Should You Pay Off Your Mortgage?

For those of us who have a home mortgage, paying it off may not be an option. Either you lack sufficient cash, or retiring the mortgage early would leave you cash poor and vulnerable.

Even for those of us who do have the means, the decision whether to pay off the mortgage is unclear. We can come to an approximate answer by comparing the cost of keeping the mortgage to the cost of paying it off, and choose the lesser of the two.

But while the cost of the mortgage is knowable, the cost of paying it off is not. That’s because we cannot know the return we’ll receive by investing the money elsewhere.

Even if the math favors paying off the mortgage, there are a lot of other nuances to consider.

My Dilemma

I bought my house in 2011, financing it with a 30-year, fixed-rate mortgage at 3.75% interest. Two years later, lured by an even lower rate environment, I refinanced to a 7-year, adjustable-rate mortgage at just 2.625% interest. This knocked $212 off my monthly mortgage payments, netting me a savings of 18%.

My rationale seemed sound. In addition to saving more than $2,500 a year, refinancing locked me in to guaranteed cheap money for at least 7 years (an eternity, right?).

Moreover, the fine print on the note stipulated that after the 7-year fixed-rate period expired, my rate could adjust up (or down) by no more than 2% per year, and never exceed a maximum of 7.625%.

This number is quite reasonable by historical standards; quite tolerable, too, I reasoned, should it come to pass. After a decade of rock-bottom interest rates—or more accurately the macroeconomic environment holding them down—many predicted rates would never go that high again.

The graph below helps illustrate how one might be forgiven for making this assumption.

Related: What Are the Financial Advantages of Home Ownership?

Related: Renting vs. Buying: The True Cost of Home Ownership

Adjustment Time

In June 2020 the fixed-rate period on my loan expired. My rate went up, but by less than 1% (to 3.5% from 2.625%). This was the first in a series of annual rate adjustments, which were to be calculated by adding 2% to the 1-year LIBOR (since replaced by SOFR) in the quarter preceding the adjustment.

One year later, in 2021, my rate actually went down. For the next 12 months I would pay just 2.5% interest on my mortgage (was that 2013 refi a stroke of genius or what?).

With 12 years of ultra-low rates in the rearview, there was no reason to believe my rate would ever adjust up again.

No Income, No Loan

All the same, I like certainty. So I decided to refi again, this time to a 15-year, fixed-rate mortgage at ~2.5%. Such was the rate being offered in the summer of 2021.

Trouble is, I was a retiree, and 98% of the mortgage lenders out there couldn’t wrap their heads around lending to a zero-income borrower, even if that borrower had more than enough assets to make good on the loan. I submitted one application after another. Each was summarily dismissed.

What of the 2% of lenders that would work with me, those that would make me a so-called asset-only loan? Well, they wanted to charge me a ~1% premium for the privilege.

I punted, reasoning that as long as rates didn’t go up, I could continue to ride the low-interest gravy train, maybe even for the duration of my existing loan. Again, this was an understandable—if not altogether rational—expectation after a decade-plus of ultra-low rates.

Related: Getting a Mortgage When You Have Assets But No Income

The “I” Word

Then came 2022, and we all know what happened next. Inflation reared its head in a big way, and forced the Federal Reserve to raise short-term interest rates, fast and by a lot.

This resulted in two consecutive years of 2% increases on my mortgage (remember, this was the maximum annual increase guaranteed by my lender), pushing my rate up to its current level of 6.5%. Now I’m facing another rate adjustment, to the 7.625% maximum, in June 2024.

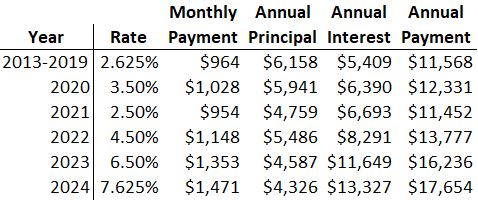

Here’s a table that paints the picture more concretely. It illustrates the effect of moderate rate increases on the actual cost of my mortgage.

For the first 7 years of my loan—the fixed term, lasting from 2013 to 2019—I paid $964 a month on my mortgage. I’m currently paying $1,353 a month and, as of June 2024, I will be paying $1,471. That’s an increase of 53%, which equates to $507 a month ($6,086 a year) more than what I paid during the fixed period of my loan.

What’s more, the higher my rate, the greater the proportion of my monthly payment that goes to interest, not principal. So much for thinking 7.625% would be a tolerable rate.

A Wider View

It’s instructive to note that this is very much the situation facing a lot of businesses in the U.S., and is precisely the pain the Central Bank aims to inflict when it increases the federal funds rate.

The upshot for businesses is that they spend less money. After all, when you’re spending more on debt service, you’re spending less on other things. This cools aggregate demand, thereby bringing the overall price level down (or so goes a half-century of macroeconomic theory).

For businesses, this means less investment in plant and equipment, and maybe even layoffs. For people like me, it means fewer dinners out, and thinking twice about that trip abroad. By hurting businesses and individuals alike in this way, the Fed hopes to wrestle inflation back down to a reasonable level.

Here’s a graph of the Fed’s policy rate dating back to 1970. If you compare it to the one above, graphing the average 30-year mortgage rate over the same period, the correlation is unmistakable.

I try to remind myself that low inflation in the long term is likely worth some pain in the short (but I’m a silver-lining kind of a guy).

Retire the Mortgage?

Why don’t I just pay off the mortgage? Great question! And one to which I have given a lot of thought lately.

Paying off my mortgage would be akin to making a substantial investment in a particular asset class—namely real estate. It would also represent a significant reallocation of my retirement portfolio. At a 7.625% return on investment, I admit it is a tempting prospect.

Consolidation of Risk

But paying off my mortgage has downsides, and not an inconsiderable amount of risk. For one thing, that real estate investment represents a single point of loss.

What if my house burns down? Yes, I’d get money from the insurance company, hopefully enough to rebuild a habitable structure where that smoking hole used to be. But how can I be sure?

Maybe I’d just walk away with that insurance money and become a renter. This would amount to a huge loss on my real estate investment. In this sense, paying off the mortgage seems to me like a dangerous consolidation of risk.

Liquidity Risk

Then there is liquidity risk. Paying off the mortgage would tie up a boat load of otherwise liquid capital I might need for unforeseen circumstances; say a new car if my existing one gives up the ghost.

I’d be forced to sell other assets to generate cash, potentially at a loss.

Related: 3 Bad Financial Decisions That Helped Me Retire Sooner

Tax Implications

Short Term

What about taxes? In order to raise cash to pay off the mortgage, I’d need to sell assets–i.e., stock and bond ETFs and/or mutual funds–in either my brokerage account or my IRA. Either way, this could result in a substantial, one-time tax liability.

And if the sale results in a capital loss? Then I’d have to think hard about selling at a loss assets intended to fund my retirement.

Also, as a recipient of ACA subsidies and cost-sharing reductions, I would lose the majority (if not all) of those benefits in the tax year I sold the assets. I lean heavily into ACA; in fact, without it, I would not have felt comfortable retiring as I did at age 53.

Long Term

The picture brightens a bit when I consider the long-term tax implications of paying off the mortgage.

My retirement income strategy amounts to withdrawing a fixed amount from my brokerage account monthly, and maintaining a cash cushion in that account of about a year’s worth of expenses. In order to maintain that cushion, I sell stock and/or bond ETFs periodically at the long-term capital gains rate.

With the monthly mortgage payment gone, I’d have to sell fewer assets to maintain my cash cushion. This would have the effect of lowering my tax liability in the years after that first-year tax hit.

Interest Rate Risk

What about interest rates? What if they come back down, say by a lot? Then the return on my investment is no longer anywhere near the 7.625% I booked when I paid off the mortgage, and by then it’s too late to do anything about it.

Psychological Implications

The allure of being completely debt-free is powerful. Some might be reading this and think, boy, if only I had the cash to pay off my mortgage, I’d do it in a heartbeat!

You can’t put a price tag on quality sleep. If paying off the mortgage allows you to sleep better at night, the financial costs may be worth it.

Upshot

The decision to pay off a mortgage is not as clear-cut as it may seem. Even if you can afford it, there are myriad factors to consider. Many of these will depend on the particulars of your financial situation. Each must be factored into the equation, and the return assumptions on paying off your mortgage adjusted accordingly.

For my part, I have decided not to pay off my mortgage…at least not yet. I am betting that interest rates will come down sooner than later, thereby reducing my monthly mortgage payments. If/when that happens, I’ll revisit a refi. Conversely, if by 2026 or 2027 I’m still paying 7.625%, then I’ll revisit a payoff.

Mistakes

Some might argue I made a mistake taking an adjustable-rate loan in the first place. I might agree. But that is water under the bridge. There’s nothing I can do about it now, and I’m not going to waste brain cells dwelling on it.

More pertinent (and irksome) to me was giving up so easily on my efforts to refinance in 2021. In hindsight, that 1% premium asset-only lenders were going to charge me looks like a bargain.

I’d be paying ~3.5% on a 15-year fixed-rate loan now, instead of the 6.5% (soon to be 7.625%) I’m paying on my existing loan. Blindly assuming rates would stay low forever was a mistake, and that bad assumption is costing me now.

Part of my decision to punt on the 2021 refi was just plain laziness. I mentioned I like certainty. But I traded the certainty of a fixed-rate mortgage for the convenience of not having to deal with one or more asset-only lenders; notably all the ceremony that accompanies a mortgage refinance–gathering bank and brokerage statements, signing documents, getting appraisals, dealing with third parties, and so on.

Going Forward

Rates may indeed come down again, thereby nudging my mortgage back down to a reasonable level. Even in the best-case scenario, that is not likely to happen any time soon.

The Fed has indicated it intends to cut its policy rate in 2024, perhaps as many as three times. But it takes a long time for the federal funds rate to ripple through to the longer-term rates that affect mortgages.

Silver-lining guy that I am, in the meantime I’ll do my part to tame inflation by spending less money on other stuff.

What Do You Think?

Do you have a mortgage? If so, have you thought about paying it off? What factors did you consider that I didn’t?

Feel free to share your insights in the comments below, so that I and others might learn something from your perspective or experience.

Programming Note

I will be rafting the Colorado River the day this post gets published, which means I won’t be able to read or respond to your comments until after I get back later this month.

Please do not let this discourage you from leaving a comment, however, and/or discussing this topic amongst yourselves.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[I’m David Champion. I retired from a career in software development in March 2019, just shy of my 53rd birthday. To position myself for 40+ years of worry-free retirement, I consumed all manner of early-retirement resources. Notable among these was CanIRetireYet, whose newsletters I have received in my inbox every Monday morning for the last ten years. CanIRetireYet is one of exactly two personal finance newsletters I subscribe to. Why? Because of the practical, no-nonsense advice I find here. I attribute my financial success in no small part to what I have learned from Darrow and Chris. In sharing some of my own observations on the early-retirement journey, I aim to maintain the high standard of value readers of CanIRetireYet have come to expect.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Hi David. This is a great discussion about what to do about your adjustable rate mortgage. I agree you should have tried harder to refinance. A relative of ours who is retired and on SS and in her 80s was able to get a mortgage last year when she bought a new house, believe it or not. She paid it off when she sold her old house. She had investments also. This saved her from having to sell as many of them.

In your situation, I hope you are also prepaying principal as much as you can. We did this when we moved in 2015 and wanted to be mortgage free by retirement. My spouse made an interactive amortization chart and bookmarked it on our computer. We made a promise to each other that any extra money we were fortunate to receive, we would put on the mortgage. When we did this, I entered the payment in the amortization chart and it was amazing to see the principal amount go down. It was very motivating, and I would highly recommend doing this. We paid off a 10 year, $100k mortgage in 3.5 years.

David, lastly I wanted to say thank you for being honest about your situation, I think it will give people a lot to think about.

It’s your home. Pay it off. When some awful and unexpected event occurs in your life, at least you won’t be homeless.

This is a tricky decision with a lot of hard to quantify risks. I sold my paid off home recently and now I rent in another town but am considering buying. If you do decide to pay off the mortgage, how do you adjust your budget going forward? Your mortgage payment goes away and the money reallocated should be in an appreciating asset. Do you still feel it’s appropriate to continue using the same 3.5-4% rule? I am facing that dilemma now when deciding to buy a house. Thanks for the article.

Thanks for discussing your mortgage saga. At my spouse’s urging, we paid off our mortgage early and I am happy we did. It seemed that as soon as we did our property taxes increased as did other expenses while our income declined when I retired at 60. It gives us peace of mind and there’s no price you can put on that.

We paid off our mortgage not quite a year before I was downsized and decided to retire back in 2019. We had a low interest 10 year loan at 2.85%. We always called the house our albatross. We paid it off and haven’t looked back. Was it the perfect play? No, not even close. I should have bough NVDA but who knew? Anyway, I wouldn’t change a thing. If I need a loan I can always go get one. Don’t let perfect be the enemy of good (good enough).

Your last line is perfect!

Thanks for sharing your story and the difficulties you’ve had with your mortgage. In 2017 when the tax laws changed, we decided to pay off our mortgage since we would be using the standard deduction going forward, but mainly for peace of mind. Years earlier, my dad paid off his mortgage before retiring for the same reason. It was as though he gave me permission to do the same.

When I reached 60, I was worried about being laid off, since my sister and her friend were laid off at age 58 and 60. Not having a mortgage helped me sleep at night. I never did get laid off, but who knew?

I agree with Chris that it’s worthwhile prepaying the principal. I kept the ‘before’ and ‘after’ amortization schedule as an incentive of the thousands we could save by prepaying.

We were able to get a mortgage based on assets after we retired. Our best options for such were with Rocket Mortgage and a local lender with people we had known for years. We went with the latter for 2.875% for 30 years in 2020, so seemingly with no penalty. They did require that we automatically funded our bank account from brokerage every month. I initially didn’t like that, but in hindsight has been working well to manage our cashflow. We planned for enough down payment to avoid mortgage insurance premiums, and borrowed an amount that fit our desired cashflow while having “no income”.

ACA premium subsidies weren’t an issue that year, as we were still on my wife’s cobra insurance through the end of the same calendar year.

We also did this type of “retirement” loan. I cancelled the auto withdrawal after 1 time… and we were in the house. Though it was required for signing the paperwork- there was no fine print that I had to do this forever. I wanted control over when I sold, so you may see if you can do the same.

Many lenders don’t know how this type of loan available. We had no penalty either. We financed through a builder, and I had to actually show them this type of loan exists.

I faced the same dilemma as you when I refinanced a 30 yr fixed 6.25% mortgage to 3.25% at the bottom of the post-Great Recession interest rate drop ending in the Fall of 2012. Planning to retire in a few years and not sure if we would sell the house and relocate to another state thereafter, I seriously looked at a 10 year adjustable rate mortgage, figuring it would take 2 years worth of post-term adjustments to wipe out the interest rate savings versus a 30 yr fixed. In the end, the uncertainty of our moving out of state within that 12 yr breakeven period drove me to lock in the low interest 30 yr fixed mortgage (helped me sleep a little better). Now at that 12 yr mark, we’ve happily decided to stay put so I have no regrets about my decision.

Would you mind elaborating on this for someone who is not from the US?

it would take 2 years worth of post-term adjustments to wipe out the interest rate savings versus a 30 yr fixed

I am 5 years from retirement and paid off my mortgage 4 years ago. There was no way I would have a mortgage in retirement much less a variable rate mortgage. While you did better than anyone could have expected in 2013, you are now fully engaged in the downside risks of these financial products.

What you should have done back in 2011 or 2013 was get a 15 year fixed rate mortgage. You’d almost be done now and not dealing with interest rate fluctuations.

What to do now is just double up on your payments and get this paid off as quickly as possible while also minimizing your taxes on selling stocks. This will also lower your future interest payments when your mortgage adjusts again in the future.

Your concerns about concertation risk are not quite right. You own the house. It just has a lean against it. You cannot just take the check and walk away. The bank is going to want to get paid. Your town will also not like it that you walked away and left a mess. Good chance, they will at a minimum want the lot cleaned up. If you didn’t want this risk, you should not have bought the house to begin with.

Pay it off! If you do you will have much more control over your future finances. You’ll have less concern about:

1. Future rate increases,

2. What mortgage company may or may not want your business,

3. Monthly expenses.

Not to mention overall peace of mind. And if an emergency or unforeseen situation requires you to need more money you can consider a home equity loans or reverse mortgage.

Do you not have to pay what you owe to the bank if the house burns down and you haven’t paid off the mortgage?

What’s the financial difference between the house burning down with the mortgage paid off or not?

Our mortgage is less than 4%, got it in 2019, 30year fixed. Have been paying extra principal since that’s a 3 point something return on the money when CDs were paying nothing. Not in a hurry to reduce the total loan and have been able to take the payoff date down to 2034 or something like that with this approach, not too cash poor or too house rich.

Pay it off, ya silly! If you’ve been paying the principal down for 10+ years, you’re likely not in a terrible spot. Ideally pay it off entirely over the next couple of years if ACA is the hinderence. Your home is not just an asset, like a stock, it is first and foremost your shelter and the shelter of your life-partner/animals/kids. My home is my safe place, for example. Namaste and all that – I have to consider the emotional benefits of my loved ones sometimes and not just the very bottom $ line. What a gift – to rest your head inside of a place that you 100% own.

Anyyyywho: I think you are tricking yourself into what I recognize as comfortable inaction by going off into the “it could burn down, anyways” territory and moving on with your day.

That said, I appreciate and applaud your overall efforts at frugality.

I still have about 5 1/2 years left on a 3.75% 15 year mortgage I took out to buy my summer cottage. I’m not paying it off early because at this point what I’m paying is almost entirely principal, so I’d be giving up the interest I’m currently earning on that money and not saving any interest on the loan. (In fact, with inflation the value of the principal I’m paying off is decreasing, making it an even easier decision.) And as in the article I’d either be taking money out of my retirement accounts and thus having income that throws my ACA subsidy away, or else lowering the amount I have in my non-retirement accounts and making myself nervous about not having as much of an emergency cushion! Not sure if my thought process would be different if it was my full-time home but I don’t think so.

I guess each person’s situation is unique but we try to apply a fixed universal principle to each issue. The “pay off mortgage before retiring” was the principle I practiced before I retired, using a 15 year fixed loan. I retired in 2015 at age 63. I came late to this retire-early strategy. But I strategized that I did not want to pay debt while I was retired. However, my retirement calculation did show that at some time in my 80’s I would need to tap the liquidity of my home asset to fund anticipated higher health expenses and/or increased living expenses that, lacking a pension, my SS and 401-k would not fully fund. Last year, at age 70, I had an opportunity to sell my home of 25 years for a profit. Simultaneously, I purchased a new home in a 55+ community with a builder-financed mortgage. The new home cost slightly more than what my previous home sold for so I had to make up the difference either by selling investments or taking a mortgage. As a retired accountant, I analyzed this situation and chose the latter. In fact I took out a mortgage for more than the difference, providing me more liquidity from this fixed asset. I am investing these extra funds to offset the cost of the debt. I do have a small tax benefit for the interest deduction. So my strategy changed from a “fully paid off mortgage while retired” to this peace of mind to have more liquidity now, rather than having to go through all that real estate sale work and time again. And, looking “long” range, I probably will not own this house as long as the term of the mortgage. Yes, there is some cost with this new strategy, but I think it suits my unique situation in my life. Therefore, you do You, “silly,” whether it is to have a mortgage or not. The “no mortgage” rule does not have to be “fixed” in your retirement and/or life strategy.

We have a 2.75% fixed rate loan. We can handle payments well. It would be nice to pay off the mortgage, but the only reasonable sources we have are either a Traditional IRA or Roth IRA withdrawal. The taxes resulting from the former would be substantial. Main benefit would be lower RMDs, but this isn’t a big factor for us. The latter is primarily for our beneficiaries and since they will also inherit the home at a new basis, their doesn’t seem to be a benefit in raiding Roth to pay down the loan. Feel either account will do better than 2.75% mortgage rate. Sitting tight at this point.

For me, the answer to this question was yes. It was yes so that I could have a roof over my head in early retirement with a 50% reduction in income. And, it continued to be yes when I sold my condo and purchased one which cost more, which required a withdrawal from retirement funds. I had a mortgage on the second condo for 1 month. I am a saver. I live below my means. I am debt free. This means more to me than anything.

We spent the first 15 years of our retirement living and traveling in our 40′ Diesel Pusher Motorhome. Then, in Aug 2021, we decided to get off the road and buy another sticks and bricks. We found a place we liked in Lead, SD and at a price we liked, $285k. But then we had to decide whether to pay cash and pull that lump sum out of our portfolio or take out a mortgage. Since I was a vet I was able to obtain a VA Loan at 2.75%, no money down, and no PMI. So that’s what we did. The mortgage will mature in 2051 and I will be 101 years old. 8^)