December 2020 Best Of The Web

We’re in the home stretch. 2020 is coming to a close! I don’t know anyone that isn’t ready to flip the calendar and start a new year. Before we do, it’s worth taking time to reflect on a few things.

This was a pretty average year for the stock market if you only looked at the starting and ending points. But in between, a whole lot happened! We have some thought provoking resources that examine those things and what we can learn from them.

Often perception and reality are not the same. This month’s selections look at the reality of FIRE, Tim Ferriss’ 4 Hour Work Week, personal finance gurus, “making it” as a real estate investor, and remote work arrangements. We also get down to basics to help you do better with tax planning and charitable giving.

Finally, I’ll end the year with some optimism and a special offer from me to you.

An Extraordinarily Ordinary Year

Jonathan Clements shares Twenty 2020 Lessons.

Tyler at Portfolio Charts explains The Fastest Way to Lose Money in 2020.

Many experts have proclaimed the death of the popular 60/40 portfolio. 2020 showed that reports of the demise of this portfolio have been greatly exaggerated. Gregor Stuart Hunter writes The 60/40 Portfolio Is Muzzling Critics With Another Big Year.

Perception vs. Reality

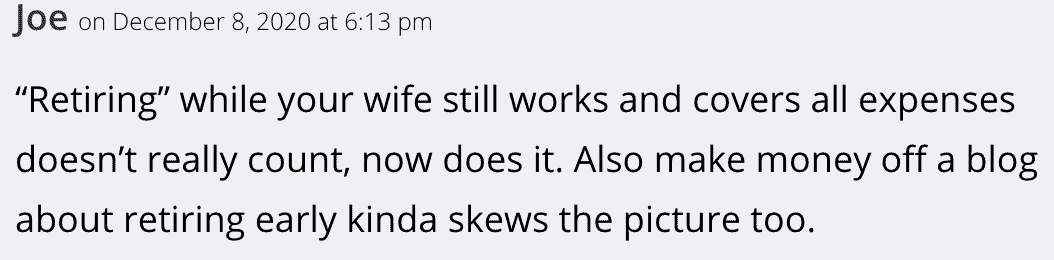

In an effort to help others learn from my successes and failures, I’m as transparent as possible in my writing shy of sharing my social security number, mother’s maiden name, and the street I grew up on. So it is frustrating that people still take time out of their day to leave comments like this one I received just this month.

J.D. Roth addresses this and many other Myths and misconceptions about financial independence and early retirement.

Jeff Haden wrote Tim Ferriss Is No Longer Living the Tim Ferriss Lifestyle. Neither Should You.

Many people start off enamored by the idea of early retirement or literally working four hour work weeks, as popularized in the title of Ferriss’ first book, in order to escape the hamster wheel it feels like we’re running on.

Once we apply these principles and have the mental space to ask bigger and better questions, we start looking for purpose and meaning in life. Many of us find that purpose and meaning by working hard at things that matter to us.

Not meeting others’ expectations of retirement or working more than four hours a week does not invalidate the principles of the FIRE movement or The 4 Hour Work Week. Instead it does exactly the opposite.

The biggest benefit of going down these paths is being able to choose what you want to do with your life. You don’t have to follow any predetermined path, including the one you started down, if you decide to try something different.

Another Dose of Reality

One reason people should legitimately be skeptical of personal finance “experts” is that many are not transparent and they often don’t follow their own advice as Nick Maggiulli points out, writing Rich As I Say, Not As I Do.

Chad Carson is my go to source for real estate investing information, because I know he practices what he preaches. He writes Why The Massive Real Estate Empire You Think You Want Won’t Give You the Life You Imagine.

One thing I’ve been completely transparent about is the fact that while I’ve left my career as a physical therapist, my wife continues to work remotely. This arrangement has many benefits, but also presents challenges. Michelle Schroeder-Gardner sums them up well writing 7 Myths About Work From Home Jobs & What It’s Really Like.

Tax Planning (And A Time To Ignore It)

Mike Piper explains the importance of knowing Marginal Tax Rate or Effective Tax Rate? This is a vital topic to understand before doing any tax planning.

Simple planning to legally reduce taxes is one of my favorite topics. I’ve written about tax planning for early retirement and the amazing tax benefits of semi-retirement.

One time I totally ignore taxes is when doing my favorite method of charitable giving. Christine Benz and Susan Dziubinski make a compelling argument why you should do the same. Why You Should Consider Direct Giving.

Ending on a Positive Note

Three years ago, I introduced myself on this blog with an article titled Hello, I’m Not Mr. Money Mustache. Despite using his name in that click-bait title to draw in readers, there is a lot I admire about him.

Among those things are his masterful use of language, relentless optimism, and charitable spirit. All three were on full display when he wrote Poisoned Just Enough: Why I’m So Optimistic About 2021.

Often overlooked in all the chaos and negative news in 2020 was one of the great achievements in modern human history. Jim Dahle was one of the first beneficiaries as he shared, writing COVID Vaccines and Gratitude.

Let’s Talk

I’ve really enjoyed having the opportunity to talk with a number of blog readers in October and November. After taking a break from doing this in December, I’d like to meet more of you next year. I’ve blocked off an hour a week on Monday afternoons in January to meet with one blog reader (or couple) online to discuss anything you would like to help you on your journey to financial independence. Remember, I can not offer any specific investment or tax planning advice.

If you’d like to chat, and are available on Mondays from 4-5 PM Mountain time, grab one of the January slots on my calendar.

I look forward to meeting a few more of you next month. To everyone reading this, best wishes for a great year ahead!

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Good post as always Chris.

We have been running weekly “office hours” via Zoom on our site to answer questions – it’s been pretty helpful. We think it’s simpler to just have a standing time where a small group can gather.

https://www.newretirement.com/retirement/newretirement-live-events/ (fyi on what it looks like)

Thanks for sharing Steve. I enjoy meeting one on one with readers to get a deeper understanding of who is reading and what their pain points are, but as I move to greater efficiency and involving more people, that is a great idea. I admire all that you do to serve your community.

Hi Chris, your January dates are all full, will you be scheduling any in February? I’m getting very close to retirement or already there depending on what SWR I use, and was hoping to bounce some thoughts about what’s next. – Nancy

This is something I enjoy doing, so I anticipate I’ll keep making time for it in my schedule as long as it makes sense. Keep an eye out in the end of month round up as they tend to fill up very quickly.

Cheers!

Chris

Excellent post, Chris. Always appreciate the work you and Darrow do. Thank you and Happy New Year.

DJ

Thanks and happy new year back at you!

Health insurance, health insurance, health insurance! My wife and I retired early five years ago (56/59) and the biggest issue is keeping our countable income under around 64K. Go over the cliff by $1 and suddenly Obamacare goes from $172 a month to $1,600 a month. Now as you suggest, that is actually plenty of money for regular living since we have no debts, but pretty annoying when you want to spend on a big ticket treat. I sometimes think 80% of FIRE folks are ex-government employees–teachers, bureaucrats, etc. who never have to think about health insurance (for now:)) There are some people like us–not rich and not ex-gove.

Neither my wife or I have been government employees. We think about heath insurance lot. In my experience, most FIRE folks think a lot about health insurance, and it’s a big reason more people aren’t retired in the traditional sense of not working at all for income or benefits. It’s something we’ve covered in depth on the blog. https://www.caniretireyet.com/category/health-insurance/

Regarding being rich, that’s a matter of perspective. I would argue that anyone who is able to contemplate early retirement is rich by the standards of most of the current world’s population. And all of us live in luxury that couldn’t have been imagined even by the most wealthy people in the world a century ago.

That said, linking the ideas of wealth and health insurance, few of us are wealthy enough that a major illness, accident, etc. wouldn’t substantially impact our finances. Without careful planning, these events could destroy all but the most wealthy of us.

Interesting that Tim Ferriss is no longer living the Tim Ferriss lifestyle! It’s true early retirement is about adapting and being able to focus on what matters to you. It’s not about conforming to others’ expectations of what retirement should be. Thanks for all the links to different articles.

Jordan,

I’ve been a big Tim Ferriss fan since reading, not the 4HWW which I didn’t like on the first pass, but the 4 Hour Body. I read it skeptically as a physical therapist upon the recommendation of a patient who told me how great it was. I was pleasantly surprised that it was a great book. I then started listening to his podcast, and I’ve been impressed watching him evolve as a person over the years, rather than being stuck as the “4 Hour” productivity/ life hack guy. It’s an inspiration for all of us to continue to learn, grow, and evolve throughout our lives.

Best,

Chris

Morning!

I retired 11 days ago and it still doesn’t seem quite real. The school year finishes at the calendar end of the year here in Australia, so it still feels like a normal 5-week summer break.

I’ve promised? threatened? to send the staff a photo at 9 AM on term 1, day 1 of me and the dogs on the dog beach while they’ll be in the first staff meeting of the year.

Maybe THEN it’ll all seem real…

Congrats! Enjoy all that comes your way in retirement.

There are no times available in Jan, but the calendar won’t click over to Feb to check there for slots.

Yes. I just go month to month with these depending on what my schedule looks like and to mix it up to give an opportunity to meet with people with different schedules. The time slots don’t last long.

Cheers!

Chis