ACHIEVE FINANCIAL INDEPENDENCE. LIVE WITH PURPOSE. LEARN FROM THOSE WHO’VE DONE IT.

AS SEEN ON

PREMIUM PRODUCTS

Additional Resources To Achieve Financial Independence

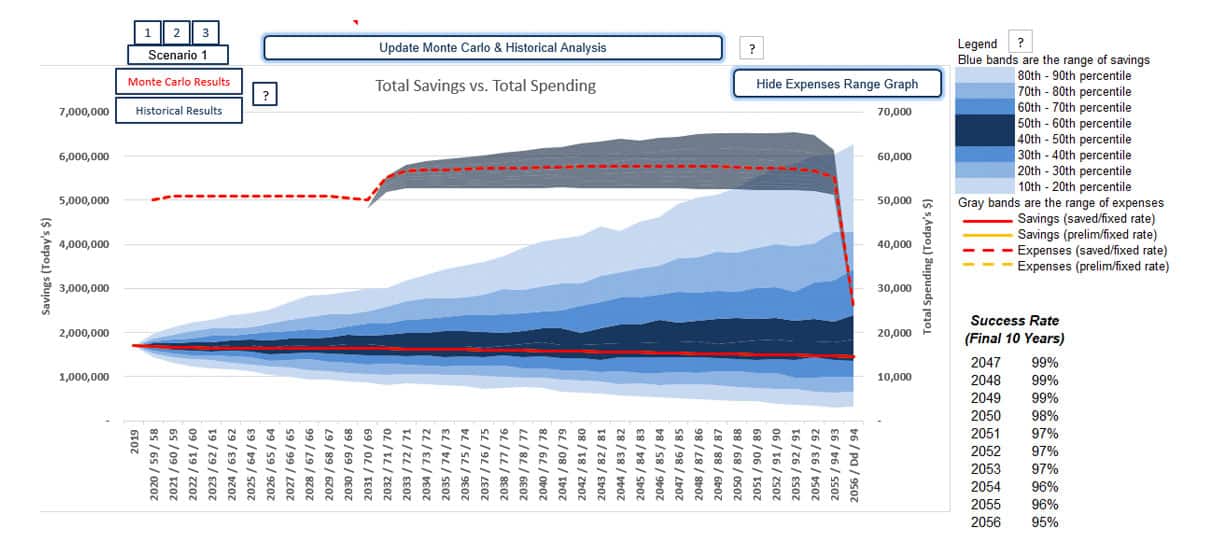

Pralana Gold Retirement Calculator

See into your financial future with arguably the most advanced personal financial model available at any price.