My Favorite Retirement Calculators

I’ve used many retirement calculators. More than 80 at last count. I relied on the best retirement planning tools to project my own retirement trajectory, culminating in early retirement at age 50. Then I started this blog and began reviewing retirement calculators.

Over time, these posts have become the most popular on the site. I’ve recently updated my best retirement calculators list — the most comprehensive survey of retirement calculators available.

Despite their shortcomings, retirement calculators are essential tools in preparing to leave a career. Nobody, not even a highly compensated financial advisor, can foretell the future. Projections from a retirement calculator are the best we’ve got.

Just remember, a good retirement calculator is a set of binoculars, not an autopilot. It will give you some visibility into the future, but you still have to drive yourself there….

The Best Retirement Planning Tools

Retirement calculators come in all flavors. There are calculators with sexy, dynamic web interfaces. And there are spreadsheet-based calculators with dowdy, tabular interfaces perfect for geeks.

There are simple, fast ones that will analyze your retirement savings in a few minutes. And there are sophisticated personal financial models that will attempt to optimize your retirement withdrawals decades from now.

After all the years, all the reviews, and all the number crunching, I find myself returning to a small subset of favorite high-fidelity retirement calculators. These are the “best of the best” retirement planners when I need to perform detailed financial modeling.

When you’re ready to dive deeper into your own financial picture, perhaps one of these will be perfect for you too. So here they are, in the order I discovered them:

Flexible Retirement Planner

Not long after starting this blog, I began reviewing retirement calculators. I came across a single high-fidelity tool friendly enough that I could recommend it to anyone who wanted to do their own in-depth financial planning. The Flexible Retirement Planner impresses with its simple, clean, and professional user interface, married to a sophisticated financial model.

For years, when I thought of the ideal interface for powerful financial modeling, I looked to the Flexible Retirement Planner first. That it is offered freely for non-commercial use, runs on the web and major desktop platforms, and comes with excellent documentation, are added bonuses.

Originally offered only on the web, The Flexible Retirement Planner is now available in download versions for desktop use. Its use of Java can sometimes lead to configuration issues. Once the software is running, it is generally an easy and reliable tool to use.

The Flexible Retirement Planner is a near-perfect mix of simplicity and power. It starts with one input screen, where you can quickly generate results. But flexible financial events and simulation options are found under the hood. It also has very attractive and well-organized graphical and tabular output.

The Flexible Retirement Planner is missing historical simulations. It uses Monte Carlo by default, which can also be configured for average return. It was one of the first calculators to offer variable spending policies.

The Flexible Retirement Planner remains a finely crafted and well-balanced tool. It is mature software now and development has slowed. However, thanks to its simple, general design, I expect it to remain a viable planning tool for years to come.

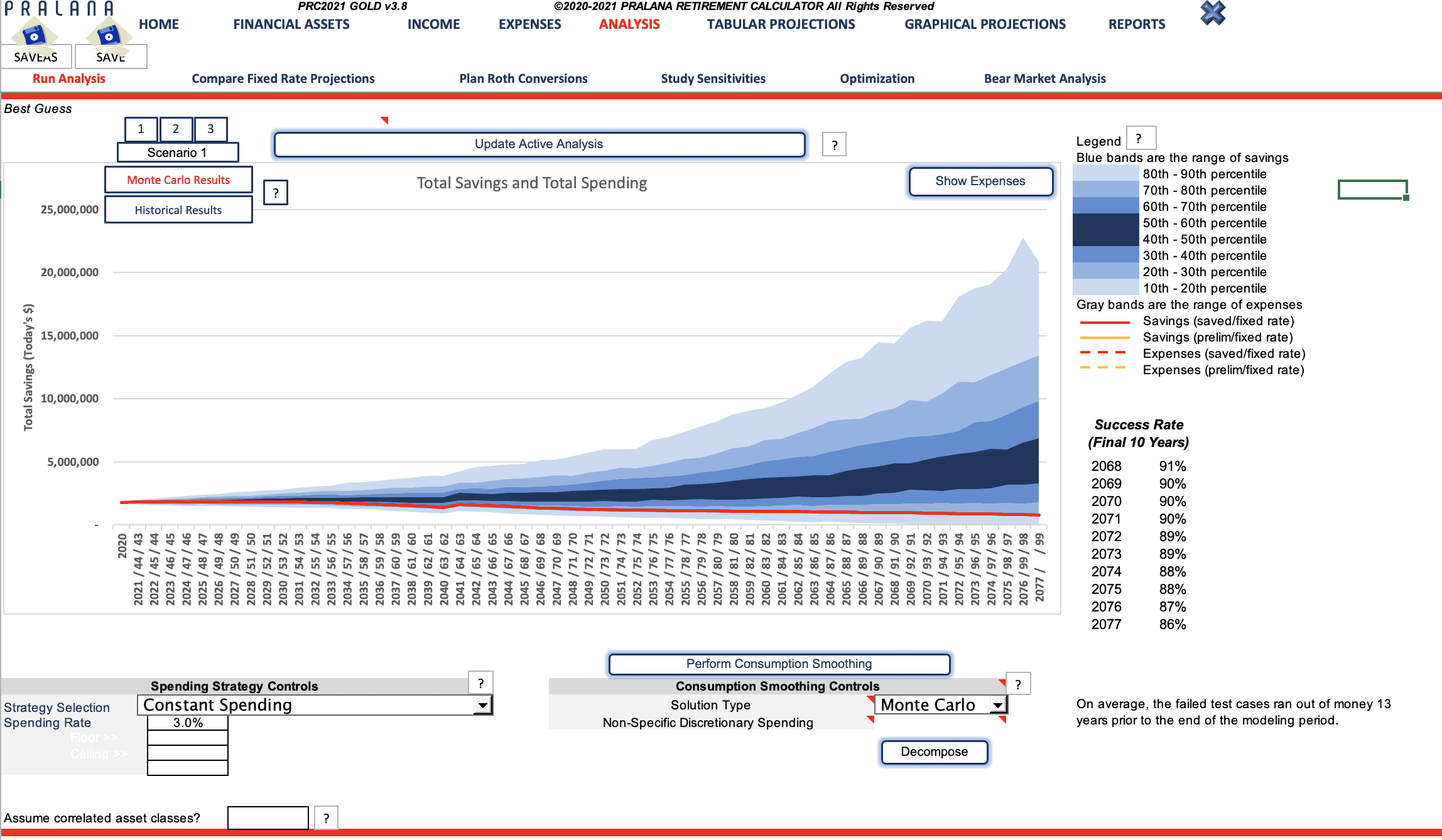

Pralana Bronze and Gold

In the fall of 2013 I received a detailed letter from a retired electrical engineer who, it soon became apparent, might be the only person in the world to have spent more time on retirement calculators than me! This was Stuart Matthews of Pralana Consulting.

He had been hard at work on the financial simulation technology that has grown into the PRC product line. PRC2021/Gold is the latest version of his flagship offering. It is very likely the most powerful retirement calculator on the planet right now.

The PRC calculators, created using Microsoft Excel, will run on either the Windows or Mac platforms. The user interfaces are efficient and functional but don’t have the polish or snap of the latest web and desktop software. Generally speaking, the products will be appealing to more technical users.

However PRC/Bronze, available via free download, could be the easiest to use high-fidelity calculator on the market. It offers three simple input screens and generates long-term results that closely match those of PRC/Gold.

PRC2021/Gold is by far the most powerful tool in the Pralana lineup. In addition to the numerous existing features, the latest version adds the following:

- The ability to automatically optimize Roth conversions to determine the best conversion percentages and tax-bracket limits to use to maximize lifetime savings,

- The Roth conversion optimization process takes into account ACA subsidies and user-specified IRMAA limits to prevent optimized Roth conversions from excessively driving up your medical insurance costs in early or traditional retirement,

- Detailed income tax calculations (using 2021 tax tables), and

- Modeling of Home Equity/HELOC Loans.

PRC2021/Gold can also create an immediate annuity from a tax-deferred savings rollover, and model rental properties, investment loans, and personal loans.

It offers an impressive “sensitivities evaluation” page. This lets you dial various critical parameters up or down and observe the impact on your assets.

There are also optional withdrawal strategies applicable to discretionary spending. Consumption smoothing can be based not only on fixed rate projections but also on Monte Carlo and/or historical analyses.

If you need the absolutely most powerful and flexible retirement calculator in 2021, your choice is clear.

Related: Pralana Gold Retirement Calculator full review

OnTrajectory

In the fall of 2014 I was contacted by the developer of another newcomer to the retirement calculator scene. This offering targeted a younger audience working toward financial goals in the accumulation stage of their careers. Yet it offered a strong feature set for near-retirees too.

And it targeted a new platform, with a slick, dynamically-updated web interface and easy-to-use graphical controls. This was OnTrajectory, a powerful and friendly new financial model.

OnTrajectory simply has one of the best user interfaces available in the retirement calculator world. The central graphical metaphor is instantly understandable. Anyone with the slightest interest in their money will feel immediately at home. The program is equally easy to use.

You start by answering four simple questions, and then fine tune your results from there. And you can progress from low- to medium- to high-fidelity modeling in the same software. (OnTrajectory was recently promoted into the elite ranks of high-fidelity calculators on my Best Retirement Calculators list. )

OnTrajectory doesn’t sacrifice powerful, modern modeling in offering a fun user interface. Digging deeper, it offers very rich income, expense, and account choices. It performs average return, historical, and Monte Carlo simulations.

It doesn’t shy away from detailed tax calculations or RMDs either. Going further, it can save and manage scenarios for comparing complex alternatives. And, a unique feature, it lets you create your own financial goals and track your progress towards them.

Despite the feature set already delivered, OnTrajectory has not rested on its laurels. In conjunction with an Adviser Board of other leaders in the retirement calculator field, the team has continued hard at work.

The plan is to keep implementing the best features of other financial modeling tools. Given its own trajectory to date, OnTrajectory is likely to soon find itself nearing the top of the retirement calculator heap!

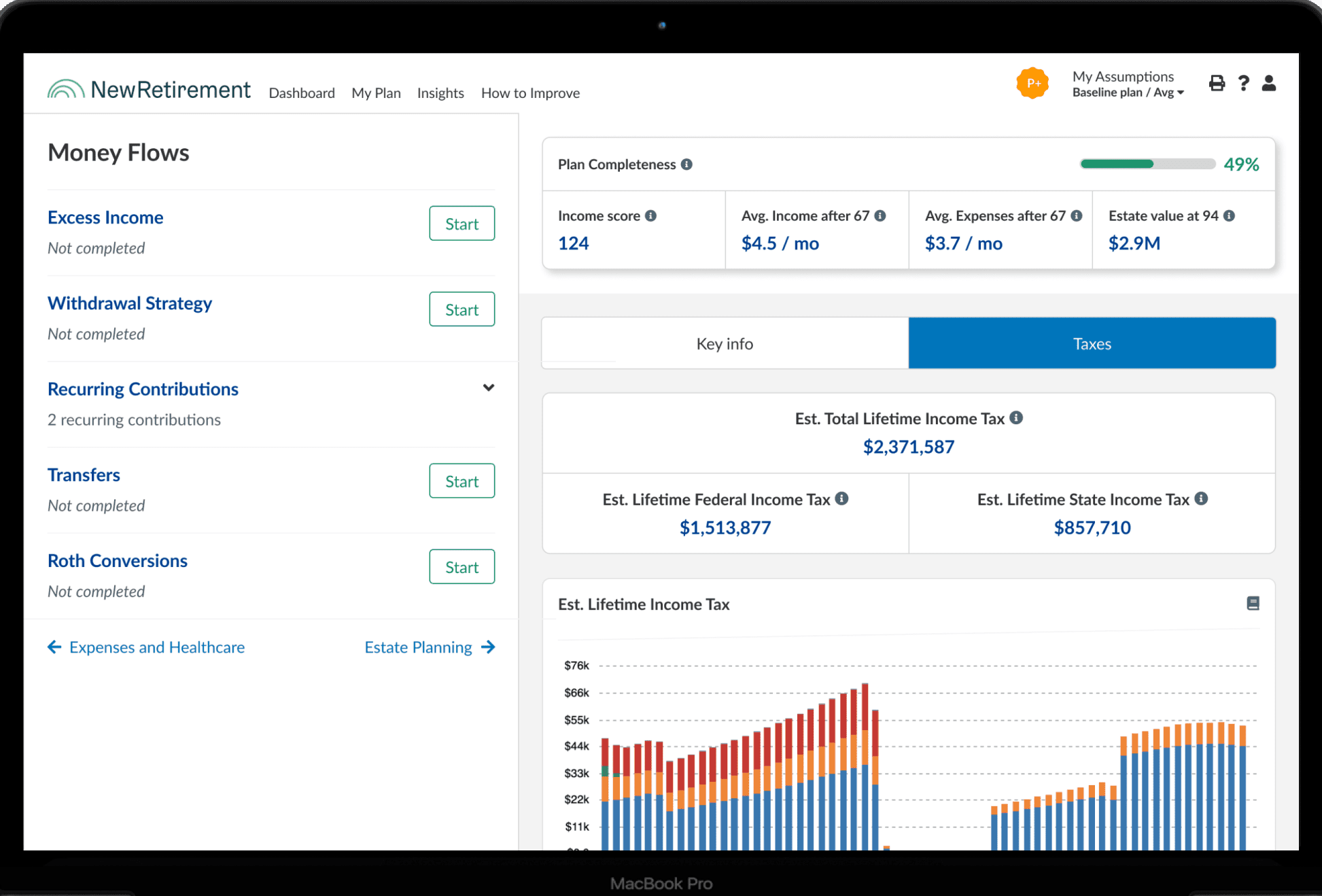

NewRetirement

The final entry on the list is NewRetirement’s PlannerPlus, added to the Best Retirement Calculator list in February 2017. This is another powerful retirement and comprehensive financial planning tool with an easy to navigate web interface that continues to evolve and improve.

Similar to the other best retirement planning tools above, NewRetirement PlannerPlus has the ability to model based on detailed personalized inputs including multiple income sources, real estate, pensions, annuities, Social Security benefits, savings in a variety of tax-advantaged and taxable account types, personal spending projections, and variable withdrawal strategies.

Outputs include year by year modeling of cashflows to meet spending requirements including detailed federal and state tax calculations and the ability to analyze Roth conversions.

Outputs are based on average or Monte Carlo returns. There is no option to model historical returns.

In-tool feedback and instruction, including checklists, “coach” tips, and links to relevant resources, provide just in time education to help you gather and enter more accurate data and optimize your plan. These features will allow many DIY planners to have more confidence in their plans.

While all of the tools outlined are outstanding for do-it-yourself investors and planners, NewRetirement PlannerPlus recognizes that retirement planning can be overwhelming, and many people will want or need help. NewRetirement provides additional options to find the help you may need. You can purchase a live one-on-one planning session with a coach to help you get the most out of the tool or consult with a Certified Financial Planner® for those needing more personalized help.

NewRetirement PlannerPlus is competitive with the other calculators on the list for do-it-yourselfers. It really shines in simplifying the process of collecting, entering, and understanding your data and helping connect users with additional assistance they may need or desire.

Related: NewRetirement PlannerPlus Retirement Calculator full review

Rise of the Personal Financial Model

Like the word retirement, the term retirement calculator is barely appropriate. I’m “retired” from my original career, but I’ve spent years “working,” sometimes pretty hard, on this blog.

In the same way, these favorite high-fidelity retirement calculators of mine don’t stop working after they’ve investigated your retirement. They continue on to analyze all phases of your financial life, helping you choose among the many complex alternatives for your money, making it last longer and do more than if you were flying blind and alone.

Stuart Matthews of Pralana Consulting continues to lead in retirement modeling, both with his software, and his thoughts on the subject. He’s suggested we use the term “Personal Financial Model” (PFM) for these advanced tools.

Ultimately the market will decide, but I agree with his point. These tools can supplement basic budgeting or money management software, and are much more than just retirement calculators. In fact they are generalized financial models. They improve decision-making at all stages of life: early career, young family, empty-nesters, near retirees, retirees, and survivors.

The Best Financial Planners

What makes for a true Personal Financial Model? The hallmarks include a mix of features: flexible financial events, variable portfolio mix, taxable/tax-deferred/tax-free accounts, detailed tax calculations, scenario analysis, average/historical/Monte Carlo simulations, and detailed, verifiable output. The most advanced offerings also include features to optimize specific financial scenarios in your future, such as Social Security claiming and IRA conversions.

These tools are OK for a quick check that your retirement savings are on track. But they were really designed for long-term relationships, built up and revisited over the years. Ultimately, for many of us do-it-yourselfers, they take on the role of sage financial advisers, integrating and leveraging computer intelligence to improve our financial lives.

Note: For many years, Pralana Consulting and Can I Retire Yet? were engaged in an informal technical collaboration aimed at raising standards for accuracy in retirement modeling, with no business relationship. However, as of January 2020 we have an affiliate relationship. That means, if you purchase a Pralana product here, a portion of the sale goes to support this site.

* * *

This article was originally published August 8, 2016 and was most recently updated October 12, 2021 to reflect changes since that time.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[The founder of CanIRetireYet.com, Darrow Kirkpatrick relied on a modest lifestyle, high savings rate, and simple passive index investing to retire at age 50 from a career as a civil and software engineer. He has been quoted or published in The Wall Street Journal, MarketWatch, Kiplinger, The Huffington Post, Consumer Reports, and Money Magazine among others. His books include Retiring Sooner: How to Accelerate Your Financial Independence and Can I Retire Yet? How to Make the Biggest Financial Decision of the Rest of Your Life.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.