Using Real Estate to Retire Early

I connected with real estate investor, entrepreneur, writer, and educator Chad “Coach” Carson in 2015 when we were both getting into blogging about financial independence and retiring early (FIRE). We’ve developed a friendship around our similar values, family situations, and philosophies for life. We also are in a similarly fortunate financial situation early in life. However, our paths to FIRE could not have been more different.

Chad took a path of entrepreneurship and used real estate as his primary investing vehicle. I took the path of getting a professional job, saving a high percentage of income, and investing in paper assets.

Chad took a path of entrepreneurship and used real estate as his primary investing vehicle. I took the path of getting a professional job, saving a high percentage of income, and investing in paper assets.

We also approached retirement differently. I worked full-time as a physical therapist until I reached financial independence, then left my career. Chad embraced the idea of “mini-retirements” and developed systems enabling him to step out of his business for extended periods. This includes recently returning from 17 months living in Cuenca, Ecuador with his wife and two young daughters.

I asked him to share a different perspective on careers, investing, and retirement. If you enjoy his perspective as I do, subscribe to his blog at coachcarson.com and pick up his recently released book Retire Early With Real Estate.

1.) I frequently write and talk about the need to redefine retirement. How do you define retirement? Would you consider yourself retired now? If not, do you desire retirement and what do you envision being different when you retire?

My definition of retirement is reaching the point where your wealth pays for your bills instead of your 9-to-5 job. But it’s not just a final destination for me. There are also many fun sub-milestones along the way.

For example when I was 29, my wife and I stopped working and took a mini-retirement for four months. We lived on some passive income and some savings.

We weren’t fully retired at that point, because we couldn’t continue that financial pattern forever. But we had certainly moved up the retirement mountain and had more freedom.

More recently my wife and I moved with our two young girls (3 and 5 at the time) to Cuenca, Ecuador. At this point our expenses were completely covered by passive rental income, so our situation met a more traditional definition of retirement.

But at 38 years old with a long time horizon and many uncertainties ahead of me (like health insurance), I’m not just sitting around doing nothing. I still plan to build more wealth and occasionally earn some income from work. I also plan to stay flexible with our expenses as needed.

Most of all for me, however, a redefined retirement means building a wealth of time to do what matters most. And that has been the most rewarding part of the retirement journey.

2.) You’ve taken a different path to FIRE than Darrow and I write about on this site. What are the advantages of using real estate as an investment vehicle rather than paper assets (stocks, bonds, mutual funds, etc.)?

I find that real estate gives you a larger amount of control over your path to financial independence and retirement.

This is true because real estate is part entrepreneurship and part investment. Especially early on, it’s very active. You have to get involved, learn, make decisions, and manage other people.

Later, however, it can become much more passive and investment-like. As you build a team and systems to operate the day-to-day activities, you can step back and enjoy your free time.

For some people this active nature of real estate is a negative. But for others, it gives you a sense of control over your financial destiny. Instead of waiting for the passive market to produce returns, you can get involved, choose properties, improve them, and earn above-average profits that move you towards retirement sooner.

Related to this, real estate produces income returns at above average rates. Even without leverage, I regularly see conservative rental properties with between 5 to 10% income yields.

This high income allows real estate investors to live off their assets without eating into principal, and that allows them to be much more resilient through future economic ups and downs. I use this income a lot like Darrow recommends as an income floor during retirement.

3.) What are the biggest challenges you’ve faced as a real estate investor?

My first big challenge came when I got started. It was very difficult to find good deals.

The year was 2003, and the market was heating up (much like in 2018). So, it took me six months of searching EVERY day (and constantly reconquering my self doubts) before I finally found my first deal.

Once I found those first few deals my confidence soared and things got easier.

Later in 2007 I faced my second and much bigger challenge. My business partner and I grew aggressively (too much as it turns out), and we were left holding a large number of leveraged properties just as the market began it’s record downturn.

We had periods of negative cash flow for a year or two because of many vacancies, turnovers, and unexpected repair expenses. Luckily we had saved large cash reserves beforehand, so we were able to draw on them. We also had long-term financing, which allowed us to ride out the storm.

That period was a serious test, but we made it through. We learned a lot about the risks of fast growth and debt. And we also learned the importance of flexibility as a core strategy to survive (and even thrive) during economic uncertainty.

4.) How many properties do you currently own and manage? What systems have you put in place that enable you to have the control over your time to leave the country for over a year while your business keeps running?

I have a 50:50 business partner, and together we own 90 units. This includes some small multi-unit buildings with 12, 4, and 2 units each.

About ⅔ of these units we manage “in-house” with a bookkeeper/administrative assistant and a handyman. We trained these key people to do most of the day-to-day activities. We also have a third party property management company managing the other ⅓ of the units.

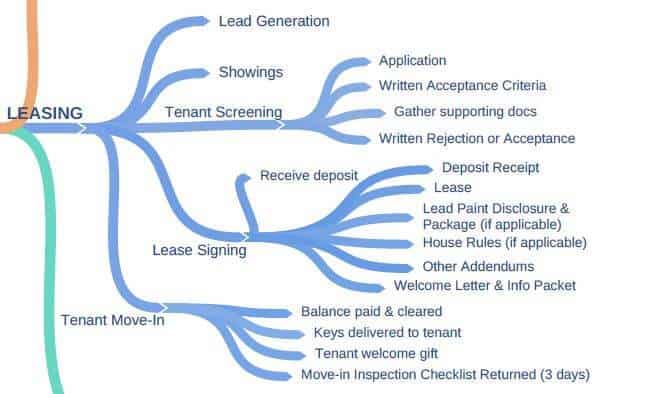

Most of our systems revolve around tenant attraction, screening, management, and turnover. I wrote all about the specifics in detail in Landlording 101 (or How I Managed 90 Units From Another County).

Most of our systems revolve around tenant attraction, screening, management, and turnover. I wrote all about the specifics in detail in Landlording 101 (or How I Managed 90 Units From Another County).

All of our systems together form an operating manual that we have used to teach and hand off key functions to others. That has allowed me to step back and spend time on other interests, like travel, writing a book, and volunteering my time.

5.) You’ve written and talked extensively about using “house hacking” as an entry to real estate investing and as a way to accelerate your path to FIRE? Can you briefly introduce the concept to our audience and describe the ideal candidate to utilize this strategy?

House hacking is a strategy to turn your principal residence into an investment. You essentially live in one part and rent out extra space. This extra space could be extra bedrooms, a basement apartment, or extra units of a small multi-unit apartment building (like a duplex).

I love this strategy because it’s a simple way to get into the rental business while simultaneously reducing your cost of housing.

For example, one of my first homes was a 4-unit building. I lived in unit #2 and rented out the other 3 units.

My mortgage payment (including taxes and insurance) was under $1,000 per month. And my rent from the other three units was $1,200 per month! Even allocating money for maintenance and vacancies, I was living for free!

My mortgage payment (including taxes and insurance) was under $1,000 per month. And my rent from the other three units was $1,200 per month! Even allocating money for maintenance and vacancies, I was living for free!

Not every house hack deal will be this good, but even covering 25% or 50% of your housing expense is a BIG deal. And once you live there for a couple of years, you are free to move out and keep the property as a rental.

Doing a few house hacks early in your wealth building can set you up with solid rentals for life! It’s why I try to tell every 20 or 30-something who will listen to give this strategy a try.

But even those starting later in life or those who don’t want to live next to tenants can do a variation of the house hacking plan. I call it “live-in-then-rent,” where you live in a regular house and later keep it as a rental. The key is to buy a simple house that will make a good rental after you move out.

6.) Most of our readers are in their 40’s to 60’s, already have substantial assets, and are approaching the retirement decision or are on the other side of it. What would be the benefits of adding real estate to diversify their investments? What would be the best strategy or strategies to get into real estate at this stage in the game?

I think the primary benefit of real estate for those in their 40s and 60s is income. Real estate can provide a steady, conservative, and possibly increasing income stream to supplement other assets.

If you’ve already arrived at financial independence, I recommend staying very conservative with your financing. For example, my blogging friend at ESIMoney paid all cash (i.e. no mortgages) for several rental properties while in his 50s. They now provide enough income to pay for his family’s financial needs.

If you want to buy rental properties, it’s also critical to build a good team. It starts with a real estate agent to help you find deals. Then a property manager will help you find and manage good tenants. And a list of reliable repair contractors (handyman, plumber, electrician, roofer, etc) will give you peace of mind and help with inevitable repairs.

For those who want an even more passive experience, you can also begin by loaning money to other rental or fix-and-flip investors. I have begun doing this more, and it’s possible to receive reasonable or even high returns with very little time invested.

The risk of making loans is that you may have to take the property back if the borrower stops paying. So, always make the loan assuming that will happen. This means you want to keep your loan to value ratio very low (65-70% max) to provide a large margin of safety. If you wouldn’t be excited to own that property, don’t loan money against it!

7.) One of my biggest limiting factors to getting into real estate is a debt aversion. Is this a healthy fear, or do the pros of using leverage outweigh the cons in your opinion? Are there strategies you recommend for investing in real estate without debt?

I have used debt extensively while building my real estate portfolio. But I have real estate friends who have used no debt. They both work!

My recommendation is to follow an investment strategy that suits your personal risk tolerance. If debt keeps you up at night, just find a way to invest without debt or with less of it.

For example, I wrote about the All-Cash Plan where you can build wealth in real estate with no debt. You typically have to buy lower-priced properties to make it work. But the final result is very similar to more debt filled plans.

If you already have assets, raising the cash for real estate may not be an issue. But it can be challenging as a new investor to save up enough cash to get started. That is the case where I think safe debt can make sense. But eventually paying off that debt to build a portfolio of free and clear properties is a smart, low-risk retirement goal.

8.) You recently released your book, Retire Early With Real Estate. Who is your target audience? How does your book differ from other real estate investing books?

My target audience for the book is anyone who wants to use real estate in part or whole to retire early from the grind of a 9-to-5 job.

Most real estate investing books do a good job of explaining details of a specific real estate strategy or two. But many of them miss the big picture of how to use those strategies to achieve financial independence and retire early.

I tried to include both the details AND a big picture map of how to use them.

When you read the book, I guide you step-by-step through the process of starting, growing, and then retiring with a real estate portfolio. Darrow’s book Can I Retire Yet was actually a big inspiration for my own advice. I borrowed some of his concepts, like an income floor + upside investing, and showed how it could be applied using real estate.

I also interviewed 24 other investors who used real estate to retire early. So you can learn from and be inspired by their real-life stories.

My Take Aways

Many people have limiting beliefs around real estate. I know because I was one of them. Chad’s work opened my eyes to many opportunities that real estate investments can provide which can help you retire sooner. “Coach” Carson focuses on teaching core principles which can then be applied in a variety of situations.

I asked about “house hacking” knowing it is unlikely that many people in this audience would be attracted to a “classic house hack” as Chad started with. However, the concept that your house can be a source of income is powerful for many people at different stages of life, and it has many applications. This concept helped my wife and I feel more comfortable purchasing our new home due to income potential as an Airbnb. This allowed us to downsize our primary living space as we desired, while having a place to host friends or family for prolonged periods which was also important to us.

We also did the inverse of Chad’s suggestion, doing a “rent-then-live-in.” We got the idea (and courage to try it) after talking to Chad and his wife about their plans to rent out their primary residence while traveling to Ecuador.

Thanks to Chad for the thought and effort that went into answering these questions. If you want to learn more about using real estate investments to retire sooner and have more time to do what matters to you, check out his new book Retire Early With Real Estate. If you have specific questions or comments for Chad, leave them below.

* * *

Valuable Resources

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers.

Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.