A Closer Look at Annuity Fees and Taxation

In response to Darrow’s recent post on inheriting an annuity, I received the following comment, which I edited for clarity:

I have a variable annuity via Fidelity. It is the result of a 1035 conversion of a whole life insurance product I wish I hadn’t bought in my late 30’s…..I pay .1% (for a) Fidelity VIP Index plus .25% annual annuity charge for a total of .35%…..For comparison FXAIX (Fidelity’s S&P 500 index) charges .015% or .335% less than the annuity version. Thus it is $335 more expensive per year per $100,000 invested.

The variable annuity is better than the whole life product! I’m glad I was able to turn lemons into lemonade.

Would I buy it again on its own merits? Yes!….I’m sure I’m missing something because everyone else is so negative on them.

This comment highlights an excellent strategy for those who have been sold annuity and insurance products they regret buying, the 1035 exchange. On a less positive note, the idea of buying an annuity on its own merits highlights the misunderstanding of annuity fees and taxation that I suspect are the reason so many people end up with these products that they later regret. Let’s explore….

1035 Exchanges

Let’s start with the part of this comment that I love, the 1035 exchange. Section 1035 is a section of the IRS code that allows a tax-free exchange of one insurance contract for another.

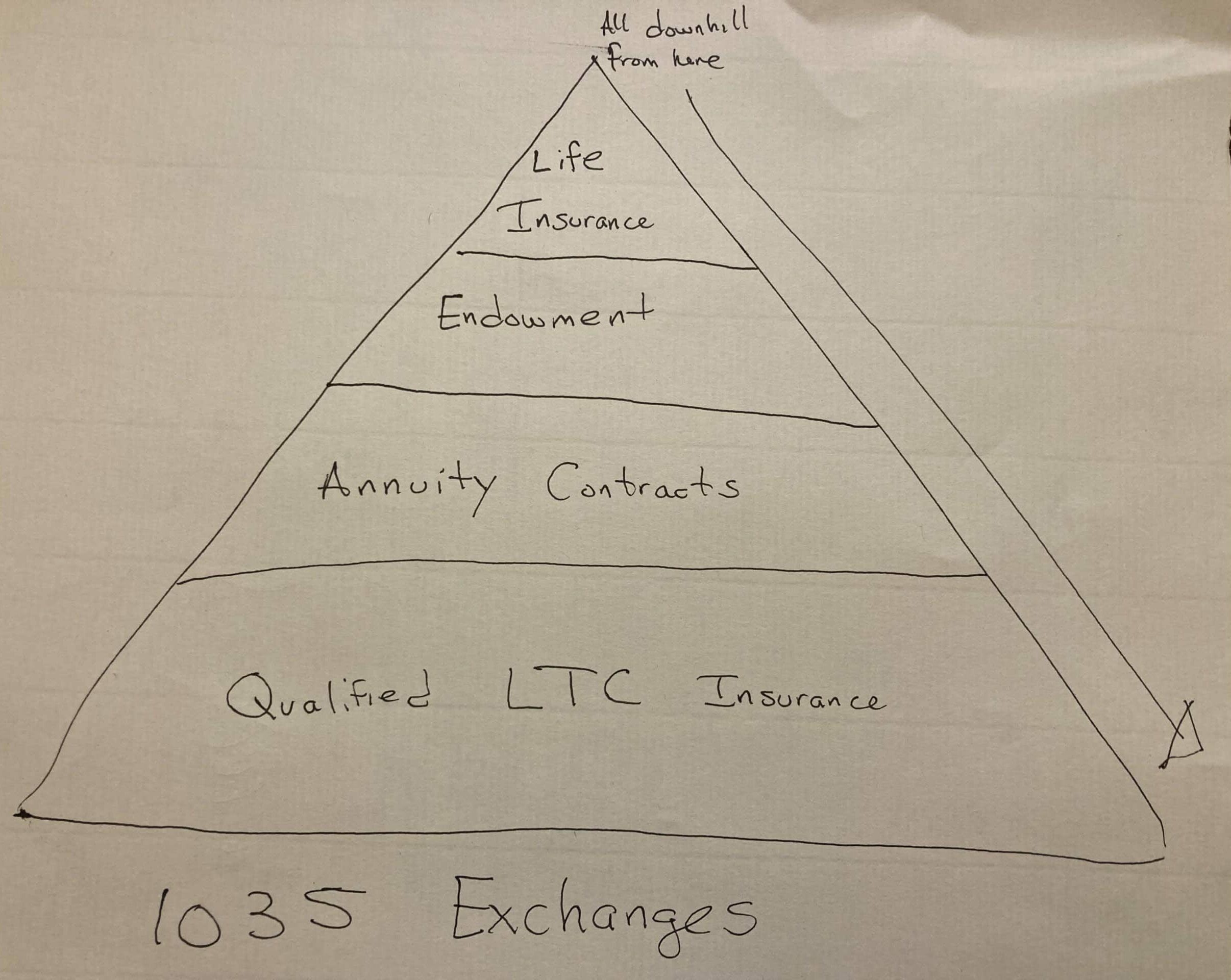

Section 1035 applies to life insurance, endowments, and qualified long-term care insurance (LTC) policies, as well as annuities. I learned the mnemonic device below that helped me when preparing for my CFP exam:

Any of these policies can be exchanged for a like kind of policy. Life insurance policies, at the top of the pyramid, can be exchanged into another life insurance policy or for any of the other policy types below it on the pyramid. At the other extreme, LTC policies, at the base of the pyramid, can not be exchanged for anything other than another LTC policy.

Annuities, being near the bottom of the pyramid, are a popular place to exchange undesirable, but commonly sold, life insurance products or annuities. As such, there are products sometimes termed “rescue annuities” because they are designed for the purpose of rescuing consumers from suboptimal products they were sold.

Vanguard used to offer a product for this which I exchanged my parents’ annuities into years ago. They no longer offer these products. To my knowledge, the Fidelity annuity product referenced in the comment is the best option currently available.

When to Consider a 1035 Exchange

1035 exchanges work best with an insurance contract that you were sold years or decades ago outside of a qualified account. In this scenario, you are typically out of any surrender period that would prevent you from exiting the contract.

However, you may have accumulated substantial taxable gains. These gains would make surrendering the contract in one lump sum undesirable due to tax consequences.

A 1035 exchange to a more favorable contract provides a reasonable solution. You can lower your fees. You will also buy time to continue deferring taxation and to determine a more tax efficient strategy to get money out of the annuity rather than taking a lump sum all in one year.

Choosing an Annuity?

A 1035 exchange can be a good solution to “make lemons out of lemonade” with an old annuity or life insurance product you were sold. But do these low-cost annuities deserve to be considered on their own merits? Generally, no.

There are two key reasons for this: annuity fees and taxation of annuities.

Annuity Fees

Let’s take a closer look at the fees on the annuity mentioned. It is one of the lowest fee variable annuity products on the market, if not the lowest.

The commenter astutely points this out, noting the difference of .35% all-in for the variable annuity vs. .015% for the same investment purchased outside of the annuity. The commenter also correctly points out that the difference of .335% equates to a difference of $335 per year on a $100,000 investment.

However, this overlooks (I believe accidentally) the same thing that those that sell these contracts don’t explain (I’m not as generous in assuming it is accidental on their parts). That overlooked component is the compounding of fees!

Let’s consider the difference between two otherwise identical $100,000 investments. Each compound at 8% per year minus their respective fees for twenty years.

A $335 annual fee for twenty years would be $6,700. But fees aren’t linear. They compound. Determining the actual impact of this fee difference requires a couple of time value of money calculations.

The money invested in the variable annuity with all in fees of .35% would compound to $436,798. This same amount of money invested with all in fees of .015% would compound to $464,803.

The result of this seemingly small difference in fees results in ending with $28,005 less after the twenty year period, all else being equal. If we compound the difference out 30 years, the difference grows to $89,186!

Anyone selling annuities will be quick to point out that this is not a valid apples to apples comparison. Annuities are taxed differently than taxable investments.

This is true! However, in most cases taxation is another reason to avoid annuities rather than a reason to choose them.

Taxation of Annuities

Investment gains in an annuity are shielded from annual taxation. This is the biggest tax advantage provided by an annuity.

In exchange for this benefit, gains on investments inside the annuity lose favorable capital gains tax treatment. Any gains within an annuity are ultimately taxed as ordinary income when a withdrawal is taken, similar to a non-deductible IRA. Also similar to a retirement account, annuity withdrawals are subject to a 10% penalty on the gains if taken before age 59 ½.

In addition, annuity withdrawals are taxed on a last-in, first-out basis. This means that 100% of every dollar you take from an annuity is taxed as ordinary income (and subject to early withdrawal penalties) until all of the gains are exhausted. At that point, the remainder is a tax-free return of your principal.

If you elect to annuitize payments, taxation is a more complicated formulation where each payment consists partially of taxable gain and partially tax-free return of principal for your calculated life expectancy. If you outlive your life expectancy, payments become 100% taxable as ordinary income.

Annuities vs. Other Tax-Advantaged Accounts

Annuity gains are taxed as ordinary income like a tax-deferred retirement account. Annuities come with early withdrawal penalties similar to qualified retirement accounts. They don’t come with the upfront tax deductions of traditional retirement accounts or tax-free withdrawals of Roth accounts.

Therefore, there is little reason to ever consider buying an annuity if you are not first maxing out all other tax-advantaged options (work sponsored plans, IRAs, HSAs, etc.). They provide superior tax benefits, less complexity, and generally lower fees.

There is also no reason to ever buy an annuity inside of a qualified account for tax benefits. The tax benefits of the retirement account are already superior to those of an annuity.

If you are a super saver who maxes out all your tax-advantaged accounts, annuities can provide some additional tax advantaged space to shield your investments from the annual tax drag created by taxation of income produced within a taxable account. However, the value of this tax benefit comes with trade-offs that make this benefit questionable at best.

Annuities vs. Taxable Accounts

How beneficial is using an annuity to eliminate annual tax drag? The value is dependent on several factors.

The first is what you plan to invest in. If you are following the first rule of thumb of utilizing all your available tax-advantaged accounts, they will provide space to hold your least tax-efficient investments. You could use a taxable account to hold only tax-efficient investments like an S&P 500 index fund as mentioned in the comment.

In this case, most of your gains will come in the form of capital gains. Thus you have tax-deferral on the largest portion of your investment gain until you sell the investment. More importantly, you get this benefit free of charge and without the complexity of annuity contracts!

Tax-efficient investments like broad based index funds generate little to no annual capital gains or non-qualified dividends. That by definition is why they are tax-efficient. This leaves you with only qualified dividends which are taxed at favorable rates of 0%, 15%, or 20%.

The second factor when determining the tax benefit of an annuity vs. a taxable account is your personal tax rate and how it will change over time. If you are saving aggressively towards early or semi-retirement, you may very well pay 0% tax on taxable accounts in your lower income years.

Related: Understanding the Benefits and Drawbacks of Taxable Accounts

Before considering an annuity for tax benefits, make sure you understand the trade-offs this entails. You’ll be giving up favorable tax rates, possibly 0%, on long-term capital gains and qualified dividends in a taxable account to ultimately pay ordinary income rates on any annuity gains. You also have to weigh the negative impact of annuity fees vs. any potential tax benefits the annuity provides.

Should You Buy an Annuity on Its Own Merits?

Few people buy complex annuities like variable or equity indexed products. Most often these contracts are sold by agents who are paid handsomely to do so.

These salespeople play on fears to highlight features like “market-like growth” with limited downside and tax sheltered investment income. They downplay or outright omit discussing the impact of high annuity fees. They misrepresent the fact that in many cases there is no actual tax benefit. In fact, you may pay more tax by utilizing an annuity!

Like this commenter you may find yourself in possession of one of these contracts. You would not make an informed decision to buy this product today. In that case, utilizing a 1035 exchange is a viable option to start fresh in a more favorable contract and allow for future tax planning.

However, there is rarely a reason to buy even the lowest cost versions of these products on their own merits.

Related: Annuities – The Good, The Bad & The Ugly

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

I remember reading awhile back that “Annuities are not bought, they are sold” and stayed away from them. Your article is so informative. I can add more to the quote above in the event a family member opens up about annuities at family gatherings… there is always one at each gathering.

Triplet Mom,

It is sad how common this is! My family was certainly not immune.

I mentioned my parents each having a variable annuity in the post. My wife and I also realized we owned one which we were sold when rolling over a retirement account when she switched jobs. None of us could explain what we owned or why.

Figuring out what we each had, how these products were sold to us, and how to best move forward was what sent me down this rabbit hole of learning about personal finance and investing and writing about it.

Best wishes!

Chris

I’m reading the on-line version of Charlie Munger’s “Poor Charlie’s Almanack” https://www.stripe.press/poor-charlies-almanack One thing he continually rails on are investment fees, and he’s especially negative about “funds of funds” approaches where you have fees layered on fees. I wish I had read this 30 years ago 🙂

And on taxes: It turns out that we’ll end up in a higher tax bracket in retirement, particularly when both wife and I are taking MRDs as well as Social Security. Now another piece of 20-20 hindsight would have been to convert a lot of our retirement money to Roths when we had the chance and were in a lower tax bracket.

Thanks for sharing David,

It would be nice to be able to turn back time and get back all of the wasted fees and taxes incurred by making decisions without understanding these things. The best we can do is to move forward from where we are when we figure these things out…. and spread the word to help prevent others from making the same mistakes.

Best wishes,

Chris

Thanks for highlighting these pitfalls, Chris. Most people don’t appreciate the long-term impacts of whole-life policies… emotional as well as financial.

Speaking of “agents who are paid handsomely”, a 1035 is a popular tactic for potential elder abuse: churning their finances in old whole-life policies.

In 2011 when I took over my father’s finances (due to his Alzheimer’s), I discovered that in the early 1960s he’d taken out a total of four whole-life insurance policies on my brother and me. (We were toddlers.) Over the years, they had performed poorly and he’d had many disagreements with the insurer over their premiums & cash value. Despite over four decades of letters arguing with the company about the policies, I couldn’t find updated copies of them.

When I finally contacted the insurance company, I learned that in 2010 Dad had done a 1035 exchange. (At the time, he had been in early-stage Alzheimer’s for over a year but had refused assistance and still lived independently.) The four whole-life policies (now with a cash value just over $100K) had been converted to a single-premium life insurance policy payable to my brother & me.

When I obtained a copy of the new policy (with my conservator’s appointment from the probate court), the application was not in my father’s handwriting. His handwriting had changed with Alzheimer’s, but I’m skeptical that it was his signature. The commission on the 1035 transaction was ~$7000.

I’m sure Dad saw an ad in his town for rescuing bad whole-life insurance contracts with a 1035. The friendly local agent was more than happy to facilitate the transaction. One exchange at a time, a 7% premium scales to a great business model.

The emotional cost was even worse. We never needed the whole-life policies as kids, and they could have been cashed out in the early 1980s when they started underperforming. 30 years later when Dad converted the policies, my brother and I had already reached financial independence. We certainly didn’t need the insurance payout from Dad’s death.

Years after Dad’s passing, I still wish he’d simply cashed out the whole life policies (in the 1980s or even in 2010) and spent the money on his own retirement.

I hope your other readers can learn from my Dad’s financial mistake… and from an agent’s financial moral hazard.

Nords,

I’ve always viewed 1035 Exchanges in a positive light and have used this tool to move my parents out of a horribly fee laden variable annuity to a far less bad one.

I hadn’t ever heard, or even thought of, these exchanges being a potential method of taking advantage of people. But that totally makes sense. Instead of consciously moving the contract to a more favorable one an agent just sells another lousy policy with another big commission.

Thank you for sharing this! It is yet another thing for consumers to be aware of and another reason I am proud that I decided to go down the path of being an advice only planner that can help people navigate these complicated situations.

Happy new year!

Chris

Another 1035 option for variable annuities etc. are MYGA (multi year fixed annuities) These are fixed guaranteed interest contracts typically offered in 3, 4, 6 & 10 year periods. So say you have a large annuity and are beyond the surrender period; you could take a $100,000 annuity and do a 1035 exchange into 3, 4, 6, & 10 yr annuities of $25000 each. This spreads out when you want to withdraw the money and pay taxes. If you are not ready to take the money, you can rollover to a new MYGA for when you are ready/need the money.

Fidelity https://fixedincome.fidelity.com/ftgw/fi/FILanding#tbannuities has good MYGA with AAA rated insurance companies.

FinanceWarrior,

The one downside I see to your solution is that annuity contracts are mind bendingly complex. So the idea of trading 1 contract in for 4 seems very unappealing.

The nice thing about these lower fee variable annuity products is that they are relatively simple and you don’t have to annuitize them, so you do get tax deferral until you decide to take the money out and you can do so gradually on your schedule in a tax efficient way. Of course the downside as pointed out in the post is that you are generally adding a quarter to a half a percent annual fee even for the most stripped down and basic contracts, which adds up the longer you keep money in the annuity.

Best,

Chris

Chris,

I agree what we did was not for the faint of heart.

When we were young & not paying attention the wife and I got SOLD variable annuities. I literally questioned the CFP, why wouldn’t I just invest post tax $$$ in stocks and just let it grow… Bought the upfront loaded funds for our kids college too.

Fast forward 30 years and I started paying attention to VA fees and A.M. Best Fitch ratings. I read the contracts and both had options for GIA (general interest account) earning 3% and 4% fixed interest. This got rid of the fee drag and we just left it for about 4 years.

We did my wife’s annuity first and did a 1035 exchange to a Fidelity brokered MYGA. The previous insurance company is A++ rated as well as the Fidelity MYGA company. Transfer of funds took 3 business days. Super easy.

For my annuity the previous company was B– and I was concerned about its financial stability and the financial gymnastics in annual reports. If an insurance company goes bust, most states insure annuity contracts only up to a certain amount– my contract was well above the covered amount.

Working with Fidelity they chopped up my annuity into 3 MYGA contracts with 2 different insurance companies to spread the risk. Fidelity handled all the paperwork, however the B– company invented all sorts of hurdles– the variable annuity contract was no longer being offered and they were getting hammered with fund depletion (not a good sign). Legally insurance companies can hang onto your money up to 6 months depending on the contract and funds invested.

It took me almost 4 months to get the money transferred and it was all in a GIA!

The hassle payed off as interest rates were rising during the summer, so we were able to lock in fixed rates between 4-5% depending on contract periods.

We knew we did not want to annuitize both contracts. The Fidelity option in your article is also a good low cost option. We went the fixed income route to keep our investment mix unchanged.

Fidelity was super helpful with their fixed income team which covers a broad portfolio of products.

Annuities may have a place for you depending on your specific circumstances. However as you say they can be super complex to understand.

Insurance companies write life policies– bets that policyholders are going to live out the contract and they do not have to pay the $$$. Insurance companies also write annuity policies and once you annuitize the contract– it is a bet that you are not going to live out the contract terms and they get to keep the remaining $$$. Nice hedge.

Keep up the helpful retirement articles!

FW,

I’m happy to hear this worked out well for you. And it sounds like that was mostly a result of your diligence (and a little luck with the interest rates). That said, the idea of taking months to get YOUR OWN money strengthens my beliefs that these complex annuities should rarely be considered for everyday investors and should rarely be bought on their own merits as was my contention in the article.

Thanks again for sharing your experience which may help others.

Cheers!

Chris

As I get older I do start to think about the role annuities could play in simplifying financial management as we age and perhaps capacity declines. How do people think about managing money in later years, particularly for those of us who do not have children?

Andrea,

I agree 150% that this is the strongest argument for buying an annuity. If doing so I would buy the most simple vanilla single premium immediate annuity with the strongest rated insurer I could find at that time.

Best wishes,

Chris

Not a huge slice of overall investment portfolio (less than 5%) but I have a deferred annuity inside a Roth. It’s subject to annual contribution limitations of course and guaranteed a floor of 1% APR. It’s probably not earning much at all but seems to be about as risk free (from the perspective of declining in value) as anything else in the portfolio (and for emphasis – it is not where I put all my Roth eggs – is is only a slice of overall Roth contribution year over year). Current Intention is to use it for predictable recurring medical costs when I reach non-penalty withdrawal age (59.5). However, w/ the complexity of these things, hard to understand if I’m missing something. I’m wrestling with what is the best move be done with such a relatively odd investment vehicle.

C,

I agree fully that these are extremely complex investment vehicles. Luckily with the annuity being such a small portion of your portfolio, it hopefully won’t make a major difference in your planning and outcomes.

Best wishes figuring it out!

Chris

There’s always a market for annuities – for people who are unable to handle their own finances, for a variety of reasons. Whether it’s because they are intellectually disabled, they have dementia, they have brain damage due to an incident that happened later in life (an accident, tumor, stroke), they have a spending or other addiction and no self control, or they are a victim of financial / other abuse from a spouse or other person close to them, these types of people are unable to handle their own finances and they are generally better off with an annuity. It’s important to not forget about these types of people and not make blanket statements that it’s never a good idea to buy an annuity. It’s also important not to shame people for buying an annuity because you may not realize the real reasons why people bought the annuity. For example, someone may know full well that an annuity is not the best financial choice but they live in fear of their intimate partner and know that the only way they can guarantee monthly income in future is if they lock away their savings into a monthly annuity–because their partner may steal that month’s annuity but they can’t steal future months, and they are hoping to get away from their partner one day in the future.

EBG,

Thanks for reading and sharing your perspective.

As I noted in a comment above in response to Andrea, these types of scenarios are the best argument for utilizing an annuity. However, these cases you describe also represent some of the biggest challenges as well as the people you describe are extremely vulnerable of being taken advantage of by salesmen that are incentivized to sell the worst products due to the fees they generate (See Nords comment above).

Best,

Chris

Thanks for the article! Was helpful to learn about taxation exchange.

Thank you for the feedback David!

I bought a variable annuity from Vanguard back in 2006. I am now 55 and evaluating what if anything I should do with it. Its current value is just over 6% of my overall net worth. Would it make sense to cash out of it when I hit 59-1/2 and pay the tax, so I can let it grow in my taxable investment account? Or am I better off leaving it and annuitizing it in the future? I am a moderate income earner and my only other tax deferred account is also currently valued about 6% of my overall net worth. Help! I don’t know what to do about this regrettable investment.

Donna,

I wear two hats. One as a financial blogger/educator. I also do financial planning work with Abundo Wealth. You can contact me if your needs justify pursuing this.

In this capacity as an educator, I can not provide any specific advice. Also, it would be inappropriate to try without understanding your entire situation.

What I can tell you is that if you cash out an annuity as a lump sum, you will pay tax at ordinary income rates on any earnings on the annuity + a 10% penalty until you reach age 59.5. So factors to consider are whether you need income this year, what other income you have access to without a penalty, how much gain you have on the annuity (I assume a fair amount after nearly 20 years), the fees on the annuity (probably similar to the one discussed in this post), etc.

Best wishes,

Chris