Book Review: A Healthy State of Panic

Farnoosh Torabi is an author, journalist, podcaster, speaker, and thought leader in personal finance with a special connection to this blog. Her 2012 interview with Caroline and me at our home in Chattanooga for Yahoo Finance and our 2015 discussion on her So Money podcast brought thousands of new readers and helped vault Can I Retire Yet? into the front ranks of early retirement blogs.

I can still remember Farnoosh arriving in her limo from the airport, a star reporter with a humble attitude and a big heart. She seemed genuinely interested in understanding and communicating our story. And I can remember her standing in front of the camera on our front lawn in the Tennessee heat doing a half-dozen takes of her summation, to make sure it was right.

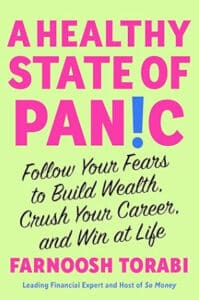

In her latest book, A Healthy State of Panic, which launches tomorrow, October 3rd, Farnoosh departs from purely financial topics to dwell on the deeper ingredients of success. Taking an autobiographical approach, she dissects one of the most common human emotions, fear, and explores how we can leverage it to become all we can be.

Exploring Common Fears

As I scanned the table of contents for the book, I was struck by the fresh take on a familiar subject. Farnoosh has created a very useful catalog of everyday fears and put them in a universal chronology—the order we might experience them in life, from the primal fears of childhood to the anxieties of maturity and old age.

The core message of the book is that fear is not an emotion that we should, or even can, seek to avoid. All of us launched on the path of a rich life will inevitably experience fear, again and again. Rather, Farnoosh advocates for honoring this critical emotion, welcoming fear and embracing what it teaches.

She writes that fear is “not out to get you. It wants a healthy relationship with you so you can reach your greatest potential with a net at your back.” Thus her book is about how to process, navigate, and learn from fear.

As a reminder of how this all relates to finance, Farnoosh states that fear is “the emotional underpinning of many of our financial questions.” So true. Fundamentally, money represents our ability to feed and shelter ourselves and our families. And what could be more fear-laden than failing at that task?

Partly Memoir

For Farnoosh, this book is no abstract exercise. Like all good authors, she leverages her own experience. A good portion of the content consists of stories from her life, starting with childhood and extending through early career trials, later career successes, marriage, and parenting. Some of the stories are quite candid and intimate. She honestly profiles her father and mother. She discusses miscarriage and breastfeeding. This all makes the book in part a memoir.

The end result is that we see up close and in detail how Farnoosh has experienced and dealt with fear on her road to success.

Having just spent more than two years immersed in writing my own memoir, this genre is top of mind for me. Whereas my book is first an adventure travel story with elements of instruction and self-help, Farnoosh’s book is the reverse: a self-help book with strong elements of memoir. Either approach can work, and Farnoosh fully commits to the personal elements of her book with first-class storytelling and sometimes painful honesty, but always a sense of humor.

Fear of Rejection

The meat of the book is the discussion of nine common fears. This begins with the fear of rejection—one of the primal fears of childhood when we are fully dependent on parents for survival.

As we grow up, belonging to a peer group is an essential developmental step, while being rejected from the group is a recipe for emotional and physical trauma.

Farnoosh points out that the fear of rejection can push us into a likeability trap, denying our true selves in an attempt to be more like and more accepted by others. The end result can be just as destructive as rejection.

She counsels that a wise understanding of the fear of rejection actually encourages us to start over, contemplate who we are, and center ourselves. “Relax and be real.”

Fear of Exposure

In today’s social media and reality show-driven world, exposing the details of a successful or dramatic life has become a formula for fame and success. And Farnoosh points to evidence that vulnerability can lead to success in our personal and professional lives.

I understand this formula all too well. In past blog posts here, I was more transparent about the details of our financial life and early retirement than my younger self ever would have expected. And the story caught on. In general, that has been a positive process that’s given readers valuable insights.

In my memoir I’m even more candid about my physical and mental challenges.

But Farnoosh warns that such exposure is not without risks. Sharing aspects of our lives or identity that could be unpopular or confusing has its downsides. Usually the problem is when we say too much to someone we shouldn’t trust.

The fear of exposure tells us to proceed with caution. Farnoosh counsels that we reveal ourselves only to those who can respect and value our truth. “Before you share, read the room.”

In her case, she saves her deepest reflections, insights, and revelations for her podcast and books, where she knows she has a purposeful and sympathetic audience.

The story of finding her husband demonstrates that without exposing your true self, you’ll never develop the intimacy for a great relationship. But it’s only wise and natural to do so gradually, and in the right company.

Fear of Money

Farnoosh is an acknowledged expert on personal finance, as well as a successful entrepreneur, so I was curious to hear the lessons she’s learned around fear related to money.

For example, I was intrigued to read that this highly successful woman still feels the need to play it safe in certain areas, including reducing her stock exposure with her increasing family obligations.

She acknowledges that the financial fears we carry into our adult life emerge from our earliest experiences with money and asks “What is the story you’re telling yourself about money?”

In her case, she watched her mother experiencing less control in marriage because she didn’t have access to her own money. This led Farnoosh to vow she would never lose her financial independence in a relationship.

For Farnoosh, more money means more power. But she’s not writing about the abusive, morally hazardous power to conquer or control, but rather the power to positively influence, support, and make an impact in the world.

Fear of Failure

I’ll confess that of all the fears discussed in this book, fear of failure is one of my biggest. Farnoosh is admirably honest about her own mistakes and ambitions. She admits that she derives her sense of self-worth from achieving things. And she points out that one of the biggest reasons we fear failing at those things is because we’re afraid that it says something about us, personally.

But when we fail, the issue might not be us. It might be the environment we’re in. Farnoosh describes trying too hard to fit into a place that wasn’t right for her. Rather than failing at her job, she was failing to define success on her own terms. She advises against borrowing our definition of success. We should pursue goals that are aligned with who we are and what we want out of life, and not be quick to pronounce failure.

Perfectionism can also contribute to a fear of failure. We may need to reframe our thinking and focus on what matters most to achieve our goals. With respect to my own creative efforts, I learned from this section to ask myself, “Do I want to publish a respected and successful niche book—a reasonable goal?” or, “Am I trying for a New York Times bestseller—essentially impossible for the vast majority of authors.”

I’ll never forget Farnoosh doing those multiple retakes in our front yard in Tennessee. What I saw there was somebody climbing the steps to her own vision of a successful career, and willing to fail as long as it took to get the results she was after.

Fear of Endings

Farnoosh observes that because endings are inevitable and affect us all, fear of endings is one of our greatest common denominators. Unfortunately we often react to potential endings with short-term thinking. Our preference for happy endings makes us lean to short-term rewards even when that risks bad long-term outcomes.

We so often strive to avoid feeling regret, grief, or doubt, even though these are inevitable aspects of human life. But something new is always waiting in the wings. “Goodbyes are integral to how we achieve happiness, gratitude, and our goals,” she writes.

Sometimes good things end too quickly. A show is cancelled, a speech falls flat, a book undersells. Farnoosh argues that even for those with talent, genius doesn’t always strike, and that’s not your fault. The reception to our work is not entirely up to us, especially in the creative field. Many other factors including luck, timing, trends, and taste go into determining success.

Regarding the greatest of all endings, death, Farnoosh points to research that shows contemplating death—specifically, our own—can generate a greater appreciation for life, making us happier. So she advises that this is a fear worth incorporating into our lives, but only by invitation, when we are in a good place for serious contemplation.

Fear of Losing Freedom

The last fear Farnoosh explores in her book is one that is increasingly familiar to those of us in our 60s and beyond— watching our parents and perhaps ourselves on the road to losing physical independence.

My life has taught me that with planning and strategic thinking, we can enjoy unparalleled freedoms in the modern world. One of my heroes, Harry Browne, author of How I Found Freedom in an Unfree World and The Permanent Portfolio was a genius at this. He argued that we should live more by our own moral compass and less by societal or tribal dictates.

But we must accept that, in the end, we can’t have unlimited freedom. In fact we will lose a great deal of what we’ve enjoyed. At that point, acceptance will be essential.

Also at that point, and especially until then, Farnoosh advises considering, “What’s an option that I, myself, can create?” What can we still control, even if we have lost some freedom? Our thoughts and attitude remain a final bastion of self-determination.

Doing the Scary Stuff

To write A Healthy State of Panic, Farnoosh spent many days and nights on her own, contemplating her fears, examining them, and finding their hidden gifts. A key takeaway is that fear is ultimately an emotion to be studied, not avoided. It can teach us how to live our lives, and it can give us more humility and empathy to connect with others.

Farnoosh clearly worked through many of her own fears in writing this book. Though she is an immensely successful woman and her success at climbing the career ladder might be intimidating for some, she bravely recounts her imperfections and her continued hard work to get her where she is. She was not excellent out of the gate. Even in finishing this book, she worried “Who will care about my stories?”

Many will. This is a brave and eloquent tale full of valuable lessons learned during a successful career and rich family life.

Fear: A Common Denominator

I remain grateful to Farnoosh for her role in putting Can I Retire Yet? on the blogging map many years ago. I also feel a special affinity for this book of hers. The terrain she traversed is similar to what I’ve traversed for my own memoir: How do we overcome our fears to live the lives we are destined for? Farnoosh worked through her fears to find success in the personal finance and media domains; I encountered my fears in tech startups and adventure sports. The environments are radically different, but the lessons and tools are the same.

It turns out that feeling fear means that we care, and that learning from fear is integral to leading a rich life.

“…you can do the scary stuff, too. And more importantly, you really should.… rather than fearing the possibility of failure or grief or regret or uncertainty or any of it, fear the risk of missing out on an actualized life.”

“…you can be afraid and still be extraordinary. And perhaps you are extraordinary because you are afraid. You can be both, together, all at once.”

Farnoosh Torabi, A Healthy State of Panic

* * *

OUTDOOR ADVENTURE: My new web site explores the books, authors, and trails of the long-distance hiking movement and has more about my forthcoming memoir Rain and Fire In The Sky: Beyond Doubt On The Colorado Trail. Click over to TrailMemoir.com.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[The founder of CanIRetireYet.com, Darrow Kirkpatrick relied on a modest lifestyle, high savings rate, and simple passive index investing to retire at age 50 from a career as a civil and software engineer. He has been quoted or published in The Wall Street Journal, MarketWatch, Kiplinger, The Huffington Post, Consumer Reports, and Money Magazine among others. His books include Retiring Sooner: How to Accelerate Your Financial Independence and Can I Retire Yet? How to Make the Biggest Financial Decision of the Rest of Your Life.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.