Use IRS Free File to Save Money at Tax Time

With tax season upon us, it seems like a good time to share a resource that can save you hundreds of dollars on tax preparation and filing fees.

It’s called IRS Free File, and it’s available to taxpayers whose adjusted gross income (AGI) is $79,000 a year or less.

I used IRS Free File for the first time last year and was very pleased with the results. Prior to that, I used Intuit’s TurboTax. Going forward, I plan to stick with IRS Free File.

If you pay a professional to prepare and file your income taxes, IRS Free File may not be for you. But make sure to check out the bonus tidbit about IRS Identity Protection PINs at the bottom of this post; a worthwhile read regardless of your filing strategy.

A Brief Rant

Did it ever occur to you how perverse it is to have to pay to file your income taxes? You either pay an individual to prepare and file your returns or, if you are a DIY filer like me, you pay for an online service like Intuit’s TurboTax.

Either way, you are in effect paying for the “privilege” of paying your income taxes.

In most other countries, income tax collection is a public service. The government provides a web portal where taxpayers can log in. If your annual income matches what the tax authority has on record, you check a box and you’re done.

The U.S. may be the only country in the world that foists such a byzantine tax collection system on its citizens. It is on this complexity that the business models of companies like Intuit thrive.

IRS Free File

Between 2010 and 2021, I paid Intuit a total of $1,155 (an average of $96 a year) to file my federal and state income tax returns using their TurboTax software.

Last year, however, having learned about IRS Free File, I decided to give it a try. IRS Free File is a public-private partnership (PPP) between the IRS and a group of private-sector tax preparation companies. These companies provide free online tax preparation and electronic filing services for eligible filers.

I had become accustomed to using TurboTax to prepare and file my returns, and was reluctant to switch to another product. I trusted TurboTax to handle my non-trivial tax situation accurately, as it had so many times in years past.

As a cost-conscious retiree, I decided to take the plunge. I was massively impressed with the IRS Free File partner I chose, FreeTaxUSA (after all, I reasoned, how good can a free service be?). FreeTaxUSA handled my complex tax situation with ease.

As advertised, I paid absolutely nothing to prepare and file my federal return online, and just $14.95 for my state return (the state return is optional). I plan to use FreeTaxUSA again this year to file my 2023 returns.

Is TurboTax a Scam?

Intuit is conspicuously absent from the list of IRS Free File partner companies. That’s because despite its proclamations to the contrary, Intuit has no interest in providing free services.

In 2022, a multi-state lawsuit accused the company of deceptive marketing practices. Specifically, the lawsuit claimed that Intuit intentionally lured customers by falsely advertising free services, but then charged them anyway.

Rather than risk a trial, Intuit agreed to pay $141 million to four-million customers who were charged for services that were falsely promoted as free.

None of this should be a surprise to users of TurboTax. I consider myself a fairly savvy technology user. Yet every time I used TurboTax to prepare my returns, it was like navigating a minefield of paid extras to get to what I wanted: a bare-minimum, completed tax return.

Even if I did manage to avoid the paid extras, I was still out nearly $100 to file a return.

Who Is Eligible for IRS Free File?

The eligibility requirements vary from company to company, and depend on factors such as your adjusted gross income (AGI), your age, the state you live in, and whether you choose to file a state return.

In general, if your AGI is $79,000 or less, you’ll find at least one partner company that fits the bill. Unfortunately, $79,000 is the maximum for all filing statuses: single, married filing jointly, married filing separately, head of household or qualified widow(er). If you exceed that threshold, you can’t use Free File.

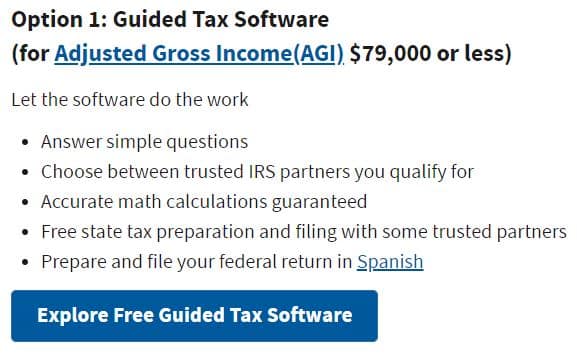

Otherwise, consider taking advantage of this money-saving opportunity. Go to the IRS Free File site and click the big blue Explore Free Guided Tax Software button.

Enter your filing status, age, AGI and a few other bits of information. The site will present a list of Free File partner companies you are eligible for. Set up an account with the company you choose, and you’re off to the races.

IRS Direct File

I should also mention that sometime around mid-March, the IRS plans to roll out its own free filing option for the 2023 tax year called IRS Direct File. In this pilot phase, the IRS is limiting access to taxpayers in just 12 states.

Initially, IRS Direct File be able to handle just simple returns. To be eligible, your income sources are limited to W-2, social security and/or unemployment; and any interest income you received must not exceed $1,500. Also, IRS Direct File currently lacks support for filing a state return.

I only mention IRS Direct File because this program will likely expand its reach in the coming years, and so too its ability to handle more complex tax situations.

Another cost-saving option to tuck away for future reference.

Bonus: IRS Identity Protection (IP) PIN

Regardless of how you choose to file–IRS Free File, tax professional or otherwise–there is a fraud-protection measure you should consider taking advantage of. It’s called an Identity Protection (IP) PIN.

If you read part 1 of my series on cybersecurity, you’ll recall that I suggested freezing your credit reports to reduce the value of your social security number to identity thieves. I added the caveat that, even with this step, your social security number can still be abused by a bad actor; namely, to file a fraudulent tax return claiming refunds or credits.

While unauthorized access to credit reports is the more prevalent problem, tax-related identity theft is on the rise. You likely won’t lose money in this scam, but you can bet it will be a hassle to get sorted out. An IRS Identity Protection PIN will protect you from it.

How It Works

Think of an IP PIN as a second factor of authentication in a multi-factor authentication (MFA) scheme. You include your IRS-supplied IP PIN (a six-digit number), along with your social security number and other requisite PII, to the IRS when you file your tax return.

If your IP PIN is missing from the return, the IRS will reject it. So too if the IP PIN you supply doesn’t match what the IRS has on record.

In this scheme, your IP PIN is an additional something-you-know. Even if an identity thief knows your social security number, without also knowing your IP PIN, he is powerless to file a fraudulent return using your identity. It is essential your IP PIN be kept secret.

The IRS goes a step further; it enforces a one-year expiration date on every IP PIN it issues. This means that each year you file a tax return, you’ll need to obtain a new IP PIN. But it’ll cost you all of 5 minutes to renew.

Final Thoughts

If you are an early retiree like me, you are constantly on the lookout for ways to save money. Somehow, IRS Free File escaped my notice until last year. I felt compelled to share it with those who might also benefit.

Ditto for IRS Identity Protection PINs (shouldn’t good stuff like this be more obvious?). I suppose the IRS can’t possibly match the advertising reach of a private-sector behemoth like Intuit–I sure didn’t catch any IRS commercials during the Superbowl.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[I’m David Champion. I retired from a career in software development in March 2019, just shy of my 53rd birthday. To position myself for 40+ years of worry-free retirement, I consumed all manner of early-retirement resources. Notable among these was CanIRetireYet, whose newsletters I have received in my inbox every Monday morning for the last ten years. CanIRetireYet is one of exactly two personal finance newsletters I subscribe to. Why? Because of the practical, no-nonsense advice I find here. I attribute my financial success in no small part to what I have learned from Darrow and Chris. In sharing some of my own observations on the early-retirement journey, I aim to maintain the high standard of value readers of CanIRetireYet have come to expect.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

David, it’s a pleasure to see a third contributor to this blog who writes clearly and provides detailed information – definitely a good fit. I’ll be looking forward to your future posts. Although my husband and I have a accountant prepare our taxes, we did point our young adult daughter toward Free File when she entered the workforce. It certainly isn’t as well-publicized as it should be.

Thank you so much, Mary.

It’s a pleasure to be here. I look forward to providing quality content in the future, and will strive to live up to the standards Darrow and Chris have set for so many years.

All the best,

Dave

David, check out OnLine Taxes at olt.com. OLT is an IRS Free File option. However, OLT will allow anyone, regardless of income, to efile their federal tax return. OLT will also compute your state and city income tax returns. OLT will efile your state retirn for only $6.95. NO income limits!

Hi Fritz,

OLT (olt.com) is indeed one of the IRS Free File partners. According to the IRS Free File site, the AGI limit is $45K.

However, OLT’s homepage indicates you can file for free if one meets any of the following criteria: AGI less than $45K, or active duty military, OR Offer Valid for ALL AGES and ALL States. This is somewhat confusing, but it appears you may be correct.

Did you file for free with OLT with an AGI greater than $45K? If not, would love to hear from others if this is indeed the case.

Thanks, Fritz!

Sorry, David, I just saw your comment.

Yes, I used OLT and filed federal for free with AGI above that amount.

State is some nominal amount – around ten bucks.

OLT.com will e-file federal for anyone, regardless of income, for free. State returns can be e-filed for free IF meet income requirements. Those above income limits can e-file a state return for $9.95. [Note: the software prepares state and city returns in PDF format for everyone. One can print each and file paper returns for free.]

Optionally, one can choose the Premium option (provides year to year comparisons, live support, etc) for $15.90 ($7.95 + $7.95).

Another data point on OLT, I’ve used them for the last two years. I first used them to file my 2022 tax return via the IRS Free File page and it was free for both federal and state returns. I got a “Welcome back valued customer!” email from them stating this year the federal was free, but the state return would be $9.95. Clicking through their link as well as going to the website directly, yep, $9.95 for state returns.

However, they are still listed on the IRS free file partner page as having free federal/state returns and if you go through that link they both are in fact free. So even the Free File providers aren’t above a little Turbo Tax shenanigans.

Do they import from brokerages on this website?

just a note that OnLineTax is free federal and about $10 for a state. I don’t think there are any limitations. (And agreed that its a shame that theres a whole industry that charges!!)

Anyone can use freetaxusa, no matter the income. At least–I’ve used it for a few years. You can access the site directly.

Ok, Peter has confirmed there is no AGI limit for OLT. Great news–thanks, Peter.

And efg says FreeTaxUSA has no limit, either. I used FTU this and last year, and was very happy with the experience. I linked their site in the post (or just go to freetaxusa.com).

I’m really enjoying your blog. After years of reading it, I’m still finding new things to learn. Thanks!

Thanks for the positive feedback, Suzanne! Glad you are with us.

I’m wondering if any of the free tax filing sites download 1099s and INT forms from financial sites or files that have been downloaded. I used one of these sites several years ago and this convenience was not offered. I really dislike having to enter every tax form manually.

Good point, Karyn.

FreeTaxUSA–the Free File partner I use to file my returns–does not currently support importing tax statements from 3rd parties. I cannot speak for the other Free File partners. Perhaps some do?

I found the following response to this very question on the FreeTaxUSA community site:

“As of right now, we currently do not support that option and do not know when/if we will be, however we are continually adding new features to the software and we encourage you to check back in the future for that option.”

So, yes, to some extent I suppose you get what you pay for, and if it’s worth it to you to pay Intuit for that feature, then it makes sense to pay. For my part, I don’t mind the manual data entry.

Thanks for the feedback, Karyn.

Dave

Thanks Dave, I really appreciate the information you’ve provided here.

Thanks for the article!

David, Just finished e-filing both state and federal returns for free using CashApp. No income restrictions and it appears to support a large variety of tax situations. Have used it the last few years with no problems.

Indeed you’re right. Thanks for the share, Tony.

I’ve also used CashApp the last couple of years, it had been Credit Karma. It is totally free. No e-filing fees for federal or state returns.

Thanks for the great article. I used freetaxusa this year for the first time and it was awesome.

Firstly, you can get an IP-PIN very painlessly after your initial set up with an account w IRS & ID yourself, it may takes about 15 minutes, then the annual retrieve is very easy but IRS will not remind you with email etc, but you can get it around late January or early February by going into your set-up account.

Secondly, in Alabama, you can file your state return for free on their site & you can also setup an alarm if someone has filed your return. They will hold it up if you respond to the alarm if you have not yet file.