Getting Higher Returns on Your Cash

I started blogging about personal finance in 2014. In the ensuing decade I’ve written about cash savings in depth exactly zero times.

Interest rates started low and got lower for nearly a decade. There wasn’t much to write about.

After the spike in interest rates over the past few years and more recent talks about potential rate cuts, cash has become a topic of interest. In just the past few weeks I’ve received questions from blog readers, family, and clients on the following topics:

- The best place to hold cash reserves,

- How much cash vs. other short-term reserves to hold heading into retirement,

- The tax efficiency of money market accounts vs. savings accounts, and

- How to lock in current rates with interest rates scheduled to be cut.

In my own personal finances, I recently encountered a situation that caused me to reassess when the effort to move my cash to get higher returns on cash is justified. It’s time to cover this topic that I’ve managed to avoid for so long. So let’s jump in….

Why Hold Cash?

Let’s start with a couple foundational questions which will help answer all of the others. There are two main objectives to having cash holdings.

The primary purpose of cash is to provide liquidity. Cash should be held where you can access it when you need it quickly and without having to sell anything at depressed prices. Having adequate liquidity is a key component of your financial health.

The secondary objective for savings is to earn a return on your cash until you need it. This is a part of your portfolio you don’t want to subject to much, if any, risk. A realistic goal for cash holdings is to keep pace with inflation over time. Until you do need these savings, you want these dollars to maintain their purchasing power.

This isn’t always possible with risk free assets. Alternatively, there are periods when you may do a bit better than inflation.

Anything that proposes to do much better than this over long periods of time should be viewed with suspicion. Risk and return tend to go hand in hand.

How Much Cash Should I Have?

The amount of cash you hold depends on your personal circumstances. A guideline of 3-6 months of expenses in an emergency fund is standard advice.

This is a reasonable goal for most people in their accumulation phase. However, as I’ve written about in the past, this target is deceptively hard to reach, especially for those who would benefit most from achieving it. Conversely, those with stable jobs and high savings rates may not need to hold much, if any, cash.

In my household, Kim and I created a lifestyle that could be supported on one of our incomes. We used the other to pay off debt, invest, and spend on rare splurges. My career was very secure. So we never held any cash throughout our accumulation phase other than a few thousand dollars in a checking account to meet normal spending needs.

At the other extreme, holding far more than 3-6 months of expenses may be prudent. Some people are preparing to buy a house and want to have a large down payment or buy the home outright. Many retirees prefer to hold at least a year of expenses in cash.

You may be nearing or in retirement and simultaneously be looking to buy a home or make other large purchases. Holding a high six figure sum in cash may make perfect sense in this case.

Does It Make Sense to Pursue Higher Interest Rates on Cash?

Most of us fall somewhere between these extremes. There are a few factors that dictate whether it makes sense to try to optimize returns on cash and how to go about doing so.

There is one scenario where it almost always makes sense. Let’s start there.

Asleep at the Wheel

Interest rates have risen dramatically since bottoming out at the end of 2021. Many consumers have benefitted with higher rates on money markets, treasuries, and savings accounts. But a surprising number of people are not benefitting. Don’t be one of them!

In the past year, I’ve had my dad and multiple clients move money from savings and money market accounts to different higher yielding savings or money market accounts. They increased the yield on their cash by about 4% on average. More importantly, this was possible without increasing risk.

As noted above, this dramatic increase in return without a simultaneous increase in risk should generally raise suspicion. In this case, it was just an example of some institutions taking advantage of people who are not paying attention to the dramatic shift in interest rates.

Sub-Par Rates Persist

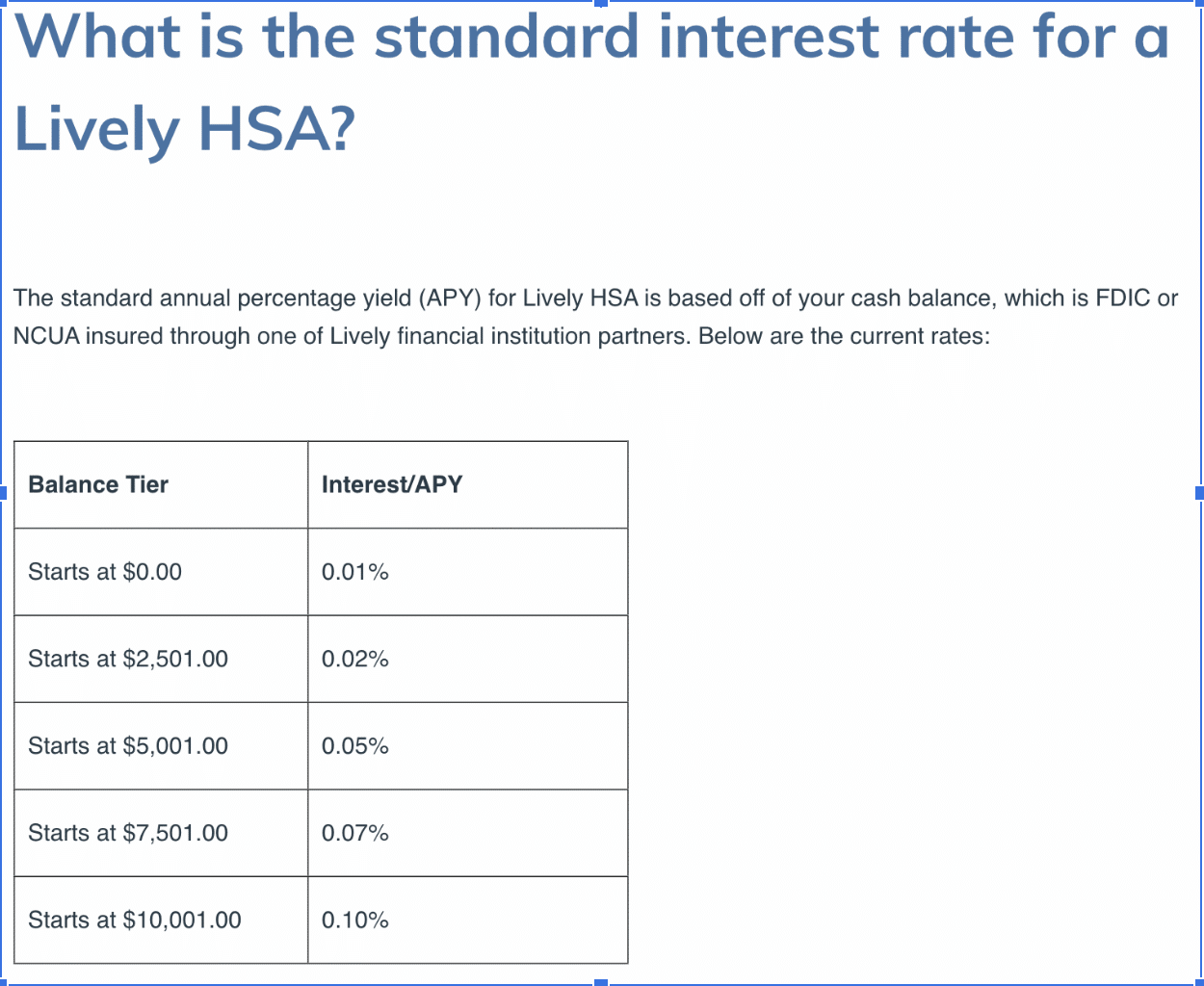

This situation persists. As recently as a few weeks ago I encountered this situation with my HSA with Lively. I chose Lively years ago because they were the only HSA provider at the time that allowed first dollar investing through TD Ameritrade. This changed after Schwab acquired TD.

I now am required to keep $3,000 in cash savings or pay a $24 annual fee for the privilege of investing my entire HSA account. I found this change annoying, but I now keep some of my HSA in safer assets anyway. So I didn’t think this would be a big deal. Then I checked the rates they are paying on cash savings (See screenshot below).

I found this appalling. My FDIC insured high yield savings account at Ally bank is paying 4.35% with no minimum balance.

I encourage everyone with any substantial amount of cash in savings to check to make sure you are getting a competitive yield on your cash in a high yield savings account or money market. Don’t overlook cash accounts at otherwise highly recommended brokerages. Schwab, for example, makes over half of their revenue from interest on deposits, loans, and securities.

Worth the Effort to Optimize?

Moving your cash to an institution that pays competitive rates without sacrificing safety and convenience is a no brainer. The spreads are large, so not doing so results in leaving free money on the table. Institutions that are paying essentially no interest on savings in this environment make me doubt whether they have consumers’ best interests in mind.

Beyond picking this low hanging fruit, the benefit of optimizing returns on your cash comes down to a few factors.

- The amount of cash you hold. The benefit of getting an extra .5% interest on a $10,000 emergency fund is negligible ($50/year). The same extra .5% for someone with a half million dollars in cash is substantial ($2,500/year).

- Your tax situation. Some options for cash holdings can be more tax friendly.

- The amount of effort you are willing to apply (or conversely convenience you are willing to sacrifice) to squeeze out this extra yield.

Best Options For Holding Cash

Keeping in mind that the first consideration for our cash holding is liquidity, there are three reasonable options for holding at least a portion of your cash:

- High Yield Savings Accounts

- Money Market Accounts

- Money Market Funds

For those with larger cash savings that are earmarked for a certain time period, CDs and T-Bills may make sense. The convenience and typically higher yields of short-term bond funds make them attractive to some. I’ll also share why we personally are using I Bonds to hold a large amount of our cash allocation.

Savings Accounts

Savings accounts provide safety and liquidity. You deposit your money and can withdraw it as needed.

FDIC insured banks make these accounts virtually risk free up to $250,000 per owner per account type per institution (or $500,000 for a joint account). For those with larger cash holdings, it is wise to spread your money across multiple banks to take advantage of this protection as we witnessed last year when several banks failed.

Interest rates on savings accounts can vary considerably. They tend to be relatively low at local brick and mortar banks. Significantly better terms can be found at online banks.

A quick search of two local banks in my area (Utah) reveal that one, Zions Bank, offers variable rates of .16% for balances less than $1,000 up to a maximum of only .19% for accounts over $100,000. Bank of Utah offers significantly better terms, .6% for balances less than $10,000 up to a maximum rate of 2.07% for balances over $200,000.

In contrast, leading online banks including Ally, American Express, and Capital One all at the time of this writing offer 4.35% interest with no fees and no minimums. CIT Bank is offering 5.05% for balances greater than $5,000. These FDIC insured banks are all established and have a reputation of offering consistently competitive rates.

Beware of savings accounts with higher introductory offers or sign up bonuses. These offers can be accompanied by a bait and switch to much lower rates. This creates a mental burden to keep track of rates and hassle to move accounts.

Money Market Accounts

Money market accounts, like savings accounts, are covered by FDIC insurance. Banks invest the funds in high quality, short-term investments. These features provide safety and liquidity.

A feature that traditionally was attractive about money market accounts was the ability to write checks from these accounts. As our world is becoming more digital, this is likely not a difference maker for most of us.

Interest rates may be higher than what you can get with traditional savings accounts at brick and mortar banks, but will likely be lower than what you will get with online savings accounts. Thus, they may provide a middle ground for those who prefer to bank locally but are looking for higher interest rates.

Money Market Funds

Money market funds are mutual funds that typically invest in high quality, short-term debt instruments. Thus they tend to provide the liquidity we desire for cash holdings combined with competitive yields.

Interest rates on money market accounts are adjusted daily, making them less stable than interest rates on savings accounts which tend to move more slowly. This can work for or against you at different times as rates move up or down. The price of the shares of a money market fund are generally very stable at $1.

Money market funds are not covered by FDIC insurance. They do have SIPC protection.

The safest money market funds, like Vanguard’s Treasury Money Market Fund, as of this writing yield approximately 1% more than high yield savings accounts. Because these funds invest almost exclusively in US treasuries, they also are exempt from state taxation. This could make them an attractive place to store cash for those subject to state income tax.

There are state specific municipal money market funds, which can be exempt from federal and state income tax. This may make them attractive to some. However, this adds an increased element of risk that you may not want to take with your cash holdings.

CDs and T-Bills

With talk of interest rate cuts on the horizon, I’ve received multiple questions about ways to lock in current interest rates. I advise caution in making any financial moves based on predicting the future, which is inherently difficult.

Interest rate cuts, however likely, are not guaranteed to happen. If they do, we don’t know exactly when or how far rates will fall.

That said, it’s not unreasonable to put some of your cash into CDs or individual Treasury bills that will guarantee you a rate of interest until they mature. CDs are backed by FDIC insurance. Treasury bills are considered risk free assets, backed by the full faith and credit of the U.S. government.

Either of these may be desirable if you have a specific purpose for your money and are confident you know when you will need it. Examples are knowing you want to purchase a home in 18 months after your child will finish school or having cash earmarked for next year’s retirement living expenses.

However, while you get the benefit of locking in your return for a set period of time, these benefits come with trade-offs.

You have to be confident you know when you will need your cash. If you need it before a CD matures, you may owe a penalty. If you need it before a T-Bill matures, you are subject to interest rate risk. Thus you don’t have the liquidity typically desired for cash reserves.

Locking in current rates is a double edged sword. You protect yourself if rates fall. However, you could miss out on higher rates if your prediction was wrong and rates go up or short term rates remain higher than longer term rates.

Bond Funds

An alternative to individual bonds are high quality short-term bond funds, such as Vanguard’s Short-Term Treasury ETF (VGSH). They generally will provide a higher yield than other cash savings (though that is not the case as of this writing) while investing in the safest bonds.

However, having any bond fund introduces some volatility. You don’t know exactly how much your shares will be worth until you sell them. For example, VGSH has a duration of 1.9 years. This means that if interest rates rise by one percent, your bond values will drop by approximately 2%. This may be more risk than you would like to incur for cash like holdings.

Related: How Low Can Your Bond Values Go?

A middle ground between buying individual bonds and bond funds are iShares iBonds ETFs. These ETFs enable buying US treasuries or TIPS that all mature in the same year. This provides the convenience of a bond fund with the price predictability of an individual bond at maturity.

These ETFs are compelling for building longer bond ladders. For cash reserves, one or maybe two treasury ETFs doesn’t seem much easier than buying a few T-bills. The expense ratio also adds cost that detracts from your return.

IBonds’ TIPS ETFs do provide a unique opportunity to easily buy TIPS that mature all in the same year. New TIPS are only issued with 5, 10, or 30 year terms. These funds have drawn a lot of attention in personal finance circles.

Again, I think these funds are interesting for building longer bond ladders where the compound effect of inflation can significantly erode purchasing power over time. For shorter time periods for which I hold cash, inflation is less of a concern.

I Bonds

I’ll propose a final option for cash reserves that I haven’t heard many people talk about, but where we are currently keeping the lion’s share of our cash savings: I Bonds. It may be an attractive option for other readers in similar situations.

I started buying I Bonds after researching and writing about them in 2021. Since then, I’ve bought the allowable allotment of $10,000 each for Kim and I each year as rates have gone up.

An I Bond purchased through April 2024 has a fixed rate of 1.3%. Combined with the inflation adjustment, that bond has a total yield of 5.27% annualized for the next 6 months. That’s nearly 1% better than high yield savings accounts and similar to money markets. Even our old I bonds with 0% fixed rates are yielding 3.94% due to the inflation adjustment which is competitive.

There are clear drawbacks to I Bonds. The annual purchase limit means it takes time to build a sizable balance. And once you need the cash, you can’t replenish it like you would other cash holdings. But the annual purchase limit can provide a forced way to gradually build up cash savings in the years leading up to retirement.

Your money is locked up for one year after purchasing the bond. After that, your money is accessible at a known value (i.e. these bonds are liquid).

In our case, we need significant cash reserves. However, we aren’t sure when we will need the cash. We drive a 10 year old vehicle, live in a 60 year old house, and have high-deductible health insurance. Kim’s income is tenuous. My blog income is tenuous and unpredictable.

Now that we are purchasing our health insurance through the exchange, we don’t like to have any unnecessary taxable income. Limiting taxable income enables us to optimize our ACA premium subsidies.

I Bonds allow us to defer taxes on interest income until we redeem the bond. So each year, we’re shifting money from our savings into I Bonds until we need the cash.

What Are You Doing With Your Cash?

I’m curious to hear what you are doing with your cash savings. Are you willing to take more risk or apply more effort than the strategies I’ve outlined? Do you have any creative strategies like my use of I Bonds that you use as an alternative to traditional cash reserves?

Let’s talk about it in the comments below.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Chris, check out the HSA accounts available at Fidelity. Absolutely no fees and you can invest your money however you want. The rollover process was simple when I did it a few years ago.

Check out Goldman Sachs online savings account…currently at 4.5%. Easy to use with a great rate.

Agreed. I keep my HSA with Fidelity.

Current money market seven day yield is 4.96% but I also buy CDs through them.

I don’t invest in the stock market on my HSA.

I transferred my HSA to Fidelity in 2022. Was very easy and like Pete said, no fees. You can also request an HSA debit card to pay for medical expenses directly from your HSA account.

Already started the process of transferring HSA, but thank you all for the tip!

Best,

Chris

Hi Chris. I have been reading your blog for some time and always enjoy and seriously consider the information you provide for our situation.

I would also recommend that those who are looking for HSA or a number of other interest bearing accounts consider reviewing the offerings of Raisin (https://www.raisin.com/en-us/). Raisin was re-branded from SaveBetter last year some time. One account with Raisin allows a user to select HSA, CD’s or money market accounts from numerous banks and credit unions to suit your needs. I have been using Raisin for more than a year and am highly satisfied with this method. My current savings are at 5.30% APR.

Ken,

Thanks for sharing that resource. I personally fall in the camp of figuring out an option that is “good enough” and I don’t like to spend much time and mental energy trying to squeeze out the last little bit of yield, but I’m sure many others reading this do and will appreciate this service.

Best,

Chris

Chris,

The Raisin bank marketplace is perfect for someone who wants “good enough” without taking too “much time and mental energy.” Raisin.com is a one-stop banking service! With just one Raisin account login, you can browse rates from among many federally insured banks, pick the best option, and deposit money there. No need to check multiple bank websites or to open multiple bank accounts!

When creating your Raisin.com login, enter the offer code glenj041847 for an opportunity to receive sign-up bonus cash.

I Savings Bonds can be a good choice for excess cash. But you failed to mention that if you need to redeem them before 5 years, you will pay a penalty of 3 months interest.

Joel,

You are 100% correct and that is a point worth considering.

Best,

Chris

Chris, I used the acronym HSA in place of High Yield Savings Accounts in my comment. I apologize for any confusion.

Thanks for taking the time to comment and correct that Ken!

Hey Chris, I recently had a situation where I’m holding a lot of cash, think 7 figures. I did a lot of research and determined short-term treasury bills are the safest and most cost effective way to hold large sums of cash. There’s no state income tax on the interest income, and the SGOV etf is paying 5.17% and increasing because the average yield to maturity is 5.36%

Unlike your vanguard example, the duration is extremely short 0.1 years so it functions like cash. It also has an extremely low expense ratio at 0.07%

This is a slightly under the radar option that deserves consideration by your readers!

I plan to do a write up of my process for determining where to store large sums of cash on my blog Hedgian, soon!

Great article thanks.

Casey,

I agree this is a great option. As noted in the post, the only tradeoff of buying an ETF vs. actual T-bills is gaining a little bit of convenience with the ETF in exchange for a, as you note, very small fee. Makes sense to me.

Best,

Chris

How does one buy an SGOV EFT? I see it’s not available on JP Morgan, and on Robinhood there doesn’t seem to be any return on the money.

More advantages of T-Bills:

– interest is exempt from state and local income tax.

– I hold several within my Fidelity account. T-Bills are easily bought and sold as desired. That is, they’re highly liquid.

– T-Bills (at least at Fidelity and Schwab) can usually be bought in increments of $1000

David,

Thanks for sharing your approach. No arguments from me on that.

Best,

Chris

You missed the easiest solution to this, although you got close with VGSH.

There are now available a number of ultrashort bond funds with maturities of less than 1 year, that include VUSB (a Vanguard Fund), JPST and a couple dozen others. These can be easily found searching the ETF database. JPST is paying 5.36% as of the date of this article.

https://etfdb.com/screener/#page=1&asset_class=bond&bond_duration=Ultra%20Short-Term

Now that we live in an era of no-fee trading, these can be bought and sold quickly and easily at your brokerage and compared there with the money market funds available. And they are completely liquid. This saves many hours in fiddling around with on-line banks and engaging in endless social media discussions about CDs. In general, DIY investors spend far too much time on this issue, opening up and closing accounts at multiple institutions like we are living in 1999. This is not a good use of investor time or a best practice in 2024.

Learn to use the tools at the discount brokerages where you probably already have accounts. You will not be “missing something” by not getting on the multiple institution merry-go-round.

My thoughts exactly! Simple, liquid and great returns. I personally use USFR.

Frank,

Thanks for sharing that. I agree that for the vast majority of people they don’t hold enough cash and the difference in yield is too small to justify spending a lot of ongoing time and effort trying to optimize returns on cash.

However, not everyone agrees and to each their own. There are definitely worse things that you can do fiddling with investments!

Cheers!

Chris

Thanks for this overview. My husband and I have always held way too much cash—if he had his way our investments would be ALL cash and CDs. (Think “under the mattress.”) Luckily my job put a percentage of my paycheck into Vanguard mutual funds during my earning years.

So when inflation and the interest rates started rising, I listened to all the pundits and started moving our cash around. We bought $60K in iBonds via TreasuryDirect over the past three years; I felt a lot better about the cash we now had earning 5% in our VG IRA money markets; we moved funds from low-interest Chase savings to several high-yielding online banks (while keeping our checking at Chase); and I even tried out a Tbill autoroll ladder this year with money from some maturing CDs last fall.

That last one I haven’t liked, even though the state tax situation would be better for us. TreasuryDirect Tbills proved one account too many to think about, and I couldn’t explain why I was buying Tbills to my husband. I realized I don’t really need the liquidity of that ladder (with partial money available every three months); that’s what our savings accounts are for. So, I’m taking the Tbill money as it matures and locking in 14-mo. 5.25% CDs for now. The high-yield savings and money market accounts bob around with the rates; turns out I like the familiarity and boringness of CD returns I can count on.

Thanks for sharing your approach NewYorker. I think your idea of simplifying and settling on a “good enough” option is where most of us should ultimately land.

Cheers!

Chris

It looks like you said that investments in Vanguard’s Treasury Money Market Fund are exempt from state taxes. However, when I go to Vanguards VUSXX page it has this on it: “Important Note: Income generated from investments in repurchase agreements with the federal reserve are generally subject to state and local income taxes.” So is this exempt from state taxes or not?

A portion of VUSXX is invested in Repurchase agreements. These instruments generally are not tax deductible at the state level. The amount of repos this fund holds varies throughout the year. The vanguard 1099 will have a supplemental section which outlines the % of treasuries held in the fund for tax purposes. So you have to do some math to calculate how much of your holdings is tax free for state.

That is a good catch Marc!

Income from interest on T-bills is state and local tax exempt, so the fund will be more tax efficient than a savings account that pays interest which is 100% taxable at ordinary income tax rates, but less tax-efficient than simply buying T-bills because as you note the fund distributes income from a variety of sources.

Best,

Chris

In 2023, 80.06% of VUSXX is Treasuries, so at least for California it meets the required 50% threshold, and 80.06% is tax exempt. Vanguards Federal Money Markets (settlement fund) was about 49% and missed the 50% threshold, so none of it is exempt in California. You need to research your own state.

Thanks for sharing MB. I’m realizing this is an area I need to do some additional research on!

Best,

Chris

These posts never fail to be timely and informative. Thank you! As a recent 57 year old retiree, I got much more interested in preservation of capital with growth. We keep 2 years of cash in SGOV, which ironically has been yielding more than a total bond fund while being immune to rising rates and actually benefiting from them. Holding our cash bucket there has been great. FYI for those interested, we fortunately hid our fixed income portion in a stable value fund in 2022 and then built a 10 year brokered CD/Treasury ladder when 10 year rates hit 5%. We supplemented the years that weren’t available with ishares ibonds Treasury ETFs, a product which I really love for its liquidity, trade-ability (if necessary, ease, and monthly dividends.

JV,

You are 100% correct that the shortest term debt has been yielding more than longer term debt for some time now. Just be aware that while the shortest term debt is immune from interest rate risk, that exposes it to reinvestment risk. If rates go down, these shortest term investments will see their rates fall, you won’t benefit from rising bond prices as longer term bonds would, and you will now have to reinvest at the new lower rates.

Best,

Chris

Chris,

Money market fund vmrxx all the way. At least right now. It’s been paying about 5.41% the past year and should stay favorable until treasuries finally fall sometime next year and beyond. Doesn’t get much simpler short term.

SGOV is a VERY short term Treasury fund holding 0-3 months Treasuries and yielding 5.1% as of today.

Mr FI and JV,

You are correct that money markets and the shortest-term bond funds are currently a great place to squeeze out a little extra yield. Just be aware as noted in the post that if/when rates drop, these funds are exposed to reinvestment risk.

Best,

Chris

+1 for SGOV. It’s the best of the best ultra-short-term t-bill fund. I’ve got 7 figures in it and have easily bought and sold over 100 times, at the middle of the 0.01 bid/ask spread. Highly liquid tons of AUM super low fee. Much better than high-yield online savings account, and much better than trying to buy tbills directly for so many reasons.

In this case, Vanguard does not offer anything similar. SGOV is the best “cash” replacement.

Thanks for sharing that experience Casey. That’s something I didn’t go into because it is so rare, but liquidity in times of extreme volatility such as in March 2020 is a real (even if short-lived) possibility.

Best,

Chris

I’m in Fidelity FZDXX for the bulk of my money market cash yielding about 5.2%. I also have my HSA with Fidelity with cash residing in FDRXX. I used to play that cray game of whack a mole with bank interest rates. Who has time for that!

Thanks for sharing Karl!

Interesting article, thanks! I have been buying non-callable brokered CDs thru Fidelity. I look for maturities of 2 to 5 years, reflecting my own needs. This lets me lock in some good rates, and the CDs can easily be sold if I happen to need the cash sooner. Much easier than hunting for CDs at individual banks.

Makes sense Coriander. Thanks for sharing your approach.

Best,

Chris

Like yourself, I’ve always kept all our cash in Ally Bank where the money market is now only slightly higher than the high yield savings. But while liquidating my taxable brokerage account at TD Ameritrade for an upcoming condo purchase I noticed that the Schwab prime money market 7 day yield was showing at about 5.1%. Having just received a $428 monthly dividend on $100K I’ve decided I may even switch some Ally bank cash to the brokerage. I can’t remember any time that prime money market paid more than online high yield savings accounts so I encourage everyone to check what’s available at their online brokerage. We are also early retirees at age 58 and 52 for 9 years now and ironically, usually follow almost every style of investing and saving as you and Kim do since I’m an ex employee of financial services. Thanks for the great article

Thanks for sharing Rodi. For folks with large cash balances, it may make sense to move money around in pursuit of higher yields. As long as you don’t lose sight of safety, liquidity, and you realize that these rates can change more quickly than those of high-yield savings accounts. So it is just a matter of determining whether chasing those yields is a good use of your time and mental energy.

Cheers!

Chris

Chris, my goal when I started taking my RMD’S was to reinvest those amounts to balance off my IRA, so the principle would remain the same but, in a separate brokerage account. Well it worked for I r a bit, but then came unexpected expenses AND travel, so I have not been able to do that of late. When my car payment ends, I will put that SAME amount back into an investment and never miss a beat.I used that practice while working, my raises went into investments, never missed it and was able to grow a substantial portfolio because of that…what you don’t see, you don’t miss! Steady investing no matter the amount(dollar cost averging if you will) over TIME, AND living within your means WORKS!

Thanks for sharing Richard. I agree that automating behaviors you want to reinforce (and conversely adding friction to behaviors you don’t) is far more likely to be successful than relying on will power.

Best,

Chris

When comparing money market fund yield percentages to high yield savings/CD percentages, shouldn’t I calculate the the money market adjusted yield (7-day yield less expense ratio) first?

For example,

VMRXX 7-day yield 5.28% – expense ratio .10% = 5.18%

FDRXX 7-day yield 4.96% – expense ratio .41% = 4.55%

This is from the Fidelity website regarding 7 day yields, stating the 7 day yield is “net of expenses” Kevin below is talking about Schwab’s expense ratio being greater that the similar Vanguard MMF. While Schwab’s is in fact greater than the Vanguard MMF, its 7 day yield is also greater. Am I missing something here? Chris, can you clarify?

7-Day Yield: The average income return over the previous seven days, assuming the rate stays the same for one year. It is the Fund’s total income net of expenses, divided by the total number of outstanding shares and includes any applicable waiver or reimbursement. The 7-Day SEC Yield Without Reductions is the yield without applicable waivers or reimbursements.

Cheryl/Dean,

Advertised yields are net of expenses. This is one area where Vanguard stands head and shoulders above their competitors with low expense ratios across the board, versus other brokerages which undercut Vanguard on index funds/ETFs by a tiny amount but then make up those fees in other areas like ER on money markets which are several multiples of Vanguard’s.

This results in higher yields on Vanguard MM accounts compared to equivalent funds at other brokerages. An apples to apples comparison of Schwab’s US Treasury Money Market (SNSXX, ER = .340) has a 7 day yield of 5.03% while Vanguard Treasury Money Market (VUSXX, ER = .09) has a 7 day yield of 5.29%. The difference in ER approx = the difference in yield.

If a more expensive MM has a higher yield than a cheaper one, it is probably because it invests in somewhat riskier underlying securities or is a result of a short-term abnormality.

Best,

Chris

My goal, when I quit work at the age of 67 was to have enough cash to

1)cover the expenses gap between then and when I took social security on my own record at 70 (around $70K a year was needed) and

2)have enough additional cash to cover expenses for the three years until my RMDs kicked in (around $40K a year is needed). I did not want to touch any investments until 2026 when my RMDs kick in.

My vacation payout from my job and installment payments on the sale of family property gave me the cash I needed. Some simple cash flow projections made laddered T-bills and an I-Bond my investments of choice. It was so easy to do through Schwab (and if I need the cash before maturity, it’s easy to sell earlier than the maturity date).

So far, so good. My next decision will be be what positions to liquidate to supplement my RMDs. But I’ve got 2 years to think about that.

Live Your Life. Live Your Life.

I covered our fixed expenses with social security and small pension. Our discretionary expenses are covered by a dividend portfolio of aristocrat/king stocks (history of paying dividends for 25+ and 50+ years) that is generating 15K/year. When RMDs kick in, the dividend portfolio will help pay taxes on the RMDs.

Thanks for sharing Margot. I hope all is well with you!

One thing to consider if having to sell anything before maturity is that it is subject to loss of value as a result of interest rate increases (of course this can also work in your favor if prevailing rates drop).

Cheers!

Chris

Excellent post Chris; thank-you!

In general I prefer Treasury money market funds for cash – at Vanguard, especially, whose .09% ER is a fraction of the .37% of Schwab’s, it’s a no-brainer place for cash. It’s good, too, to have a month or two of living expenses kept somewhere other than at your main brokerage so as not to be without cash in case of cybercrime limiting account access for awhile – though having a credit card or two with a high limit accomplishes a lot of the same goal.

SGOV and other ultra-short bond funds are viable alternatives to MM funds with high expense ratios but they’re still not cash – you have to sell them and wait for them to clear the next day and might not have access in a crisis (e.g. the 4 days the markets closed after 9/11).

We were iBond fans for a few years but liquidated all of them last year. Dealing with Treasury Direct is a royal PITA and from many reports even more so in the event one has to deal with them after an account holder’s death. And there have been enough issues with their website security over the years that any number of savvy Bogleheads won’t deal with them.

How much cash one needs altogether depends in part on one’s overall fixed income position – quality and duration. In our case we’ve gone the Jonathan Clements-suggested route: a couple of years worth of residual living expenses (we’re retired and live largely on my SS) in cash (Treasury MM) and the entirety of our remaining fixed income position (half our portfolio) divided equally between VGSH and VTIP. This is the Clements/Bernstein version of the old “take your risk on the equity side.” Given the ~2 year duration of both ETFs and the fact that the half nominal/half inflation-protected allocation is agnostic about whether inflation will be higher or lower than the Fed thinks I’m not worried about access to a major chunk of cash if unexpected circumstances arise. Not recommending this for anyone else as everyone’s situation is different but it works for us. Combine that fixed income position with VT as Clements does and you’ve got a pretty cool minimalist’s 3 Fund portfolio that’s as agnostic about the old interntional vs U.S. equity debate as it is about bonds. YMMV.

Kevin,

Thanks for sharing Kevin. Some great ideas in there.

I agree that I Bonds have serious drawbacks and aren’t for everyone, but they work well for us in the phase of life we’re in. Once we need this cash, I can’t imagine the time, effort, and restriction that go along with rebuilding those reserves will be practical and we’ll probably go back to splitting our cash reserves between a high-yield savings account and money market fund with longer term reserves taking an approach similar to yours.

Best,

Chris

Best,

Chris

Constructed a CD ladder where everything is now 4.5% or better. When they mature I’ll just do the ladder in reverse until the Treasuries seem best fit for my time horizon.

Pat,

That is an interesting approach. I think ladders make sense if you want to lock in rates on dollars that have a specific use by date. If you plan to reinvest the money anyway, you are subject to risk that rates can be lower at that time and I don’t see where the upside outweighs the downside to justify the effort of building the ladder vs. the simplicity of a bond fund. Just my $.02.

Best,

Chris

I started my HSA about 8 years ago and had a difficult time finding an option to not pay fees and have some market investment options. I stumbled upon a company called Saturna. They have some solid options for growth and income. The company follows Islamic investing principals and although I’m not a part of that faith, the performance has been great through the years. No investments in tobacco, alcohol, gaming, and banking. I couldn’t be happier watching my account grow.

Robert,

Thanks for sharing and I’m glad you’re happy with your experience. After my experience with Lively being sold, I’m personally most interested in simplifying my finances and so am moving my HSA to Fidelity where I am most confident they’ll be around for the long haul.

Best,

Chris

We decided to hold a larger cash reserve (3-5 years) so we aren’t forced to sell assets during a typical recession. As such, maximizing the yield has been very meaningful. It’s been helpful that we FIREd at a time of high interest rates (at least where our cash reserves are concerned) and that we get a pretty meaningful benefit on our ACA health insurance from not having to replenish a shorter expense reserve that would increase our income. For us, that pretty much eliminates all the “cash drag” you might typically hear about. We’ll see how things look when rates come down…

Personally, I’ve been buying t bills through Fidelity and letting dividends/cash between t bill rollovers sit in their money market sweep accounts, which are yielding about 5% right now.

I think the biggest thing is making sure your cash isn’t still sitting in accounts that are <1%. There are a ton of options in the 4.5-5.5%, which at that point is more about convenience to me.

Makes 100% sense to me Viktor. Thanks for chiming in!

Best,

Chris

Hi, Chris! Like you, we keep most of our cash needs for the year in an Ally savings account, with roughly monthly movements into our Ally checking account to cover the planned monthly expenses. We start the year withdrawing from retirement accounts to re-fill the savings account, with about half of our expected cash needs for the year; like you, we are on an ACA plan, and try to keep our taxable withdrawals low enough to maximize our health care credit.

I was surprised you didn’t mention short term cash accounts, such as the Vanguard Cash Plus Account, which they’ve been pushing lately. With interest rates near the top of the savings accounts rate range, and insurance much above the standard FDIC amounts, what are the pros and cons of these types of accounts? After we sold our old house last year, we didn’t feel comfortable holding the proceeds in a standard savings account, due to the amount being well over what FDIC would cover.

GAH,

I recall hearing about this a while ago, but honestly am not familiar enough with it to offer an educated opinion. I did add it to my list of topics for future research.

My preliminary thoughts after giving it a quick look. It looks like the way they are able to offer a higher FDIC insurance amount is by automatically spreading your deposits across multiple banks. If I am understanding this correctly and they do this for you automatically while offering such competitive yields, it certainly seems attractive.

Best,

Chris

Vio Bank is the online savings bank associated with Midland Bank in OK. Reputable and at last check was paying 5.3%.

Bill,

I just heard of this through clients who have an account there. I don’t know enough about their long-term track record to know if they consistently offer high yields or offer quality customer service, but if so this is certainly a reasonable option.

Best,

Chris

Hi Chris, thank you for your consistently insightful analysis!

Concerning the annual permissible contribution of $10,000 each for individuals towards I bonds, I wanted to highlight that if one has a trust, it’s possible to open another Treasury Direct account in the name of the trust. This enables an additional contribution of $10,000 into that account specifically for purchasing I bonds, leveraging the trust as a separate entity for investment purposes.

Jerry,

Thanks for chiming in. You are correct. You can also contribute an extra $5,000/year by overpaying taxes and applying your tax refund.

The downside of I Bonds is the restrictions and complexity they introduce to your finances, which is why I didn’t further complicate this post by going too far into depth on these nuances with this option which for most people is a fringe option for holding cash.

Best,

Chris

I currently have around $300k in cash and I am making over 5% in a money market fund through T Rowe Price. I am semi retired at age 60 and plan to continue working parttime for another 23 months for my previous employer as a subcontractor. I have over $1.6M in my retirement accounts and won’t need to touch them for another two years. I am keeping a keen eye on rates all this year to make sure I maximize my cash earnings. Once the fed starts to lower rates I will be have to think about what to do with my cash.

Makes sense Mike C.

Your scenario is one where it may make sense to lock in these nice rates with treasuries or CDs as I noted. However, locking in means doing so at a lower rate than you can get on cash now and that could work against you.

IMHO, the key thing is not being asleep at the wheel and getting little to no interest as so many people are doing. You’re getting the big thing right!

Thanks for chiming in.

Best wishes,

Chris

Bulk of my cash is with Fidelity money market as well as CDs and T-Bills bought through auctions on Fidelity’s website. Rates may be up to 0.2% less than best competitor but the simplicity of having less accounts to track is worth it to me.

Phillip,

Simplicity has long been a key theme of this blog, so you won’t get any argument from me for missing out on .2% yield in exchange for increased convenience. Now if someone refuses to move from a bank paying .01% when they could be getting 4+%, that’s a different story!

Best,

Chris

Chris are you familiar with the iShares TIPS Bond ETF? Would that be a reasonable place to put funds for a “level 2” emergency fund?

JP,

Are you referring to ticker TIP? If so, that particular fund has an effective duration of 6.63 years. This fund could be pretty volatile and I would personally not choose it to hold cash or cash equivalents in this fund because you could have to sell at depressed prices if you need the money and rates have gone up.

Best,

Chris

The ticker is STIP. Maturities range from 0 to 5 years. My first look at this was appealing because this does not look like an open ended ETF. The claimed expense rate is 0.03% and the is 2.3 years.

JP,

Bonds in that range will generally provide a higher yield in exchange for some interest rate risk. It is an individual decision whether taking on that risk makes sense. At the moment, you would actually get less yield by taking that risk on than you can get with shorter term bonds, money markets, and even some savings accounts.

Best,

Chri

Good article. My wife and I are in our 70’s, have savings, CDs, money market accounts I-Bonds, taxable and tax free bond funds, even a couple of preferred. It’s getting harder to keep up with them. Good to clue in most responsible adult children, if any, but many seniors have none. Best options?

Don,

That is a hard but common question. IMO, a great first thing to do is to find a solution that is “good enough” and start consolidating accounts. You may be able to manage multiple cash positions in your 70’s, but will you in your 80’s? And you may be able to do it, but will your wife? Or vice versa? Or the two of you may split financial duties, but would one of you be able to do things on their own? All of these questions lead me to think simple is often better. And for the record, I have this conversation often with clients in their 40’s and 50’s as well.

I agree that if you have good family dynamics that it is wise to start having these conversations with kids as soon as possible. I’ve reviewed the book Mom and Dad We Need to Talk by Cameron Huddleston. It is a great resource to start these conversations. We followed this advice in my family and it has been a blessing to have things understood and out in the open as my brother and I were able to step in and help my dad as my mom declined in health and eventually passed.

For those who don’t have children, or who don’t have family dynamics where you want to involve them then it is best to find someone you trust, be it other family, friends, or an attorney, advisor, etc. and have these conversations sooner than later. Sadly, too many people put these conversations off because they are hard. But that’s why we need to have them.

Best,

Chris

Hi Chris, Great article. I currently use the Vanguard Treasury Money Market Fund. It currently pays 5.4% interest. Simple, safe, and liquid. I purchase shares in my E*Trade account.

This is a valuable article, because so many people are not earning interest on their emergency fund savings.

That is, of course, if they have one. Unfortunately most households do not even have an emergency fund. So, your articles importantly teach people how to think about money. Thanks for your work.

Dennis

You can take partial redemptions from I-Bonds held at Treasury direct. So if you buy a $10,000 bond, if you need $2,000 at some point (ideally after 5 years), you can cash just that amount, leaving the rest untouched.

Of course, you can’t do this with paper bonds, but if you transfer them to your Treasury Direct account, it might be possible.

Tried to drop a cut/paste of Vanguard’s Federal Money Market rates (VMFXX) but this comment box would not accept it. So I moved it to my public shared dropbox location…

https://www.dropbox.com/scl/fi/5z9hen3c4ifmwn5ita836/VMFXX-Rates.jpg?rlkey=y2hwx773ysm2q5gmmpy1dcrdy&dl=0

Suffice to say; current 1 year rate is 5.18%. Latest 7-day SEC yield is 5.27%.