The 3 Best Free Retirement Calculators

Retirement calculators have an impossible job. They use various imperfect mathematical techniques in an attempt to predict the distant future. That can’t be done reliably. So they will inevitably be “wrong.”

Add to that the difficulties in communicating the many variables involved, and all the possible simulation options, to everyday users with limited time. And then there are the usual issues with designing friendly software, getting the bugs out, and then delivering it to work reliably on dozens of different hardware/software platforms across the web.

So, I’ve often been critical of retirement calculators here, but they are necessary tools. They helped me develop the confidence to make the leap into my own early retirement.

In the years leading up to that retirement, plus the last couple years of blogging, I’ve evaluated 34 different retirement calculators! And, I’ve kept extensive notes on each.

For this post I went back through those notes and picked the top half-dozen or so free calculators to re-evaluate in depth. Of those, three made my final cut, as worthy of recommendation to you. And I’ll unveil them shortly, below. But first let’s develop a retirement scenario, and then talk a little about choosing and using retirement calculators….

The Scenario

To help me put the calculators through their paces, I came up with a simple retirement scenario. (At least I thought it was simple. But it was amazing how many of the mainstream calculators couldn’t handle it.) Here are the details:

- We start with a couple, age 60, retiring today.

- Their living expenses are $4,000/month or $48,000/yr.

- Their portfolio of exactly $1 million is 100% in a traditional, tax-deferred retirement account.

- Assets are allocated precisely 50% stocks and 50% bonds.

- We’ll assume a historically low 8% average annual return on the stocks, and a 4% average annual return on the bonds (or a 6% average annual return for the entire portfolio).

- The couple expects to begin taking Social Security starting in 6 years, at age 66.

- They will each get $1,000/month for a total of $2,000/month, or $24,000/year. (If a given calculator can’t handle Social Security in some form, then we’ll add a present value of $450,000 to the portfolio to account for it. For a brief explanation of reducing Social Security to a present value, see How Much is Your Social Security Worth?)

- We’ll use a retirement length or planning horizon of 40 years, taking this couple up to age 100.

- Because inflation is a serious concern now, we’ll use a historically high inflation rate of 4.0%.

- And, because our retirement couple are relatively frugal livers, we’ll use an effective tax rate of 8%.

Selecting the Best Retirement Calculators

Next, let’s talk about my selection criteria for these calculators. I spent my entire career developing software. So I’m both very understanding of the difficulties involved, and very critical of the end results.

Attractive Design

I’ve worked with thousands of software packages over the years. I know what’s possible from smart, committed programmers using the best tools. So I don’t have much patience for anything less.

Obvious bugs, user interface glitches, and performance problems turn me off quickly. I have little tolerance for programming-101 issues like forcing users to enter data in a certain format. When there are obvious issues like these, I wonder what other problems are lurking under the hood….

For starters, I ruled out a number of calculators that were clearly dated. If the user interface looks 10 or 20 years old, can I really trust that the underlying calculations are taking advantage of the latest ideas on how to model retirement?

This also led me to rule out a number of spreadsheets that are available for free download, often from generous engineers who preceded me in the personal finance world. There may be some hidden gold there. But given the security issues, rudimentary user interfaces, and hard-to-validate algorithms buried in spreadsheet cells, I can’t really recommend them.

Simplicity and Internal Consistency

Next I looked for both simplicity and internal consistency. I don’t believe the retirement equation has any precise answers. So to collect a pile of detailed data for a complicated analysis spanning 40 years into the future is just silly and pretentious.

This is especially true if it leads to a confusing user interface and bugs! It’s so much better to create a simple, understandable model that at least provides some modest insight into one aspect of the retirement equation.

But I did consider some type of Monte Carlo or backcast capability to be a plus. Two of the finalists have this, but one doesn’t, by design.

Though the validity of those analysis techniques can be debated, they do give you some feel for the probability of various outcomes, instead of just a single answer based on averages. They attempt to simulate some of the risk from market volatility in retirement. This is important because when you retire in relation to market cycles turns out to be a lot more critical to your success than the historical averages.

Nevertheless, retirement calculations are one area where cleverness is not a great benefit, in my opinion. I’ve used two of the most heavily-hyped products out there, both supposedly applying sophisticated, proprietary algorithms to optimize your retirement. In both cases the software was virtually unusable, producing nonsense results for a set of simple inputs.

Given more time or information, could I get them to work? Probably. But if they’re that finicky, do I have any faith in their ability to predict the future? No.

Reputable Designers

Next, I looked at the company or individual behind each of the calculators. I browsed the associated web sites, looking for the credentials behind the software, and evidence of some support and ongoing development. (“Credentials” to me just means that somebody knows what they’re doing, which I find is often more strongly related to their experience than to their degrees or professional associations. )

I’ll admit, I held the big financial services firms, with teams of programmers on staff, to a higher standard. If they put up a beautiful user interface, and collect lots of data, then they’d better use it well. If they botch my scenario, then I’m going to be less forgiving, and less interested in pursuing a workaround, than I would be with a one-person operation.

The Best FREE Retirement Calculators

Finally, since I was only interested in calculators that most of my readers could access. I ruled out paid products, and even those requiring “registration” or “membership” — though that didn’t turn out to be a deciding factor.

Using the Retirement Calculators

Modeling Early Retirement

Believe it or not, the most common and frustrating issue in using most of these retirement calculators is that the vast majority of them can’t handle early retirement! Incredible, but true.

Apparently it doesn’t dawn on the designers that people might stop working before reaching Social Security age. Some might actually be at the point of retirement already.

Even a scenario like the one we’re using, which doesn’t look much like early retirement, but does feature a gap until Social Security starts, caused all kinds of headaches. Many calculators actually require that your retirement age be greater than your current age, or force you to input a current salary.

Claiming Social Security ≠ Retirement

They also generally conflate the concept of “retirement” with receiving Social Security. In reality, those two events are totally distinct. They then go on to make dubious assumptions about your Social Security benefits.

If you’re in the accumulation stage rather than nearing retirement, then the problems I ran into using the near-retirement scenario may not affect you.

Ability to Choose Your Spending

Some calculators insist on computing living expenses as a percent of pre-retirement income. For typical consumers working 40-year careers and spending nearly every dollar they make, perhaps that makes sense. But such assumptions generally make the calculation useless for frugal retirees who have lived on only a fraction of their income.

Accounting for Taxes

Note that very few retirement calculators attempt any sort of detailed tax computation. And that’s for the best, in my opinion. Usually they settle on prompting for a simple “tax rate.” In almost all cases, this means an effective tax rate, not a marginal rate. If you enter your marginal tax rate, you’ll probably grossly overestimate your tax liability.

Accounting for Investment Expenses

Lastly, note that it’s very rare for retirement calculators to prompt for an investing expense ratio. They may include it in their calculations automatically. In which case it may be much too high — if you’re a low-cost passive index investor. Or they may ignore it altogether — in which case you’d better be a low-cost investor, because otherwise the results will be too optimistic!

The 3 Best Free Retirement Calculators

Before we get to my conclusions, know that there are many retirement calculators. There are bound to be some good ones that I missed.

Of those I reviewed, some where impressive — with respected companies or academics behind them. But, for the various reasons outlined above, they didn’t measure up to my criteria.

Perhaps it’s not surprising that two of my preferred calculators are from actual retirees. The other is a lesser-known option from the most retiree-friendly financial services company. As in so many other areas, those who’ve actually done it and actually lived it know the solution best.

As I’ve already explained, I prefer a simple model you can play with to understand your best course of action in the near future, to overblown calculators that attempt to collect loads of detailed information about what you’ll be doing decades from now — all of which will change. The calculators below will provide you with relatively quick and transparent answers that you can understand.

So let me introduce the three calculators that met most of my criteria and can serve you well. These are my final picks for the best free retirement calculators, in the order I’d recommend running them — from the simplest to the more complicated:

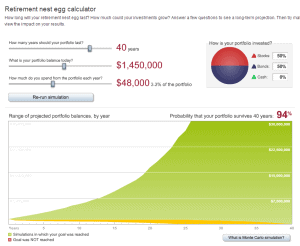

Vanguard Retirement Nest Egg Calculator

Overview

Vanguard’s Retirement Nest Egg Calculator requires the fewest inputs of any of the calculators — just 6 values. It then performs a Monte Carlo simulation using random sampling of returns from historical data.

This offering from Vanguard is associated with their employer plans, so it’s not available from their regular retirement planning tools page. But it is currently available for all to use. (Vanguard: if you’re reading this, please keep it that way!)

Pros

- Simple yet sophisticated.

- The colorful interface provides easy access to a powerful simulation under the hood.

- This is the only one of the three calculators that bases its simulation on historical data points, so it provides a valuable perspective.

- You could do worse than to begin your retirement planning here, to simply get a feel for how large sums of money behave over long stretches of time.

Cons

- You can input asset allocations but not actual returns: so historical values are used. That means, in times like these, that the returns are very possibly overly optimistic. You might try inputting a more conservative allocation than you actually use, to compensate.

- There is no explicit provision for taxes. You’ll need to estimate and add them to your expenses, if that is important to you.

- There is also no provision for Social Security, so I added a rough present value to represent the retirement scenario.

- Inflation is sampled from historical data, which you cannot override if you believe it will be higher going forward.

- The historical sampling method for asset classes assumes there is no relationship between returns from one year to the next, which is probably not accurate.

Scenario Results/Conclusion

Probability that portfolio survives 40 years: 94%. Just remember this is a simulation. It’s not a prediction for what will actually happen to your money over the decades ahead.

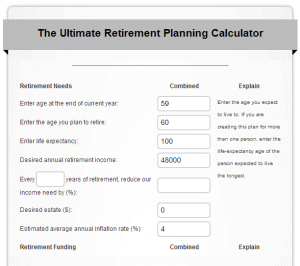

FinancialMentor Ultimate Retirement Calculator

Overview

The Ultimate Retirement Calculator from Todd Tresidder at FinancialMentor packs a lot of modeling essentials into a compact package. The user interface is a straight-ahead one-page web form.

It offers a nice, simple built-in help system.

The model performs a conventional average-return calculation, with no probabilistic results. (For an explanation of why, see Todd’s recent article at MarketWatch.)

Pros

- This calculator is based on Todd’s actual experience modeling real world retirement plans with clients.

- The calculator is designed in sections, but presented on a single screen, so it is simple to change a single variable and recalculate.

- It’s very easy to use, but actually offers a rich array of inputs covering most of the retirement possibilities.

- You can set an income glide path, leave an estate value, and control inflation and tax rates.

- It also allows scheduling a set of post-retirement incomes (including cost of living adjustments) and/or one-time benefits.

- Finally it generates a nicely formatted report that lets you easily see and verify the results.

one retirement calculator, this would probably be the one.

Cons

- As stated, there is no Monte Carlo or historical simulation, so the calculator won’t tell you the probabilities for failure of your scenario. (Understand that is by design: Todd believes probabilistic retirement planning is fundamentally flawed.) So, at a minimum, you should probably reduce the expected average annual return on investment used, to account for volatility in market returns.

- The validation of inputs could be tighter. It’s possible to get some garbage in the input or output without clear warnings from the program.

- Like many others, the calculator requires your retirement age to be greater than your current age. But you can work around this by adding or subtracting a year, without a substantial impact on results.

Scenario Results/Conclusion

Ending balance: $2,199,722. Retirement success. If you could only use one retirement calculator, this would probably be the one.

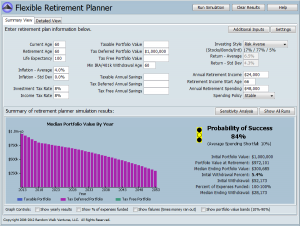

Flexible Retirement Planner

Overview

The Flexible Retirement Planner may be the most powerful free retirement calculator on the web. The user interface is rich and well executed, and the modeling capabilities are extensive, without being overwhelming at the start.

The model is a Monte Carlo simulation relying on a Gaussian distribution computed using an average-return plus standard deviation. But it can also perform a conventional average-return simulation by setting the standard deviation of returns to zero.

Pros

- The Flexible Retirement Planner is notable in offering a range of “spending policies.” It can model real-world retiree behavior by adjusting spending in response to major portfolio fluctuations. You can model “conservative” and “flexible” responses, even returning to work if necessary. I don’t know of any other free software that can do this as effectively. It would be nice if the policies could be customized, but to have them at all is impressive.

- You can also vary portfolio returns, inflation, tax treatment, and cash flows.

- The program offers several detailed tabular views and can track multiple runs.

- There are also advanced features like RMD’s and sensitivity analysis.

- The graphical output is very rich, showing the median portfolio value by year for the three available account types (taxable, tax deferred, and tax free) by default.

- You can also overlay several other parameters like the % of expenses funded, failures, and success bands (10%-90%).

Cons

- The Flexible Retirement Planner requires Java to run, and the site can be sluggish. (Java has seen a spate of security issues in recent years and many people have removed it from their browsers altogether. In general, you only want to enable Java for sites that you trust.)

- Other complaints are minor.

- The default returns for various investing styles seem overly optimistic by today’s standards, but are easily customized.

- There might be a small inconsistency in reporting portfolio values when the current age and retirement age are set the same.

Note, the program generally displays values in today’s dollars, even when it is adjusting for inflation. This might be a convenience, or confusing, depending on your point of view, since most other calculators display the inflated amounts.

Scenario Results/Conclusion

Median Ending Portfolio Value: $304,699. Probability of Success: 84%. This is a robust free retirement calculator. In fact, the web site is a small treatise in retirement planning/modeling itself.

Is There One Best Free Retirement Calculator?

Free retirement calculators are plentiful on the web. These are three of the best retirement calculators, in my opinion. Try them. Try more than one. But use them all with caution!

Understand that retirement calculators aren’t giving you the answer to a simple mathematical equation. They are actually attempting to model the future. That’s a tough assignment, even for the best retirement calculator. One that is actually impossible, in any precise sense.

I don’t recommend relying on any of these tools, and then resting on your laurels. Consult them, at least annually, to optimize your near-term financial decision making, while understanding that the future will inevitably turn out different than planned.

And, of course, your opinion or experience could well be different from mine. Do you have a preferred retirement calculator? Leave a comment about it below with the pros and cons. For extra credit, run the retirement scenario through it, and let us know the results!

Want More on Retirement Calculators? Review Our Curated List of the Best Retirement Calculators

* * *

This articles was originally published on March 19, 2013 and was most recently updated on October 16, 2021.

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[The founder of CanIRetireYet.com, Darrow Kirkpatrick relied on a modest lifestyle, high savings rate, and simple passive index investing to retire at age 50 from a career as a civil and software engineer. He has been quoted or published in The Wall Street Journal, MarketWatch, Kiplinger, The Huffington Post, Consumer Reports, and Money Magazine among others. His books include Retiring Sooner: How to Accelerate Your Financial Independence and Can I Retire Yet? How to Make the Biggest Financial Decision of the Rest of Your Life.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

I have used the Flexible Retirement Planner for years and I agree that it is a great tool. I like that you can input data for several scenarios, such as the date to start Social Security, and only use one option for any particular model run. Therefore al the data is there to do a number of different scenarios quickly.

I agree that Flexible Retirement planner is a nice tool with lots of options. It can be a lot to take in, but once I figured it out, it was interesting. I actually liked it better than Pralana Bronze or OnTrajectory (which I subscribed to for a year), neither of which I ever felt sure I was using properly.

Flexible Retirement planner is my new go-to planner.

FYI, I went to the Flexible Retirement Planner link and there was a download available that does not require Java.