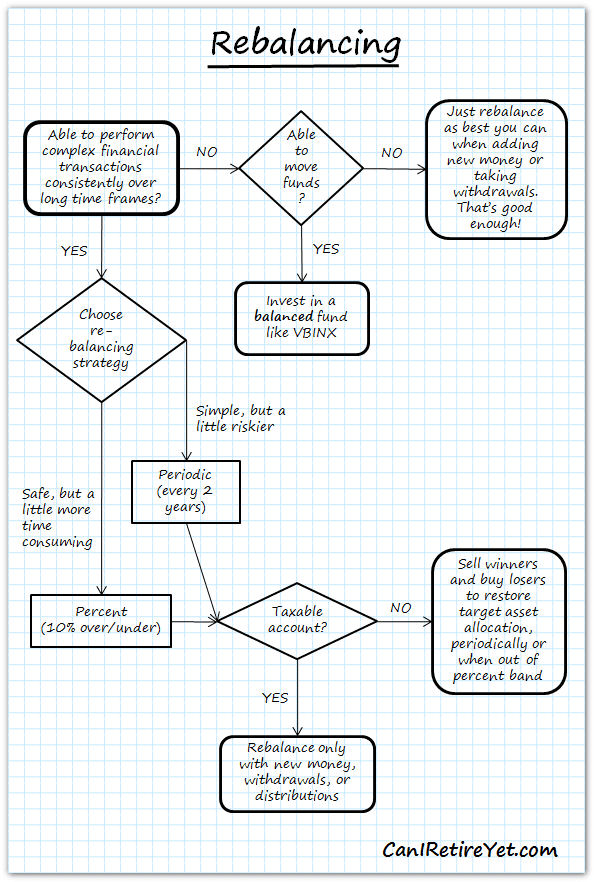

Blueprint: Rebalancing

The CanIRetireYet blueprints are easy one-page diagrams that capture the essence of important personal finance decisions. They intentionally simplify complex details to provide you with an overview, guideline, or refresher for the most common cases. Keep in mind that your situation could be different. For more detail and explanation, see the related articles below.…

(You may freely copy, download, or link to this image for personal or professional use, as long as you don't modify it, and as long as you include attribution to CanIRetireYet.com. Thanks! )

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence