Reader Story: How We Live a Nomadic Life in Retirement

I recently made a call for readers to share their stories to supplement posts by Darrow and me. First up is Margot who shares her and her husband Nick’s story.

Their path to and through retirement includes overcoming adversity in their personal and financial lives, challenging our notions about how much is “enough,” the power of flexibility and creativity, and finding the courage to live your best life in retirement.

(Disclosure/Editor’s Note: This post contains a number of links to resources Margot has found helpful. One is NewRetirement, a longtime affiliate partner of the blog. All of the other links are included for your convenience. We do not make any money if you click those links, and the inclusion of links to any of those sites does not imply that this site has vetted or endorsed them.)

Take it away Margot. . . .

What an honor to contribute a blog on this site. The resources and advice have been so helpful to me as we navigate life beyond work.

We are Margot and Nick, 70 and 75 respectively. We travel full-time. People call us nomads, vagabonds, wanderers, or “slowmads”—our preferred style is to stay in places for 1-3 months at a time. We hope to continue for at least the next 5 years, good health and attitudes allowing.

All of our belongings are in a 10×10 storage shed in Washington state. Our doctors, dentists and virtual mailbox are also there. We own no real estate or pets. We have no grandchildren and our parents have long since passed. Each of us has one child and they are on their own at the ages of 32 and 38. Our knees are still good.

We have about $750,000 in savings and investments. I took my Social Security on my own work record this month. With the assistance of plans created via NewRetirement and Schwab, we will spend to our guesstimated earthly ends. This is also called Die With Zero (the title of a very interesting book by Bill Perkins). The kids will be alright.

Where did the vagabond dream originate?

It all started in 2006 when Nick and I were matched up via It’s Just Lunch (a dating service) in Orlando, Florida. From the get-go we talked about traveling—the places we still wanted to experience.

Nick had lived in Parma, Italy as a teenager and hitchhiked Europe in his 20s. I had grown up on military bases around the world…. And, then, we started watching House Hunters International on HGTV and the dreams started to gel. At the time we were 58 and 53.

Nick was laid off from his communications position in 2010 at the age of 62. He was a graphic designer and writer—it was not his first downsizing rodeo.

So he decided to hang it up and take Social Security early. He found a high deductible Blue Cross/Blue Shield policy until Medicare kicked in. A small percentage of a family business plus Social Security kept him afloat.

Related: When to Take Social Security

Nick’s divorce and lay-offs had taken their financial toll on his savings. In 2010, he moved into my very underwater and highly mortgaged Orlando area home (thanks to a 2006 divorce, exorbitant home appraisal and the subsequent 2008 housing crisis). It was a paycheck to paycheck life.

What Kicked Us Into High Gear?

Life turned on a dime in 2011. Nick proposed; I was offered a job across the country at lower pay BUT it came with a house.

We got married on a beach in St. Thomas. We drove cross-country from Orlando to California. I persuaded the bank to allow me to do a short-sale of my Florida home. And stopped paying the mortgage, citing hardship as my salary was reduced by ⅓ at the new job. I kept up all utility, pest, and lawn maintenance for the Florida property.

Nearly 9 months later, a week BEFORE the house’s foreclosure hit a Tampa court, the short-sale settled. $180K of debt flew off my shoulders and, thanks to federal legislation, was not taxed as income. And a nice family got a great, well-maintained house at a price below what I had paid for it in 2001.

Living With Cancer (X2)

Then a hammer fell—at his Medicare exam in 2013, Nick’s PSA was 147. A tumor on his spine translated to Stage 4 (terminal) prostate cancer. Only 28% of men with his diagnosis survived for 5 years. We were still newlyweds.

A friend advised us to look at the disease through a quality of life lens. Nothing like cancer to stir the Live Your Life Live Your Life attitude! So we started dipping into my 401K and took 3-5 week vacations, thanks to my understanding bosses, to many of the places we’d dreamed about our first few years together.

After 4 years, I started to joke he’d better die or we would go broke. But, damn, he just kept on living. Miraculously, stripping his body of testosterone via drug therapy paused the cancer’s growth. And we kept draining our savings. But we knew then (and still know now) that the drugs could stop working at any time.

And then, a second hammer fell in 2019. I was diagnosed with Stage 2B breast cancer. I scheduled professional responsibilities around my treatments. Doing radiation at 7 am was chosen so I could put in a full-day’s work. I took a total of 3 sick days when I had surgery. In retrospect, what was I thinking?

Something needed to change. The stress and 60 hour+ weeks couldn’t possibly be good for me. I was working more and enjoying it less. (BTW, I had a lumpectomy and radiation and there is no current evidence of disease, thank goodness).

The Change or Die Point

In May, 2020, I hit a professional and personal wall. I was working my tail off addressing the challenges COVID created for my organization. There were deep and rancorous divisions of opinion about the best ways to manage the business.

I figured that I was being paid for my brain. But my advice and work were falling on deaf ears. Why was I still working?

Can I Retire?

I didn’t think I had enough money to stop working. All my retired friends—the ones with corporate jobs or jobs with pensions had $1.5-$2M saved. All the calculators said I had to have 10-20 times my income. I wasn’t anywhere close to that.

I had only started maxing out my 401K when I got my first 6-figure job in 2001. My divorce had taken a financial toll on me. And we had spent a ton on travel, thinking Nick’s death was imminent. We had run up credit card debt. My 401K sat at $350,000, and I had $80,000 in savings—hardly enough to live on. My only choice looked to be dying at my desk.

A Tragedy…. and a Blessing?

But fate and tragedy had intervened. My younger brother—a Type I diabetic—died in his sleep at the age of 63. He was always playing his blood sugars close to the bone and he never revealed a heart condition to me or our other brother. His two wives were in the rear-view mirror and he had no children. He also had 14 acres and a paid-off house.

The real estate market was a hot one and my surviving brother is a realtor. Within 18 months, we sold the house and 4 additional lots. Now, every journey starts with a toast to my late brother.

May 8, 2020 was a particularly difficult day at work. I walked the 9 steps from my office to our (attached) house and told my husband I had written my employers to negotiate a separation agreement. It was time for me to own the minutes and hours of my days. I was done with deadlines and pleasing others. The red ball came off my nose.

Nick was thrilled—he had seen how discouraged I was. No more Crabby Appleton. We opened a bottle of champagne and started to figure out how we could afford to live for 3 years before I took Social Security. We crunched numbers and made lists of countries.

A Financial (and Personal) Reboot

Thanks to the sale of family property and a good year for the stock market, we paid off all our debts and invested the rest. We now owned no real estate.

I ran the numbers again. If we kept annual expenses between 75-100K, our nest egg of $750K would—barring some unseemly tragedy— last us a lifetime. We keep a 2-3 year cash bucket (in a T-bill ladder) and don’t plan to touch investments until 2025.

I have a handful of speculative stocks in a Roth IRA that my late tech-geek brother recommended that may yet pay off (e.g. JOBY, IONQ, LVWR). This rocky market fascinates but doesn’t scare me.

Between May and August of 2020, we sold, donated and tossed most of our stuff and relocated to Washington, a tax-free state. I culled belongings and artwork by imagining what I wanted to be surrounded by in my 80s when we settle down. The storage unit is like a second-hand store where I want to buy everything in it!

A friend advised me when I quit to do absolutely nothing for the first 6 months. What did I want to say YES to? We sat in a waterfront cottage and turned our dreams of international travel into 5 years of plans.

Hitting the Road

We spent two months each in Honolulu and Croatia and three months on Lake Como in 2021.

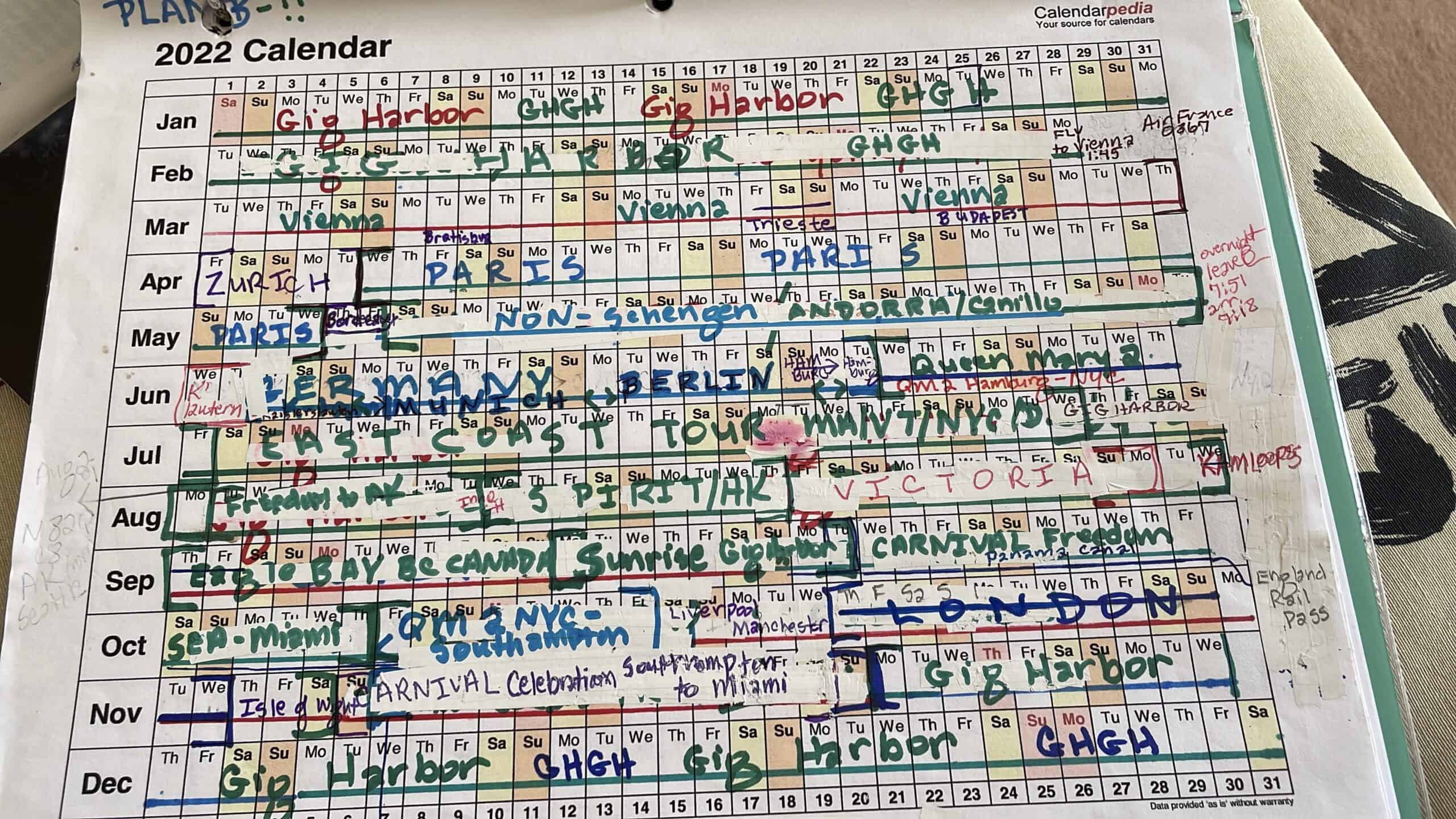

In 2022 we slept in 57 beds—a month each in Vienna, Paris, Germany and Andorra, a month-long road-trip through western Canada and another road-trip from Maine to South Carolina to see relatives and friends. We’ve taken 5 post-COVID cruises with 12 more booked through 2025.

We flew to Bonaire in February for a month, then jumped to Aruba before a 21-day trans-Atlantic cruise to Barcelona where we are now. We’ll head to a beach house near Valencia for another month before heading to England, Norway and Scotland.

2024’s plan is Sydney, Auckland, Perth, Bali and a world cruise.

2025 will be the year of South America: Lima, Cuenca, Santiago, Montevideo and Sao Paolo and then Lisbon, Tenerife, Isla de La Palma, Funchal and Porto are in the consideration set.

We integrate 6-8 weeks of pet-sitting annually to offset the increasing prices of short-term rentals. We both have had pets our entire lives and we miss the cuddles.

Via TrustedHouseSitters.com, we’ve had 2-3 week sits in Vancouver, B.C., Washington State and England. We have 5 weeks scheduled for Australian Shepherds in England and a cat on the outskirts of London.

As its name implies, this international (and very searchable) fee-based membership site and app is based on trust. People who need care for their pets while traveling post all the details and invite applications, usually 1 week to 3 months out.

Generally via video conference, we interview with our prospective hosts. No money changes hands. An added bonus is eating all perishable food in the fridge and visiting new places.

Nomad Finances

We are NOT on vacation—we just live our lives in a series of different neighborhoods and cultures. Our core budget is $60K a year plus an additional $40K for splurgey travel for five more years. The transition from accumulation to spending has NOT been a problem for us. Social Security now covers 70% of our expenses:

- Accommodations: $30K (short-term rentals and hotels)

- Food: $15K (we like the occasional Michelin-starred experience but mostly cook “at home”)

- Cruises: $25K (generally, interior cabins. As a blackjack player, I also get dozens of offers for “comped” cruises. We cruise an ocean rather than fly over it whenever possible).

- Transportation: $10K (trains, planes and automobiles)

- Charitable giving: $8K (I’ve always given financial voice to my heart by giving at least 10% of my income to causes I care about).

- Clothing, mail, entertainment, etc. $5K

- Insurance, medical & taxes, phone: $7K

We expect our post-nomad expenses—in our so called “no-go” years to be around 60K, covered by our Social Security, using dividends and RMDs for shorter stints of travel.

Won’t You Get Bored?

“Boredom is the inability to pick up on subtle vibrations.”

–Colin Wilson

People wonder if we get bored. Never, ever! There are so many books to read and people to watch. We walk. Nick brings his watercolors or guitar.

We meet new friends and try new foods and learn new train and bus systems. We pack lighter and lighter—we now travel with two roller-bags and two back-packs.

Health “Care” vs. Health Insurance

And what about healthcare? We plan at least 2 months in Washington every year for medical and dental appointments and follow-ups.

Medicare Advantage will cover an emergency overseas (I updated the original text from Medicare to Medicare Advantage in response to reader comments and added the link to information on Medicare Advantage plans for clarity).

And we also have Med-Jet for emergency hospital-to-hospital air evacuations. We also buy the cruise/air carrier insurance. AND, for longer land stints, we get coverage via a quote from insuremytrip.com.

We are considering an annual travel policy but, at our ages, the choices are limited and expensive. Many nomad friends report excellent care overseas at very reasonable prices.

We are intentional about every step we take. We are more fearful of falls than COVID. A shower mat travels with us wherever we go. We avoid the dangerous habit of being 17 years old in our heads. The “3 points of contact” rule is mandatory (i.e. if there is a railing, we USE it). Also “one thing at a time”. We often caution each other about steps, uneven cobblestones and low beams.

We find accommodations via VRBO.com, Airbnb and expat FB pages. Short-term hotel stays are easy to book last minute via Hotwire. We play the points game with credit cards to avoid paying cash for air transportation.

Related: Travel More and Spend Less With Credit Card Travel Rewards

We belong to a GREAT FB page for nomads of all ages called Go With Less where information and tips are traded generously.

The Power of Flexibility and Creativity

Everywhere we go, everyone we meet is curious and sometimes envious about how we live. And wonder if they could do it. Over dinner last week, one of our new companions said they weren’t sure they had the guts to live like we do.

My response? All it takes is the willingness to be untethered. We are easy-to-please people with newly found flexibility about what life (and train strikes) throw at us.

And what happens when you can no longer travel at this pace?

Our endgame is to find an apartment in the little Washington State town where our storage shed is. And get a dog. And maybe cats, too.

The liberation of owning nothing is exhilarating. This way of being in the world is more fun than I ever imagined. Not working is more rewarding than I ever imagined.

Live your life. Live your life.

Chris’ Take Home Points

Man Plans, God Laughs

Many of you, like me, are planners. If we’re being honest a more accurate description would be control freaks. Reading through parts of Margot and Nick’s story made my heart race and palms sweat a little as I bet it did some of yours. To name just a few examples….

- Nick “hanging it up” after a layoff, despite not having his finances in order,

- Margot shortselling her house at the last moment before foreclosure,

- Holding “speculative stock” positions into retirement,

- Both Nick and Margot meeting what is many of our greatest personal and financial fears head on, receiving serious medical diagnoses.

And yet they not only manage life, but live a life of adventure most of us even with perfect health and far larger portfolios would be afraid to pursue.

Margot suffered the loss of her brother. She grieved his passing. Then, rather than dwelling on losing him or feeling uneasy about the money he left her, she made the active decision to focus on the blessing of receiving an inheritance, being grateful for what she received, and using it to live life even more fully from that point forward.

Reading this story will not make me stop being a planner, and I hope that is not what you take from it either. However, it will serve as a reminder for me, and hopefully you, that there are many things we don’t control. Inevitably things will happen, both good and bad (and sometimes both at once!), that are not in our plans.

Our success and failure in life and retirement are not ultimately determined by those things that happen to us, but in how we deal with and move forward from them.

The Role of Flexibility and Knowing When You Have “Enough”

A major factor in Nick and Margot’s ability to move forward is their ability to be flexible and creative. A likely factor for their creativity and unconventional approach is the idea that necessity is the mother of invention.

Many of us obsess about whether we have enough, and in the process end up with more than enough. Sometimes we end up with far more than enough.

There is a body of research showing most retirees will never draw down their retirement portfolios. This is a common pattern I observe in readers I’ve spoken to and supersavers I do planning work with.

Margot and Nick have low fixed costs (no home, no car, few possessions). They are able to find creative ways to lower housing, transportation, and travel costs (house/pet sitting, comped cruises, credit card travel rewards, flexibility, etc.).

They live a life of travel and adventure that people with far larger net worths only dream of. Charitable giving is also a priority.

Kudos to them for making this work and using the resources they have to build the life they want to live!

If you would like to share your story to help others learn from it, send me an email at chris@caniretireyet.com.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

The post states that Medicare will cover emergency medical expenses in a foreign country. This is incorrect. You need other health insurance to cover medical expenses overseas. Some Medigap plans, some Medicare Advantage plans and some employer/retiree plans will cover those expenses.

OP here. . . You are correct. . . It is our Medicare Advantage program that will cover an emergency overseas. We checked.

Then why are you leaving misinformation in the article? You should fix that as it’s extremely misleading to the uninformed.

I asked the editor to correct this to make it clear that it’s our Medicare Advantage program, not Medicare that will cover an overseas emergency. My apologies—I should have been more precise.

This has been corrected in the text with a link added for clarity. Thanks for bringing this error to my attention.

Chris

I enjoyed reading this guest post greatly, as someone whose nest egg and lifestyle since I ER’d 21 years ago has had a lot in common with Margot and Nick’s, albeit with less and much more humble travel.

For readers who may be interested, the pioneers in living the perpetual travel lifestyle are Paul and Vicki Herhorst, whose book “Cashing in on the American Dream” (published in the early 80’s) remains a good read if you can find a copy. More recently Billy and Akaisha Kaderli (website: retireearlylifestyle.com) retired at 38 on about the same size of nest egg as Margot and Nick; they’re now in their late 60’s and still living that lifestyle, albeit at a far lower “burn rate” (~$24-30K a year – living mostly in Mexico and other low-cost countries).

The 40K a year in luxury spending and lack of a real plan for medical care, let alone LTC, would scare the hell out of me. As Bob Knisely pointed out Medicare does NOT cover you overseas; Part C,D,E and F plans cover 80% of such expenses up to your plan’s limits. Even with a robustly defensive asset allocation there’s no way I’d be taking more than 3% or so from a 750K portfolio to supplement SS.

Travel medical insurance becomes cost prohibitive quite quickly after age 70, thought insuremytrip.com does indeed have the best plans I’ve seen to deal with this situation. A better plan still is to restrict you travel to countries where you could probably cover almost anything that would happen to you out-of-pocket but that means sticking to places like Thailand, India and Mexico. And even then, you need at least 50K per person set aside as well as a clear plan to not only get yourself Medevacked back to the U.S. but a place to live with a community of friends and/or family to care for you as well as a good Medicare supplement plan in place.

House sitting (which is of course in actuality pet sitting) is indeed a great way to save money and get a fur baby fix and it’s been great to see opportunities opening up again after being shut down for 2+ years during the pandemic. But I recommend avoiding Trusted House Sitters like the plague. This article offers a good overview of the plusses and minuses of the various house sitting sites and I can verify the accuracy of their assessment based on extensive personal experience.

https://halftheclothes.com/best-house-sitting-websites/

Another reason to focus one’s travel on developing countries close to home is that a 750K nest egg isn’t going to support long-term care needs should they arise. The Kaderlis, for example, living as they do at Lake Chapala, have easy access to close to a dozen LTC places there where you can get nursing care and 3 meals a day for $1200 U.S. – a fraction of the cost of a dismal Medicaid nursing home – and in a culture that unlike ours actually respects and values old people.

Ultimately with that size of nest egg I think you have to have, at a minimum, the ability to live only on Social Security for a prolonged period during a market downturn and a great deal of confidence in your ability to find an affordable rental or buy a mobile home or small apartment outright when you finally do hang up your travellin’ shoes – which could of course happen at any time to any of us, but especially to those already well into their 70’s.

Kevin,

Great comment as usual. Thanks!

One area I do want to push back on though that may create an interesting conversation in the comments or for others to consider privately. Margo is 70 y/o and a cancer survivor. Nick is 75 y/o and by all account already living on borrowed time. Yet you think a 3% withdrawal rate from investments is the maximum you would be taking.

I’d love to hear your reasoning for this and I’d love to hear other’s thoughts (acknowledging we are limited on the level of detail we know about Nick and Margo’s exact account balance, allocation, spending needs once they stop traveling.)

What is your basis for determining a “safe” withdrawal rate? What time period would you be planning for, based on the information we have before us?

Chris:

I really enjoyed Margot’s post, and admire her openness.

Re: What is our basis for determining a safe withdrawal rate?

Having read quite a bit on SWR, including Big ERN’s excellent series, my conclusion is that one’s safe withdrawal rate depends a lot upon individual factors, such as the age that one retires, how much your variable expenses are (Margot and Nick seem to have a significant amount of variable expense) and how quickly that outflow can be reduced, in event of a bad sequence of investment returns, how many years you have left in retirement, whether you have additional income/retirement benefits that you might take later in your retirement (i.e. people that retired a number of years before taking Pension and Social Security benefits, may be able to significantly reduce withdrawals after they start receiving them), and what your likely range of LTC costs may be.

I agree with Kevin, that LTC costs need to be seriously considered. The amount and level of LTC that a couple may need, is really hard to project, in advance. My Parents required a few years of skilled nursing, at the end of their lives. The total cost of their high quality LTC, in a major metropolitan area, was nearly seven figures. Not all People will need such care. Costs of LTC vary, depending upon where one lives. In our experience, quality varies as well.

Re: What time period are we using in our planning scenarios?

We are both just shy of 60 years old. We are planning for an additional 35 to 40 years. More than likely, whomever is the second-to-die, will leave our heirs with a decent inheritance.

ed_h,

Thanks for the thoughtful response.

Chris

Hi Chris –

Thanks for your excellent comments and question.

I mentioned a 3% SWR mostly because as you well know that kind of nest egg isn’t considered sufficient to self-insure for possible LTC care needs for a single person, let alone a couple, and they have neither LTC insurance nor a place to live when they stop traveling. Obviously I don’t know which “small town in Washington” they plan to use as home base but as most of our family lives up there I can’t imagine many places where rent even on a small place wouldn’t eat up most or all of their Social Security income, and of course forget about buying anything given the astronomical real estate values everywhere except in the extreme boondocks of Eastern Washington.

Of course you’re correct that given their ages and health histories one wouldn’t be planning for even an average life expectancy but even if they never touched another penny of their 750K portfolio they could look at spending down to nothing during their final years. That’d be my concern. Hopefully between their friends and their children they have strong “social capital” to make up for the shortfall in financial capital.

I appreciate you checking back and taking the time to respond. Your reasoning makes sense. Another factor that you didn’t mention but that jumps out at me is that they are currently doing OK with both of their SS benefits. If one them lives a long life, but the other doesn’t then they will have to do so without the smaller of the two benefits (and admittedly likely some corresponding reduction in expenses to support only 1 person vs. 2).

There is obviously no knowable right answer to what your safe withdrawal rate is until after the fact. Nick and Margot have to make decisions and live with the consequences as we all do, good or bad. Like you, I felt like their spending rate may not be sustainable. But like many of our readers, I would put myself in that conservative, maybe overly conservative, camp. So this is an interesting case for me to think through and use to challenge my assumptions.

Best,

Chris

Thanks for your considered response. I hear what you’re saying. . . My son is taking care of his ailing father and will inherit his house. I have told him to prepare a bedroom for me when I turn 90 and am down (according to newretirement) to $48. I told him my SS is larger than his dad’s:). . . I am likely to outlive Nick (no guarantees) due to his Stage 4 cancer status. And HIS daughter is a doctor—we can count on her to help make good decisions about l-t care if and when he needs it.

The town with our storage shed in Washington State has lovely apartments in the $1700-$2000 range or about 1/3 of our joint Social Security income. And, yes, we could NEVER afford to buy there. Expenses when we stop traveling at this pace are factored into our financial plan. And it’s a calculated risk regarding long-term care. Time will tell the degree of that ant vs. grasshopper risk.

We have also discussed assisted suicide—I am open to it when my quality of life deteriorates to a point when life is no longer a joy to me and I become a financial/physical or emotional burden to the people I love. I fear excruciating pain far more than death. Nick’s religious beliefs differ from mine—it is unlikely he would ever see that path as a viable option.

Kevin—thanks for your comments and links. Thanks to you, I joined another petsitting site and just booked an 11-day sit with a Basset Hound and schnauzer in Canberra for 2024!

I appreciate your sense of fear. . . I used to think happy people were stupid and I worried a lot more. But now that we’ve dealt with so much and I am confident we could slash expenses on a dime, we are comfortable with the risk. Nick’s Stage 4 is the sword of Damocles and it makes us more fearless than we might ordinarily be. Also, I feel like I could live within my $4,000+ personal SS payment on my own if/when the time comes. I’ve lived on far less in my life. The travel is temporary icing on the cake—give me a book and a Netflix subscription and a park and some friends and I’m good to go.

I’m also a global nomad. But I’m a planner. Not that the plans end up becoming reality, but that I have an idea of where to start when change happens. The pandemic really crimped my travel, but I quickly pivoted to accomplish goals, and finally got my Italian passport.

And my storage unit? I emptied it during the pandemic, having made the decision that I would not return to that city nor country. I have a small locker, and friends willing to receive items for me occasionally. And my mail service in Seattle keeps me informed.

My finances aren’t much different from Americans staying home. But next year I’ll tackle paying Italian taxes, and I’m sure life has more in store.

And one note: Medicare does not cover care abroad. I carry global health insurance and/or trip insurance, depending on my travels. Medicare can be used when I am in the US, but otherwise I private pay and have insurance in case of major healthcare needs.

All I can say is WOW and good for you!

I’m impressed, at all you have endured and accomplished and wish you nothing but many more years of ‘living the dream’, that most of us only – dream about. Like Chris, I’m a planner, always have a plan B and typically C and even D. Though I like to think I’m pretty flexible / easy going when things change.

If you post updates of your travels somewhere, please post something here and if you ever find your way to Western NC (Asheville we currently call home) – I would love to buy you a meal or two just to hear some stories.

Keep on keeping on!

Thanks. . . I am still pretty allergic to deadlines and post regularly on FB but no blog or YouTube or anything. That would feel too much like work!

“Medicare will cover an emergency overseas.” NOPE. Medicare almost never covers care outside of the United States. The exceptions are extremely limited, and the writer doesn’t appear to be spending all of her time driving between Alaska and the continental United States. And last time I checked, Australia and New Zealand are quite outside of the 6 hour cruise range from the United States.

https://www.medicare.gov/Pubs/pdf/11037-Medicare-Coverage-Outside-United-States.pdf

You should really not publish misinformation.

I am so sorry. . I should have been more precise. I have asked the editor to change to make it clear that my Medicare Advantage program offers emergency care overseas. My apologies.

This is an amazing story! Thank you for sharing! I commend your courage and optimism which definitely have a hand in your adventures. It’s outstanding and wish you best not to stop as long as you can.

If you or anyone can share of resources of finding affordable but also reputable health insurance for such global nomads I would appreciate it. We still have children in HS and I dream about time when my spouse and I can travel overseas by ourselves and stay there for an extend period of time. I hope my dream will come true.

I see how a few individuals have jumped at the chance to “correct” you. I think it was an honest mistake and no one should believe everything they read on the internet. Always fact check yourself. Rules change all the time anyways.

And your plans work for you – and that is great because you are the one living your life! I am a planner but I am adventurous as well. I find your story very interesting, and I will take pieces of it with me to apply to my own life.

I like hearing other people’s stories- so I hope Chris continues to do this series for a stint.

Thanks for the feedback Andrea!

I actually felt they had done a good deal of planning. So, no, I wasn’t stressed out by that at all. More stressed that we still own a home :-).

Great point that what seems “normal” for us can seem “risky” for others and vice versa.

Thanks for chiming in KS.

Chris

Great story and thanks for sharing. While I like to travel this definitely gave me a little anxiety reading. That said I do dream of visiting many of the places listed so I’m going to bookmark this and read it with my wife to see what she thinks. I doubt we would fully ditch our possessions and home, but some downsizing is definitely something I think about more these days.

Wow, enthralling and inspiring. Good luck out there!

WoW! What an exciting journey you both are on. No one can accuse you of not taking life by the horns. I have tremendous respect for how you are living life intentionally. Many of us spend our time planning for what my happen and that keeps us from taking action. No doubt in my mind that you’ll make it work regardless of any financial issues that may arise. Keep going!

Margot, thanks so much for sharing your story. It is always interesting to read how other folks lead their lives, and you and Nick seem to have found a great path for you both. Thanks again, and Enjoy!

Margot, thank you for sharing your story. Good on both of you, taking the hard knocks that have been thrown you and creating a life that works for you.

We are doing something similar. We retired in 2017 and for the first few years were traveling internationally about 10-11 months a year. Now because of grandkids and aging parents we’re now averaging 8 months a year, usually 6 months internationally and 2 months domestically.

Contrary to some comments above it seems like you have thought through medical issues, between the Medicare advantage covering you for emergencies, and the emergency evacuation it seems that you have planned. I’m sure that for minor things you just cover it out of pocket. I know we do. We’ve visited doctors and dentists in quite a few countries and its much more affordable than the US’s dysfunctional system. My wife tripped and fell last summer in Romania and ended up with a broken kneecap. It involved an ambulance, ER visit, cat scan, xrays, ekg, cardiologist, orthopedic surgeon, and cast. On our way out I was expecting a walk by the billing office, nope right out the front door, cost $0.

Someone asked a question about insurance for long term travel. There are long term travel insurance policies (up to a year) available and worldwide medical insurance but it starts to get expensive once above 60 yo. A couple of years ago we bought an annual travel insurance policy (All Trips Premier) from Allianz that covers us for unlimited trips. It costs us $498 a year for both of us (age 65 & 72) and as long as we keep renewing it we will never face preexisting condition clauses. The reason it is such a good deal for seniors is because I read its not age rated. The only restriction is that we have to come back to within 100 miles of our “legal address” at least every 90 days.

I appreciate your perspective Ian, thanks for sharing. It is easy to forget how dysfunctional and unnecessarily expensive and opaque our U.S. healthcare system is, and it is nice to hear the experience of someone who has received care in different places.

Cheers!

Chris

I love this! Very inspiring and although it would take a huge leap of faith, I’d do it in a heartbeat. Unfortunately I’d never get my spouse on board. May you continue your journey in good health! He has already beaten the odds with his type of cancer (I’m all too familiar with aggressive prostate cancer–my family member made it 3 years and that was considered the max you could hope to expect). Perhaps your lifestyle is contributing–a life filled with joy and new adventures and such positive vibes! May you have many more years of adventure!

I really enjoyed this article. DH and I are planning on doing something similar very soon at 54. We just need to get youngest offspring graduated from high school (next week 🎉) and our house listed and sold.

We were also married on the beach in St Thomas. We also had sold a house we had bought in 2001 and sold during the Great Recession for less than we bought it for.

I wish you many more years travel. I enjoyed hearing how you have got things to work with joy and flexibility despite some pretty difficult circumstances at times.

I was so inspired by reading this blog. Thank you so much for sharing your nomadic travel adventures and for being so honest and forthcoming about the ups, downs, pros and cons. You’ve given me so much to think about in my quest to travel more, live life well and to feel happy and fulfilled until the end of my time on this beautiful earth. Thank you again and may you be filled with much joy as you continue this incredible life journey.

First time commenter here. Thanks for having me, if you will, of course. Margot emailed the link to this article for me to read read and I enjoyed it.

People were very quick to chastise her for the Medicare overseas statement which she immediately corrected. I actually chastised her for saying she used to think happy people were stupid. But now she’s on a mission to repent for that thinking by sharing here how retirement can work for regular folks. She’s doing great work!

I am saddened by the comments in how many people have this seemingly debilitating fear of long term care costs. One commenter shared his experience in that it cost his parents nearly 7 figures. Folks, this kind of expense is the exception not the rule. Outliers ALWAYS skew the averages in the direction of the outlier.

To get a more appropriate figure you’d want to find out how many people actually need ANY care. Then you’d want to find out of those who needed care how long did they need care for. Then you’d want to find out what kind of care they actually received. Finally what was the median cost.

The financial industry is evil in how they lie to people about this stuff. Here’s how they do it:

1. X % of people need some LTC.

2. The average cost of a nursing home room or an assisted living room is Y

3. The average length stay in such a facility is Z years.

Do you not see how dastardly this is? They’re implying that needing some LTC is the same as being in a facility, which is absurd. Tons of people have some sort of LTC need without ever stepping foot into a facility, my dear mom for instance, and tons more people have NO LTC need to begin either!

But the evil-doers want you to think that if you need ANY LTC you’ll need a room for years.

Interestingly enough, the proportion of retirees who need LTC is roughly 50%. And the proportion of retirees who use an actual facility for an extended period is about 20%. This means 80% do not have any long term stay in a facility at all. Thus why would we worry so much about the insane cost of a long term stay in a facility when the vast majority of us never use it?

So if you are one of those 20% and are worried about needing a LTC facility, what is the average cost to you? Is it millions. Of course not. The average cost is roughly 200k, give or take.

Do you also really believe you and your hub/wife will BOTH occupy a facility for years and years? Have you actually ever been to one? Hardly any men there. Why? Because they die quickly compared to their wives. Thus the idea that you and your wife/hub will both need SKILLED CARE for years, as the financial industry implies, is not based in real data.

In fact, just look at CCRC’s to further prove this. A typical CCRC will have about a $500k entrance cost, depending on area, of course. Then you’ll pay around $5k a month in fees. Oh, most CCRC’s are AGING-IN-PLACE facilities, meaning you go from independent living to assisted living to Skilled Care in the same facility without ever seeing an increase in fees.

Thus, if CCRCs were typically paying MILLIONS to cover their vast amount of Skilled Care patients every single CCRC would be gone. Yet, CCRC’s are growing as a matter of fact. How can this possibly be?

Due to the fact that the vast, vast majority of patients do not use significant skilled care, if any at all. They may use a few months to a few years of Assisted care, but the big one, SKILLED CARE, is not used much. In fact, many people die off in independent living before they even transition to the assisted living section.

I’d highly encourage anyone to read Sudipto Banerjee’s article on this. “Cumulative Out-of-Pocket Health Care Expenses After the Age of 70” By far and away the best article about the REAL WORLD regarding LTC.

https://www.ebri.org/content/cumulative-out-of-pocket-health-care-expenses-after-the-age-of-70

But instead people will read this tripe from Morningstar. https://www.morningstar.com/articles/1013929/100-must-know-statistics-about-long-term-care-pandemic-edition and will never retire due to worry about spending 7 figures in a faclity.

It’s sad, and evil, how the financial industry has manipulated people. Don’t fall for it.

Josh,

I appreciate your comment and agree with much of it. One push back is confusing averages, which is great for insurance companies that can spread risk across a population, and worst case scenarios that an individual could face, they would have to bear the full brunt of, and could wipe them out. You are correct in stating that these worst case scenarios are rare. However, as a retiree choosing to self-insure you are an experiment with an n = 1. For that reason, you can’t just ignore those risks completely and they should at the very least be carefully considered.

Best,

Chris

Josh,

Great comments. The financial industry wants to scare everyone into believing they will live to 100. Statistically, it’s just not true—not by a long shot. And then what really happens, is people hoard their assets in their own names and the health care industry is there to gobble it all up. In reality, people should be moving assets out of their names and into Medicaid protected trusts, etc. Hopefully, if they have good relations with their children, the assets will be protected from the healthcare industry and the person becomes Medicaid eligible if/when they need to go to an assisted living facility or nursing home while the assets they moved can be used to supplement that cost. Rather than saving all your life in order to hand it over to the healthcare industry, good planning can allow you to live your dreams, protect your children and still have care if you need it.

Margot, bravo for you. You’ve realized that life is precious and that travel would be much more limited if you wait until your 70’s like the financial industry coerces people to do. I love your budget and think that way too many people are afraid to live because they’ve been beaten down into financial fear. It’s a real shame. You’ve inspired me.