Navigating ACA Tax Credits to Purchase Affordable Health Insurance

A massive challenge for Americans planning to retire early is determining how we’ll obtain affordable health insurance. The earlier you want to retire, the more challenging it is to determine how much you need to bridge the gap until Medicare eligibility at age 65.

Health insurance costs increase faster than the rate of inflation. Medical expenses also tend to rise as we age, reflected in higher insurance premiums for older individuals.

Health insurance costs increase faster than the rate of inflation. Medical expenses also tend to rise as we age, reflected in higher insurance premiums for older individuals.

The Affordable Care Act (ACA) provides tax credits for low income households. Your health insurance costs depend on how you are able to structure income in early retirement. It is vital to understand the rules.

While these facts present challenges, careful planning can meet them. A tougher planning issue is the lack of political stability in the system.

If the health care system changes substantially, any projection of health care expenses until we become Medicare eligible would be nothing more than a blind guess. Projected savings needs could be off by six figures in either direction.

Instead of guessing, our plan is to cash flow our expenses year to year by continuing to earn some income in “retirement.”

The upside to this approach is that it allows us to start our transition to early retirement sooner.

The downside is we have to take measures to insure we can continue to earn income in a manner that is consistent with our desired lifestyle. Earning income can also make our insurance more expensive.

Open enrollment has started and continues through December 15. Assessing health insurance options is a tedious and confusing process. However, it allows me to provide insights and resources to assist your planning.

The Status Quo

Each situation is unique. It is impossible to cover every scenario for every individual or household.

I’ll share our decision process and resources we found useful to estimate our health insurance costs. This framework and these tools can be applied to your own financial situation, risk tolerance, and assessment of stability of the marketplace.

We have yet to purchase our medical insurance on the open marketplace. We had medical insurance through my employer until I left my job last December.

Over the past year, we’ve obtained insurance through my wife’s employer. They pay 80% of premiums and employees pay 20%.

The cost for our family of three is $235/month in 2018. We would actually see a slight premium decrease in 2019 to $218/month, or $2,620 for the year. This plan comes with a $2,000 individual and $4,000 family deductible for the plan year and allows us to contribute to a Health Savings Account (HSA).

The Alternative: Buying Insurance On Our Own

When comparing options for buying health insurance through the exchange, I focused on Silver Level Plans because they were most similar to what we currently have. They also offer the most generous subsidies for those looking to optimize costs.

For lower income households, Silver plans are the only option that also offer cost sharing reduction. This is a discount on deductibles, copayments and coinsurance in the event you need care.

The Upside of Obtaining Health Insurance Through an Employer

We like several features of obtaining our insurance through an employer. Insurance is affordable and we have a fixed cost, regardless of our income.

We are also able to control our downside risk in a worst case scenario. This is ultimately the purpose of having any insurance. Suffering a major injury or illness without adequate insurance would cause serious financial hardship for all but the most wealthy.

Having seen worst case scenarios hit close to home, I know it is not difficult to accumulate massive expenses with serious and/or chronic conditions.

The Downside of Obtaining Health Insurance Through an Employer

My wife is required to work at least 30 hours/week to obtain health insurance through her employer. She currently works 32 hours. Working less than that would mean forfeiting that benefit. We would have to buy our insurance on the open marketplace or seek an alternative to traditional insurance.

She has been considering cutting back her work to closer to 25 hours/week. This would fit nicely with our lifestyle. With flexible work conditions, work she enjoys and location independence, she doesn’t desire full early retirement.

Therefore, the decision for us is measuring how much quality of life would be improved by her having an extra day off each week versus the costs and and/or risks we would incur by purchasing medical insurance on our own or seeking an alternative to traditional insurance.

Buying an ACA Plan on the Open Marketplace

Buying insurance through healthcare.gov (or your state’s marketplace) guarantees access to health insurance similar to what we always had available through our employers.

There is a lot I don’t like about our current healthcare system. That said, I find comfort in familiarity.

An ACA compliant plan allows us to have contractually binding health insurance that protects us in a worst case scenario. The issue is determining whether it is a good value proposition.

Using the Kaiser Family Foundation’s Health Insurance Marketplace Calculator allows you to get a close approximation to what health insurance would cost based on income, age, geographic location, family size and whether or not you are a smoker.

Calculating MAGI

The price you actually pay for health insurance and care when buying through the exchanges is dependent on the amount of premium tax credits and cost sharing reductions received. These tax credits are dependent on your Modified Adjusted Gross Income (MAGI). Therefore, we need to understand what is included in MAGI to determine how much insurance will cost.

MAGI includes earned income from a job, tips or self-employment. Most sources of investment income including interest, dividends, capital gains, rental income and royalties must be included. It also includes other sources retirees may rely on for income such as Social Security, IRA/401(k) withdrawals (or amounts converted to a Roth IRA), and pensions. You must also include alimony and disability income when calculating MAGI.

Cost of ACA with Maximal Subsidy

If we chose a traditional retirement (no work and no earned income) and maintained our current investment strategy in our taxable accounts, focused on broad stock market index funds (limited dividends, no interest, minimal to no capital gains, no rental or royalty income), we would be able to have great control over our MAGI. We could obtain insurance for less than we ever paid when obtaining our insurance through employers.

You need to have a MAGI of at least 100 to 138% of the federal poverty level (FPL) to receive subsidies and avoid being pushed into Medicaid. The level depends on whether you live in a state that expanded Medicaid. Avoiding Medicaid is desirable for most people, because it is not accepted by many providers.

Our family of three living in Utah would need to generate a MAGI of about $28,700 to reach 138% of the FPL. (UPDATE: Since doing my research for this article, Utah along with Nebraska and Idaho voted to expand Medicaid coverage. Montana recently voted down Medicaid expansion.)

Income that counts toward MAGI could come from a combination of dividends from taxable investments, capital gains incurred by selling shares from our taxable portfolio, earning small amounts of income, and/or performing Roth IRA conversions. This would allow us to qualify for ACA subsidies and avoid being forced into Medicaid.

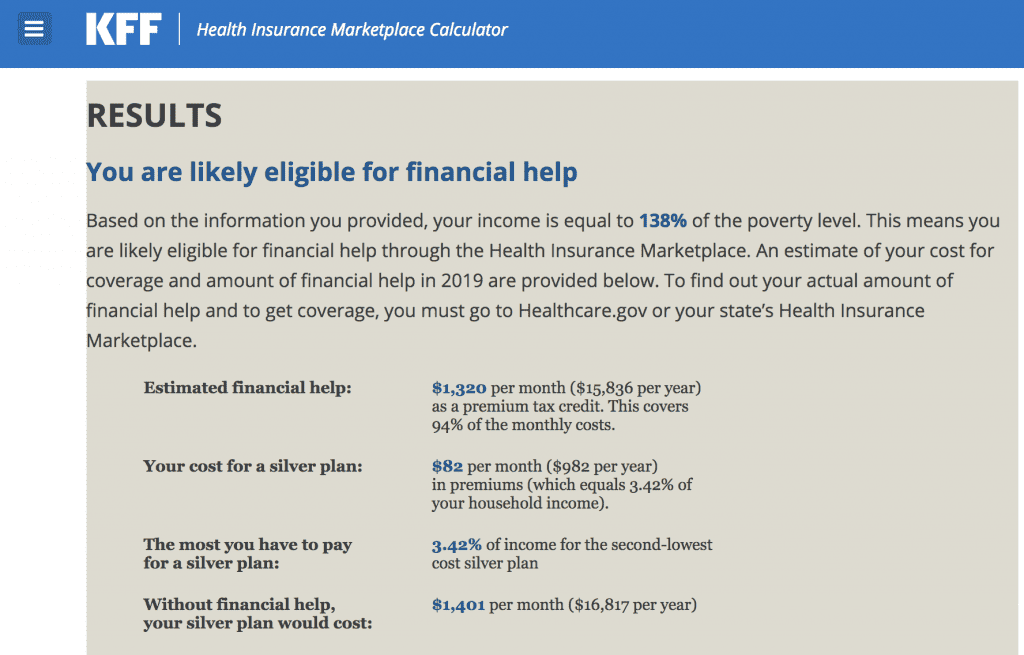

Other spending needs above the FPL could be met from basis in taxable accounts, cash from savings accounts, or Roth IRAs. None of these sources are factored into MAGI, and thus would not affect subsidies. We could then maximize our premium tax credit and pay only $82/month and receive a tax credit of $1,320/month.

In this scenario, we could get health insurance for our family of three for only $982 for the year. We would receive $15,836 in tax credits. This compares very favorably to my wife working 30 hours/week to qualify for employer subsidized health insurance. We pay $2,620, while her employer picks up the remaining $10,480 of premiums.

Downside of Relying on Subsidies

Relying on tax credits to keep health insurance affordable introduces political risk to your plan.

It’s important to understand the full price of an insurance policy. The difference in premiums between the total cost of insurance vs. the subsidized amount is about $15,000/year in our optimized example.

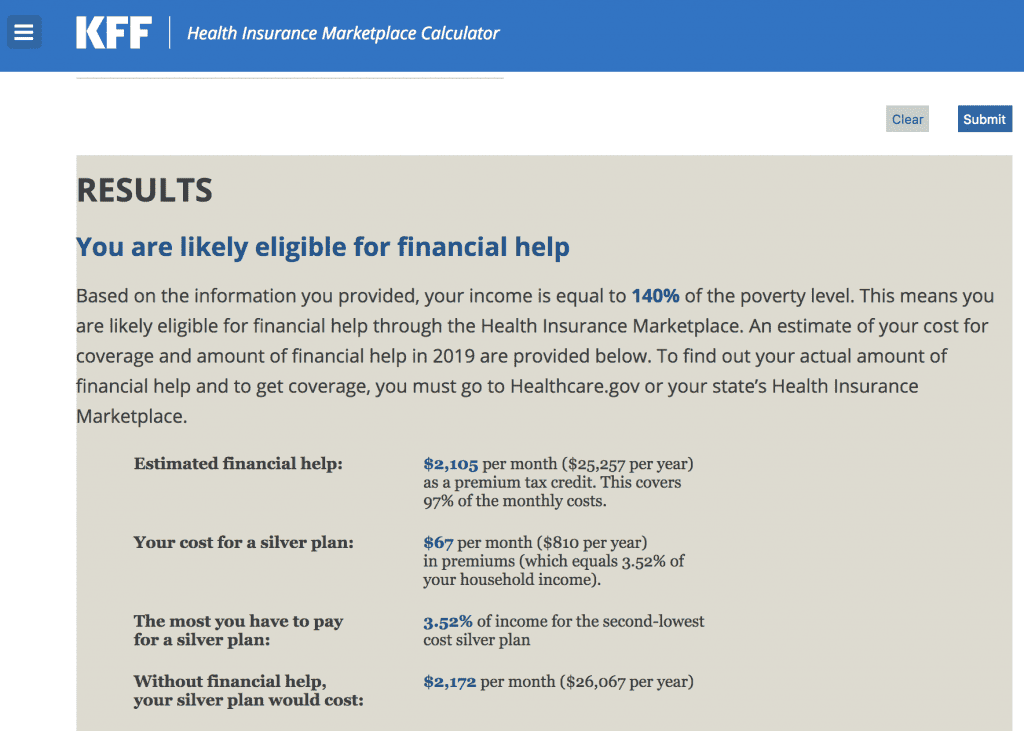

I experimented with the Health Insurance Marketplace Calculator to project what insurance would cost if we were 20 years older. I would be 62, my wife would be 61, and our daughter would be 26 and presumably not on our insurance. The unsubsidized cost for the two of us in that scenario jumps to $26,067/year. The optimally subsidized cost would drop to only $67/month.

Political Risk

Relying on subsidies makes early retirement feasible far sooner. However, this assumes these generous subsidies will continue to be available.

John McCain’s 2017 iconic thumbs down vote for a proposition that would have gutted the ACA reminds us how different the current health insurance conversation would be if he had not delivered that knockout punch.

Health insurance continues to be a political football. Popular talking points during the recent midterm elections included continuing to guarantee coverage for pre-existing conditions and proposals for “Medicare for All.” There is also continued uncertainty surrounding Cost Sharing Reduction which remains part of the law.

Building an early retirement plan that relies on subsidies is rolling the dice on a precarious system. Things could change with the outcome of any election. Alternatively, ignoring subsidies could mean working and saving years longer than necessary. We need to find ways to balance these risks.

Limiting Income Options

Even if you’re comfortable with the political risks, a plan dependent on receiving subsidies means structuring your life around limiting your MAGI.

It’s comforting to know that we currently have an option for nearly free health care if we couldn’t earn income. However, we need to determine what purchasing health insurance would reasonably cost while factoring in the lifestyle we want to live. In our case that includes continuing to earn some income.

The Challenge of Estimating Insurance Costs

Health insurance costs for 2019 are based on 2019 MAGI. This requires projecting future income.

My wife wants to continue to work. This will produce some earned income for our household. We can control some of that income counting against MAGI by contributing to tax-deferred retirement and HSA accounts.

I will also make a small income from this blog. Most, if not all, of my income can be shielded from MAGI by contributing to a deductible IRA.

However, we still have to produce income to live. A portion could come from dividends which already count towards MAGI. We could also sell shares from our taxable accounts. A portion of these shares would be cost basis, which does not count toward MAGI. The other portion would be capital gains, which would count towards MAGI. It is impossible to know how much would come from basis vs. gains. That would depend on the direction of markets until we would need to sell.

Not knowing exactly how we’ll structure our income, it is difficult to determine exactly what our MAGI will be. Without knowing MAGI, it is impossible to know how much health insurance will cost.

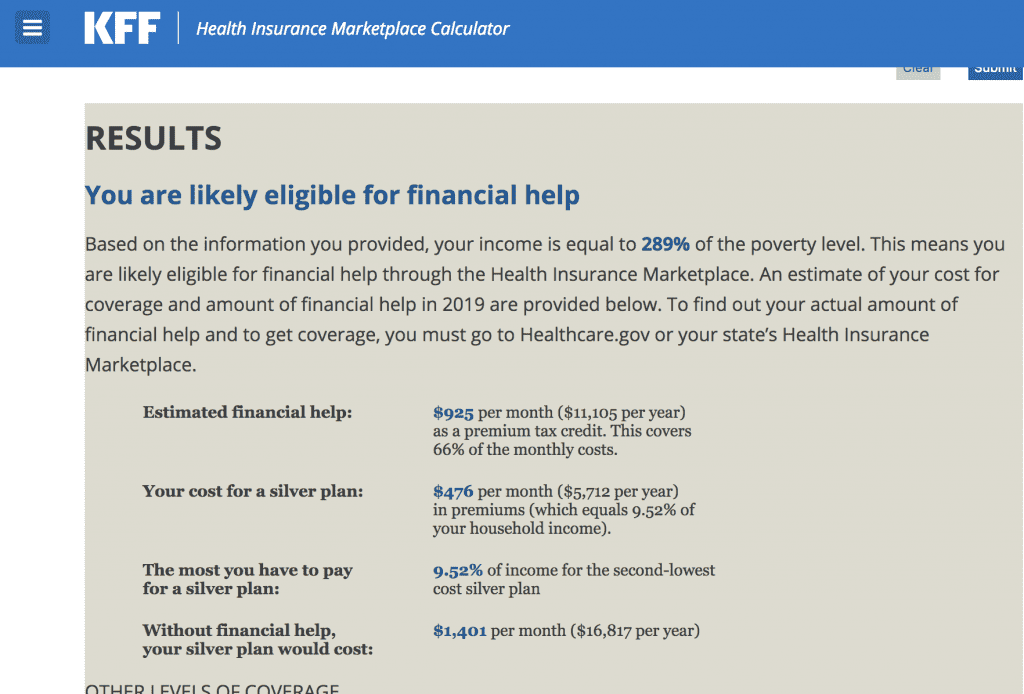

We chose $60,000 as an estimate of our 2019 MAGI. We entered this figure into the Health Insurance Marketplace Calculator to get a ballpark figure on our health insurance premium costs for 2019.

Increasing our MAGI increases our health insurance premiums to $476/month for a silver level plan. We would still get a generous $925 monthly premium tax credit. This would more than double our current monthly expenses, but the tax credit keeps premiums reasonable.

Comparing Plans

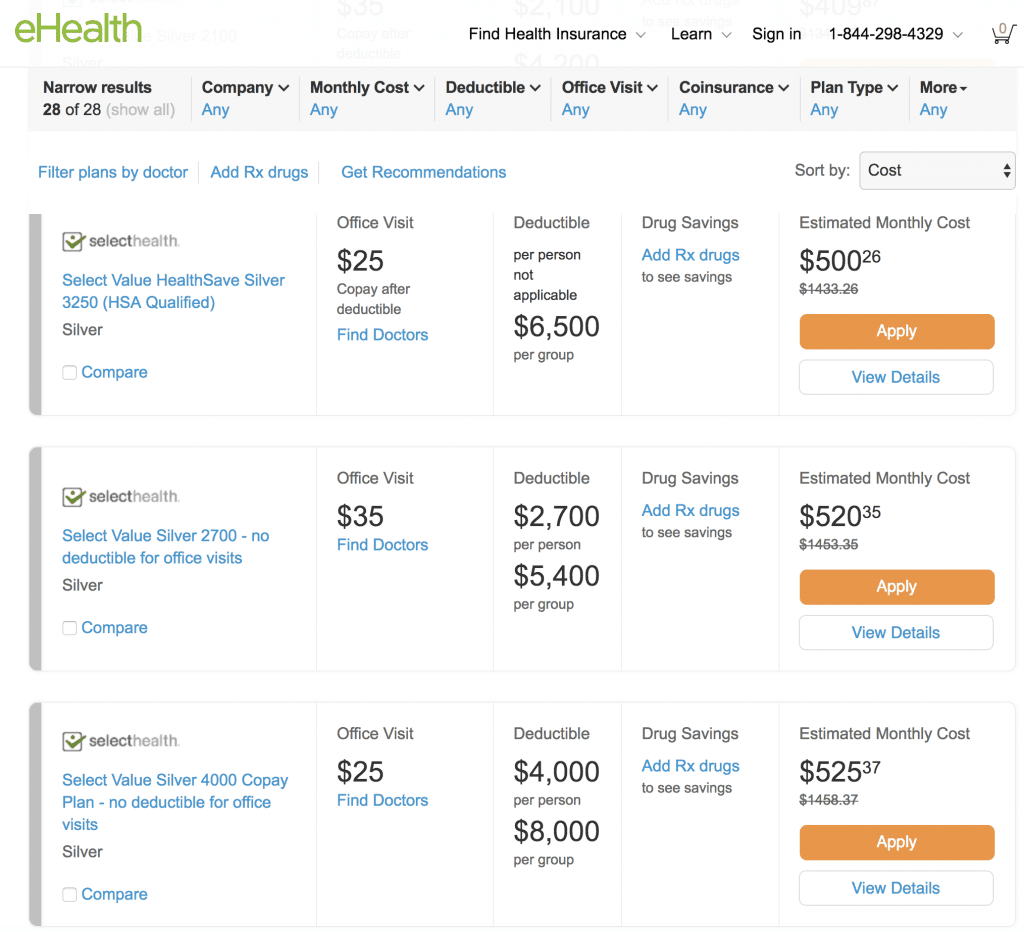

I next compared benefits of Silver level plans bought through the marketplace to our current benefits. The healthcare.gov site is not user friendly for window shopping. It requires creating an account and entering personal details before seeing plan specifics and pricing.

I found eHealth more user friendly for comparison shopping and experimenting with different income scenarios without creating an account. (Warning: Be wary entering personal identifying information to eHealth, unless you’re ready to purchase insurance through this online broker. There are numerous negative reviews of aggressive sales tactics once they have your information.)

The results I found through eHealth correlated closely with the estimated expenses and premium tax credits given by the Health Insurance Marketplace Calculator. The full unsubsidized costs of these plans, our personal share of premiums, and deductibles on these plans were all substantially more than what we would have if staying with coverage through an employer.

Utilizing premium tax credits seems to be a viable strategy to obtain health insurance for someone with a small to moderate income from part-time work, a working spouse, real estate investments, a pension or other sources that count against MAGI. Again, this strategy also means accepting the risk that subsidies could change in the future.

Beware Subsidy Cliffs

When planning on purchasing health insurance with premium tax credits, it is vital to be aware of “subsidy cliffs.” If your household income is greater than 400% of the federal poverty level, subsidies stop completely.

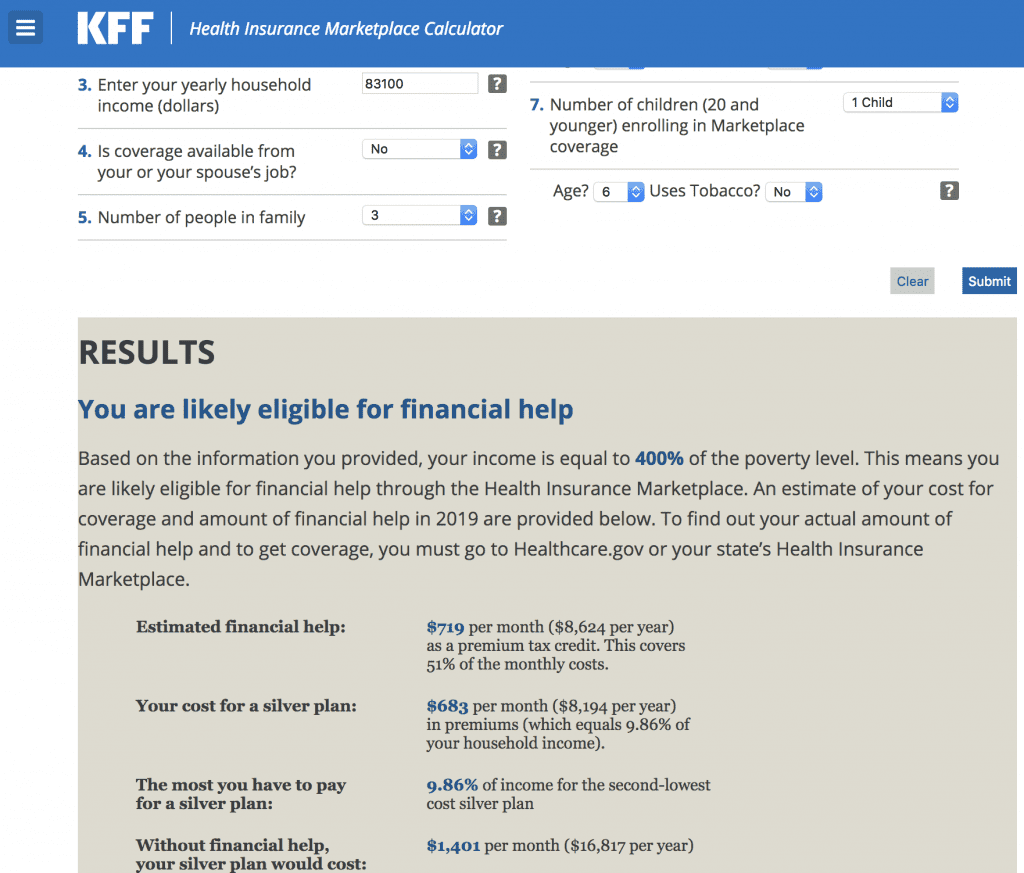

Returning to the Health Insurance Marketplace Calculator, our family’s MAGI could reach $83,100 and we would pay $683 monthly premiums while receiving $719 premium tax credit.

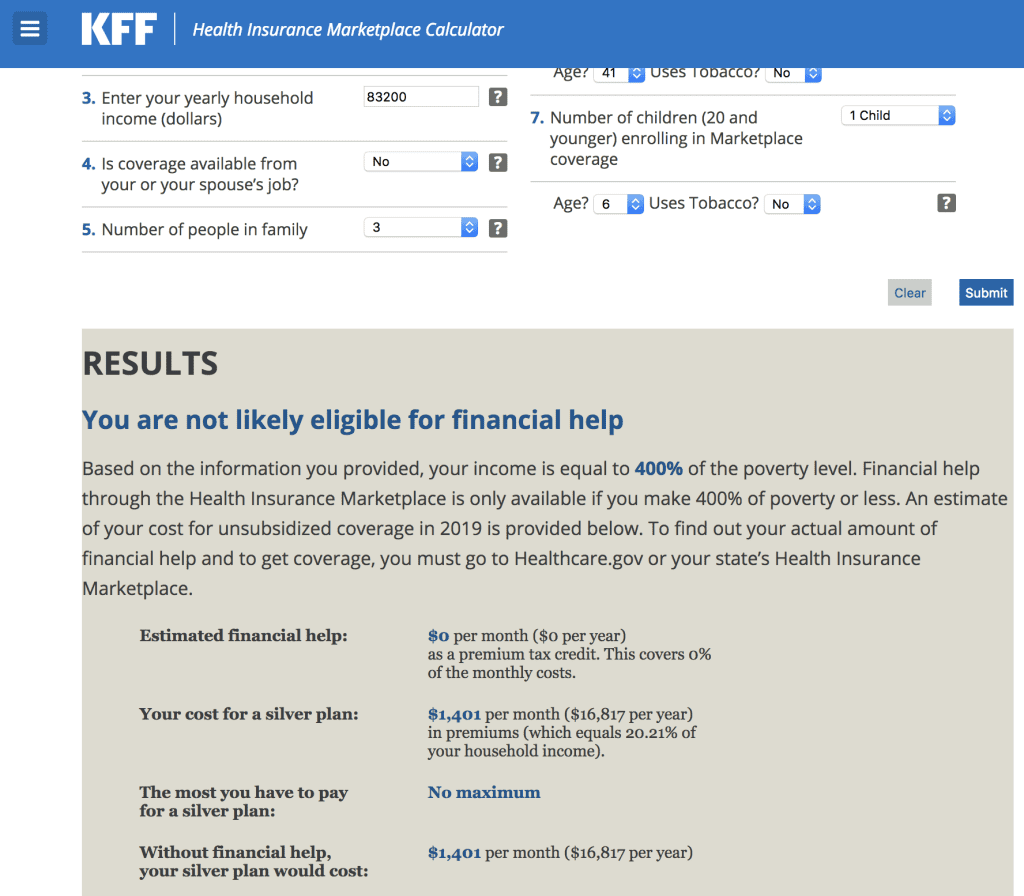

However, earning just $100 more would push us over the “subsidy cliff”. With a MAGI of $83,200, our subsidy would drop to $0 and our monthly premium would increase to $1,401.

Making an extra $100 in a year could cost us $8,616 dollars in extra insurance premiums by pushing us over the “subsidy cliff”! This would obviously not be desirable.

We looked ahead at potential sources of income next year. I’m planning to release a book in the first quarter of 2019. I have no way of projecting how much I might earn from the book. It is conceivable that I could earn enough money to push our household income over the subsidy cliff.

I also am considering working 6-12 weeks as a traveling physical therapist in either 2019 or 2020. This would likely bring in $10,000-20,000 in income which could push us close to or over the cliff.

Maintaining the ability to return to my career has been part of our plan as “health insurance insurance.” I plan to work a rotation every 2-3 years to maintain my skills and knowledge base.

We don’t have a long-term plan for health insurance to bridge the 20+ year gap from full-time work until Medicare eligibility. The ability to return to my former career gives another option to get affordable health insurance if necessary.

I would not be working because we need the income or because I have a burning desire to return to PT work. It would be ironic if this income pushed us over the subsidy cliff and cost us thousands of dollars in extra insurance premiums. Losing $8000+ in premium tax credit to earn $10,000-$20,000 would be an effective tax rate of 40-80% on that money, in addition to payroll taxes owed.

Assessing Our Options

Choosing to go out on the open marketplace to purchase health insurance could cost us anywhere from about $1,400 to $14,000 more than we are currently paying for health insurance. The benefits provided by marketplace plans are not as good as the insurance we would get through my wife’s employer for the next year.

There’s a reasonable chance that we could exceed the subsidy cliff next year and be at the high end of those figures. We’re going to pass on buying traditional insurance through the open marketplace for at least another year.

The Challenge of Buying Health Insurance on the Marketplace

Our situation demonstrates the challenge of buying affordable health insurance currently faced by those who have earned income, business income, rental income, pensions, social security, disability or other income included in calculating MAGI. Planning is particularly challenging for those with variable income, due to the difficulty projecting MAGI a year in advance.

The difference between the cost of subsidized insurance and the full cost of insurance demonstrates the variability that any early retirees need to plan for in case subsidies are discontinued or the system substantially changes.

As shown with our example, we currently pay about $2,600/year for health insurance through an employer. Buying insurance on our own, our annual premiums could drop to about $1,000 if optimizing subsidies or go up to $17,000 if paying full costs.

Modeling insurance for a couple in their early 60’s showed the variability was even greater. Premiums range from about $800 annually in an optimally subsidized scenario to $26,000 annually for a couple purchasing the same insurance policy without subsidies.

What To Do?

I frequently share articles or write about non-conventional approaches to retirement such as semi-retirement, mini-retirements, one spouse retiring first, or investing in alternative asset classes like real estate or small businesses that may produce more retirement income than traditional paper assets.

These approaches allow starting down the road toward early retirement sooner, with more income and more life options. However, having more income produces unique challenges to obtaining affordable medical insurance.

Likewise, taking Social Security early or having a pension can produce income that makes health insurance far more expensive.

Next week I’ll explore an alternative to buying insurance on the open marketplace. I’ll compare the costs and coverage provided by health sharing ministries.

Will this option better suit our needs? Will we continue to rely on employer provided health insurance for at least another year?

Chime In

How are you dealing with the challenges and risks of obtaining health insurance? Is health insurance keeping you trapped in a job when you would otherwise retire or work less?

I am always impressed by the level of knowledge and creativity shared by readers of this blog and look forward to reading your ideas, insights and solutions in the comments.

That said, I understand political instability and risk is part of the challenge when planning for health insurance. Name calling and ideological rants are not helpful to anyone trying to develop a plan to transition to retirement sooner.

Please refrain from making this a political conversation. There are thousands of other places on the internet for those seeking that. I reserve the right to delete or edit comments that don’t comply with this request. Thank you.

* * *

Valuable Resources

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers.

Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we're familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.