7%/1700 point plunge and has now re-opened. Oil futures have tanked and Treasury yields have plunged to unprecedented lows. Gold is at an 8 year high, The volatility we’ve been living through and are continuing to experience here is already at or beyond 2008 market crash levels and there’s neither an end in sight nor any sign of “adults in the room” in our government as the process unfolds.

Without a doubt we who invest in the markets sign on for such “Black Swan” events by doing so, but there are certainly wiser strategies than JL Colliin’s silly, irresponsible macho posturing about “buying more” during dips. One might start with educating oneself about truly diversified portfolios that have proven their mettle during past market crashes, not because the past repeats itself but rather in order to understand what truly diversified portfolios look like.

A good point of entry on days like today would be learning about the “Ulcer Index:”

https://portfoliocharts.com/2017/11/01/the-ulcer-index-is-a-helpful-way-to-quantify-portfolio-pain/

Moving from there to the Drawdowns Calculator that shows just how stupid the grind-and-bear-it advice of the JL Collins and Mr. Money Mustaches of the world really is:

https://portfoliocharts.com/2016/10/23/how-to-manage-investment-drawdowns-by-thinking-differently/

Last not least comes looking at how to build a better mouse trap by understanding portfolio construction and knowing a bit about market history:

https://portfoliocharts.com/2019/08/20/the-top-4-portfolios-to-recession-proof-your-investments/

These perspectives are useful to investors at any stage but especially vital for those already at or near traditional retirement age because the missing part of the question you asked yourself about risk tolerance has to do with duration: “how could you handle a 60% loss in the value of your stocks that lasted for a decade or more?” It’s easy to be stoic when you think you have time for things to recover – but it’s also needless.

Kevin,

You make some great points that should be considered. However, let’s look at the counter points.

Most of those portfolios you recommend trend away from stocks and toward bonds and/or gold. While they will generally do better during market crashes, the fact is most times, the market is not crashing but growing. Weighting your portfolio heavily towards bonds and/or gold leaves a lot of growth on the table.

Regarding gold: We recently shared an article that considered the role of gold in a portfolio related to sequence of returns risk for someone drawing down a portfolio, and the results were unimpressive. See: https://earlyretirementnow.com/2020/01/08/gold-hedge-against-sequence-risk-swr-series-part-34/

Regarding bonds, particularly in today’s low interest rate environment, a portfolio that is loaded up with bonds is scary IMHO. With the most recent rate cut, the 10 year yield dropped below .5%. Traditionally, lowering interest rates could stimulate the economy in times of crisis, which made prices rise on existing bonds. In that context, bonds were a great diversifier that would go up when stocks went down. But there is nowhere left for rates to go (other than negative). When rates are stable, there is little income from bonds in this environment. And when rates go up, bond prices go down. I consider bonds, which most people hold because they are a “safe” investment, to be extremely risky in this environment.

These are challenging times to be an investor, particularly one in retirement who is relying on their portfolio for income. That is why we have chosen to continue to generate income outside of our portfolio as I fully disclose in this post and on a regular basis in my writing, despite being financially independent in any normal circumstance. I simply am not confident enough to bet my family’s financial well being that we’re in normal circumstances where the old rules apply to stocks, bonds, and gold that people have traditionally used to create retirement income.

Best,

Chris

Hi Chris,

It seems like you’ve replied here without actually looking in any detail at the Portfolio Charts site – specifically at the performance of such allocations as the Golden Butterfly, All Seasons, Larry Portfolio and Permanent Portfolio, relative to the plain vanilla aggressive pure stock and bond portfolio you hold (and that’s recommended by the people you cited). Of the portfolios I just mentioned above, only the GB and PP have significant (20 and 25% respectively) gold holdings. The All Weather has a mere 7.5% and the Larry Swedroe one none.

To take the Golden Butterfly in particular since it’s probably the best of the bunch for risk-averse retirees, it DOES tilt towards prosperity by having its biggest allocation (40%) to stocks. And given that it has 20% in another uncorrelated but very volatile asset (gold) you could say it’s kind of a variant on the classic 60:40 TSM/TBM approach – but with a fraction of the volatility, better returns, far lower drawdowns during market panics and a far higher safe withdrawal rate. The data on the Portfolio Charts site for this and all the other portfolios shown are real (after inflation) returns over every time period for which there’s data. So I think you’re mistaken in saying that these approaches leave money on the table.

And yeah I read the ERN article on gold you posted and he willfully twists data to fit his preconceptions. Here’s a comment on it from Tyler (creator of Portfolio Charts) that’s a useful/necessary corrective to that poorly done piece:

“I think a lot of people just don’t understand gold. Including ERN. And people (rightly) tend to invest in things they understand.

The thing I find most fascinating about the article has nothing to do with the numbers. Behaviorally speaking, I find it interesting that ERN chooses to ignore both the small and value premiums because he doesn’t believe the data applies today (something I disagree with, but a common critique with lots of debate on the topic), while simultaneously making no mention at all that from 1834 to 1971 the price of gold was legally fixed to the dollar and the data under a gold standard definitely doesn’t apply today. Forget monetary theory — just look at the green line.

https://en.wikipedia.org/wiki/Gold_as_a … nt-usd.svg

Now think about how ERN acknowledges that the data including gold is quite desirable without realizing that the majority of the backtest didn’t model gold as it behaves today but essentially modeled pulling that percentage of money out in paper cash and hiding it in the closet. How much better would those portfolios have performed with another real asset (commodities, silver, etc) that could legally change price? And on the other end, what does that say about the measurable utility of another asset that is usually ignored today — cash? Peel back the layers with a bit of context and the results get less conclusive and more thought-provoking.

IMHO that’s a good example of how personal biases and holes in our knowledge shade even the most thorough analysis. And I don’t mean to be overly critical of ERN, as I respect his thought leadership in SWRs and we all deal with the same issues. If anything, I see it as a good reminder to always question my own assumptions.”

Your comments about bonds show you’re not familiar with the importance of bond convexiity. In all fairness neither are many if not most financial advisors and I certainly didn’t before reading this article:

https://portfoliocharts.com/2019/05/27/high-profits-at-low-rates-the-benefits-of-bond-convexity/

The 30 year Treasuries you consider to be the epitome of risk have returned 24.71% YTD (using the TLT ETF as proxy) and went up enough today alone to almost completely offset stock market losses for those holding the Permanent Portfolio. That is what it means to hold a portfolio whose assets are actually not just theoretically uncorrelated.

I’ve been fully retired and living off of my investments since 2002 with no real prospects for work to bring in income (admittedly a big mistake on my part planning-wise) so I know what it’s like to live through market crashes when you depend on your investments to live on. And of course I understand that folks like yourself who are much younger and have better Plan B and Plan C options can afford to take more risk, but that doesn’t mean you need to in order to achieve your investment goals. The Portfolio Charts site taken as a whole, including its rich “Commentary” section, makes that quite clear and is a resource that I think is worthy of attention by anyone who appreciates data and fresh thinking about investing.

A final note: these are GREAT times to be generating income outside of the markets whether through work, rental property income or other options. When I first explored ER the few good books available really emphasized that few people are really cut out to be pure investors while many more would be temperamentally much better off having most or all of their nest egg in rental properties or privately-held businesses. Wall Street is way too good at persuading people that being in the market is the only option, and better still at getting people to believe that real assets (like gold) within a portfolio are a bad idea even when the data shows otherwise.

Thanks as always for your thoughtful writing.

Kevin,

I appreciate your passion and different viewpoints to push me and other readers out of our comfort zones. However for me, I think we’re going to have to agree to disagree.

I understand the point about the great volatility of long bonds with only slight increases in interest rates. But with rates so low, it’s just hard to imagine them continuing to drop. I admit, this is an assumption that could be dead wrong. I have such a small percentage of my portfolio in bonds b/c I started with the assumption that 0% was the absolute floor and I never imagined rates would get this low. Now, I would not be at all surprised if rates go negative. I just can’t wrap my head around buying 30 year bonds with negative rates. Especially when small increases in rates (which I still thing in the long term is inevitable) would create volatility that hurts you far more than the benefit of reinvesting your interest at the higher rates.

Likewise with gold, I simply choose not to hold this commodity. At all. We can each cherry pick data from the past, but that still doesn’t give us a guarantee of the future. Maybe a cryptocurrency is the future that replaces gold. And that doesn’t even get into how you actually hold the gold. Do you use a fund? Do you buy actual gold coins? If the former, it’s not exactly owning gold. If the latter, it introduces another set of risks (storage, theft, transaction costs, etc).

And I happen to agree with you on continuing to believe there is a premium for holding value and small stocks. I also believe in being internationally diversified. For the record, those opinions have all been wrong for nearly a decade. Maybe those bets will pay off in the long haul, but there is certainly no guarantee.

Still, while we both have different opinions and approaches, we each clearly understand what we’re doing and why we’re doing it. And we’re doing each doing fine. All of this shows that none of us have to be perfect and get everything right to be successful.

Agree everyone has to assess their own risk tolerance. As for me, after suffering multiple 6 figure losses on paper the past few weeks, I am still trying to catch that falling knife and getting bloodier every day (so it seems). Call me a fool but I’m still buying (including today, March 9) with my excess cash. Maybe I’m an idiot for systematically buying via dollar cost averaging as the market continues to dip. But for roughly every 5% drop, I’m buying more equities. I still have surplus cash that I will use to buy more if the market continues to decline.

I wouldn’t call you a fool; it does take a cast iron stomach to average in.

I was a relatively new investor in 1987, when the market had a ~22% drop in one day.

I didn’t do anything then (other than continue to save in my employer plan), and am doing the same now.

Here’s a stomach test. Cruise ship stocks are plummeting (NCLH, CCL, RCL). Just bought in at $10/shr with NCLH. No clever insight with this buy. Just gambling with some stored up excess cash while the industry is way down.

I’ve never bought an individual stock and I personally despise everything about cruises (I’m claustrophobic, get seasick, and don’t like being in large crowds) so the idea has no appeal to me. I have no knowledge whatsoever about cruise lines to distinguish one versus the other to have a guess if/when they’ll bounce back.

I was looking out of pure curiosity at SW and Delta airlines last night, both of which are companies I know, use and like. Prices of both have been cut nearly in half and Delta in particular has a ridiculously low P/E and high dividend. If I was going to roll the dice, I’d go there. But to be crystal clear, I have never invested in an individual stock and have no inclination to start now and am not recommending these stocks (or any other) to anyone reading this.

I have both a “gambling bucket” (roughly 10% of liquid NW) where I allow myself to buy individual stocks and an “equities investment bucket”, which has the bulk of the money (e.g. 80%+). When attempting to “buy on the dip” with larger equity purchases, it’s with index funds. The more broad the index, the bigger the purchase, typically. I don’t claim to be able to beat the market and when I eyeballed my aggregate individual stock purchases over 10+ years, I’ve performance roughly the same as the S&P, but with higher volatility. But I enjoy dabbling in buying individual stocks, just like some like Vegas games. At least I’m not losing money (in aggregate) playing with individual stocks so to me, it’s entertainment with a payout.

Certainly wouldn’t consider you a fool for buying now, especially if following a system. Agree also that you’re buying more each time the market drops.

I’m always genuinely interested to know why buy now though? What changed that made you invest money today if you didn’t invest it last week? Had you been dollar cost averaging? (I’m not talking about investing with every paycheck, which I wouldn’t call DCA, but instead investing as soon as you have the money to invest (though in the end, it functions the same as DCA)). Do you have some markers at which you will/won’t buy? If so what are they? Is this a gut decision? Genuinely curious and appreciate anything you’re willing to share.

I look at 1 month, 1 yr., 2 yr. and 5 year high/low prices. I also look at PE/CAPE ratios compared with historic levels. PE ratios can be tough to get for index funds/ETFs so I find the closest market index that does offer PE ratios. I eyeball other metrics but those are the primary ones. If those metrics hit certain thresholds (very subjective … probably should be a little more disciplined with using technical analysis), I buy. If the price continues to drop, I buy more. My fundamental driver is dollar cost averaging with a weight to buy more during dips (e.g. 10% drop initially and each 5% drop thereafter). Honestly, my strategy probably isn’t much (any) better than straight dollar cost averaging because I found that I hoarded cash when I thought the market was overvalued only to find the market rise another 20% over the next year or so. But having excess cash when I thought the market was high made me feel better. I guess that’s why I continue to do it. But I do have fun playing the market … I rather bet on the market than Vegas games and never bet in the market more than I can lose (my assumption is that the market can lose up to 50% of it’s value before I claim I can’t afford to lose any more). I have no clever insight into buying/selling. It’s basically a buy and hold strategy, letting growth compounding and dollar cost averaging do it’s magic over time.

Thanks Phillip! Appreciate you taking the time to explain.

I’ve put a lot of thought into this, but I keep coming back to this part of your comment. “I found that I hoarded cash when I thought the market was overvalued only to find the market rise another 20% over the next year or so.” It’s hard to buy when you’re convinced things are already overpriced, and it’s scary to buy or hold at times like now knowing that we may not be close to the bottom. I just can’t find any convincing evidence that I’ll do any better trying to time the market, and I’m sure trying would mean spending a lot of time. So we follow our plan and look for opportunities outside of the markets (tax planning, investing in career/business, etc) to actively improve upon our finances.

At the basic level, I hold surplus/new cash (via earnings and equity sales) when I think the market is high (per historic PE and high/low averages) just to make myself feel better (just like I buy homeowners insurance, even though statistically it’s a bad bet). If the market goes even higher, then I haven’t lost anything, just missed out on additional gains. If (when) the market drops (say around 10%), then I buy equities with what I hoarded in cash at a more fair price and I buy more every additional 5% drop. I suspect if I did an analysis, I’d do just about the same statistically as a straight DCA strategy (maybe slightly worse since unless I eventually deplete all my cash to purchase equities, I would have some cash out of the market forever). So I don’t claim I make any more money than straight DCA. It just makes me feel better not buying when I feel equities are high. It just fits my personality on not buying things that IMO, are overpriced.

I cannot time market but am fortunate to be able (so far) to time retirement; have just put off open-endedly. meanwhile continuing to put about 25% in 401k, same mix (28% bond funds, 60% stock fund, balane ‘fixrd return ‘).

Steve,

We came to the same conclusion that we weren’t ready to trust our portfolio to fully support us, but we realized that making just a small amount of money combined with our low living expenses meant we could have a very low burn rate that we were confident in. As it turns out, we’re making far more money in “retirement” than we anticipated without really giving up any of the lifestyle that we desired.

Best,

Chris

I use the VIX (volatility index) as a general guide to help access buying (and when not to sell) stocks (and mutual funds). Generally, when the VIX is above 30 it is a good time to buy. You could also make a case for using a lower number such as between 20 and 30. At the least, I would not be looking to sell when the VIX is above 30 unless taking a quick profit. The problem with my guide is when the indicator keeps rising as it has been recently (mid 50’s today). How high will it go? Also the VIX does not help telling when to sell.

To help gauge the global confirmed cases of Coronavirus COVID-19 I have been using the Johns Hopkins (Center for Systems Science and Engineering) interactive map.

John,

I’m always suspicious of those rules of thumb once they become widely known. For the record, many people say the same about small cap and value premiums, but I still am betting on those factors over the long term. Only time will tell.

Tracking the virus is tough as well, but I agree that Johns Hopkins is probably one of the better sources of information.

Best,

Chris

My wife and I retired early (at 48) this past November. Out top goal when updating our plan/portfolio at that time was to do whatever we could to avoid being forced back to work. We implemented a three bucket approach that in the grand scheme is pretty conservative but has us sleeping good right about now.

Bucket 1 consists of 3-4 years of expected spending in cash and cd ladders. In a worst case scenario (now?) we can live off this for quite awhile until things recover.

Bucket 2 is a non-retirement brokerage account with another 6-7 years of spending. This is invested with an 80/20 mix of Vanguard balanced index fund and REIT fund. This is a conservative mix and is “only” down about 7% at the moment. Our plan calls for “topping off” Bucket 1 with the growth and dividends from this account at the beginning of each year to the extent necessary but gives us the flexibility to do nothing if were in a period a market decline. Who knows where we’ll be come next January.

Bucket 3 is a mixture of traditional retirement accounts that We don’t expect to access for at least another 10 years. They are aggressively invested Vanguard equity index funds and needless to say are down substantially over the last few weeks. It’s not a pretty sight to see but we have made no changes and in fact will soon (early April) receive a large lump sum pension payment into an IRA that will be invested similarly. Our plan includes the notion that as we get closer to being able to access these funds (2-3 years away from access) we will shift them to a more conservative allocation similar to Bucket 2 or perhaps even more conservative than that.

Honestly as I explained this to a number of friends and colleagues over the last few months many thought we were being too cautious and said they’d never do that. I’ve gotten a few calls from them over the last few days asking me to explain it again as it doesn’t sound like such a bad idea any longer. 🙂

Thanks for sharing Mike. You’re in a similar boat as us (43 & 42 years of age) in retiring so young. This means we have to strike a balance between being too conservative and seeing our spending power eroded by inflation over a long time frame and too aggressive and being subject to sequence of returns risk. Our approach was totally different in that instead of doing whatever we could to avoid going back to work, we decided to make having some earned income (as well as flexibility in spending) part of our plan. This allows us to invest more aggressively during these early stages without having to sell from principal. Thus we’re insulated from market volatility and sequence risk. Though it clearly comes at the expense of continuing to need to find ways to generate some income.

There’s no single right answer, which is what makes these conversations fun and interesting.

Hi Chris, Throughout my life I have been a data driven person that uses logic rather than emotions to make serious life decisions.

I know I have no control over markets or interest rates. I have been retired for almost 6 years having retired at the age of 57. I still

Have total control over one thing and that is my spending. I will ride this economic downturn out, probably without making any

Changes to my portfolio. I will reduce my spending as much as practical while still enjoying life and retirement. I have always thought that most people pay too much attention to their investments and not enough attention to their spending habits. This may be a good opportunity for people to reevaluate their lifestyle and determin what brings them real happilness and enjoyment. Say hello to Darrow for me, the next time you see him.

Russ Leonard

Excellent point Russ. Agree that has also helped us to stay calm amid this chaos. We tend to spend pretty freely. If we needed to cut back, we could temporarily cut out 50% of our spending (travel, gifts/charity, new gear/toys, restaurant meals, entertainment, etc) and still live a comfortable lifestyle. That said, at times like this we see how interdependent everyone is and I sure hope to not have to cut back on those things. Lots of people will be hurting when the dust settles from this.