Do High 401(k) Fees Outweigh Benefits of Participating?

Work sponsored retirement plans including 401(k), 403(b), Simple IRA, or Thrift Savings Plans have several key features that make them valuable tools to save for retirement. They provide an easy way to automate investment contributions, free money via employer matches, and potentially lucrative tax benefits.

What’s not to like? In a word: fees. Fees are one of the most important factors that determine your investment outcomes. Many retirement plans are laden with high fees.

How do you determine when 401(k) fees outweigh the benefits of participating in the plan? This requires quantifying and comparing the fees versus the benefits. A cost/benefit analysis allows us to make an educated decision. Let’s dive in…

(Note: I’ll use the terms 401(k) interchangeably with work sponsored retirement plans because it is the most commonly available type. You can substitute whatever plan you have for the purposes of this article.)

How do you calculate 401(k) Fees?

Disclosing 401(k) fees is required. Doing so in a transparent way is not. Determining how much you’re paying to invest in your 401(k) plan often requires detective work.

Fees matter, so it is worth applying the effort to determine what you’re paying. There are several layers of fees that need to be deciphered.

Expense Ratios

An expense ratio is the fee charged by a mutual fund or ETF to operate the fund. It is expressed as a percentage of the fund’s assets. Expense ratios can range from zero to 2+% at the extremes.

Expense ratios should be easy to find in your list of investment fund options or in the prospectus of any particular fund you’re considering. You can also search the name or ticker symbol of a fund on the internet and find it on Morningstar, Yahoo! Finance, or a number of other popular financial sites.

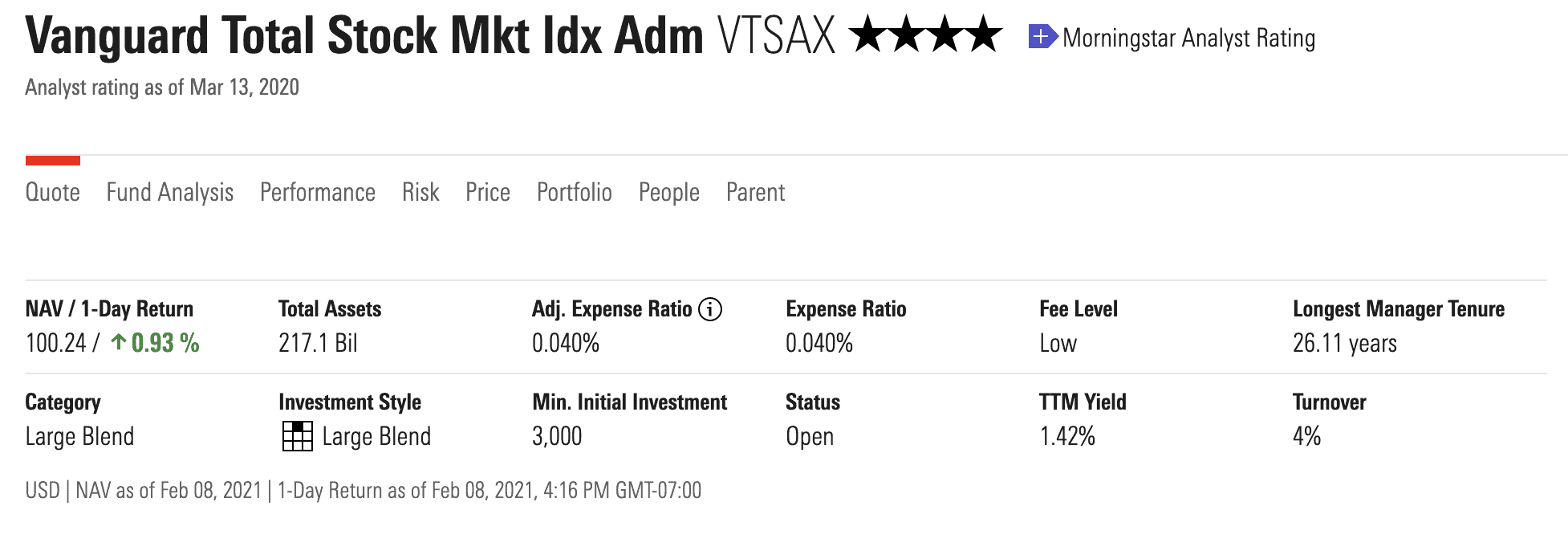

See the screenshot from Morningstar for Vanguard’s Total Stock Market Index Fund (VTSAX) which has an expense ratio of .04%. For every $10,000 invested in the fund, you would pay $4/year.

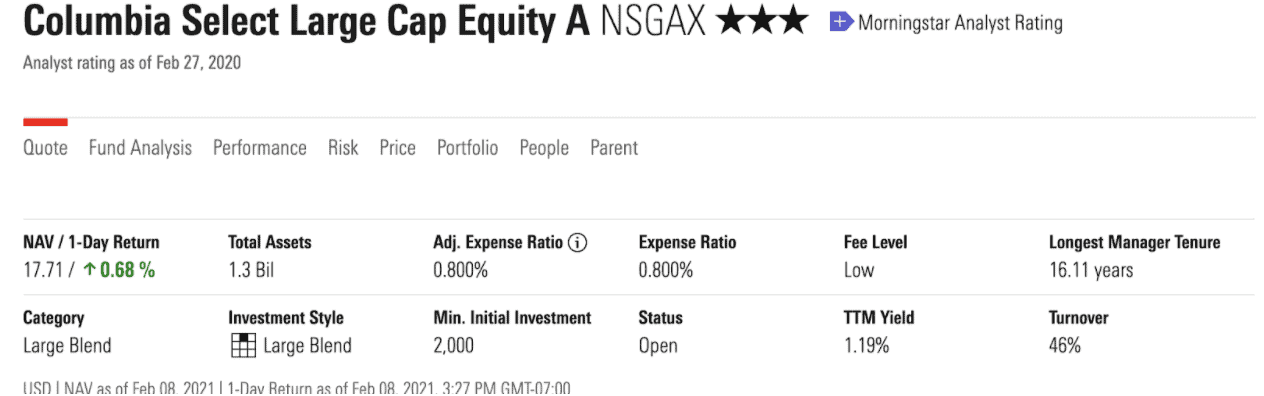

As a comparison of an actively managed fund that invests in the same segment of the market, see the screenshot of the Columbia Select Large Cap Equity A shares (NSGAX). It has an expense ratio of .80%, or twenty times the expense of the index fund. For every $10,000 invested in the fund, you would pay $80/year.

If you hold more than one fund, repeat this process for each fund. Then add up the individual fund expenses to determine your total investment cost.

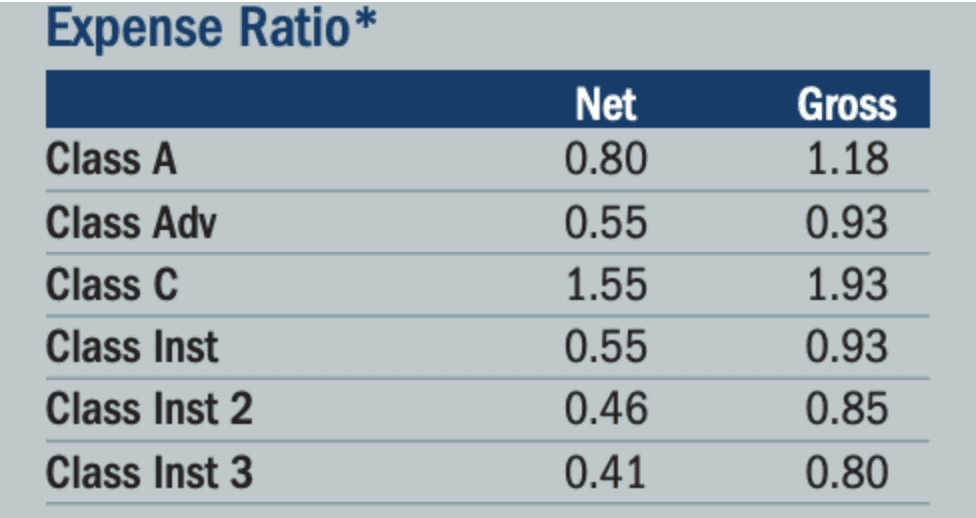

If looking up expense ratios independently, make sure you look at the exact investment options available in your plan. I highlighted the Columbia Select Large Cap Equity fund because it is an example of a fund with different share classes. Expense ratios for this fund range from a low of .41% to a high of 1.55%. A $10,000 investment could have an annual cost of $41 to $155. You may pay nearly four times more for the same mutual fund depending on the share class you invest in.

Administrative Fees

The next level of 401(k) fees are administrative fees. These fees can be paid by the plan sponsor (employer), passed on to employees, or some combination. You may be charged a flat fee, i.e $25/month or $300/year or a “wrap” fee, i.e. a fee based on a percentage of your assets similar to the expense ratio.

Administrative fees are harder to decipher. They are often buried in plan disclosure documents. In my experience, the harder the fees are to find, the more expensive they will be.

401(k) plans with high fees want to bury them; out of sight, out of mind. Plans with low fees go out of their way to show you how low their fees are.

As an example, I recently tried to find the administrative fees on Kim’s 401(k) plan. To find these fees, I first had to find the 404(a)(5) participant fee disclosure form. This took several minutes of searching the plan’s website.

Inside this 14 page document, were two sentences disclosing fees. There is a .71% record keeping fee and a .44% administrative and management fee. That totals 1.15% of administrative fees charged on all assets in the plan, in addition to expense ratios of the funds.

Advisory Fees

Many plans give the option of working with an advisor to help you manage your investments. For this service, you may pay an additional layer of fees. You may be charged a flat fee, for example $500/year, or a percentage of your assets under management for this service, for example 1% of assets under management.

All-In 401(k) Fees

To determine your all-in fees, you would need to add up the total investment fees, administrative fees, and advisory fees. As an example, I recently did a fee analysis for Kim’s 401(k) plan.

The only fund she holds in her 401(k) is the John Hancock Total Bond Market Fund. It has an expense ratio of .08%. The plan has a .71% record keeping fee and a .44% administrative and management fee. She didn’t elect advisory services. Her annual expenses are 1.23% of her account balance.

To make the math easy, let’s assume she has a current balance of $100,000. Her all-in investment fees would be $80 for the year. The total administrative cost would be $1,150. She doesn’t pay an advisory fee. The total all-in fees are about $1,230/year.

Escaping High 401(k) Fees

For decades, Vanguard has focused on lowering investment fees. This put pressure on other firms to enter a price war. It is now possible to invest with negligible fees when you choose where you invest your money.

Unfortunately, 401(k) plans limit your ability to choose. If you have a 401(k) plan with high fees, you are stuck with the plan’s fees until you part with your employer. At that point, you have the option to roll over your 401(k) to an IRA with lower investment fees.

SIMPLE IRAs are an exception to this rule. You can roll over money in a SIMPLE IRA to a traditional IRA with lower fees periodically without parting service. See the IRS website for full details.

Know Your 401(k) Fees

We monitor our investment fees in an Excel spreadsheet. As of year end 2020, I noticed that Kim’s 401(k) fees accounted for 50.8% of our investment expenses, while the fees on the remainder of our portfolio accounted for the other 49.2%. This is remarkable considering her 401(k) balance represents only 6.6% of our total portfolio value. The remainder of our funds account for the other 93.4% of our balance.

There is nothing we can do about fees on investments already in the fund until she parts service with her employer and can move the money to an IRA with a different brokerage. This prompted my question of whether the fees for ongoing contributions outweigh the benefits gained by continuing to contribute to her 401(k) plan.

Quantifying Future 401(k) Fees

To determine the cost of future contributions, we need to know several variables.

- All-in fees on the contribution

- Contribution amount.

- Anticipated growth rate of investments

- Anticipated number of years until parting service

Kim’s 401(k) fees are much greater than our other investments. The investments in the 401(k) are tax-deferred and we will eventually owe taxes on this money and any growth. For these reasons we elected to hold a portion of our bond allocation here. With interest rates being so low and her 401(k) fees so high, we are anticipating her annual growth rate to be about 0% after fees.

We don’t know how long she will continue to work. We plan everything a year at a time, so we anticipate a minimum of at least one more year and a maximum of 10 more years. This provides reasonable “best case” and “worst case” scenarios for the amount of time fees will compound .

So for every $1,000 invested, in the “best case” scenario, she would pay $12.30 in fees. In the “worst case” scenario it would cost her $123 for every $1,000 invested.

This is an estimate. For our purposes, it is good enough to inform our decision.

If you anticipate a higher rate of growth or longer tenure with your company, your asset based 401(k) fees will compound non-linearly along with your investment balance. It may be worth your time to calculate this growth in fees more accurately.

Quantifying 401(k) Benefits

Next, you need to determine the benefits of utilizing the 401(k) plan so you can determine whether it makes sense to contribute. There are two major financial benefits you need to consider.

- The impact of the employer match.

- Tax benefits of contributing to your plan.

Determine the Employer Match

Many 401(k) plans offer an employer match. This is additional money that an employer contributes to your retirement account to match your contribution.

Some plans will match 100% up to a particular contribution limit. For example, a plan may call for an employer to match 100% of every dollar contributed up to 5% of an employee’s salary. If you make $50,000 and contribute $2,500, your employer will invest an additional $2,500 for you. This is an immediate 100% risk-free return on your money.

Other plans’ match at different levels depending on how much you contribute. A common scenario is that the employer would match 100% of the first 3% of your salary and 50% of the next 2%. In the same scenario as above, you would receive a $1,500 employer match on your first $1,500 contributed, then an additional $500 match for the next $1,000 contributed. This would be an immediate 80% risk-free return on your money.

Guesstimate the Tax Benefits

The contribution limit for 401(k) plans in 2021 is $19,500. For those age 50 and over, you can also make a $6,500 “catch-up contribution,” bringing the contribution limit to $26,000. This leaves a lot of room for contributions beyond the employer match.

There may be tax benefits for contributing to a 401(k) that outweigh high fees. These tax benefits are less clear. We can know with certainty the tax impacts on the front end when contributing to the accounts. Determining the benefits on the back end when taking money from the account requires zooming out to look at your overall situation and making some assumptions.

Tax Rate Now

To calculate the current year federal income tax implications of your decision to participate in your 401(k), determine what your marginal tax rate will be on your highest earned dollars. Then multiply how much you would contribute to a tax deferred account by the marginal rate. If you don’t understand this concept, it is explained in detail here.

In our case, our last taxable dollars should fall in the middle of the 12% marginal tax bracket this year. So for every thousand dollars invested, it would save $120 in federal income taxes in the current year.

Tax Rate Later

Contributing to a 401(k) does not eliminate your tax burden. The taxes are being deferred and will be owed later. To determine how much, if any, tax benefit you’ll receive by utilizing your 401(k) account you need to estimate how much you’ll pay in the future.

If you have the option of contributing to a Roth 401(k), you could perform a similar analysis but calculate the impact tax-free growth and withdrawals would provide compared to the fees you would pay for participating in the retirement plan.

Why Your Future Taxes Could Be Lower

Future income taxes owed could be less than you would pay at your current marginal tax rate. Circumstances that could cause your money to be taxed at a lower rate in the future include having:

- Less taxable income when taking the money to provide living expenses in retirement,

- Less taxable income when converting the money to a Roth IRA,

- The same taxable income in the future, but tax rates generally being lower due to a change in tax policy.

Why Your Future Taxes Could Be Higher

Taxes owed could also be greater in the future than you would pay at your current marginal tax rate. Circumstances that could cause your money to be taxed at a higher rate in the future include having:

- Income from Social security, a pension, and/or paid work in retirement that push these dollars into a higher future marginal tax rate in retirement.

- High required minimum distributions. Oversaving in tax-deferred accounts can force you to take large distributions in years when they will be taxed in higher marginal tax brackets in retirement.

- The same taxable income in the future, but tax rates generally being higher due to a change in tax policy.

- Future income taxes you anticipated paying married filing jointly compressed into narrower marginal tax brackets as a single filer after the early death of a spouse.

Our Cost-Benefit Analysis

In our situation, for every $1,000 Kim invests in her 401(k) she will pay about $12.30 in fees in a “best case” scenario of staying in the plan for only one more year and $123 in fees over ten years in a “worst case” scenario.

Her plan has a policy such that her employer will match 100% of the first 3% of her contribution, plus 50% of the next 2%. The plan has no vesting period for employer matching contributions.

For every $1,000 she contributes up to 5% of her salary, she will get an immediate risk free $800 return. Even if she stayed in the plan and paid high fees for ten or more years, this benefit alone would easily eclipse the high 401(k) fees.

Quantifying the fees and comparing them to the impact of the employer match gave us clarity that she should contribute enough to her 401(k) to receive the full employer matching contribution. In 401(k) plans with all but the most egregiously expensive fees and long vesting periods, it is a no brainer to contribute at least to the amount of receiving the full employer match if at all possible. The benefits of the employer match clearly outweigh high 401(k) fees.

After receiving the match, we could put more money in the 401(k) for potential tax savings. Being in the 12% marginal tax bracket means she would defer $120 in federal income taxes for every $1,000 contributed to her 401(k).

Our best guess based on our situation is that these dollars will be taxed at a rate of 5% in the future. So she would pay $50 federal income tax on every $1,000 in the future.

Assuming our assumptions are reasonably accurate, every $1,000 contributed to the 401(k) account would save $70 in taxes. But the potential $70 tax savings would come at a cost of $12-$123 in 401(k) fees.

With no clear answer, we zoomed out and looked at the bigger picture.

Other Considerations

Some additional factors you should consider in this secondary analysis include:

- Tax Cliffs. Are there benefits that can be achieved by lowering taxable income in the current year? Examples include obtaining a larger ACA premium tax credit or getting income low enough to be in the 0% long term capital gains tax bracket. If not, can you position yourself for future tax flexibility based on current year decisions?

- The absolute size of tax deferred accounts. Larger accounts means you’ll pay more taxes in the future.

- Number of anticipated years with low or no income prior to RMDs and Social Security. The more years you have to spread out retirement withdrawals or Roth IRA conversions in the lowest tax brackets, the less taxes you’re likely to owe on tax-deferred money.

- Tax rate diversification. If all or most of your money is already in tax-deferred accounts, it may be beneficial to save in Roth or taxable accounts. If you emphasized Roth or taxable accounts earlier, it may make sense to defer some income taxes now.

- Capital gains taxes. High earners who bypass retirement accounts to invest in taxable accounts will be subject to annual capital gains taxes on these investments. Lower earners may pay 0% on long-term capital gains, so this will have a smaller impact.

Take Action

Our analysis didn’t provide the definitive answer we were seeking as to whether high 401(k) fees outweigh the benefits of contributing to retirement plans. However, they did give us an objective basis to make an informed decision and take action.

Kim will definitely continue contributing to her 401(k) up the level of the employer match for as long as possible. After that, we will emphasize diversifying our portfolio by adding to our Health Savings Account (HSA) and Roth accounts which make up only 2% and 11% of our portfolio respectively, compared to 49% already in tax-deferred accounts.

We will only make additional contributions to the 401(k) if it makes sense to lower our taxable income for other tax benefits in a given year.

Have you done a similar analysis? Do you know what your 401(k) fees are? Do you fully understand the benefits of contributing to work sponsored retirement plans?

How are you using your retirement accounts? Are you able to share any lessons from the other side of retirement about ways you would have used these accounts differently with the benefit of hindsight?

Let’s discuss it in the comments.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

I finally moved my 457b account to a Vanguard IRA. I saved at least a percent to 1.5 percent in fees doing that. The fees in my defer comp account had been higher in the past. But moved down because of competition. If I could of access Vanguard from the get go I would likely have 20 to 25 % more money. As Bogle told us, with out taking the risk or putting up the capital the typical mutual fund company by fees gets the lion share of the returns over a life time of of investing.

Steve,

Agree that fees on these plans are often atrocious. Too bad not more people are aware of Bogle’s writing about the impact of paying “only” 1-2% in fees annually.

Best,

Chris

I worked for a public school District the last 24 years of my career. We only had 403B plans offered by lousy, high-cost insurance companies. Fees were hidden very well – never knew exactly what they were. As soon as I turned 59.5 y/o, I rolled what I had to a Vanguard IRA. I had to continue with 403B until retirement due to the pre-tax benefit, but would periodically roll funds to the IRA.

Chris W,

Thanks for sharing. Can you point me to the resource that explains how you did a Rollover of a 403(b) to an IRA prior to retiring/leaving your job. I found a quirk through the Bogleheads forum years ago that allowed us to do that with a SIMPLE IRA as I noted in the post, but my understanding is that you’re stuck with all of the other work sponsored retirement plans, and the fees that come with them, until you part service with your employer. If I’m wrong, I would be happy to be proven wrong and would love to share that with readers who could benefit.

Best,

Chris

+1 This is my understanding as well Chris that you are bound to stay with the plan until you are no longer with the employer.

Remind employer plan administrators that they are required to be fiduciaries. I shared the John Oliver video on his 401k plan struggles (pardon the language), and they soon were replacing high expense funds with better options from VG. Also keep in mind that your outside plan providers are likely acting in their self interest, and not fiduciaries, even if they are “certified” to be such.

Tom in WA,

I had a similar experience with my former employer of getting better (i.e. lower cost) options in our plan. My approach was different though, focusing on his self-interest rather than focusing on his fiduciary requirements which could be seen as threatening. I simply pointed out what the fees were that we were paying in simple terms that the provider did not. I then let him know that improving the options would be a great benefit for employees (like me) that he was trying to retain and for himself as he was also subject to these unnecessarily high fees. And it worked!

Best,

Chris

Wow! As a finance person, love the analysis but as a finance person, not willing to do the work. My sense is most won’t either. Doesn’t stop me from nerding out on it and giving you props for the work.

Edwin,

Honestly, as much as I am a nerd for this stuff I haven’t put a ton of thought into it up to this point. When we were both working full-time and thus in a higher marginal tax bracket, it did make sense to defer despite high fees. Now that we’re in the position of semi-retirement with only one part-time income it made me question things, especially when I saw what an insanely high percentage of our investment fees the 401(k) created despite being such a small part of our overall investment portfolio.

Best,

Chris

As a reminder, it is Kim’s employer’s decision to pass on the administrative and recordkeeping fees to the plan participants. Based upon the costs outlined, I would guess she works for a small employer (less than 100 employees) so there are fewer people to spread the fees between.

Indeed. I’ve actually talked to them about better options for small businesses like Employee Fiduciary and Guideline. The problem with small employers being responsible for these decisions is that there is no HR department who is knowledgable. She was receptive to me explaining it to her, but there is still the issue of inertia b/c as a small business owner, changing plans creates more work and most of the employees won’t appreciate it b/c they don’t know the difference either.

Best,

Chris

That’s sad, but I know you’re right. My employer has an excellent plan, but there are still employees that choose not to participate. Many people only begin to really pay attention after they reach 50 years old or so.

Yes. If financial literacy was higher, then employers wouldn’t accept these subpar plans and if they did then more employees would be complaining about them. Unfortunately, all of these high fees are buried in layers of complexity where most people don’t even know they exist.

Great post and analysis Chris. I don’t trust the bastards trying to hide and obfuscate the administrative fees as best as they can. A couple of reasons I have not rolled-over some of my 401k assets;

1.) ERISA laws creditor protections that would be lost if rolled over to non-ERISA accounts (e.g. IRA.) Each investor needs to look at their own unique risk profile and governing state laws to make a truly informed decision. My belief is that the industry mantra to always rollover when you leave your employer is bad advice.

2.) 401ks have some unique legal advantages that allow them to offer some insurance products not generally available in IRAs. One such annuity product that is offered in my 401k keeps me there for a bond/fixed income allocation.

Thanks Chris and keep the good stuff coming!

Bill

Agree Bill that there are other considerations beyond fees. I discussed this and some other factors to consider in this decision process in more detail in this separate blog post.

Best,

Chris

I retired last year and have chosen to leave my sizeable account in the employer-sponsored 401k instead of rolling it over to an IRA. The 401k has only a $20 annual fee, and fund fees are at the lowest institutional rates. I am satin with the large choice of funds offered. So I see no reason to rollover, it will likely take distributions annually into a Roth account moving forward.

JoE,

I fully agree that some funds with larger companies or government employees with access to the TSP plan have even better options than individual investors can get on their own and have superior legal protections than an IRA offers. In this case, using a work sponsored retirement plan and staying in it after retiring or otherwise leaving your job is a great decision.

Best,

Chris

Another thing to consider along with fees are possible returns. If one has 50% bonds which may only gain about 1% and lose 3% annually due to inflation you cannot offset the administrative fees with those meager gains. Your example also relied on a perk which includes an employer match, however the scenario would also change if investment fees had to stand on their own.

I agree completely Scott. I hope I made that clear when stating she will contribute to get the match, but won’t contribute beyond the match unless secondary factors push us in that direction.

Best,

Chris

My wife had similar lousy, high fee choices but we still went with it. My logic was that you get a head start on investing more with the 401-k. Assume you are able to put $10k into your 401-k and assume your marginal tax rate is 25%. Comparing with after tax, you get to invest $7500 in an after tax account. Let’s say 10 years from now you want to cash out upon retirement (or switch jobs so you can rollover to an IRA with low fees) and investments have doubled using a low cost index fund. In a good 401-k plan, you have 2*$10k*75% = $15k after taxes at retirement (assuming your tax rate is still the same 25%). Let’s say the incremental drag on your lousy plan has an excessive fee of 1%. Over 10 years, you have about 91.5% (1 / 1.01^9) of the full amount of a low cost plan so that drag is 91.5%*$15k = $13.725. If I went the after tax route, I’d have (2*$7.5k)-($7.5k*25%) = $13,125. Hence, unless you stay with a single employer a really long time and can’t rollover or retire, you will likely still gain more with the lousy 401-k.

Philip,

I’m not sure I’m understanding the logic you’re using here.

I think a better comparison is not contributing to a taxable account, but to a Roth. In that case, if you assume that the money will be taxed at the same rate going in and coming out, and each have tax free growth, then it doesn’t matter if you pay the taxes up front or on the back end. You will end up with the same amount either way. Tax deferred = $10k in *2 (double money) =$20k *.75(left after tax) = $15k. Roth = $7.5k in after tax * 2 = $15k * 100% keep going out = $15k.

Where you can actually invest more money in a taxed advantage account, if that is your goal, is by utilizing a Roth option b/c you are contributing $19k after tax dollars which will then grow tax free and never be taxed again as compared to $19k pre-tax dollars which will also grow tax free, but will then be subject to taxation down the road.

If you are comparing contributing to a tax advantaged account vs. a taxable account, you have to factor in the annual taxation on dividends, interest, and capital gains that would create a drag on taxable investments but not tax-advantaged investments (tax-deferred or Roth). Then you would have to compare what you lose in annual taxation of the taxable account vs. what you save in fees by having the freedom to choose vs. what you lose to fees in a bad 401(k).

Does that all make sense, or am I missing your point?

Chris

Good clarification point. Yes, max out on Roth IRA first if you’re eligible. We don’t qualify due to our MAGI. But even if we did, we would max out the Roth and then participate in the 401-k because any extra cash would just go into a taxable account and invested anyways. So the comparison is still relevant.

I don’t think my wife has an in-plan Roth IRA. And even if there was, it would still be with the same lousy, high-fee choices.

Separately, I was trying to simplify the calculation by not adding in taxes on distributions/dividends on the taxable account which makes investing in a taxable account even worse by a little bit (adding to my case of doing the lousy 401-k).

Have you looked into a backdoor Roth contribution? We’re in the same boat, don’t qualify for a direct Roth contribution due to MAGI but we do backdoor Roth contributions every year by doing non-deductible IRA contributions then immediately convert to Roth. It’s not a super well-known option but it’s a legal way to do Roth contributions. Takes some work to track the non-deductible IRA contributions for tax filing but it’s been our way into a Roth in our duel income family.

Back in the dark ages (15+ years ago) the HR dept told me that the fees were confidential (even though it was obvious I was paying fees because my annual returns were lower than the same fund in a retail account).

After separation, the employer decided to pass along the employer portion they had been paying the 401K administrator to any out of service participants. Not surprisingly, all of us responded by rolling over our accounts to our own IRAs. This resulted in reducing the size of the 401K holdings enough that the admin fees to that employer doubled because they no longer qualified for the discounts based on total holdings. I just ROFL when one of the folks there told me how upset the CEO was when he found out, and in his usual logic, blamed the former employees for ditching his 401K program and being ungrateful.

LeeMKE,

The problem is the way the work sponsored retirement plans are structured. The simple and obvious thing to do is to have a TSP plan for every tax payer or allow every employee to invest the 401(k) money wherever they want. But there is a lot of money at stake for the 401(k), 403(b), etc providers to keep the status quo b/c this is where most people who invest in the market do their investing. So there are billions of dollars in fees at stake.

Both Kim and I have been fortunate to work for small companies who go out of their way to take care of their employees. The problem is that they, like most people, aren’t aware of the impact of ivesting fees. Despite this, they are in charge of selecting these plans which employees are then stuck with. In both cases, they have been receptive to listening and learning, but there is still the issue of inertia. As important an issue as this is, it is not that important in the grand scheme of things for employers who are trying to run a business and also have to administer health insurance plans and other benefits.

My plan is to keep poking the bear and agitating for change in whatever ways I have possible, both by staying at it with employers I know and encouraging others to do the same with my writing.

Best,

Chris

Chris – Thanks for the informative article. I am now retired. While working I was able to transfer funds from the ‘work IRA’ (with relatively high fees) to a Vanguard IRA, as long as I did not close the ‘work IRA’. So, I then kept a minimal amount in the ‘work IRA’ and was able to enjoy the lower fees. The difference, as I recall, on a S&P 500 Index Fund was 0.75% fee vs 0.05%. On $500,000 of retirement funds, the annual fee was reduced from $3,750 to $750.

Perhaps this is an option for many others.

Joseph,

Someone else alluded to this in the comments. I’m not sure how you are doing this unless you somehow had an event that prompted a distribution that you could then roll over. The only ways I’m aware of this being possible is if turning 59 1/2, becoming disabled, or a few even more rare instances.

Would you mind sharing how you did the rollover while still working?

Best,

Chris

Chris – As I recall, I contacted the Administrator for the work IRA and asked if I could move the funds. I was told that I could roll over funds to another IRA as long as I did not completely close out the work IRA. I withdrew about 80% of the work IRA, rolled over to a much-lower-fee Vanguard IRA.

Thanks for your blogs.

I did this when I was still working. It’s called an “in-service distribution “ (or “in-service withdrawal”), the proceeds of which can be directly rolled over to an IRA with no adverse tax consequences or penalties. But it can only be done if the employer’s plan allows it, and if the employee is at least 59 1/2 yrs. old.

Joseph and Bob d.,

Thank you both for the replies. I’ve been searching and it seems that this is possible in some but not all plans. I did my own search and also have been asking around on Twitter and I can’t seem to find a definitive legal answer. When I do, I’ll update the post accordingly.

Best,

Chris

Great summary, Chris, thanks for the article! As recent retirees we are just going thru the rollover analysis. At first the advice “always rollover” was in our heads but we chose to stay in the 401k, at least until we are sure we want to make the change. This 401k has good options (and fees we know about) from a large employer we respect. Thanks for giving us more to think about/investigate!

You’re welcome! And good luck with making the best decision for you.

Chris

Great article. Great summary. I worked for a company for 30+ years. I was fortunate to have both a pension and a 401k. When the pensions were frozen, the company match was increased from $.75 to $1.00 match up to 6% of my salary. Wish I knew of the Roth advantage earlier. On another subject I found the Pralana Gold quite useless compared to New Retirement. It really doesn’t offer any useful scenarios. Thanks again

JD,

Thanks for sharing your experience and for the feedback on the calculators.

I obviously disagree on the assessment that the Pralana Gold is useless. In fact, it is probably the closest thing a retail consumer can get to professional planning software for an extremely reasonable price.

That said, we affiliate with both b/c they are really for different tools targeting different audiences. NewRetirement is more user friendly and has a shorter learning curve IMO, and thus it is probably the better tool for a wider audience, even if it is a bit less powerful and customizable when doing calculations.

Best,

Chris

Before I retired, I often attempted to explain the high 401k fees to my colleagues. The fees were not clearly stated and they just saw (usually) the balance go up every payday. I contributed enough to get the match. The rest of my retirement savings went into my own Roth and IRA.

Near the end of my career started maxing out the 401k so I’d have a sizable bucket with the better legal protections.

Fred,

Another reason to max out later in your career is that if you alternatively decide to roll the account over to an IRA, you would be stuck with the onerous fees for only a short time.

When we were both working and saving aggressively toward FIRE, we didn’t give this issue a lot of thought b/c we were maxing out everything available and still contributing to taxable savings. For the majority of people that can’t do that, it is definitely worth giving some thought to what advantages and disadvantages these different account types provide.

Best,

Chris

I didn’t realize what a ripoff they were until I talked to a friend who “sold” 401k programs to companies. She told me she netted over $250k per deal! And she is just one sales person and that was just one deal. Who do you think pays her? Yeah… the account holders.. aka suckers.

Wow! That seems high, but I suppose if you have a large company it wouldn’t take long to make that money back in fees. It’s definitely a sign that the system isn’t working for the people it is supposed to.

Best,

Chris

I was on the committee that managed our company retirement plan. In our case the company covered all of the fees except for the individual funds’ expense ratio’s. The account fee and record keeping fees were donated by the company. Our available funds were pretty low expense ratio ones so it was a great deal. I maxed out my 401K every single year of my career when one was available and we had a good match. It was duck soup to become a 401K millionaire without ever noticing the money directly invested before I received my pay.

steveark,

Thanks for chiming in. As I said in the intro there are great potential benefits to be gained by using 401(k) plans, IF the benefits aren’t overwhelmed by the fees. Unfortunately, your experience is too rare and these plans are not a great deal for many employees who they are supposed to benefit.

Cheers!

Chris

Thanks for the informative writing! Luckily we have TSPs, which as far as I can tell have low fees. For the past decade+ we have been maxing out our TSPs and Roth IRAs (including using back door) and have no funds in our taxable accounts (used the money instead to buy real estate, which we will liquidate for early ER living expenses). Good decision or bad, with only 1 yr to ER, now it’s a matter of planning to manage the taxes in the future. Namely our strategy is to draw down the TSP Traditionals as fast as we can with Roth conversion ladders and 72T SEPPs, before pensions and SS kick in. We are targeting staying <=12% tax bracket pretty much forever if we can swing it. Any other options to do this?

M,

Indeed you are lucky to have access to TSPs. That’s a great plan if you have it. Be extremely suspicious if anyone tries to talk you into rolling it over into something “better.”

Congrats and best wishes on a smooth transition to, and low taxes in, retirement. 😉

Chris

Chris, great article and reminder of the impact fees have. I have a related question about the impact of funds of funds fees as I’m not sure if those fees are additive or just represented by the investment fund fees I can display. Perhaps you or one of your readers know. Many mutual funds invest in other mutual funds and it’s the second layer that I don’t understand the impact the expenses have for me. Thanks again for your articles and insights.

Mike,

Good question. This is what is called a fund of funds. It is a mutual fund made up of 2 or more other funds, so you have the fees of the original funds + an additional layer of fees to put them together into the fund of funds.

An example is a target date fund. Let’s use Vanguard as an example, because they are reasonably low cost and easy to understand. Their 2025 (VTTVX) fund is made up of essentially 4 other funds VTSAX, VBTLX, VTIAX, and VTABX, (+ a tiny percentage in inflation protected bonds, but at <1% of the fund it's irrelevant to our conversation). The fund of funds has an expense ratio of .13%. The other funds have expense ratios ranging from .04-.11%. So if you put them together yourself, your composite expense ratio would be <.1%, but because they're doing it for you it will cost .13%. In this example, it's not a huge deal. If you're talking about underlying funds that start with higher expenses and then you add on another layer of expenses on top of that, it is a big deal. Make sense? Best, Chris

Hi Chris, thank you for the response. I wanted to clarify your answer if you will entertain it. In your example I took a $100,000 investment in VTTVX which has an .13% expense ratio or $130. Then you indicate I need to add the expense ratio’s of the other funds in the following way. VTSMX a 35% holding with .14% expense which comes to another $49. Doing the same for the remaining top investments of VTBIX of $25, VGTSX of $40, VTIBX of $15. I then add those together for just over $260 or a .26% expense ratio cost on my VTTVX investment? A good number for that particular investment however I probably have some others that won’t be as reasonable once I dig into them. You are leaving me with some homework to check into those costs deeper for some of my investments. 🙂 Thanks again for your articles.

No. Sorry if that wasn’t clear. The .13% would be your all in expense.

I think you got confused b/c you are looking at different share classes that no longer exist (closed to new investors). For example VTSMX with a .14% ER. That fund is the more expensive version of VTSAX. VTSMX is now closed. VTSAX has an ER of .04%.