When to Take Social Security

This is a milestone year. The girl I married in her 20’s, is now a “senior citizen.” Though she doesn’t look like one. And I’m close on her heels. (Though I am starting to feel like one, at least on certain days!)

With Caroline turning 62 this year, along with other adjustments to becoming “seniors,” it is time to evaluate for real when she should start taking her Social Security. It could start this summer if she wanted.

With Caroline turning 62 this year, along with other adjustments to becoming “seniors,” it is time to evaluate for real when she should start taking her Social Security. It could start this summer if she wanted.

But we can also afford to continue living off our investments, like we’ve been doing through our 50’s, and delay Social Security for a while. The rules are complex, the math is intimidating, and popular (though not expert) opinion is divided.

So, what should we do?

Social Security Made Simple

For years now, my go-to reference on Social Security has been friend-of-the-blog Mike Piper’s book, Social Security Made Simple. Mike has a knack for boiling complex subjects down to their essentials and explaining them in as few words as possible.

His talents are put to the test explaining the government’s arcane Social Security rules, but he succeeds in great style. After finishing this easy-reading 100-page book, you won’t be an expert on Social Security, but you will most likely understand everything about it that the majority of us need to know.

For starters, the book includes several handy tables showing the reductions or increases in retirement and spousal benefits depending on your claiming age. These demonstrate the essence of why to consider delaying benefits: you get more.

The book also explains spousal benefits, the complicated deemed filing and restricted application rules (which no longer applies for us younger retirees), and the earnings test for taxing Social Security when you are continuing to work.

Then the book delves into the all-important claiming decision. It explains and discusses the important “breakeven point” for unmarried people. Basically, if you expect to live to at least age 80.5, you’re better off waiting until age 70 to claim, instead of doing it earlier. You’ll get more money in the long run that way.

For married couples, the situation is similar, but more complex. The book walks you through the issues for the higher and lower income spouses. Turns out that delaying benefits, to maximize the higher-earning spouse’s amount, becomes even more valuable for couples, since that larger sum lasts for the duration of both their lives.

This is even more true now that the only generally-available commercial alternative to Social Security, inflation-adjusted annuities, are no longer available.

Mike offers an interesting explanation of accounting for investment returns, with a strong argument that you should use (relatively low) CD/bond returns when evaluating the benefits of taking Social Security early. And it turns out that delaying Social Security, spending your fixed income investments sooner instead, is superior to keeping that fixed income untouched. That’s because Social Security beats fixed income on two counts: overall return and protecting against longevity risk.

The book explains how, when setting aside assets for additional spending prior to taking Social Security, it is mentally helpful to separate your portfolio in two: one (conservative) portion for spending slated prior to beginning Social Security, and a second, conventional, portfolio of balanced investments tailored to your risk tolerance over your remaining lifetime.

The book touches on important financial planning topics for maximizing your lifetime wealth: the taxation of Social Security benefits, the issue of high marginal rates, and tax planning opportunities like Roth conversions.

Finally the book concludes with 6 essential rules of thumb for dealing with Social Security. They are worth reading. I won’t steal any more of Mike’s thunder here. Social Security Made Simple is short, easy to read, and dirt cheap compared to the lifetime of Social Security benefits it advises on. Highly recommended.

Open Social Security

Not content just to publish one of the most useful books on Social Security, several years ago, Mike also put his programming talents to work and created a cutting edge Social Security calculator for optimizing your Social Security benefits. It’s as easy to use as one of Mike’s books, and best of all it’s totally free (and open source, if you’re a programmer and want to see or modify the code)!

Assuming you already have a copy of your benefits statement from the Social Security Administration (and if you don’t, getting one should be a high priority), you can analyze your personal claiming strategy using Open Social Security in less than 5 minutes. So what do you have to lose by trying it?

Open Social Security is different from many other Social Security calculators in taking an approach based on probabilities and life expectancy. The About page tells us that us that it “runs the math for each possible claiming age (or, if you’re married, each possible combination of claiming ages) and reports back, telling you which strategy is expected to provide the most total spendable dollars over your lifetime.”

It does this by multiplying the retirement benefit in a year by your probability of being alive in that year (using average life expectancies), to calculate a probability-weighted annual benefit. All of those benefits are then discounted to account for the time value of money, and summed, to arrive at a total “present value” for the claiming strategy being investigated.

For married couples, the calculator adds a few more details: in addition to analyzing retirement benefits, it also includes spousal benefits and survivor benefits.

When it’s done analyzing, the calculator presents a table showing your year-by-year benefit amounts, and offers a Recommended Strategy for maximizing total dollars over your lifetime. In our case, it recommends that Caroline file for her retirement benefit to begin when she is a little over 65, not quite full retirement age. And that I wait to file for my retirement benefit to begin when I’m age 70. Caroline would also file for her spousal benefit to begin when I turn 70.

If desired, you can use Open Social Security to test alternative claiming strategies, experimenting with the claiming dates for your retirement benefit, your spouse’s retirement benefit, or your spouse’s spousal benefit.

Finally, if you want to customize the calculation further, you can incorporate advanced options including disability benefits, pensions, and disabled children. You can also change options for mortality tables (if you don’t believe you have an average life expectancy), the discount rate used, and possible future benefit cuts — if you believe Social Security could be reduced in the future.

Pralana Gold

Useful as it is, Open Social Security does not do comprehensive financial planning. It computes how you can get the most Social Security over your lifetime, but doesn’t look at your other financial factors. It doesn’t have access to all your income or assets, and it can’t analyze your tax brackets, so it doesn’t have the data needed to recommend strategies such as Roth conversions to smooth out your tax payments over the retirement years. Thus it can’t maximize your total wealth over your lifetime.

For that you need a comprehensive personal financial model, like our affiliated product Pralana Gold.

In addition to collecting information on your other income, expenses, and assets, Pralana includes a section for defining your Social Security benefits. It asks for these inputs:

- The benefit amounts you and your spouse expect to receive at your Full Retirement Ages based solely on your own work records (or alternatively, the amount you’re currently receiving).

- The ages at which you and your spouse expect to start receiving benefits (or alternatively, that the benefits have already started).

- If your benefits have already started, when did they start?

- Who, if anyone, is doing a File & Suspend?

For the most part, the program takes it from there, and fully automates the analysis. Based on these few inputs, Pralana Gold computes your benefits and your spouse’s benefits, including any applicable spousal benefits, with appropriate reductions or increases based on your specified start ages.

The calculator also handles survivor scenarios. For example, consider a married couple where both partners have Social Security benefits but the husband’s are the higher of the two. In the year in which he dies, Pralana Gold models Social Security income to accurately reflect both his and her benefits up to the point of his death and then only her survivor benefits thereafter.

If you want, the calculator can model a decrease in Social Security benefits at some point in the future. It will apply a benefit reduction of the % you specify, starting in the year you specify. It also allows setting inflation specific to your benefits if you wish.

Pralana Gold offers several key benefits:

- It enables easy what-if exercises: by simply changing start ages, you can quickly observe long term impacts on your net worth without having to compute and enter the benefit amounts yourself.

- It computes the optimum ages for you and your spouse to begin taking benefits.

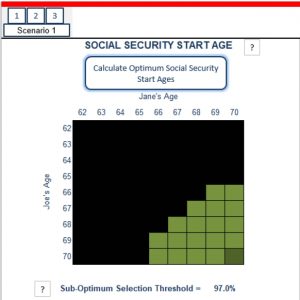

The calculator offers a clever graphical widget to present its optimized results. It’s a two-dimensional grid of small squares. One axis is your age. The other axis is your spouse’s age. Each square is colored one of 3 ways: optimal, suboptimal, or not recommended.

By clicking the Calculate Optimum Social Security Start Ages button on the Optimize page, Pralana Gold will calculate the optimum ages for you and your spouse (if applicable) to begin taking Social Security benefits. The result is reflected as a dark green square in the widget. The calculator also calculates slightly sub-optimum ages, and these ages are reflected as lighter green squares.

The overall best strategy is taking Social Security at the combined ages marked by the optimal square. The sub-optimal squares represent nearly as good solutions. (And you can control how close they are to optimal by setting the Sub-Optimum Selection Threshold.) These latter squares might represent appealing solutions if you have other qualitative factors in mind, such as wanting to reach a certain level of benefits, or having concerns about government viability. And if you and/or your spouse die prior to your life expectancy, one of these other solutions would end up providing more benefits than the optimal solution. But, if you outlive your life expectancy, the opposite will probably be true.

The analysis the calculator performs during this process is more sophisticated than just determining the start ages that result in the largest long term income; it also examines the long term effects of that income on investments, taxes, and survivor scenarios. In our case, Pralana recommends that we both wait until age 70 to file for Social Security benefits, though Caroline can take hers up to three years earlier, while remaining within a 97% sub-optimum threshold.

The key takeaway to remember with Pralana Gold is that, because it is a complete personal financial model, the analysis takes into consideration not only the absolute amount of your Social Security income, but also its impact. You are getting the “best” overall solution to maximize your standard of living, taking into consideration all the other factors in your personal retirement situation.

Finally, when you are actually using this feature, understand that the program doesn’t automatically incorporate its optimal solution into your plan. To do that, go to the Income page and revise the Social Security start ages you previously specified.

The Claiming Decision

Back to Caroline’s and my Social Security situation. We share two primary concerns with many other people looking at this decision:

- If we delay our benefits, as the calculators encourage us to do, then we will be leaning more heavily on our portfolio in our early and mid-60s. That’s OK as long as the government makes good on its commitment to us when I turn 70. But what if it doesn’t? What if our fickle politicians change the rules in an attempt to shore up Social Security or other government spending, and we get less than we expected? In that case our portfolio will have been permanently reduced in expectation of receiving more Social Security, and might never recover. Our lifestyle might have to be curtailed and we could enter our 70’s worried about money.

- It’s very tempting to “hedge our bets” by asking the government for some of our money now. Then, if something happens to the Social Security rules down the road, at least we will have gotten some of our money out of the system. This seems to be a common approach to Social Security claiming, even though the calculators tell us the odds are we’ll get less money in the long run, if we at least live to our average life expectancy. The main issue in my mind is that we lose an important piece of longevity insurance. We permanently reduce our inflation-adjusted income stream for the rest of our lives, which could be critical if one of us should live a very long time, perhaps approaching 100 years.

What will we do? I think this decision depends a lot on how you think about the government. If you trust it to deliver, or believe that politicians of all stripes are too fearful of the aging baby boomer vote to ever cut existing benefits, then you’ll likely delay longer for larger benefits. And I think that summarizes our viewpoint, for the most part.

I will definitely wait until age 70 to claim my benefit. The mathematical analysis is just too clear that we’ll do better in the long run, by keeping some invaluable inflation-adjusted longevity insurance.

As for Caroline’s benefit, we may hedge our bets and take it earlier. Even though we would theoretically do better waiting until about her full retirement age. That said, Caroline is leaning against taking it this year at age 62. That would mean a relatively paltry benefit of only about $700. She wants to wait at least a few more years in order to push that number over $1,000 — a more substantial-sounding figure.

* * *

[The founder of CanIRetireYet.com, Darrow Kirkpatrick relied on a modest lifestyle, high savings rate, and simple passive index investing to retire at age 50 from a career as a civil and software engineer. He has been quoted or published in The Wall Street Journal, MarketWatch, Kiplinger, The Huffington Post, Consumer Reports, and Money Magazine among others. His books include Retiring Sooner: How to Accelerate Your Financial Independence and Can I Retire Yet? How to Make the Biggest Financial Decision of the Rest of Your Life.]

* * *

Note: For many years, Pralana Consulting and Can I Retire Yet? were engaged in an informal technical collaboration aimed at raising standards for accuracy in retirement modeling, with no business relationship. However, as of January 2020 we have an affiliate relationship. That means, if you purchase a Pralana product here, a portion of the sale goes to support this site.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Excellent article, as usual, Darrow.

I have run other calculators that provide a different recommendation, usually both waiting until 70. I think this difference may be due to assumptions made in this tool about longevity. My wife’s parents lived to be 93 and 104, so we expect her to last much longer than averages. My parents both passed in their early 80s, but my mother was overweight and my father was a lifelong smoker, but I am neither, so all else being equal I should beat these odds.

Thank you Darrow. Good stuff addressing a controversial and much-debated topic.

Mike Piper is interviewed on a recent Bogleheads podcast in which he explains an interesting hybrid strategy (New to me.) for those of us choosing to delay benefits, yet wanting to have comfort spending those future benefits while our bodies are capable of enjoying them (The strategy is explained at the 32 minute mark of the interview.).

https://rickferri.com/podcast/episode-007-bogleheads-on-investing-guest-mike-piper-host-rick-ferri/

Mike’s explanation is based on a strategy from this paper by Wade Pfau et. al.http://longevity.stanford.edu/wp-content/uploads/2017/11/Optimizing-Retirement-Income-Solutions-November-2017-SCL-Version.pdf

Darrow, as always, thanks for another excellent and thorough article. When to take SS is one of the most difficult decisions a lot of us will make in our financial lives. And it just shows how valuable this “last” decent annuity is to retirees. The calculators are great for giving us the numbers, but we all know how life doesn’t always work according to the numbers. Like you, I will be delaying my SS until 70 to provide my wife with the highest spousal benefit on the assumption that I go first. In my parents case, my Mom died many years before her time even though she had longevity in her family and good health too, so that just shows the difficulty in using the numbers only. I am more concerned about the government than I was before since they recently took away the “stretch” IRA with little fanfare. The question is whether this is opening the door to other things like SS that were once sacrosanct. Thanks for keeping us well informed, -Ed

I was the high earner, while my wife who is 5 years my senior was the lower earner. She just meets the Restricted Application cut off and we have been waiting for me to hit 62 this year. Though she is now at FRA, I will file and she will claim 1/2 of my retirement until she’s 70. At that time, her benefit will exlipse anything I could ever have claimed, making her the “High Earner” of SS. This gives her the greatest survivor’s benefit if I die, and ME the highest possible benefit (by glomming onto hers) in the event of her death prior to mine. This also gives us an earlier cash flow while maximizing survivor’s benefit.

No wonder this strategy was discontinued…

Good strategy. Also, more good news. Your wife will receive half of what you would have received had you waited until FRA. A caveat…the people at SSA local office are not well trained in this option.

I discount my expected SS benefits by 20% due to the uncertainty of future benefits when running the numbers to help me decide. The 20% is somewhat arbitrary (I’m using this figure since current projections say in 2034, only 80% of promised benefits can be paid with projected inflows) but at least I account for what the fickle government might do in the future.

One other argument for delaying. There is at least the possibility of some breakthrough that raises average lifespan. All of the “risk” is in this direction. If you are still enjoying life at 105, you may wish you had more income. If not, you won’t be worrying about it one way or the other.

The way I’m thinking about it is based on need. Ie if I have enough invested in AA and IRA/401k to live comfortably without SS then might as well leave SS until I can’t or 70 (whichever comes first). On the other hand if the investment portfolio doesn’t support expenses or simply not enough money to live then might as well tap into SS as soon as possible.

Nobody knows how long they will live. Case in point is my dad. He died from a stroke when he was 56. However my mom is a lifelong smoker, obese, almost no exercise. Eats whatever junk. And she’s almost 70 now. My father in law died when he was 86. Also a lifetime smoker. I have a feeling longevity is just luck for the most part. And that is why I treat SS as an insurance against not having ‘enough’ money… On the flip side we can cut back in expenses when needed… but a prolonged downturn problem is sufficient to start SS at first opportunity imo.

Thanks for the excellent article. The calculation would, of course, be much simpler if I knew how long my wife and I will live! Mike’s calculator recommends that my wife claim at 66 and I claim at 70. We decided to have her start at 65 because the difference was so small. I’m thinking of possibly claiming at 68 or 69 depending on the state of my investments and the political environment concerning social security. Like you, I think it is unlikely benefits will be reduced for anybody currently in or near retirement, but I may hedge my bets as you put it. Like the commentator Phillip, for planning purposes I assume my benefit will be reduced 20% just to be conservative.

Thanks for the great article, Darrow! My wife and I see the total financial benefit of waiting until age 70, but we plan to take SS earlier(between 62 and 65, in late 50’s now). Reasons are: 1. we believe our spending will follow natural aging trends, so we plan for a 10% reduction per decade. We want to front load retirement spending, not back load; 2. This early SS will be enough to be our income floor in almost all situations; and 3. it feels “odd” to delay after paying in for 35 years(I know, I know, not a great reason but it’s how we both feel!).

Hi Darrow,

Thanks for another quality article. I am wondering if any of the tools you mentioned considers the effects of the Windfall Elimination Provision: https://www.aarp.org/retirement/social-security/questions-answers/what-is-the-windfall-elimination-provision/

My wife is a teacher as a second career and her limited teacher pension will offset some of her Social Security payments that she is eligible for as a result of her work before she became a teacher.

Is the WEP something you and your wife have had to consider?

Regards,

Seumas

Hi Seumas. It hasn’t affected us, but the Windfall Elimination Provision is addressed in Social Security Made Simple, and in the Pralana Gold User Manual.

Thanks for reviewing the online resources. Glad you talk about longevity insurance!

Another thoughtful post! I learned a lot from playing with the calculator. The big decision to get right is the higher earning spouse claiming at age 70. Very little present value difference for the lower spouse claiming at 62 versus 66. Like most investing decisions, the “best” strategy will only be known in retrospect. In our case, when the lower earner turns 62 we will evaluate. Are we BOTH still in good health? Will the extra income cut too much into ACA premium tax credits (if the still exist)? What is the condition of our “bridge to social security”? And taxes and Roth conversions could even be a consideration. Nice reason to have PRC Gold to see how all of these decisions interact.

I too appreciate Mike Piper’s calculator. I would encourage people who use it to run at least one alternate case as Pete did. I found (for my wife and me) that the optimum or best case was not much different than an alternate case that better fits our goals and situation. In our case the OpenSocialSecurity optimum was not like the top of a steep mountain but more like the crest of a rolling hill. My plan currently is to use one of these alternates that better fits our situation. In the specific case we have chosen, the difference from the optimum was less than 0.5% in total benefits received. This is likely well within the uncertainty our specific life expectancy and possible future social security changes.

In brief, I suggest you check your optimum claiming strategy against several of your alternatives. You may find a claiming strategy the best fits your situation that is “good enough” though not “optimal”. Another suggestion is to re-run the calculation each year to make sure any changes in your situation are considered.

When I was making this decision a few years ago, I read Mike’s excellent book at that time. I also read Get What Your Deserve by Laurence Koltikoff and Paul Solmon. At the time, Mike did not have his free calculator available, so I went with Koltikoff’s paid software package Maximize My Social Security. Because my wife and I were old enough to take advantage of file and suspend strategies, we both have something coming in from SS (my FRA amount plus spousal benefits she claims on my record) until she turns 70, at which time she will claim her own benefit. Although she’s the lower earner, together over time (assuming we both live to be 90) we end up with about $36K more than if we both waited until 70. Not a lot, but something, and it allows us right now to keep more of our retirement savings in our accounts. I am not necessarily recommending Koltikoff’s product, but I do present it as another option for those looking for something a bit more sophisticated when it comes to evaluating SS possibilities.

Thanks Tom, I reviewed Maximize My Social Security several years ago in Comparing the 2 Leading Social Security Calculators.

I’m taking at FRA and the hell with the calculators. I have plenty to live on with and without SS but I hate touching my own money! My break even is 83 and while the life tables Tell me I’ll surpass that , no one in my family has.

So , I’ll take my “ entitlement”, as the nasty counselor in the SS office called it , while I’m here.

“And it turns out that delaying Social Security, spending your fixed income investments sooner instead, is superior to keeping that fixed income untouched.”

On the surface this seems like a compelling argument. Since cash/CDs/bonds pay so little, use that money to bridge the gap from 62 to whenever and let your SS returns “grow”. However, this assumes that in scenarios where you either take SS early or late, your fixed income allocation stays the same.

But what if in the scenario where you take SS early you decide to reduce your allocation to fixed income because you need less cash since you will be taking SS? For example let’s say you will be retiring and living on 100k a year starting at age 62. If you decide you will live off your fixed income until you reach 70 to get the greatest amount of SS income this means you will have to set aside 800k in fixed income.

But let’s say you decide to take SS at 62 which amounts to 50k/year(rough numbers). This means that to cover the additional 50k a year you will need you only have to set aside 400k. This means that you have 400k extra in cash(compared to the full 800k you would need if you didn’t take SS) which you could invest in the market. This would help to balance out the difference in income you would receive at 62 vs 70.

This means that you are accepting the volatility risk of the market which could turn out badly, however it also means you are getting your money earlier and are less likely to deal with the possible consequences of reduced benefit as a result of a change in the funding rules.

This does not make taking SS at 62 a no brainer but it does help to further muddle the decision making process.