Early Retirement Tax Planning Checklist

‘Tis the season for year end tax planning articles. During our accumulation phase, I mostly ignored them.

I like keeping things simple with finances. This was easy with regards to tax planning in peak earning years.

We had two predictable sources of income, were able to max out all our tax advantaged accounts, and automated everything. The only times I applied effort were annually adjusting our contribution amounts, then periodically checking our accounts when markets dipped to look for tax-loss harvesting opportunities.

It took me a while to develop a framework and plan for our early/semi-retirement years. Income now comes from a mix of earnings from part-time work and self-employment, royalties, dividends, capital gains, and interest. Each source is irregular and taxed differently.

After a few years of learning by doing, I’ve developed a system that minimizes ongoing thought, effort, energy, and most importantly… taxes we owe. Here is our tax-planning process and checklist.

Establishing a Tax Planning Framework for Early Retirement

The first thing we considered when entering early/semi-retirement is our overall tax planning framework. The goal is to minimize our tax burden over our lifetime.

In general, you want to avoid paying taxes in your high income years when it will be taxed at higher rates. Pay taxes in your low income years when it will be taxed at lower rates.

The challenge is determining which we are in. In early or semi-retirement it isn’t as clear whether we want to defer or accelerate paying our taxes… or be ambivalent in any given year.

Defining High or Low Income Years

How you recognize income over the course of your retirement will vary from person to person. Consider the following factors:

- Will you receive part-time or business income, pensions, inheritances, or other taxable income in some or all of your retirement years?

- Do you anticipate high spending years that will require you to generate higher taxable income in those years (paying for kid’s college or other one-time big purchases (home, RV, etc)?

- What mix of taxable, tax-deferred, and tax-free (Roth) investments can you draw from?

- What is the size of your tax-deferred accounts which will be subject to required minimum distributions (RMDs) and how many years do you have until RMDs start?

I’ve found a good retirement calculator that calculates federal and state taxes is helpful to see when it may be beneficial to be more aggressive with tax planning. Both the Pralana Gold and NewRetirement PlannerPlus calculators that are affiliates of this blog do this well.

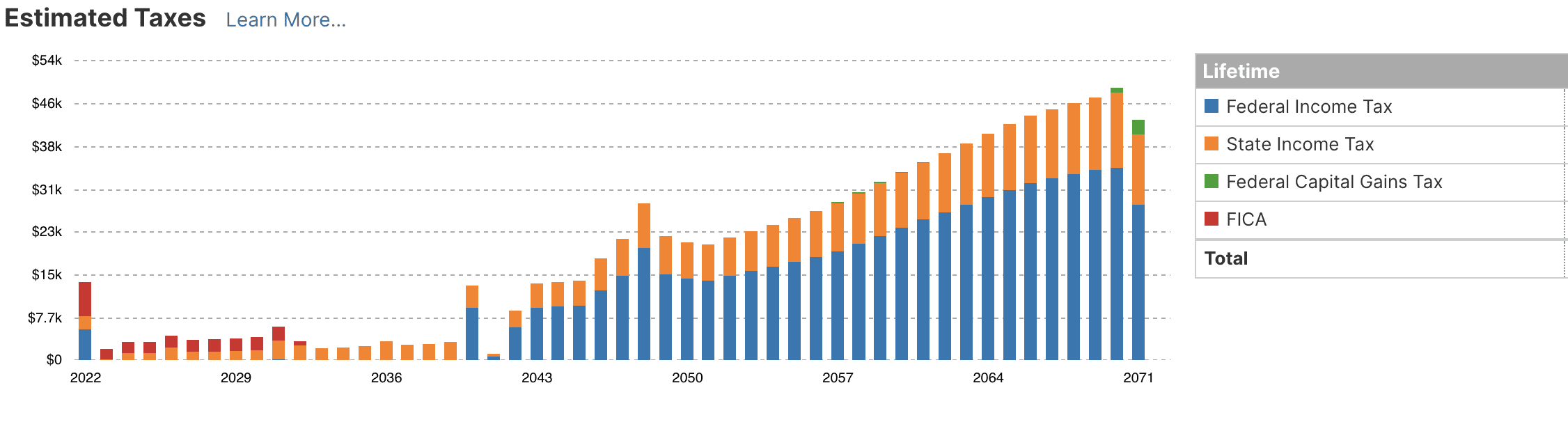

Below is a visual representation of our most likely scenario from NewRetirement PlannerPlus. It shows we have a large window between 2023-2042 when we may want to accelerate paying taxes at low rates.

Even though we are currently in a low tax year compared to our peak earning years, we are still in relatively high tax years compared to what we anticipate looking ahead.

Related: The Amazing Tax Benefits of Semi-Retirement

It is important to emphasize that I share our case only as an example. Your situation may be considerably different, so you should develop your own plan and make your own decisions.

Year to Year Goals

We do year to year planning within our overall framework. We start by thinking about what actions make the most sense given our circumstances.

If you are confident you are now in your highest income years, doing everything to defer taxes makes the most sense.

When we had two full-time incomes, we confidently assumed we were in our highest income years, and emphasized deferring as much tax as possible every year. We did this by always maxing out our 401(k) accounts. When available, we utilized a health savings account (HSA) and looked for opportunities to harvest tax-losses in our taxable investment accounts.

Related: Early Retirement Tax Planning 101

In lower earning years, it may make sense to accelerate paying some taxes at lower rates. Levers you can pull include converting tax-deferred accounts to Roth accounts and harvesting capital gains from taxable investment accounts. But which should you emphasize?

Determining Your Marginal Tax Rate

You can’t know what to do until you determine your marginal tax rate, the rate at which your last dollar is taxed. Again, I’ll share our situation as an example only and not a prescription of what others should do.

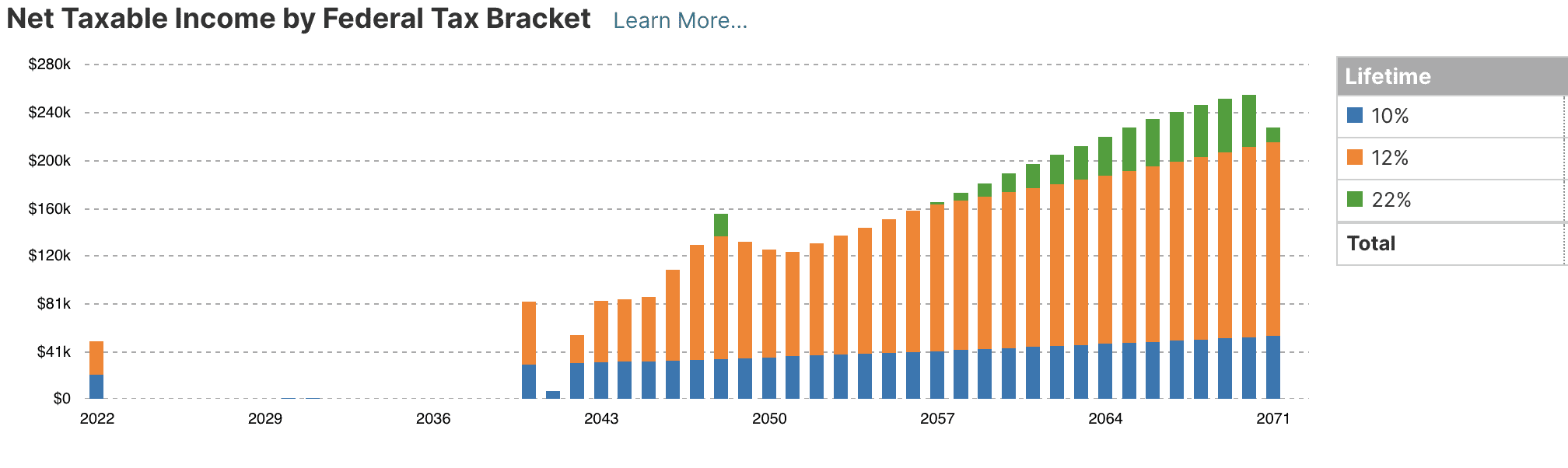

Our current marginal tax rate is 12%. A different look at our future taxes from the NewRetirement PlannerPlus gives perspective on whether that is likely to be high or low for us.

Determining What Tax Planning Strategies Make Sense

Assuming tax rates stay as they are, we will likely never pay more than 12% federal income tax. I see little reason for us to consider doing Roth Conversions at the 12% marginal tax bracket. I would absolutely not consider Roth Conversions at the 22% rate.

An argument could be made to employ more tax deferral strategies. I’m indifferent to this.

Deferring taxes wouldn’t save us a lot of money in the current year. We may pay more in the long run. It would also require more complexity to generate income from investments that we need to support our current spending vs. just spending new earnings as they come in.

The strategy I’ve decided makes the most sense for us is to focus on harvesting capital gains from our taxable investment accounts. These long-term capital gains will be taxed at 0% given our relatively low income.

Annual Early Retirement Tax Planning Checklist

With a tax planning framework in place, I next focused on creating a checklist to assure it is as easy as possible to carry out our plans.

Our checklist actually starts for us at the end of the year prior to the one we’re planning for. This means our planning for next tax year is already underway.

Our checklist ends in late December of the current tax year. I’m currently putting the finishing touches on our final few financial moves that impact taxes we owe this year.

If you want more flexibility, you can extend this up to the tax filing deadline.

Learn Tax Brackets and Contribution Limits

The IRS typically announces any adjustments to tax brackets, standard deduction amounts, and contributions limits to tax advantaged investment accounts in early November for the next year.

Check these numbers. They are important to know in order to implement your plan.

Select Healthcare

The other major decision that occurs towards the end of the prior year that impacts tax planning is determining how we will get our health insurance for the upcoming year.

If purchasing ACA compatible health insurance through the marketplace, your taxable income will greatly impact the price of your insurance premiums. Plan accordingly.

Related: Maximize ACA Subsidies and Minimize Health Insurance Costs in 2022

Beginning of the Year Moves

We make the following moves at the beginning of the year:

- Update our spreadsheet to indicate which accounts we want to use, the maximum amount we can contribute to each for the year, and whether we have made the contribution.

- For us this includes in order of priority:

- 401(k) up to employer match

- Health Savings Account (HSA)

- Roth IRA (x2)

- IBonds (x2)

- Automate any contributions that can be automated.

Related: Order of Operations for Tax Advantaged Investing

Set Annual Taxable Income Goal

Based on your tax planning framework and goals, set a target income. This may be your adjusted gross income (AGI) or Modified Adjusted Gross Income (MAGI).

Related: How to Calculate AGI and MAGI and Why It Matters

- If you are still in accumulation mode, your goal may be to simply max out every possible deduction to get taxable income as low as possible.

- For those doing Roth IRA conversions or tax gain harvesting, determine the maximum income you want to generate in a given year.

- If your focus is on harvesting capital gains at the 0% long-term capital gains rate, determine what the limit is depending on your tax-filing status.

- If purchasing health insurance with ACA premium subsidies, you need to determine the optimal income to pay the lowest insurance premiums in the current year with an eye on your larger overall tax picture.

In our case, our goal is to harvest the largest amount of capital gains possible while staying within the 0% long-term capital gains tax bracket.

Track Taxable Income

We recently added a place to our spreadsheet for monitoring investments to track our taxable income. I update this monthly to keep a running total of our income throughout the year.

We also added the maximum income limit we don’t want to exceed right next to this on the spreadsheet. This enables easily tracking where we are in relation to this limit month to month and informs actions to take at the end of the year.

Now this information is conveniently at hand when making investment decisions.

Related: How to Monitor Your Investments

Year End Moves

The following actions should be taken before the end of the year if you want to decrease taxable income:

- Contribute to tax-deductible work related retirement accounts, HSA, college savings accounts, etc.

- Complete any tax loss harvesting transactions.

- Incur any legitimate business expenses that decrease profit.

The following actions should be taken before the end of the year if you are looking to accelerate the payment of taxes to the current year:

- Complete any Roth IRA conversions.

- Complete any tax gain harvesting transactions.

We double check that we have fully utilized each of the accounts that we outlined at the beginning of the year to the best of our abilities. I prioritize using proceeds of tax gain harvesting to fill these buckets before reinvesting them in taxable accounts at a stepped up cost basis.

Moves to Complete Prior to Filing Taxes

We contribute to an HSA and Roth IRA prior to the end of the year. You can wait to contribute to a Traditional or Roth IRA or HSA up to the tax filing deadline if you did not do so prior to the end of the calendar year to give yourself some wiggle room.

This may be advantageous if you aren’t sure if you want to use an HSA. It may also be wise if you’re not certain whether a Traditional or Roth IRA is best for you in a given year.

Conclusion

Ideally we want to get the maximum financial benefit with the minimum amount of effort. When it comes to taxes, some effort is required to keep up with inevitable changes both to your personal situation and tax laws.

Tax planning in early retirement involves:

- Establishing a framework

- Automating all tasks that can be reasonably automated

- Developing systems and following a checklist to assure we complete tasks that can’t be automated.

This has provided the right mix for us.

Each of our situations is unique. Hopefully sharing our process and procedures is helpful. Consult a tax professional to assist you with your individualized planning as needed.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- New Retirement: Web Based High Fidelity Modeling Tool

- Pralana Gold: Microsoft Excel Based High Fidelity Modeling Tool

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

- Choose FI: Your Blueprint to Financial Independence

- Can I Retire Yet: How To Make the Biggest Financial Decision of the Rest of Your Life

- Retiring Sooner: How to Accelerate Your Financial Independence

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

The goal should be to maximize after tax income – not keep taxes to a minimum.

I agree with this sentiment 100% and could have worded that better.

Thanks for keeping me honest!

Chris

When planning for a couple, the dilemma of the Last Man Standing should be considered. Have you run your numbers assuming various death dates for each member? You might discover some surprises you can mitigate in these next set of low tax years.

Laura,

This is a great point and something that was recently discussed on the blog in the context of an early retiree who’s husband passed away very young. https://www.caniretireyet.com/early-retirement-plans-death-spouse/

As far as this impacting our planning, I personally wouldn’t take any different actions at this time to prepare for this contingency. We are both young and healthy and anticipate our most likely outcome is both living into older age, though obviously you never know, so our planning reflects this.

If one spouse has known medical issues and an anticipated shorter lifespan, my approach would be different depending on the specific circumstances.

Thanks for chiming in with the thoughtful comment.

Chris

We plan to Rothify at zero % equal to the standard deduction plus HSA contribution. HSA deductions are above the line, so reduces MAGI for ACA premium tax credit considerations. I’d like to Rothify more in the 12% bracket, but that quickly exceeds 20% when you exceed the 400% federal poverty level for MAGI. That might have to occur once we qualify for Medicare and before RMDs at 72.

Tommy,

I agree that ACA subsidies greatly complicate the tax planning process. If we had a more clear benefit with doing Roth conversions at some point, I would definitely be doing them aggressively now when we’re not buying ACA insurance.

Best,

Chris

Thanks Chris. I didn’t realize that the New Retirement Planner helped to guide tax optimization. One thing I learned recently from our Accountant is that Roth conversions have to happen by December 31st….just something to note. Again, thank you for sharing your experience and Happy Holidays!

But HSA contributions can happen up to tax day!

Hi again, Chris. Have you or do you know of anyone that used the New Retirement Plan CFP resources and whether the advice was well received? Just curious. Thanks again!

Dave,

Your correct that Roth conversions need to be completed by 12/31. That is in the original post.

I don not have any firsthand knowledge of any one who used the CFP resources they offer. NR has a very active FB group that allows pretty honest and lightly moderated content discussing the product, including things people don’t particularly like about it. If you are active on that platform, I’d pose that question there and see what kind of response you get. Here is the link:

https://www.facebook.com/groups/newretirement

Best,

Chris

Please check out the ACA MAGI rules on capital gains. Non-taxable capital gains are still considered income for purposes of ACA. https://www.healthcare.gov/income-and-household-information/income/

Cathleen,

You are correct. We still get insurance through my wife’s employer. One of the important reasons we are focusing on harvesting capital gains is that it will raise our cost-basis, meaning less taxable income in the future which could hurt us with premium subsidies when buying insurance through the exchange.

I should have pointed that out in the post. Thanks for catching it.

Best,

Chris

Hi Chris, I have a related question as I’m in my higher income years however a very large % of my retirement savings is already in deferred tax holdings. Do you have suggestions or reading material to help determine what the relative value of having taxed vs untaxed retirement buckets once I leave work would be? Is it worth paying a higher % tax to be left with Roth savings to hold or withdraw from later? Great article and I enjoy the dialoge.

Mike,

I tried to do my best job explaining the basics in this blog post. That is a solid foundation.

However, beyond the basics you have to really consider your own situation. Will you be buying insurance through the marketplace in early retirement? Will you have large RMDs that will cause you to be taxed at higher rates and pay more for Medicare later in retirement? etc.

This is where having a retirement calculator/planning tool is helpful to see the big picture. Even then though, it is important to understand that the accuracy of your outputs can only be as good as your inputs and assumptions. We simply can’t know what future market returns, interest rates, inflation, tax rates, life expectancy, etc. will be. So the best we can do is to understand the rules, understand the range of outcomes and which are most likely, and then do the best we can with the information available to us.

I hope that helps.

Best,

Chris

Chris, great and timely post as always. QQ: on those calculators you mention, do either of them have “what if” tax tools? What Im trying to solve for is if I get X amount of Div/Cap gains, what would the impact be to my Marginal Tax rate/bracket etc? Im planning to do some rebalancing in Taxable accounts and Im really struggling to understand the impact to my taxes, bumps to higher tax bracket etc. I’ve done some reading and understand that Div/Cap gains are taxed lower, but also read that these gains do impact marginal tax rate, but I’ve not found a simple calculator where I can just enter some assumptions and see how it impacts taxes for a given tax year.

Wade,

Yes. Pralana allows more customizability in general, but has a bit longer learning curve. You may want to reach out to each individually with specific questions to see which would best meet your needs and desires.

Best,

Chris