Creating and Adjusting an Investment Policy Statement — With Free Downloadable PDF

Our Investment Policy Statement (IPS) includes our investment objectives, asset allocation, strategies to control investment fees and taxes, and plans for managing the portfolio.

A written investment policy statement is vital to achieving investment objectives. It helps prevent making bad decisions driven by fear or greed. It’s also helpful to have this document to refer back to because inevitably we forget things.

Our IPS was written when we were in accumulation mode. It served us well during this time.

However, as we shift from accumulation to decumulation mode we’ve realized a new plan is necessary. So we’re updating our investment policy statement.

We’re sharing our original IPS, changes we’re making as we transition to a new stage in life, and a downloadable PDF to help you create your own IPS.

Our Investment Policy Statement

I’ll share our investment policy statement as originally written. That may be helpful to others saving towards financial independence. This will be in italic font for consistency.

I’ll then provide commentary to share key things we got right, where we’ve veered from our written plan, and how our plan continues to evolve. My commentary will be in normal font.

Investment Objectives

This plan will be followed to build our assets to reach financial independence and provide for financial security in early retirement.

During our accumulation period, we were essentially living off one of our salaries and saving the other. We were focused on growing our investment portfolio.

Now that we’ve achieved our original financial goals, our investment plan will shift. Our investment objectives now are to protect our assets from unrecoverable losses and to employ a strategy that will enable our investment portfolio to support our spending needs indefinitely.

Assets Included In Allocation

Assets included in our portfolio include our retirement and taxable investment accounts and cash savings.

Investment Accounts

Investment accounts include taxable, rollover IRA, and Roth IRA accounts. We will also include our current work retirement accounts. These accounts will be considered together for the purpose of planning and asset allocation.

Since we wrote our original plan, Kim switched jobs, and I’ve terminated my employment. We rolled over her old 403(b) and my 401(k) to IRAs with Vanguard. This means that the vast majority of our funds are held with one brokerage firm.

Related: 5 Factors to Consider Before You Roll Your 401(k) to an IRA

Having this concentration of funds in one place is mildly troubling from a security perspective. However, we feel the simplicity of having our accounts in one place as well as the benefits that come with having a larger account balance outweigh the security risks.

We have no immediate plans to move any funds to another brokerage. It is something we may consider in the future.

We began using a high deductible health plan when I left my job in 2017. This made us eligible to utilize a health savings account (HSA). We’ve been contributing the maximum allowable amount each year since. We now include this account in our asset allocation.

Related: Using an HSA to Save for Retirement

I recently researched the benefits of IBonds. After doing so, I opened an account with TreasuryDirect to buy IBonds. I now include these bonds in our asset allocation as well.

Related: I Bonds vs. TIPS

Cash

Part of our financial plan will include having cash to serve as an emergency/opportunity fund and to hold money we plan to spend in the near term when in retirement. Cash held in a high-yield savings account and money market account will be included as part of our allocation.

We will always keep at least 6 months of living expenses in cash. We will never carry more than 2 years of living expenses in cash at any time to avoid excessive drag on investment returns.

Cash held in checking accounts that will be used to deposit paychecks and cover normal spending will be omitted from the plan/allocation.

Cash was our biggest point of contention when initially developing our asset allocation and IPS. I’ve never liked holding cash because of the drag on investment returns. It seemed wasteful to me to have money sitting around when we had abundant cash flow and a high savings rate.

Kim always loved the feeling of security a large cash cushion provides. We generally settled on keeping our cash reserves at about 3-6 months living expenses when both of us were working.

Deciding how much cash to hold continues to be challenging for two reasons. Our “high yield” savings account currently yields only .5%, unlikely to keep pace with inflation. As our investments have grown substantially, 5% of our portfolio accounts for over a year and a half of living expenses, which feels excessive.

We’ve settled on keeping about one year of expenses in cash. We’ll allocate extra cash to bonds.

IBonds offer tax deferral similar to retirement accounts, but they do so without the associated age related restrictions of retirement accounts. That makes IBonds attractive to us as an alternative to holding excessive cash.

Assets Not Included in Our Allocation

Our Home

Part of our plan will be to own our home. We currently own our home outright, valued at approximately $250k. This also will not be included in our investment plan, asset allocation, or our assets factored into reaching financial independence (FI).

When developing our IPS, our thinking was heavily influenced by Rick Ferri, CFA. In his book, “All About Asset Allocation”, he wrote that your primary residence should not be included as part of your portfolio because it is illiquid, produces no income, and typically appreciates only at about the general inflation rate.

Still, our home is a large piece of our net worth. Since we wrote our IPS, our home value has nearly doubled.

I’ve started to look at home ownership as a potential investment. We bought our current home, in part, because it could be used as an AirBNB rental to produce income if needed or desired.

We still don’t include our home directly into our asset allocation. I have written in detail about how home ownership can fit into an investment portfolio and financial plan. Benefits of owning our home include having an inflation hedge, because we don’t have to pay rent.

Having a paid off home keeps our monthly expenses low, which will help us optimize premium tax credits when we start buying our own health insurance on the Marketplace. We also have the option to downsize, utilize geoarbitrage, a HELOC, or a reverse mortgage to create cash flow in the future.

Thus owning our home both decreases the amount of risk we need to take while simultaneously increasing the amount of risk we can afford to take with our other investments.

Writing Projects

When we wrote our original IPS, I was blogging but not earning money doing so. Since leaving my career, I’ve invested time writing a book and working on this blog. Each produces regular monthly income which decreases stress on our portfolio.

This blog is also a business. Similar to a stock, its value fluctuates over time in addition to producing regular income. Unlike a stock, it is not easy to sell or buy shares in this small business.

So ultimately, we consider my writing projects in our IPS similarly to home ownership. We don’t factor these assets directly into our asset allocation for the purpose of managing the portfolio. However, they do help shape the amount of risk taken and strategies employed in managing our portfolio.

College Savings

We will keep an account for our daughter that will be used to fund college. These funds will be invested in a taxable account. We’ll continue to consider tax advantaged accounts if the tax savings outweigh the restrictions on the accounts.

These funds will be held in a separate account and will not be considered as part of our investment asset allocation or assets factored into reaching FI. This will eventually be her money, but we will have control over how it is used.

Since developing our initial IPS, we’ve saved aggressively for our daughter’s college education. We’ve reached our funding goal, and have stopped saving for her since I quit working.

This money remains invested in a separate taxable investment account in our names. Theoretically this is another backup that we could tap into without penalty if needed. However, that would be an absolute last resort.

Related: Saving For Your Children’s College Education vs. Saving For Your Retirement

Social Security

We will periodically monitor our Social Security benefits. Given the long time frame until we are eligible to claim benefits and the political uncertainty around Social Security, we won’t factor these benefits into our plan. Instead, we’ll consider benefits we eventually receive as a bonus and backup to our plan.

Since we originally developed our IPS I’ve become more interested in Social Security. Helping my parents with their finances and interacting with readers of this blog who are at or nearing traditional retirement age has made me truly appreciate how valuable these benefits are.

Related: How Does Retiring Early Impact Social Security Benefits?

As I’ve gained a better understanding of our benefits I’ve started checking them annually on the MySSA website. I use these numbers when running our retirement scenarios with the NewRetirement PlannerPlus or Pralana Gold high fidelity retirement planning tools.

But we’re still 20+ years from claiming Social Security benefits. We still need to navigate a few decades of early retirement before we become eligible for Social Security at traditional retirement age. So we don’t factor these benefits into our investment allocation.

Asset Allocation

We will begin with an asset allocation of 80% stocks, 15% bonds and 5% cash distributed across these different accounts.

This was roughly our asset allocation during our accumulation period. It was actually a bit more aggressive than that. We generally held less cash.

Many people agonize over their asset allocation. We did initially. Should we allocate an extra 10% here… or 5% there?

At the end of the day, if you have a reasonable allocation and you’re saving aggressively towards financial independence and early retirement… your exact asset allocation doesn’t matter very much.

We’ve accumulated a substantial portfolio. We’re not saving as consistently and are transitioning to spending from our investments. Asset allocation is more important now.

Stay too aggressive, and we make ourselves vulnerable to a bad early sequence of returns that we can’t recover from. Get too conservative, and inflation can erode the spending power of our portfolio. Kind of like Goldilocks, we want to find the combination that is just right.

To those ends, I’ve gotten a lot of value out of the free ”My Portfolio tool” at Portfolio Charts. It allows you to compare different portfolios and see a number of variables based on back tested data.

We settled on an allocation of 70% stocks, 20% bonds, 5% cash, and 5% gold. This is the allocation we’ll likely hold for the foreseeable future.

Stocks

During our accumulation phase we held about 80% of our portfolio in a collection of stock index funds. Of our total portfolio, 55% was allocated to domestic stock funds and 25% was allocated to international stock funds.

We’ve gradually been shifting our allocation as we transition to semi-retirement and eventually early retirement. We now allocate 70% of our portfolio to stock index funds. Of our total portfolio, 46% is allocated to domestic stock funds and 24% is allocated to international stock funds.

Domestic

- 35% Vanguard US Total Stock Market Index Fund (VTSAX)

- 10% Vanguard Small Cap Value Index Fund (VSIAX)

- 10% Vanguard REIT Index Fund (VGSLX)

When we started managing our own portfolio, we considered all our old actively managed funds as part of our VTSAX allocation until we were able to gradually sell them off in a tax-efficient manner.

While invested in my 401(k), I didn’t have the option to invest in the exact funds specified in our IPS. I used the Vanguard S&P 500 (VFIAX) index fund as a proxy for VTSAX and the Vanguard Small Cap Index Fund (VSMAX) as a proxy for VSIAX.

We’re staying with our general allocation within domestic stocks. As we’ve gotten a bit more conservative since I’ve left my job we’ve been gradually shaving a few percentage points off each asset class.

Our current domestic stock allocation is:

- 30% Vanguard US Total Stock Market Index Fund (VTSAX)

- 8% Vanguard Small Cap Value Index Fund (VSIAX)

- 8% Vanguard REIT Index Fund (VGSLX)

International

- 10% Vanguard European Stock Index Fund (VEUSX)

- 10% Vanguard Pacific Rim Stock Index Fund (VPADX)

- 5% Vanguard Emerging Markets Index Fund (VEMAX)

When we built our portfolio, we decided to divide up our international holdings by region. This approach may provide a little extra return over time due to rebalancing.

If I had this to do over again, I would just combine these holdings into one fund such as Vanguard’s Total International Stock Index (VTIAX) or their FTSE All-World ex-US Index (VFWAX) for simplicity.

Since we set up our portfolio, international stock investments held in taxable accounts have accumulated substantial gains. It makes sense not to simplify due to tax consequences.

When I rolled over my 401(k) several years ago, we shifted 5% of our allocation from VTSAX to VEMAX to give us a little more international exposure.

As with our domestic stock allocation, we’ve gradually been shaving a few percentage points off each asset class in our international stock allocation to take some risk off the table.

Our current international stock allocation is:

- 8% Vanguard European Stock Index Fund (VEUSX)

- 8% Vanguard Pacific Rim Stock Index Fund (VPADX)

- 8% Vanguard Emerging Markets Index Fund (VEMAX)

All our stock funds are in Vanguard Admiral shares, the lowest cost share class available to retail investors with Vanguard.

The only portion of our stock portfolio not currently held in these exact funds are shares of SPDR Portfolio Total Stock Market ETF (SPTM) held as a proxy for VTSAX in our HSA account.

Bonds

- 10% Vanguard Total Bond Market Index Fund (VBTLX)

- 5% Vanguard Inflation-Protected Securities (TIPS) Fund (VAIPX)

I was not excited about holding bonds during our accumulation phase. Kim liked the idea of having some bonds in our portfolio, so we initially settled on allocating 15% to bonds.

On paper, we settled on a ratio of 2:1 Total Bond Index to TIPS when designing our portfolio. We never actually purchased the TIPS until I rolled over my 401(k) to an IRA. Prior to that we didn’t have a space in our portfolio to hold TIPS in a tax and cost efficient manner.

We assumed we would shift more of our allocation from stocks to bonds as we approached early retirement. However, with interest rates remaining low, we let things ride without increasing our bond allocation.

Related: Retiring With Extreme Low Interest Rates

The bull market rages on. Our investment balances continue to swell. So we recently considered increasing our bond allocation to decrease portfolio volatility risk.

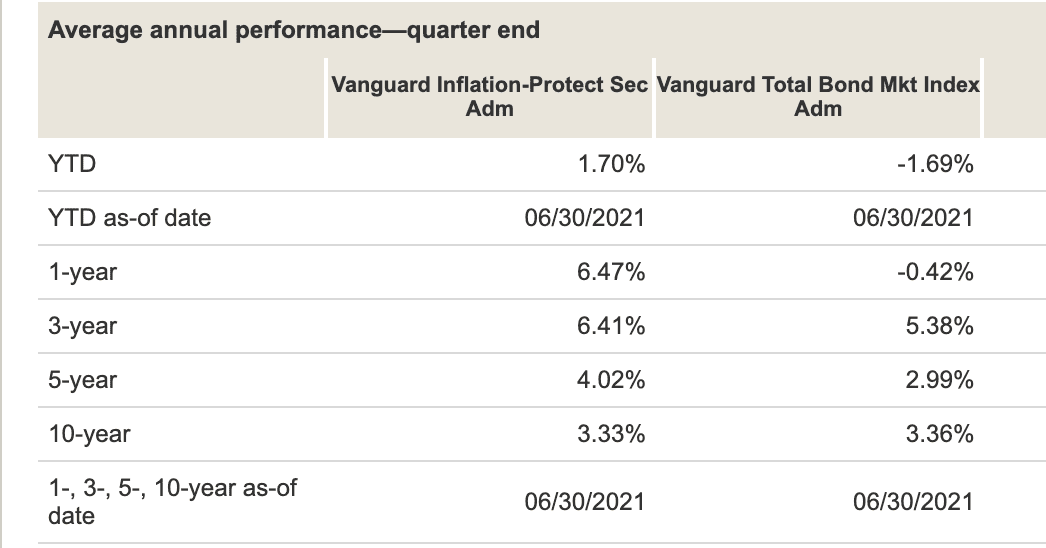

I was pleasantly surprised to see how well our TIPS have done compared to our total bond index despite low inflation over the past few years.

We increased our allocation to inflation protected bonds from 5% to 10% of our portfolio. Most of this allocation continues to be held in TIPS, but we recently began buying IBonds and will continue to do so.

I’m most comfortable with IBonds which mitigate both inflation and interest rate risk. But annual purchases are limited.

Our current bond allocation is:

- 10% Vanguard Total Bond Market Index Fund (VBTLX)

- 10% Vanguard Inflation-Protected Securities (TIPS) Fund (VAIPX) + IBonds

Kim’s 401(k) is currently 100% bonds, invested in the John Hancock Total Bond Market Fund (JTBMX). Our HSA is also predominantly bonds, held in SPDR Portfolio Aggregate Bond ETF (SPAB).

Prior to leaving my job, I held a portion of my portfolio in the Federated Total Return Bond Fund (FTRBX) until rolling my 401(k) over to an IRA.

Each of these funds are/were held as a proxy to VBTLX.

Cash

- 5% Held in online savings and money market accounts.

This is the portion of our IPS we’ve followed least strictly. We’ve typically held only a few months of cash during our accumulation phase.

Moving forward, we’ll likely keep about a year’s living expenses in cash. Beyond that, any additional cash allocation will be used to purchase safe bonds which should provide a higher yield with minimal volatility risk.

GOLD

When we wrote our IPS a decade ago, gold was nowhere on our radar. After doing a lot of reading and backtesting, we decided that adding a bit of gold to our portfolio made more sense than an equivalent amount of bonds. I’ve written in detail about our decision making process around adding gold to our portfolio.

Our target allocation to gold is now 5% of our portfolio. We’ve been dollar cost averaging, regularly buying shares of iShares Gold Trust ETF (IAU) over the past year. We recently reached our target allocation.

Changing Our Allocation

- We will adjust our allocation only when we mutually agree and only when something fundamentally changes to the point that it would be beneficial to do so. Examples would be shifting to a more conservative allocation as we meet investment goals, exiting an asset class if it no longer meets our investing objectives, or adding asset classes if they become available in a cost efficient way as we combine accounts over time.

- If we choose to shift our allocation from stocks to bonds (or bonds to stocks), the relative percentages within each category will be kept the same.

- If we exceed 2 years of expenses in cash, we will shift excess money into bonds.

In the decade since we began managing our portfolio, we’ve made very few changes. We made no changes during our accumulation phase.

Transitioning from two incomes to one and rolling over my 401(k) account provided a good opportunity to revisit our plan a few years ago. The only changes we made were to add TIPS (as had already been in our IPS), increase our allocation to emerging markets, and get our cash holdings in better alignment with our stated allocation.

Last year, we decided to add gold to our portfolio as outlined above. Recently we decided to take some more volatility risk off the table and increase our bond allocation as we’ve become less certain about Kim’s future earnings.

We have had only one disagreement about changing our investments. I wanted to add more value stocks to our portfolio a few years ago. Kim did not like the idea of adding more complexity to our portfolio when she didn’t see a compelling argument for that change.

Per our written policy, if we couldn’t both agree to a change, we wouldn’t make it. So we didn’t.

Cost Control Strategy

- For cost and simplicity, we will use Vanguard funds whenever possible to meet our goals. When this is not possible, we will use the closest alternative that meets our investment objectives.

- We will attempt to choose index funds and avoid any actively managed funds unless none are available to meet our needs (in work sponsored retirement accounts).

- We will consider funds only if the expense ratio is less than .3% annually unless there is no other option available (in work sponsored retirement accounts).

We’ve been happy watching expenses progressively decrease since we began managing our portfolio.

We sold off our expensive actively managed funds at opportune times. Since selling them, we’ve reduced fees on that portion of our portfolio by over 95%! We’ve also eliminated short and long-term capital gains taxes by switching to tax-efficient index funds in our taxable accounts.

We substantially lowered expenses when rolling over my 401(k) plan after leaving my job. Kim’s 401(k) is our last high fee remnant. It currently constitutes only about 6% of our portfolio balance, while generating over 50% of our investment fees! We plan to roll it over to her IRA as soon as it is possible.

Related: Do High 401(k) Fees Outweigh the Benefit of Participating

Since we started investing, there has been a fee war among the major brokerages. Our IPS statement about using Vanguard funds exclusively is no longer relevant. There are now lower fee funds with Schwab and/or Fidelity.

The difference in fees is not significant enough to warrant the effort of switching. If starting over, I may choose one of those brokerages. In the future, we may diversify some of our holdings to one of them.

Tax Control Strategy

- We will make every attempt to locate assets in the most tax efficient places. (Bonds, index funds with higher turnover, and REITS in tax sheltered accounts, broad stock index funds and cash in taxable accounts.)

- We will limit transaction fees by rebalancing only once annually. Rebalancing will be done on May 1 each year after filing our previous year tax returns, at which point we will make our ROTH IRA contribution for the year.

- We will limit capital gains taxes by rebalancing within our tax advantaged accounts. We will sell funds in our taxable accounts only for tax-gain or tax-loss harvesting when to our benefit.

We’ve had similar success reducing our taxes since we started managing our own investments. We’ve eliminated capital gains taxes by holding tax efficient Vanguard index funds in our taxable accounts and rebalancing only in our tax advantaged accounts.

Index funds still produce taxable dividends. Our lower household income means qualified dividends are taxed at 0%.

I’ve made two tax loss harvesting transactions since beginning to manage our portfolio. The first was in mid-December 2015, selling off funds we held in taxable accounts that had dropped in value. I moved that money back to the original funds in late January 2016 after the markets fell more. I harvested enough losses in those transactions that we carried losses forward through our 2020 tax return.

Now that our income is lower, tax loss harvesting doesn’t make sense for us. We now look for opportunities to harvest capital gains that will be taxed at the long term 0% capital gains rate.

I have explored Roth IRA conversions with both the NewRetirement PlannerPlus and Pralana Gold retirement calculators. Both confirmed my suspicions that Roth conversions would not be beneficial for us at this point. I’ll continue to re-evaluate this decision in lower income years.

Future Contributions

- We will contribute the maximum amount to our work sponsored tax-deferred accounts each paycheck.

- We will make the maximum allowable annual contribution to our Roth IRA accounts.

- After maxing out our tax deferred accounts and Roth IRA, we will invest any other available money into our taxable accounts monthly via automatic transaction.

These were no brainer decisions when we were both working. Maxing out our 401(k) accounts offered substantial tax savings. Our combined incomes were always too high to also contribute to a deductible IRA, but well below the limit where Roth contributions were restricted. This made the Roth vs.Traditional IRA decision easy.

I love making financial decisions one time, automating them, and focusing on the things that matter most in life. This was easy for us when we had stable incomes and a large savings rate. It’s proven substantially harder in this phase of early/semi-retirement.

Related: Financial Autopilot

We’re continuously reconsidering this portion of our plan. Now that we have a lower income and lower tax rates, the deduction for investing in a 401(k) isn’t as valuable, particularly when weighed against high fees.

Our goal in this phase of part-time work/semi-retirement is to keep annual recognized income low enough that qualified dividends will be taxed at 0%. We’ll continue to analyze our numbers and determine the best way to use our tax advantaged accounts as circumstances change.

Related: Order of Operations for Tax Advantaged Investing

We also recognize the need to develop a system to take money from our portfolio. At this point, we are net savers more months than we are net spenders. When we need to take from our portfolio we take it from cash savings, and to this point we’ve been able to replenish it with new savings.

Portfolio Monitoring

One area we neglected in our original IPS was monitoring our portfolio.

The first metric I started monitoring was fees. Fees are one of the few things investors can control, so we focus on getting fees as low as possible without adding complexity.

The aggregate expense ratio for all our investments is currently .16% to hold a widely diversified portfolio. As soon as we are able to get Kim’s 401(k) rolled over, that number will drop to under .1%.

The other metric we’ve begun monitoring is the tax status of our investments. Two articles got me thinking about this. The first was Darrow’s post on this site, A Surprising Contender for Tax Efficient Retirement Saving. The other was Physician on FIRE’s My Money Is Worth More Than Your Money.

We focus on limiting our current year tax burden, with an eye on getting more money to Roth and taxable accounts over time. Those dollars will be more valuable when we start consistently drawing down our portfolio.

We’re happy with our tax diversification. Our current breakdown is 49% tax-deferred, 37% taxable, 12% Roth, and 2% in our HSA.

Over the past few years, I’ve started tracking more variables to make investment management easier. This was helpful due to our unpredictable income and cash flow month to month.

I dedicated an entire blog post to this topic: How to Monitor Your Investments.

Investment Returns

So what have our returns been since we began managing our investments? I have no idea. We don’t monitor investment returns.

We’ve decided on a buy and hold approach to investing. This means accepting the returns the markets give us.

It’s tempting to calculate returns, but I think calculating investment returns would have potential for doing more harm than good. So I don’t do it.

Knowing I beat an arbitrary benchmark may make me feel smarter than I am and lead me to start tinkering with the portfolio. Knowing I applied extra effort and paid more fees to under perform a benchmark may tempt me to bail on our strategy at the wrong time. Either scenario is possible in any given year.

I’m happy to be willfully ignorant of our returns. We focus on things we can control, such as limiting portfolio fees, taxes, and complexity while building a portfolio that should do well in a variety of scenarios.

Otherwise, we let the chips fall where they may, confident that our plan will work out over the long term.

Downloadable Investment Policy Statement Template

If you would like to create your own IPS, I’ve created a free downloadable PDF to help you. Share any suggestions on how I can improve it below.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

One question I have is why bonds in your HSA? Isn’t that account tax free?

Like you, I had a variety of accounts during accumulation. It was nice to be able to roll everything into just one Roth and one IRA per person (plus I have a Roth at a separate brokerage as cyber insurance).

Bonds are almost all in the IRA account to subdue taxes and let the tax free Roth run on US and intl equities.

The ISP is a great tool, and mine has evolved as I got closer to retirement and have figured out a strategy for withdrawals. And it is nice to be reminded WHY I’m doing certain things before I make any changes.

Laura,

Here is our thinking. HSA offers tax-deferral with contribution and tax-free growth. It does also offer tax free withdrawal IF the money is used for qualified medical expenses for a triple tax benefit.

There is an argument for investing HSA money aggressively, and taking the money out for likely medical expenses later in life (either when you need them or for expenses incurred earlier in life but paid for with after tax dollars at the time). This gives the max triple tax benefit on your HSA money.

We do have some of our HSA money invested aggressively for that reason. However, we may want to use HSA money earlier if we have medical expenses and want to minimize taxable income to optimize ACA premium subsidies. For that reason, we also keep a healthy portion of our HSA in a less volatile bond fund.

Thanks for the question and I hope that makes sense.

Best,

Chris

I suggest you consider converting your Vanguard mutual funds to essentially their equivalent ETFs. This is allowed per Vanguard as follows from Vanguard’s own website, (tax free conversions by-the-way, since your accounts are at Vanguard):

“Can I convert my conventional Vanguard mutual fund shares to Vanguard ETF Shares?

Yes. Most funds that offer ETF Shares will allow you to convert from conventional shares of the same fund to ETF Shares. (Four of our bond ETFs—Total Bond Market, Short-Term Bond, Intermediate-Term Bond, and Long-Term Bond—don’t allow for conversions.)

Conversions are allowed from both Investor and Admiral™ Shares and are tax-free if you own your mutual fund and ETF Shares through Vanguard.”

Good Luck to you and your wife. Oh, I have a three bucket portfolio (2 IRAs and a 401K) IPS plus checking account for bills and living. Took SS at 70 to max out monthly payments for my life and then for my 55 year old wife in the future. GLTA!

Good suggestion Rand. I’ve been aware of this, but haven’t taken action b/c of inertia. It won’t make a huge difference, but any time you can save money without giving up anything, I suppose we should.

Best,

Chris

So, I’ve been following this blog for a few years now, but have recently started to dig into more details. And in that context, the question is, If I don’t have either index mutual funds or ETFs, it sounds like ETFs are the way to go? And if that is a clear yes or no answer, what is (are) the reason(s) – fees, taxes? I have a note to myself to research the choice between index funds and ETFs… Chris, do you have a prior post on that topic?

Kirk,

That could be a full blog post. I just added it to my list.

The short answer, particularly if you are using the same or similar Vanguard funds I mention in this blog post is that they’re essentially the same and it is far down the list of most important investment choices you will make.

Chris

Yours is well thought out and written plan Chris. Thank you for sharing it and the template.

Thanks Bill. Glad you found it useful.

“We will always keep at least 6 months of living expenses in cash. We will never carry more than 2 years of living expenses in cash at any time to avoid excessive drag on investment returns.”

For sure, I don’t recommend anyone go below holding 6 months of living expense in cash. On the upper end, I like a X% allocation better than the 2 year rule. If you’ve “won the game” and for example, have $5M in investable assets, IMO there is nothing wrong with holding $250k in cash even if this exceeds 2 years of living expense. And beyond that, you may want to take some of the bond allocation (assuming a 5% cash, 15% bond, 80% stock allocation) and put in another 5% in ultra short term bond funds with very little volitility and low returns. The logic is that you’re buying piece-of-mind. This runway of 4+ years of living expense enables you to sleep more easily with the rest of your portfolio being in risky assets. The big caveat, of couse, it getting $5M in investable assets so you get the luxary of this cushion.

Chris,

Separately, I’m curious whether you’ve considered real-estate syndications or real estate funds. A few other popular bloggers have written multiple articles in this space. It seems like a prudent way to further diversiy your asset allocation. I’m looking into it myself. Several reliable sources I’ve come across say that up to 20% allocation in this space (vs equities or gold) is prudent.

Phillip,

Thanks for the thoughtful comment.

Re: cash. I don’t share what I do to be prescriptive for anyone else. I respect that these are personal decisions. I personally don’t agree that everyone needs 6 or even 3 months of cash. I do agree with you that we need to do what allows us to sleep at night. I just encourage people to be aware of what that decision costs.

Re: real estate options. Brian Davis (who’s written several other real estate articles for this site) has written another post that I’ll be publishing in the next month or two about the range of different real estate options and the amount of risk and effort involved with each. Stay tuned.

Re: other bloggers writing about them. Realize that many of these platforms have blogger affiliate programs that pay people for exposure, leads, and/or a share of sales. I don’t write that as criticism of others who write about these products. I do the same with credit cards, retirement calculators, etc. Those are products I use and so it’s a natural fit for me. That may be the case for these syndications or funds for other bloggers. Just realize that when someone is writing about them, that they may have incentives to do so. It’s OK, good even, to be skeptical.

That’s not to say these platforms and products aren’t legitimate. Just that you should do your own due diligence before blindly trusting anyone else’s recommendations. Many (most?) of these platforms haven’t been around 10-15 years. Thus, they have only seen blue sky days. I’m nervous how they’ll hold up when the next bear comes.

Best,

Chris

Good point about noting some blogger’s get incentives for referring certain crowdsourcing sites. I totally agree to always do your due diligence and be mindful of sources. For me, bloggers are one starting point for my research and like any source, certain bloggers are more reputable than others based on quality of writing, longervity and knowledge/experience. Most of the bloggers I follow are quite good with clear disclosures on thier affiliate relationships. Separately, I’m improving my knowledge in the real estate asset class through other websites focused on real estate investing, a couple of books, talking with sponsors directly, subscribing to some crowdfunding sites to see specific deals, joining and reading real-estate investor club forums, Google searches to get me better understanding of specific topic areas and even spoke with advisors to see what they offer (conclusion is even with alternative investments, there are plenty of ways to cut out the “middle-man” and invest directly in these asset vehicles). To me, diversification is imporatant enough to warrant such research. Since this is a blog site I respect, I look forward to further posts in this area in the future.

Regarding cash holding, I didn’t mean to put words in your mouth. I should clarify that it is my opinion that following “conventional wisdom” having 3-6 months of living expense in cash is prudent. I understand folks say they want that extra capital invested but IMO, this can be penny wise and pound foolish during adverse events. I see a certain amount of cash as a form of not that expensive insurance. HELOCs can get frozen or re-adjusted as a source of cash. Job serverence packages are not guaranteed and it takes time to process unemployment insurance. Cash reserves also serve as emergency funds if you need emergency house repairs, uncovered medical expenses, etc. I’m sure there are some (many?) that are still unconvinced as they have many lavers of cash sources that could be tapped if needed and want to put that exra $ in the market but IMO, if you have all those multiple sources of available cash streams, you’re probably already pretty well invested that in incremental gains of 3-6 months of living expense is negligible. That said, I’m not claiming to be right, just expressing my opinion and why I came this conclusion.

Philip,

In my book, I write about 3 paths for investing. 1. Traditional paper (stock and bond) investments. 2. Real estate and 3. A personal business. Like you, I think it is wise to diversify beyond just paper assets, particularly in these times of extreme valuations and interest rates. I just have more interest and see more upside without putting capital at risk with a personal business vs. real estate. Else, I’d be doing the same as you.

Re: cash. Yes and if you read Emily’s posts over the past couple of weeks, she made a compelling argument that cash can be underrated in circumstances where you don’t have the mental energy (i.e. when everything is hitting the fan as you allude to). I appreciate the point of view you share, and as we can build a position in IBonds, I consider them the equivalent of CDs (another way of storing cash) with no interest rate risk, virtually no default risk, and mitigation of inflation risk. So in my eyes it is actually less risky than having extra cash.

Chris-

This is an important topic so, I’m glad you dedicated a post to it. I’ve had an IPS for about a decade now, and I update it when I experience a major change to life circumstances or, if my goals change. I noticed a few things addressed by my IPS that were not mentioned in yours, and I submit them here for the community to consider when they draft/update their own IPS.

1. I don’t see a specific income goal mentioned in your IPS. I actually quantify (in $$$/yr) what my income goal is. I like the specificity of it but, that’s not necessary for everyone.

2. You do not address how you plan to fund “essential” expenses, which I think is key, and is determinative of other IPS aspects. For example, my IPS states that I will fund my “essential” expenses from “guaranteed” sources (SS, pension, etc.).

3. Your IPS does not address whether or not you have a goal to bequeath anything at the end of your/spouse’s lives. Since you’re a parent, this seems an important item to address.

4. While your AA indirectly quantifies your risk tolerance, it’s just that…indirect. My IPS states how much NW or Annual Income (by %) that I’m willing to lose. Then, I specify the AA to address my risk tolerance. I like this specificity because, when TSHTF, I know precisely whether or not I need to take action.

5. You do not address any backup plans. For example, I have three budgets (Optimum, Cut Back & Bare Bones). I will also consider a SPIA if things get really bad. My backup plans are specific to me but, I think everyone’s IPS should state theirs.

6. If your IPS discussed rebalancing criteria, I missed it.

7. You did not discuss “Decumulation”, which is as important as Accumulation, and is something every IPS should include.

8. My IPS also addresses LTC because it’s such a critical item in our financial life. Maybe it’s just me but, I think having a plan for that is essential.

Keep up the good work.

Thanks for the great comment and keeping me honest Mark.

1.) I don’t typically share specifics of my spending or net worth, b/c I think when writing for a broad audience principles are more valuable. We do track our spending and have years of data, so have a good idea of both our total and essential expenses that we need/want to support.

2.) As early retirees w/o pensions, we don’t have any guaranteed sources of income. For that reason, we’re very conservative as I’ve written about here. https://www.caniretireyet.com/redundancy/

3.) It’s not a concern for us. We are investing a lot of time with her while she’s young and I did address our plan and desire to help her with college and to successfully launch into independent adulthood. That is not a viewpoint or approach shared by many though, and I respect that.

4.) On this one, I think I disagree that it matters what I’m “willing to lose.” Markets are going to do what they will, whether we like it or not. I think I agree with the spirit of this point though. I touched on the Portfolio Charts tool, but could have gone into more detail. We particularly spend time with the max drawdown and max time to recover historically to help guide the amount of risk that we’re willing to take. All that said, I again know full well that our outcomes could be worse (or better) than what has happened in the past.

5.) From an investment standpoint, very conservative return assumptions and a low planned drawdown are already built in. Our housing is also a big back up as I addressed in the plan. Social Security is also really a back up for us, as we designed our plans as if it wouldn’t exist, though as noted we are now paying more attention to it. We also anticipate receiving an inheritance at some point, though we can’t know when, how much, or even that it is definite that there will be anything, so we consider it a backup only.

6.) I briefly mentioned it under tax control. I’ve also written a full post on rebalancing. https://www.caniretireyet.com/is-it-time-to-rebalance-your-portfolio/

7.) I briefly mentioned this also and acknowledge we would like to develop a more systemized approach. I’m just not sure how to do that yet. I was encouraged, and honestly a little surprised, to read Darrow recently state that they still don’t follow a particular system a decade+ into early retirement. https://www.caniretireyet.com/catching-up-with-darrow-kirkpatrick/

8.) Again, we plan conservatively in general rather than trying to have individual plans for every possible contingency. I think it is unwise to think that nothing bad will happen. I think it is equally unwise to assume that everything that could possibly go wrong will.

Cheers!

Chris

I have gone with two separate accounts, one a dividend account providing an income and the other for accumulation. It is my intent to leave the accumulation account alone (except for rebalance activity). The income fund provides a significant income for us and should cover most expenses beyond a Federal annuity and SS incomes. I realize that we are much closer to retirement (actually 6 months in) than the early retirement concept, but this methodology is working quite well so far. Is there a specific reason so many people go accumulation and the reduction of the account value, drawing down value, method? Total disclosure, my wife is 2.5 years older than me and has the higher income of the two since I was enlisted Navy for 10 years. I will take SS shortly after 62, wife will take at FRA about 2 years later. One other little tidbit I have learned, if you work for the Federal government (I was USPS) it is certainly easier to just transfer TSP money to a rollover IRA right away if you are married, due to quite troublesome paperwork.

Thomas,

Interesting question. Focusing on total return, rather than dividend income, has been shown to be more likely to lead to a greater final balance over time in most scenarios. A total return approach is also almost always more tax efficient in taxable accounts during the accumulation phase. That’s because it produces more of your gains in the form of capital gains which are not taxed until you take the money from the account, presumably in lower income retirement years when it may be taxed at 0%.

In contrast, a dividend focused approach will produce more dividend income every year, whether you need it or not. This causes a significant tax drag on taxable investments in your higher earning, and thus higher tax, accumulation years when you likely don’t need that investment income.

I do agree that it is easier for most people to spend earned income, dividends, rental income, SS, pension… almost anything other than drawing down investment principle. This is a mental hurdle to the total return approach that doesn’t get enough attention in my opinion.

I’ll turn this around and ask you a couple of questions, if you would be willing to share.

Why do you have the accumulation account? Do you intend to ever spend that money? Is it to pass it on to heirs?

Also why transfer money out of a TSP? Are you going to invest that with a dividend focus as well? If not, do you like other investment options outside of the TSP better? Just curious, because I would love to have had the TSP, and if I did couldn’t imagine rolling it over and losing the asset protections it provides that an IRA doesn’t.

Best,

Chris

I was somewhat vague on a couple areas. TSP IS indeed a very good accumulation vehicle, I pushed from 16 to 20% of my earnings into it (and 5% match) for 20 years. The problem comes with disbursement. Unless you sign up for an annuity (which it seems they are quite fond of), or recurring disbursements the process to remove cash is tediously complicated, but, realistically it is certainly secure. If you have a spouse you must download paperwork and have both your and spouse’s signatures notarized, then either scan them into PDF’s at a specific megabyte size and upload, or send them via mail to the TSP. The process of getting the notarized signatures can be somewhat tedious especially if your spouse has a busy schedule. From there they were quite efficient in the process of sales and transfer of assets. If either of the first choices (annuity or common recurring withdrawals) was your favored methodology the TSP would be continuing to be an excellent choice. We had more of an interest in occasional withdrawals. In actuality, the dividend investment started WITH the TSP funds, as I was working on an asset allocation that would be acceptable for both my wife’s 403(b) and my IRA. (Her hospital has changed retirement account providers several times in the past years and we actually really liked Fidelity , so to prevent any further change we rolled her account over into a Fidelity IRA). The Fidelity IRA is in an accumulation asset allocation with possibly a tilt towards 65 /35 stock/bond holdings for now since bonds are barely holding their own. Her IRA is about 1.5x as large as mine and our plans are to remove assets at rebalancing if needed. We are brand new grandparents and that set of kids are Catholic school teachers (the other set is engineers), so we intend to help with college when it comes along, (yes, any youngsters from the other set, also, but it could be less needed) and although we are not planning on getting to the stage of bequeathing assets for 30 years or so, that is in our very long term plans. The dividend investing has the benefit of not having to sell assets for income, while providing (from TD Ameritrade’s income estimator) income that will significantly cover any shortfalls in income. I do believe, although if you have a different thought, I will seriously consider it, that income from good dividend investments is quite divested from stock prices. If company income becomes affected, then divestiture from that investment will be considered especially if the dividend is cut or seriously reduced. This allows market changes to be less involved in this account. In the near future the income will actually be more than needed and then will be invested in either dividend royalty and/or Ibonds. The actual problems occur at 72 when we will be forced to start divesting in IRA’s and reinvest in taxable accounts. Which does remind me of one other TSP issue, they withhold 1/5 of withdrawals, making for significant loans to the governments.