How To Monitor Your Investments

Managing your investments is easier than most people think. It does require developing a system to monitor your investments. This enables you to make optimal portfolio management decisions with minimal effort.

Let’s look at why you should monitor your investments, what metrics you should track, and how you should track your portfolio…

Why Should You Monitor Your Investments?

Start by understanding why you should monitor your investments. Then reverse engineer your processes to get the result you desire. This allows you to determine what metrics you should track and how you should monitor your investment portfolio.

You should monitor your investments so you can quickly answer a few key questions:

- Am I on track to meet my goals?

- Can I find that relevant information needed to manage my investments quickly so I can act upon it efficiently?

- Do I need to take any actions now?

If you start by asking what metrics you should measure or how you should measure them, you’re likely to end up with a lot of useless data. Simultaneously, you risk missing important information that could guide your investment decisions.

What Should You Monitor With Your Portfolio?

Once you understand why to monitor your investments, you should have insights into what you will need to track. We each have different goals, plans, and unique circumstances. There is no one size fits all answer for what you should monitor.

I’ve put a lot of thought into what is important for my situation. I frequently take ideas from others and apply them to my own situation as they fit. Here are key metrics to consider monitoring in your portfolio.

Portfolio Balance

The first thing I look at when monitoring my portfolio is the overall account balance. This provides several key pieces of information.

- Is there anything obviously amiss?

- What is my general trajectory?

- Am I on track to meet my goals?

One thing I do differently than most people is also monitor my balance as a multiple of my annual spending. This helps keep me focused on the most important variable to financial independence, how much money I have relative to my spending needs.

Portfolio balance as a multiple of expenses is more important than your absolute portfolio balance. A person with a $1 million portfolio, who needs the portfolio to produce only $30,000/year is in better shape than someone with a $2 million portfolio who needs $100,000 to maintain her lifestyle.

If you’d like to learn more about this important concept check out this article about choosing your safe withdrawal rate.

Investment Returns/ Performance

Another possible metric to monitor is investment performance. A common practice is to compute your overall investment return. (Here’s how to do that.) Many people like to compare their investment returns to a benchmark like the S&P 500 or the risk free rate of return.

I personally don’t do this.

As a buy and hold investor with a widely diversified portfolio, my returns are ultimately out of my control. I’m not trying to match or beat any arbitrary benchmark over any particular period of time. In fact, the way I invest assures that some asset classes will always be doing better or worse than others. This under or over performance of one asset class relative to another can persist for years at a time.

Calculating my personal investment returns doesn’t provide me any valuable information. To the contrary, it may tempt me to abandon my strategy of holding a widely diversified portfolio at exactly the wrong time. I simply monitor performance by looking at my balance over time.

Asset Allocation

The next thing I look at is my current asset allocation compared to my target asset allocation. This is important because it provides key information.

Am I following my stated objectives? Am I staying within my predefined risk tolerance? If the answer to either question is no, what actions do I need to take to change my allocation?

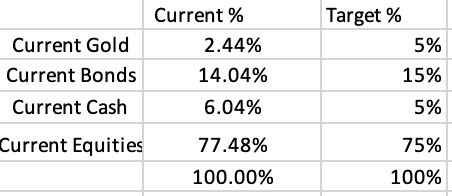

Below is a screenshot of my current asset allocation when I most recently checked it.

Looking at this breakdown, I can quickly see that we’re roughly following the plan we outlined in our investment policy statement. We’re currently short on gold and bonds.

Processes are in place to address each shortfall. We’re following a plan we made last summer to gradually add gold to our portfolio. We also have a plan to buy bonds through contributions to Kim’s 401(k) plan throughout the year and our annual H.S.A. contribution. No further action is necessary to rebalance our portfolio at this time.

Related: Is It Time to Rebalance Your Portfolio?

Investment Fees

We have monitored fees since we started managing our own portfolio. Investment fees are one of the best predictors of investment performance. Or as Vanguard founder John Bogle famously said, “In investing, you get what you don’t pay for.”

I like to see the fees I’m paying in dollars, rather than a percentage of my assets as they’re commonly reported. This helps me make better decisions managing my portfolio by seeing the impact of the fees I’m charged. Here are two real world examples.

A few years ago, there was a lot of hype when Fidelity announced they would launch index funds with a zero expense ratio. If low fees are good, no fees must be great! A quick peek at my fees revealed the funds that I held in similar funds at Vanguard that could be moved to Fidelity cost me a couple hundred dollars per year in fees.

Transferring my funds to Fidelity would cost me thousands of dollars in capital gains taxes to sell off the taxable investments where a substantial portion of my funds were held. I would also open myself up to the risk that Fidelity would decide this then brand new “loss leader” no longer made sense and close the fund, forcing me into another investment with higher fees. It was quickly apparent that no action was required.

Recently, I wrote about the high fees we are paying for Kim’s 401(k) plan. Seeing the impact of these fees led me to do an analysis of whether the high 401(k) fees outweighed the benefits of participating in her 401(k) plan. You can read about that here.

Investing fees matter. You should have a way to monitor them in a way that helps you to make better investment decisions.

Tax Diversification

Another thing I look at is tax diversification. This is something I’ve been monitoring for the past couple of years after reading Darrow’s article on this site as well as this one from the Physician on FIRE blog on the topic of tax efficiency of investments.

I track the percentage of our portfolio and the absolute dollar amounts that we have in taxable, tax-deferred, Roth, and HSA accounts. The percentages are interesting, but those absolute amounts are more important to me as I do long term planning.

Knowing how much we have in taxable accounts helps to determine if we can sustain our spending needs until we can access tax advantaged accounts without penalty. Seeing the actual dollar amount in tax-deferred accounts will help determine what impact future RMDs may have and whether and how much to convert from tax-deferred to Roth accounts.

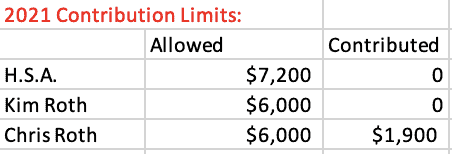

Contributions/Limits

Another category I began tracking since leaving my job is the contribution limits of tax advantaged accounts we want to use and whether we have actually made the contributions. I prefer to automate things when possible, but without a regular income this is hard. This simple addition to our investment monitoring process gives me a quick reference of how much we can contribute and whether I have actually taken that action.

Portfolio Inflows/Outflows

Since I left my job, we go through months at a time where we may be net spenders or savers. We’ve mostly been managing cash flow by feel, without a good sense of what exactly is going into or coming out of our investment accounts.

Recently I sat down and considered all the ways we add money to or take money from our portfolio in any given month. We now track these transactions. We then subtract outflows from inflows. A negative net number means we took more money than we added. A positive number means we were net savers.

This also provides a nice way to track movement of money within our portfolio.

For example, in January I had $1,900 of cash left over in our Vanguard taxable accounts from December dividend payments. I used that to make a contribution to my Roth IRA. This just moved money within our portfolio, without adding to or taking money from our investments, thus it nets out to zero.

Taxable Income

The other thing we added to our investment monitoring process is a system to track our gross income. This information is helpful to have at our fingertips when making investment decisions to manage our annual tax burden.

When we were both working full time this was unnecessary. We were both salaried employees with predictable income. We also had too much income to do much in the way of year to year planning. Everything was on autopilot.

Our household income is now much less and my income is much more lumpy. These two facts present both opportunities and challenges when thinking about tax planning. Taking a few minutes to enter this data from time to time throughout the year will be helpful to provide an idea where we are for planning purposes.

I also record any income limits I may want to stay under for a given year next to our total income. This helps me take appropriate actions with my investments. The only limit currently on our radar is keeping taxable income low enough to stay in the 0% tax bracket on long-term capital gains.

Other examples would be avoiding ACA premium subsidy cliffs, increasing taxation of Social Security benefits, or considering Income Related Monthly Adjustment Amount (IRMAA) for Medicare.

Update: ACA subsidy cliffs were eliminated for 2021 and 2022

I can then consider contributions to tax-deferred accounts or harvesting tax losses to decrease taxable income when beneficial. Alternatively, we may do Roth IRA conversions or capital gain harvesting to pay taxes sooner if we will be able to do so at a favorable tax rate in the current year.

Related: Early Retirement Tax Planning 101

How Should You Monitor Your Investments?

Once you’ve determined what metrics you want to track, the final step is developing a system to actually monitor your portfolio. This system should incorporate a physical way of keeping a record of your investments that provides useful information when you need it.

You also need to determine how often your investments need attention. Then develop a system for getting it done.

Spreadsheets

We monitor our investments using an Excel spreadsheet. There are several reasons this is my preference.

I love having the ability to customize the exact information I want at the point in time that I find it useful. I am able to simultaneously see all the information that is important to me on my computer screen.

Security is another reason I prefer a customized spreadsheet. Many portfolio monitoring programs have you link your accounts electronically. This is admittedly a convenient feature compared to my method that requires manual data entry. Security concerns have been well thought out. However, with all of the online threats we are already vulnerable to, I prefer not to provide another potential portal for hackers to access my accounts.

A Software Solution

I should note that I am married to a spreadsheet wizard who builds spreadsheets for a living. I also am comfortable that I’m choosing the appropriate metrics to monitor and not overlook anything important to me. Alternatively, I would look for software solutions to monitor my investments. There are a number of free and paid software solutions currently available. One free tool that is frequently recommended and highly rated is provided by Personal Capital.

Personal Capital

Personal Capital (affiliate link) has a free tool for monitoring your investments and aggregating your financial information in one place. Features include:

- A comprehensive financial dashboard that allows you to monitor asset allocation, investment performance, individual account balances, net worth, and cash flow.

- A dedicated Fee Analyzer™.

- A quality free retirement calculator. (See review here.)

I don’t personally use Personal Capital for the reasons outlined above, but I would if I didn’t have the ability to create my own customized spreadsheet. Be aware that Personal Capital uses this tool as a way to gain leads to manage investments for relatively expensive assets under management fees. However, you don’t have to use their advisory services to access and use the free software tools.

How Frequently Should You Monitor Your Investments?

The final step in developing a system to monitor your portfolio is to determine how often to track your investments. There is no single right answer for how frequently this needs to be done.

Many people are intimidated because they think managing their own investments requires a lot of time and effort. If you develop a solid plan and automate as much as possible, there should be little to do on an ongoing basis.

I update my portfolio monthly. This is a relic from reporting my numbers as a monthly progress update for my original blog. I’ve continued this habit so I have data available when writing this blog. For most investors, this is overkill. An ideal frequency for monitoring investments is probably not more than once a quarter and not less than once a year.

Conclusion

Managing your own investment portfolio is not as complicated or labor intensive as one might assume. Choosing to manage your own investments can save a considerable amount of money compared to paying a professional to manage them for you.

However, you have to develop systems to monitor your investments to ensure you have the ability to do what is required to get the same or better results than you would if paying someone to do this for you.

This requires knowing why you need to monitor your investments, what metrics to monitor to provide the information you need, and putting a system in place to actually accomplish your goals.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Good post Chris – it’s helpful to see how you manage this and at what granularity & frequency. Agreed that the key metrics are

1) Portfolio tracking to target allocation?

2) Contributions made/maximized

3) Performance – at a high level – it’s not actually good to track this too frequently

Thanks Steve. The thing that prompted me to write this is making the couple of changes I noted. Agree that the factors you highlighted are pretty universal, but what needs to be tracked is fluid and depends on your stage in life.

Cheers!

Chris

I use Quicken to monitor all my accounts transactions and returns. That said its not the greatest at reporting or insightful info. Basic performance its ok. Reporting hasn’t been updated in a very long time. I envy the spreadsheet solution but i now have 2 decades of data in quicken and dread moving to spreadsheets

Darrow has written about his extensive history with Quicken and maybe as a product of selection/confirmation bias, it seems a lot of readers, like you, are long-time users as well. I originally started short reviews of Quicken and Mint, but reviews of both were consistent with your experience, so I chose to focus on Personal Capital for those looking for a software solution. It seems to be the best tool of these three that dominate this space and it is free to use, though I do have my reservations about their business model as shared in the post.

Best,

Chris

Chris,

Can you share the spreadsheet you use? Maybe you could make a template with a sample made-up info and drop it in Google sheets and your readers can download it and tweak it for their own needs?

I personally track in the spreadsheet too but it’s not great at all and I am open to suggestions on how to improve it.

I’m extremely leery of linking our brokerage accounts, IRA’s, and 401k to Personal Capital and I haven’t done that yet.

If I understand correctly I could still enter balances of various accounts, but what would it give me? Just a picture of the portfolio on a certain date and nothing else. I can X-ray our portfolio on Morningstar.com and perhaps obtain more info that way.

Is there a way to get performance on Personal Capital w/o giving it access to our numerous accounts? Say I enter balances of various accounts today which would be my start and then every 6 months I would enter updated balances. Is it possible to do this or would I need to over-write my old balances which again would be a static picture with no trend up or down?

TY, S&M

Re: our spreadsheet, I believe we could do that. But I would have to figure out how. Let me play with that (translation let me see if I can get Kim to figure it out b/c she is our spreadsheet/tech person. 😉 )

Re: Personal Capital. I have the same reservations. I know they have thought through the security concerns. I’ve been kicking around setting up an affiliate with them since talking to them at a conference when I first came on board here, and we talked about it back then. That and their overall business model have kept me hesitant to recommend the tools, though by all accounts they are excellent.

Bottom line, is that for the best experience I think you have to trust them and link your accounts. I would assume that is a big part of the reason that they offer the tool for free, as it lets them see your balance and know who to market to (i.e. those with bigger balances). And again I would not recommend using their investment services with an unnecessarily high AUM model.

Thanks for the thoughtful comment. If I can figure out how to share our spreadsheet, I’ll do so in an upcoming post or as part of the monthly best-of roundup.

Best,

Chris

Thanks Chris. I too am an Excel user and monitor my investments Monthly or quarterly and adjust annually. My question is about whether you have, or have thoughts about, tracking accounts that use a fund of funds approach, which is harder to track by sector.

Good question. I haven’t thought about that, as we don’t hold any target date, lifestyle, etc funds or even actively managed funds which tend to hold some cash so determining how much we have in stocks, bonds, gold, & cash is pretty straight forward for us. If you hold just one fund of funds, which IMO is the ideal use for them then the fund docs should tell you what you own in what percentages. If you have a mix of individual funds and fund of funds, I suppose you would have to just manually separate out how much is in different asset classes. I believe this is what Darrow does if you read his annual portfolio posts. Here is his most recent.

Hope that helps.

Chris

Thanks for this. But do I understand you to say you put dividend income in a Roth IRA? I did not think that was allowed. Again, thanks for your good work.

We don’t automatically reinvest dividends in our taxable accounts, so we can do whatever we want with it including spend it or use it to contribute to a traditional or Roth IRA (as long as we have earned income). If we didn’t have earned income, you are correct that you can’t use dividends, savings, etc to contribute to an IRA (trad or Roth). I assume this is what you mean?

Best,

Chris

Hi Chris,

I’ve used Fund Manager from Bailey Software for many years. I love that it can retrieve prices so I have account balance on any given day with the press of a button. It also has transaction retrieval but I enter my distributions manually at the end of each month. Provides a great opportunity to do a monthly check without giving software access to my account. Amazing reports so I can track basically anything I want.

https://www.fundmanagersoftware.com/versions.html

Thanks for sharing Pete. That does have some nice features including capital gains calculations and the ability to transport data to tax software. I’m not sure it would provide enough value to entice me to pay for the software, and I assume it has similar concerns that I have with Personal Capital with needing to link your accounts. I did add it to my list of future topics and may give it a closer look in the future. I’d also be curious to hear if other readers have had similar positive experiences that may make it worthwhile to explore it further.

Best,

Chris

Agree completely on not wanting to link account. The securities prices (mutual funds in my case) are pulled off the web from Yahoo Finance and the like using Fund Manager’s quote module. So there is absolutely no access to my Vanguard or Fidelity account. Not allowing access does require that I enter transactions ( distributions, purchase, withdrawals) manually. But since I’m a buy and hold investor this is mostly manually entering bond fund distributions monthly and stock funds quarterly.

Thanks for clarifying. That makes that sound more appealing to me as well, as I’d prefer the little bit more work for the added security, even if the threat is minimal.

I use Fidelity’s Full View feature. I linked my non-Fidelity brokerage and bank accounts to this tool. I login to my brokerage account then hit the Full View link to view my entire portfolio and run analysis against it using this tool. Probably not the best tool but it’s free and good enough for me to quickly track balances, holdings and portfolio diversification that are updated every day.

Phillip,

Agree. Having something to quickly track balances and portfolio diversification was all I really needed when in accumulation phase with most things on autopilot except for annual rebalancing.

I do not find it useful to have a record of our progress and changes over time. It’s also helpful now that we have less income and it is more irregular to have a record of where we are for the year alongside our investments in order to efficiently make decisions for the purpose of reducing our tax burden year to year.

Best,

Chris